If you own land or property that is valued at cadastral value, you may be overpaying tax. They talked about three situations in which tax amounts can be reduced.

There are three situations in which entrepreneurs, due to the fault of the state, overpay property tax or land tax. Sometimes in such cases they do not have to pay these taxes at all.

Who is obliged to pay

According to the Tax Code of the Russian Federation, NIFL taxpayers are recognized as all individuals who own property assets recognized as taxable objects. Composition of taxable objects in relation to NIFL:

- Apartments, rooms or shares in them.

- Residential buildings, parts (shares) of residential buildings.

- Garages (permanent and temporary), parking space.

- Unified real estate complexes.

- Unfinished construction projects.

- Other premises, buildings, structures and structures.

It is worth noting that Article 401 of the Tax Code of the Russian Federation recognizes houses located on land plots and intended for running subsidiary, dacha, gardening or vegetable gardening as residential buildings.

But the common property of an apartment building (elevators, entrances, emergency exits, basements, stairs) is not subject to taxation.

IMPORTANT!

The key point for calculating and paying property tax for individuals: the presence of official ownership of a specific object. Moreover, the fact of using the property asset does not matter. For example, if an apartment or garage is temporarily unused, you will still have to pay NIFL.

In addition, officials determined that when an object is in common shared ownership, all owners are recognized as taxpayers. But copyright holders have the right to independently determine one payer who is obliged to pay the property tax for individuals to the budget.

Similar conditions have been approved for heirs of property assets. Thus, the obligation to pay arises from the moment the inheritance is opened. Liabilities are calculated in full, regardless of the fact of use.

Transfer of employees to 0.5 rates

If an employee’s wages are halved, then payroll taxes are reduced in proportion to the reduction in salary.

A transfer to part-time work can be justified by the financial crisis and the deterioration of the financial situation of the enterprise. As a result, there is no need for the employee to be at work full time.

Attention! An employee is allowed to transfer to 0.5 rates based on his written application, after which an additional agreement is drawn up to his employment contract indicating a new work schedule.

An employer will be able to unilaterally introduce a part-time regime only under the following conditions operating simultaneously:

- to prevent mass layoffs of workers (in the manner prescribed by part five of Article 74 of the Labor Code of the Russian Federation);

- when organizational or technological working conditions change.

Advantages of the method: Obvious savings in personal income tax and insurance premiums by reducing the base for calculating salary taxes. If an employee refuses to be transferred to a new work schedule, it will be possible to dismiss him (under clause 7 of part 1 of Article 77 of the Labor Code of the Russian Federation).

Disadvantages of this method: Employees may not like this optimization method, because it will negatively affect their future pensions and other social benefits. Labor disputes cannot be ruled out.

If the transfer to part-time work is fictitious, then this is fraught with fines, penalties and arrears for the employer. Naturally, when labor disputes arise, this fact will “pop up” first.

In this case, some entrepreneurs use a trick: they index wages with a reduction in working hours. That is, they share part of the benefits with employees. For example, if previously an employee received 25,000 rubles for 8 hours of working time, now he officially must work 4 hours and will receive 15,000 rubles. It is clear that the range of responsibilities does not decrease: the employee must complete his work, just in a shorter period of time.

How is personal property tax calculated?

NIFL is calculated in the same way as all direct tax obligations in force in the Russian Federation. First of all, the tax base is determined, deductions and benefits are applied to accounting if the taxpayer is entitled to them. The tax rate in force in a particular municipality is applied to the calculated tax base.

The calculation of property tax for individuals is based on the cadastral value of the property. But in 2021 there are exceptions. In relation to constituent entities of the Russian Federation that have not made appropriate decisions, calculations can be made based on inventory value, taking into account special deflator coefficients. (The Ministry of Finance of the Russian Federation in its Letter dated August 22, 2019 N 03-05-06-01/64176 determined that the practice of calculating tax based on inventory value ends in 2021, and from 2020 the whole country is switching to calculation using cadastral value) .

The transition to calculating NIFL based on cadastral value is mandatory for all regions of Russia. It will be completed in 2021. That is, from January 1, 2019, it will no longer be possible to calculate property tax for individuals based on inventory value.

IMPORTANT!

Each municipality has its own tax rates. The procedure for calculating NIFL may differ from generally established standards. Find out how personal property tax is calculated in your municipality on the official website of the Federal Tax Service.

The cadastral value of property or land is inflated

Assessment of the value of property or land plots, which is carried out en masse by government specialists, is not always objective and does not take into account the individual characteristics of the objects. The cadastral value is often inflated compared to the market value. Accordingly, you pay more than you should.

If this is your case, you can challenge the cadastral value. If you succeed, you'll not only pay less in the future, but you'll also be able to recoup what you've overpaid for the last three years.

