Individuals have the right to receive a tax deduction of a property or social nature from their employer.

The first is related to the acquisition or construction of residential real estate, and the second is related to training or treatment. A deduction is a failure to pay or return personal income tax from the budget, taking into account the limits established by law.

To receive a tax deduction from an employer, you must provide a package of documents, on the basis of which the accountant will reflect the provision of the deduction in the 1C: Accounting program for payroll calculation.

Let's look at the main points in more detail, and also analyze the accountant's actions necessary when providing tax deductions to an employee.

What is a tax deduction

A tax deduction is the amount by which taxable income is reduced. Almost every citizen of the Russian Federation over 18 years of age pays personal income tax on one of their types of income. You paid for treatment, study at a university, bought a house or replenished your personal investment account, and you automatically have the right to return part of the value added tax paid.

This can be done with the help of the state, which will return part of the taxes. To do this, a citizen submits a tax return and documents that confirm his right to a deduction. You can also get your money back through your employer. The tax office provides the citizen with a notification, which he submits to the employer’s accounting department. For some time, the latter ceases to withhold personal income tax when paying wages.

Only residents of the Russian Federation who have official income subject to personal income tax at a rate of 13% can count on receiving a deduction. To get your money back faster, you need to submit a year-end declaration in advance. The tax deduction is refundable within three years from the date of payment of expenses.

Changes for 2021

In April 2021, the State Duma approved a law simplifying the procedure for receiving part of the deductions. Until this year, deductions were applied to all income subject to a 13% rate. Now the income of individuals is divided into basic and non-basic bases.

The non-core tax base includes income such as the sale of securities or lottery winnings. Basic income includes income at a rate of 13-15%. Deductions are applied freely to the income of the main base, and to the main base only in three cases:

- Deduction for carrying forward losses to future periods.

- Deduction for long-term holding of securities.

- Deduction for income from IIS type B.

Types of deductions

At the moment, for income received in 2021, you can take advantage of property, standard, social, professional and investment deductions.

Property

A property deduction can be received by a citizen who has carried out transactions with real estate over the past three years. This includes the sale of property, the purchase of land, housing or its construction. Art. 220 of the Tax Code of the Russian Federation describes the entire list of transactions with property deductions.

Social

A citizen-resident of the Russian Federation who had one of the following types of expenses during the previous year can count on a social tax deduction:

- Independent assessment of qualifications.

- Own training, as well as children, sisters and brothers.

- The funded part of the pension.

- Charity.

- Non-state pension provision or insurance.

- Treatment: purchasing medications for yourself, your spouse, children and parents.

120,000 rubles is the maximum amount you can count on. This does not include charity, training or expensive treatment. Charity expenses can reduce annual income by 25%, education for children allows you to return up to 50,000 rubles for each child, expenses for expensive treatment are deductible without restrictions.

Standard

The standard tax deduction is divided into 2 types: for the child and for yourself.

The last deduction is provided to certain categories of individuals: disabled children, Chernobyl survivors, parents and spouses of military personnel who died in service, etc. Art. 218 of the Tax Code of the Russian Federation defines a complete list of all categories of citizens who can count on this type of deduction. If an individual is entitled to several types of deductions, then the state will provide him with the maximum.

Both parents, guardians, adoptive parents, etc. can count on a deduction for a child. The main thing is that they provide for the child according to the law. The state carries out a deduction from the month of birth of the child until he is 18 or 24 years old if he is studying full-time. Parents can count on a cash benefit in the amount of 500 - 3000 rubles. The amount is affected by the taxpayer category.

The more children, the greater the deduction amount. The state does not provide deductions to parents if their income since the beginning of the year is above 350,000 rubles.

Investment

Citizens of the Russian Federation can take advantage of the investment tax deduction:

- Those who received income from transactions that are accounted for on the IIS.

- Those who contributed money to IIS.

- Those who received income from transactions with securities.

Professional

The deduction is due to individual entrepreneurs and those who receive income from professional activities. The following citizens can take advantage of the professional deduction:

- Notaries.

- Authors receiving compensation.

- Individual entrepreneurs who pay 13% personal income tax.

- Lawyers.

- Individuals who do not have individual entrepreneur status, but work under civil contracts.