According to Rosreestr, over the first 9 months of 2021, the courts considered 6,198 claims challenging the cadastral value of real estate. The vast majority of claims concerned the establishment of cadastral value in the amount of market value. The courts satisfied 5,934 claims. As a result, the total cadastral value of the disputed objects was reduced by 136.427 billion rubles. (53.2%).

To find out whether the review process is worth undertaking, order a property or land assessment from independent experts. If it turns out that the cadastral value is too high, contact either the commission of the territorial division of Rosreestr or directly to the court. Previously, before going to trial, it was necessary to first contact the commission. Now there is no such requirement; if you wish, you can go straight to court.

The cadastral value may also be overestimated due to the fact that inaccurate information about the property was used during the assessment, including due to a technical or cadastral error. For example, the area of the room is 250 square meters, but the information indicates 300 meters. In such cases, you also need to contact Rosreestr to correct the data, or go to court.

You can find out the cadastral value of a property using the electronic service of Rosreestr.

Keep in mind that you can only challenge the current cadastral value . Government agencies periodically conduct revaluations. Currently, assessments are carried out no more than once every 3 years, but at least once every 5 years (no more than once every 2 years in federal cities). From 2022, land will be revalued every 4 years, and from 2023, real estate as well.

If the cadastral value of your property or land was inflated, but the authorities have already carried out a new assessment, you will not be able to challenge the old value and return the overpayment of taxes. Therefore, if you now see that the cadastral value is too high, do not delay in going to court or a commission. The main thing is to submit your application before the revaluation. If everything works out, you will be able to return the overpayment for the entire time the disputed cost was in effect, but only within three years.

By challenging the cadastral value, you can reduce rental payments if you are leasing municipal property and the payment depends on the cadastral value.

Example 2.

The metal structures plant rented a plot of land that was municipally owned. Rent payments were calculated based on the cadastral value. By going to court, the company achieved a reduction in the cadastral value from 109 to 33 million rubles. Rental payments decreased accordingly (resolution of the Supreme Court of the Republic of Tatarstan in case No. 3A-401/2019).

Right to benefits

Federal legislation establishes a wide range of benefits and deductions for property tax for individuals. And local authorities, by adopting their own municipal laws, have the right to expand the list.

So, a significant reduction in property tax for individuals is received by:

- Heroes of the Russian Federation and the USSR, citizens awarded the Order of Glory of all degrees.

- Disabled people (group 1 or 2, disabled children and disabled since childhood).

- Participants of the Second World War, defenders of the USSR - veterans of military operations.

- Chernobyl survivors, citizens participating in the liquidation of nuclear disasters.

- Certain categories of military personnel discharged from military service and members of their families.

- Persons who received radiation while participating in nuclear tests and exercises.

- Old-age pensioners, citizens who have reached the age of 60 and 65 years for women and men.

- Individuals who own buildings, structures, the area of which does not exceed 50 m², and which are located on land plots used for running subsidiary, dacha, vegetable and (or) gardening.

The benefit is provided in the amount of the calculated tax liability for a specific type of property asset. Please note that this property cannot be used in business activities. Otherwise, no reduction in personal property tax is provided.

The benefit is provided in respect of one property of each type by the independent decision of the taxpayer. For example, the beneficiary owns two apartments, a residential building and a garage. He is required to pay property tax for individuals (Tax Code of the Russian Federation) only for one apartment. Moreover, a citizen has the right to choose which object is recognized as taxable.

Compensation payments and financial assistance

With the help of compensation payments, part of your salary can be legally exempted from insurance premiums. For example, this applies to reimbursing employees for interest on their mortgage. Insurance premiums are not paid on these amounts, personal income tax is not charged on amounts not exceeding the limit of 3% of the payroll.

Some compensations are completely exempt from insurance premiums and personal income tax. This includes any of the following payments:

- travel expenses to and from your destination,

- airport service fees, commission fees,

- expenses for travel to the airport or train station at places of departure, destination or transfers,

- baggage costs (related to work trips),

- living expenses,

- expenses for payment of communication services and others.

As for financial assistance, it should be remembered that insurance premiums are not charged for payments to employees in connection with marriages, funerals of close relatives, as well as for treatment of employees and their family members (this is indicated by the resolution of the Arbitration Court of the Moscow District No. F05-26116/ 2019 dated February 20, 2020).

Advantages of the method: There are quite a few options for compensation provided to employees under the Labor Code of the Russian Federation; if desired, each company will be able to replace part of the employee’s salary with the corresponding payment. At the same time, they will be exempt from personal income tax and insurance premiums in whole or in part.