- Self-employed.

- People in private practice.

How to return tax on the purchase of an apartment

The right to a property tax deduction arises if you recently became the owner of residential real estate or a plot of land intended for the construction of a private house and paid tax at a rate of 13% every month. It follows that individual entrepreneurs using the simplified tax system (simplified taxation system) cannot realize this opportunity. The property deduction applies to apartments, houses and land plots intended for individual construction. The right to return income tax arises only after the housing is put into operation.

List of documentation required to collect a property deduction:

- certificate of ownership of residential space or extract from the Unified State Register of Real Estate;

- certificate 2-NDFL;

- contract of sale;

- agreement on participation in shared construction; payment documents - checks, receipts, payment orders;

- act of acceptance and transfer of living space;

- statement;

- bank account details.

A 2-NDFL certificate must be requested from the accounting department for the period for which the tax refund is issued. In some situations, a tax representative may request additional documents. An application from spouses for the distribution of deductions is submitted in cases where the living space was acquired during marriage.

If you paid for a spouse's or child's share, you must provide a birth or marriage certificate. When money for housing was paid by order, a power of attorney for payment should be prepared. All documents are provided in the form of copies. Federal Tax Service employees may request originals for verification.

Separately, it is worth mentioning the package of documents if the property was purchased with a mortgage. In this case, it is additionally necessary to prepare a mortgage agreement and a certificate of interest paid. If the property is acquired as shared ownership, you should immediately prepare a statement on the distribution of the area.

To compensate for the costs associated with building a house, you will need expenditure documentation and an agreement on the finishing and construction of a residential property. You can collect the deduction for the last three years at once by preparing a separate declaration for each period.

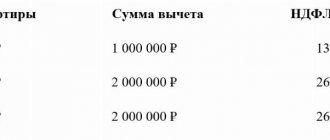

Anyone can return tax on the purchase of residential space, taking into account the maximum value of 2 million rubles. The amount compensated by the state is 13% of this amount, that is, it cannot exceed 260,000 rubles. Many citizens buy an apartment with a mortgage.

An additional deduction for interest is provided for them with a limit of 3 million rubles. Since 2014, you can return tax from several objects until the total payment reaches the maximum established limit. That is, if the first apartment cost less than 2 million, the tax can be returned after purchasing the second residential property.

Calculation example.

Perevozchikov A.Yu. became the owner, the cost of which is 3,700,000 rubles. Last year he paid taxes of 290,000 rubles. Let's calculate the property deduction: 13% of 3,700,000 rubles = 481,000 rubles. The amount exceeds the maximum amount established by the Tax Code of the Russian Federation. Perevozchikov A.Yu. can issue a refund of 260,000 rubles.

What requirements does the law impose on applicants?

- have Russian citizenship;

- purchase residential space or land plot on the territory of the Russian Federation for individual construction with a mortgage or for cash;

- register ownership of the living space, and have a transfer and acceptance certificate for a new building.

The seller of the apartment can be an individual or legal entity - a developer, an intermediary company. Article 220 of the Tax Code of the Russian Federation does not allow tax refund if the parties to the agreement are close relatives of each other. A refund from the purchase of real estate will also not be possible if the funds for the transaction were allocated in full or in part by the employer, or the square meters were purchased under a preferential program using budget funds.

How to return tax on the purchase of residential real estate to married spouses?

An apartment purchased after the official registration of family relations is considered jointly acquired property, unless the spouses indicated other conditions in the marriage contract.

Participants in the process have equal rights to property deduction. If the cost of housing is 4 million, then each spouse can claim a deduction of up to 2 million rubles. In this case, for tax refund, it does not matter who is listed as the owner or for whom the payment documentation is issued.

How to issue a property return if the apartment costs less than 4 million? If the property is worth 2 million, each spouse can return tax on 1 million. Or one person will claim a deduction from 2 million, then the second will be able to exercise his right after purchasing a second residential property.

Who can receive a tax deduction

Budget deductions return the tax actually paid. The right to deduction has a citizen who is a resident of the Russian Federation, works officially, pays personal income tax, has the right to tax deductions and documents confirming this right. The full list of persons who can receive a tax deduction is indicated in Articles 218 - 221 of the Tax Code of the Russian Federation.

| Property | A taxpayer who sold or bought property, built housing or acquired land for this purpose. |

| Standard | Disabled people from childhood and groups 1 and 2, parents and spouses of fallen military personnel, WWII participants, Chernobyl survivors, parents of minor children. |

| Social | People who spent money on the education of children, sisters and brothers, themselves, treatment of close relatives, who have expenses for the funded part of their pension, voluntary insurance, and charity. |

| Investment | Taxpayers who have received income from IIS operations, deposit money into their IIS, conduct transactions on the securities market and receive income from them. |

| Professional | Individual entrepreneurs, self-employed people, people working under a civil contract, lawyers, notaries, authors who received income for the creation or use of works of science, literature, art, etc. |

How to get money back for treatment

When purchasing certain medications and paying for medical procedures, the patient has the right to receive a social refund for paid treatment. This category does not include women on maternity leave, non-working pensioners and students.

Citizens who have used paid procedures or purchased medications as prescribed by a doctor, the list of which is determined by law, have the right to a deduction for medical services. The list of paid medical services covered by the rule contains almost all items necessary for the patient:

- initial examination, reception, preventive procedures, tests, treatment and recovery in the clinic and hospital;

- emergency medical services;

- medical examination;

- staying in sanatoriums for the purpose of healing and preventing the body;

- sanitary education of the population.

Persons who have taken out a personal voluntary medical insurance policy can also apply for this type of deduction. In addition to a basic set of documents, they need to provide a policy or contract with an insurance organization, its license and payment certificates.

To receive a tax refund for treatment and the purchase of medicines, in addition to the main list of documents, you will need the following data:

- prescription in form 107U;

- cash receipt from a pharmacy, certificate or receipt confirming payment for medicines and medical services;

- a written agreement with a medical institution for treatment;

- medical institution license.

The state will also return the money if a citizen of the Russian Federation paid for medical procedures and purchased medicines for his relatives: husband or wife, parents, minor children. To confirm your relationship, you will need a document: a marriage or birth certificate.

How to calculate tax refund for treatment

13% of expenses for medicines and medical services is the maximum deduction. It cannot exceed the tax withheld for the year. The state sets the maximum amount that is taken into account when calculating social deductions - 120,000 rubles. Additionally, you can compensate for the costs of expensive treatment.

If you paid 170,000 rubles for the operation, only the permissible limit will be taken into account for the calculation. The rule does not apply to operations classified as expensive treatment (IVF, plastic surgery, treatment of serious illnesses). Below is a sample of how to calculate your medical tax refund.

Calculation example.

In October 2021 Ivanov A.A. I spent 50,000 rubles on the hospital and the purchase of medicines. At this time his salary was 60,000 rubles. During the year he earned 720,000 rubles, the state withheld income tax of 93,600 rubles. The amount does not exceed the maximum. The refund will be 13% of 50,000 rubles = 6,500 rubles. This is less than the 2021 income tax. Ivanov I.I. will receive it in full.

How to get a tax deduction

Any citizen who meets the conditions for receiving a tax deduction specified above can receive it through the tax office or employer. In the first case, the money will be returned to him, and in the second, the employer will not withhold personal income tax from his salary.

To obtain a tax deduction, the following documents are required:

- TIN and copy of passport.

- Declaration 3-NDFL. With its help, you can get a deduction only from the tax office. The original is served. You can fill it out yourself or through an intermediary.

- Certificate of income in form 2-NDFL.

These documents must be present in almost every case. Depending on the type of tax deduction, other types of documents will be needed. These can be copies of payment documents for the purchase of real estate, payment for education, treatment, replenishment of the personal information system, etc. To pay for children, you will need certificates regarding the child. Each specific case is described in detail in the Tax Code of the Russian Federation (Articles 218 – 221).

From 2022, you will no longer have to file a return to receive certain types of tax deductions (investment and property).

How to return tax for paid education

The maximum amount when paying for your own education is limited to 120,000 rubles, when paying for the education of a child and ward - 50,000 rubles. The educational process is a broad concept. This includes obtaining a license and related services in kindergarten, and completing training courses. The main condition is that the institution must have a license for educational activities.