Disadvantages of this method: Optimization has a temporary effect and cannot be done regularly. For companies with a large staff, the amount of savings may be insignificant in monetary terms. This method of reducing insurance premiums requires additional documentation. Not all compensation payments and financial assistance can be taken into account when calculating the simplified tax system or income tax.

How to get a benefit

Let’s say a citizen has received the right to a benefit for the first time. Moreover, it makes no difference what regulations approved the relaxation: federal, regional or local. To reduce your tax payment, you must submit a corresponding application to the Federal Tax Service.

It is worth noting that you will have to submit an application to reduce the property tax of individuals even if the previously provided benefit was not taken into account in the notification from the Federal Tax Service.

To fill out, use the unified form.

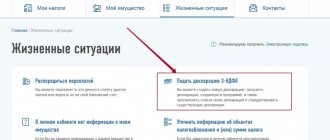

Compose the document by hand or using a computer. Submit your application in person to the Federal Tax Service or via the Internet using the single portal “Gosuslugi” or the taxpayer’s personal account. It is also permissible to contact the MFC or send documents through the post office.

Splitting wages into salary and bonus as a way to reduce taxes

This optimization option appeared last year due to the pandemic and the introduction of preferential insurance premium rates for small and medium-sized enterprises (Article 3 of Federal Law No. 473-FZ of December 29, 2021).

Companies on the simplified tax system, included in the register of small and medium-sized businesses, consider contributions at a preferential rate of 15% from salaries above the federal minimum wage (Article 3 of Federal Law No. 473-FZ of December 29, 2021).

To use this optimization method, you need to divide your salary into a salary equal to the minimum wage and a quarterly bonus. For premiums above the minimum wage, pay contributions at a rate of 15%, not 30%.

In order to reduce claims from controllers, the reduction in staff salaries will have to be justified, and the payment of bonuses will have to be fixed in the bonus regulations, otherwise Federal Tax Service employees will be able to see in the employer’s actions a deliberate evasion of paying taxes.

Advantages of the method: Reduced insurance premium rates for the period of benefits for small and medium-sized enterprises. An additional lever appears that influences staff motivation, because the employer has the right, but not the obligation, to pay a bonus to its employees.

Disadvantages of this method: It is necessary to obtain the employee’s consent to change the terms of the employment contract; not everyone can agree to this. If the company is excluded from the SME register, the savings will stop working.

Attention! During implementation, an additional burden arises on the work of the accounting department. If the feed-in tariff is cancelled, the scheme will also lose its effectiveness.

Paying the cost of medical examinations directly to the clinic

If the employee pays for medical examinations on his own, then there will be no savings on fees, so enter into an agreement with the medical institution directly. Then you will not have to pay contributions for expenses incurred related to medical examinations.

In addition, you can sign a contract for voluntary health insurance, under which mandatory medical examinations of personnel are carried out at the company’s expense. Savings also arise here, and the amounts spent are taken into account when calculating profits (letter of the Ministry of Finance No. 03-11-06/2/25906 dated May 5, 2021).

The advantage of this method: Complete legality, no risks. Officials unanimously confirm that contributions are not calculated in this case (letter from the Ministry of Finance No. 03-15-06/45499 dated June 21, 2021, Federal Tax Service No. BS-4-11 / [email protected] dated January 27, 2021).

Disadvantages of this method: Not all organizations require employees to undergo medical examinations; as a result, the amount of tax savings may be minimal or even zero.

Optimization of taxes by transferring to piecework wages

In some professions, earnings in the form of a salary are initially unprofitable for the employer, especially for blue-collar professions where the result of labor is achieved automatically. The employee receives the same amount regardless of the work performed during his time at work, and not for the result of his activities.

Moreover, piecework payment can be used in settlements with office workers, for example, with sales managers, consultants, lawyers, etc.

To transfer employees to a piece-rate wage system, changes will have to be made to local regulations. If the employee agrees to the new conditions, it is necessary to sign an additional agreement to the employment contract with him.

Advantages of the method: The employee’s income will depend on the amount of work performed, insurance premiums and personal income tax will decrease in proportion to the decrease in wages. If the employee does not agree to the new working conditions, there will be a reason for his dismissal (clause 7 of part 1 of Article 77 of the Labor Code of the Russian Federation).

Disadvantages of this method: Optimization does not work in all companies, since it is not always possible to transfer an employee to piecework wages. Implementation may cause severe dissatisfaction on the part of staff.

Attention! If there are no objective reasons for transferring to a new work schedule, then in the event of labor disputes the court will side with the employees.

And after a court decision in favor of the employees, tax inspectors may have questions. Therefore, it is not a fact that saving on the payment of the insurance portion of taxes will be profitable. But where piecework wages can be justified, employers begin to save.