If a citizen has paid for his education, then any form of education is acceptable. Collection of a deduction for paid education of relatives and wards is possible if their age is not more than 24 years and they are studying full-time. To return funds, it is necessary to prepare an agreement with the educational institution, their license to operate and documents confirming payment for services.

How and when to file a declaration

The declaration in form 3-NDFL is submitted for each year separately according to the form that was in force in the previous year. The declaration can be submitted in your personal account on the website nalog.ru. It is signed electronically and sent to the tax office. The declaration is also submitted to the Federal Tax Service in person, through a representative, or by mail.

If, in addition to the property deduction, your declaration indicates income received last year, then you must submit the declaration by April 30. If a citizen submits a tax return wishing to receive tax deductions for personal income tax (standard, social, investment, property when buying a home), then he can submit it after April 30. In this case, tax sanctions will not be applied to him.

Example 1: Own training

Conditions for receiving the deduction: In 2021, Sidorov S.S. paid for his correspondence studies at the university in the amount of 80 thousand rubles.

Income and income tax paid: In 2020, Sidorov S.S. earned 50 thousand rubles a month and paid a total of 78 thousand rubles in personal income tax for the year.

Calculation of the deduction: The deduction for training will be 80 thousand rubles. That is, you can return 80 thousand rubles. * 13% = 10,400 rubles. Since Sidorov S.S. paid income tax in the amount of more than 10,400 rubles, and the amount of the tax deduction is less than the maximum (120 thousand rubles), then he will be able to receive a deduction in full (10,400 rubles).

What else should you consider when filling out the declaration?

A citizen should remember about supporting documents if he fills out a tax return in order to receive a tax deduction. Each deduction implies its own list of documents, without which the inspector will refuse it. Therefore, it is worth remembering all the documentation and the tax refund application. The tax office will check it for up to 3 – 4 months.

If a resident paid for his education, treatment, and replenished his IIS over the previous year, then he only needs to submit one return, in which he will claim several tax deductions. You do not need to file a tax return for each deduction.

You should not indicate all sources of income if they are not needed to receive a tax deduction. The Tax Code of the Russian Federation allows not to indicate in the declaration income on which the tax is fully withheld and does not interfere with receiving a tax deduction.

If the declaration is submitted, and the applicant only later discovers an error, then nothing can be changed in it. He must resubmit a corrected version.

Tax refund deadlines

The tax office will first check all the data. She can request information from Rosreestr or another body. Thanks to amendments made to the Tax Code in April 2021, some tax deductions from 2022 can be obtained without a declaration and filing documents.

The application that a citizen has submitted for a simplified deduction will be checked by the tax office within 30 days from the date of its submission. In some cases, the period can be extended to 3 months. After a positive decision is made, the money is transferred within 15 days.

If a declaration is submitted for a regular tax deduction, then auditors can check it within 3 months. If the deduction is confirmed, the money will be transferred within a month. Thus, the time frame for returning the tax deduction in this case is from 4 months.

Common problems and errors

If you submit documents for a tax deduction incorrectly, you can not only get a refusal from inspectors, but also get into serious trouble. Below are details of common errors and problems:

- When submitting documents through their personal account on the website nalog.ru, most applicants do not control the acceptance process. Documents may be sent but not receive the “accepted” status. So the declaration can hang for several months. Therefore, you always need to monitor the entire process of submitting documents to the tax office.

- Some resident applicants do not attach documents confirming their right to the deduction. A declaration without accompanying certificates is a usual statement of intention to receive a deduction.

- Some citizens request deductions in the wrong order. If a person bought real estate, then he has access to a property deduction for the purchase of real estate and for the interest paid on the mortgage. The last deduction is provided only for 1 object. To get two deductions at once, you first request a deduction for the purchase of real estate, the tax office pays it, and then submit a request to deduct interest on the mortgage.

- You cannot request the balance of the social deduction. It is obtained only for the year in which the applicant incurred expenses for it. If a person has not received the full deduction, the remainder will be lost next year.

- To receive a tax deduction, you need to submit documents to the tax office at your registered address, not your actual residence. People often confuse addresses. The tax inspector will not accept documents if the registration address does not match the inspection address. If your place of registration is far from your place of residence, then it is better to submit a declaration through nalog.ru or by regular mail.

- Sometimes citizens expect to receive a refund greater than the amount of taxes paid. The resident must independently calculate how much money he can return so that the inspector does not reject his declaration.

Income tax refund: general concepts

If an officially working citizen has committed one of the actions specified in Art. 219 or 220 of the Tax Code of the Russian Federation, he can return within three years part of the money spent on education, treatment, medicines, and the purchase of housing.

Let's consider the list of cases when an applicant can return social tax:

- donations have been made to charitable or religious organizations;

- payment for training has been made;

- received paid treatment at a medical institution;

- contributions have been made to a non-state pension fund or additional insurance payments for the funded pension part;

- passed an independent qualification assessment.

Purchasing housing on the secondary market or in a new building is a legal basis for applying for a property deduction. It is also required if a citizen has become the owner of a plot of land intended for the construction of a private cottage or house.

You can receive your income tax refund in any month of the next year after the reporting period. That is, the declaration for 2016 began to be accepted in January 2021. The tax can be recovered within three years after its payment. If you have a qualified electronic signature, you can register a declaration and submit documents without leaving your home through the taxpayer’s personal account on the Federal Tax Service website. Alternative options are to deliver them in person or by a valuable letter with an inventory of the contents by mail.

Basic list of documentation that will be required for a tax refund:

- declaration 3-NDFL;

- statement;

- passport of a citizen of the Russian Federation;

- bank account details;

- TIN;

- certificate 2-NDFL.

The approved form 3-NDFL can be downloaded from the Federal Tax Service website. Bank account details are required for funds to be credited to them after the end of the desk audit. Certificate 2-NDFL should be ordered from the employer, in the accounting department. The basic list for different types of tax refund is supplemented with additional documents. Specific lists will be presented below.

The Tax Code of the Russian Federation limits the maximum amount of payments. When purchasing residential real estate, the state compensates a maximum of 260,000 rubles; for social deductions, the amount is 120,000 rubles. In one year, you can recover money from the tax service in the amount of taxes transferred for the past period.

Calculation example.

Ivanov E.I. purchased residential property for 1,800,000 rubles in 2015. The amount of the tax deduction is 13% of the cost of the apartment, that is, 234,000 rubles. In 2015, he transferred 60,000 rubles in taxes to the budget. This amount will be transferred to his account. To receive the balance (174,000 rubles), he must file tax returns for several more years.

Two tax refund methods

Property and social tax can be returned in different ways. The first option is to request a certificate from the Federal Tax Service and submit it to the employer. The tax base will be reduced by the amount specified in the notice. In other words, no tax will be deducted from the employee's salary until he has paid the full amount due.

The second way is to submit a declaration to the Federal Tax Service. With its help, you can return taxes for the previous three years. If you correctly fill out all the documents and submit them to the Federal Tax Service, then if the decision is positive, after a desk audit, a property or social deduction will be sent to your current account. Consideration of the application takes no more than three months. The legislation allows 30 days for the transfer of funds.

Is it worth using services for filling out and sending a declaration?

The tax office carefully checks all the data that a resident submits to receive a deduction. Because of one minor mistake, inspectors may refuse to return the money, and then the citizen will have to submit documents and fill out the declaration again, waiting several months for inspection. And even then it is not a fact that the person did everything right.

In order not to have to worry about filling out and to avoid possible errors and loss of time, you can use the services of agencies that fill out and send the documentation. Below are some examples of companies with their services and prices for them.

| Property deduction (3-NDFL) | Social deduction (3-NDFL) | Professional deduction (3-NDFL) | |

| Dvitex | 2,500 rubles | 2,500 rubles | 2,500 rubles |

| Accountant | 500 rubles | 500 rubles | 500 rubles |

| NC "Garant" | 2,500 rubles | 1,500 rubles | |

| Yurprofit | 1,500 rubles | 750 rubles | 2,000 rubles |

Not everyone can figure out how to fill out a declaration, so people turn to intermediaries. But even in this case, there is no guarantee of successfully obtaining a tax deduction, since there are scammers posing as experts. They will take money to fill out, submit, send, and in the end the tax office will refuse the deduction. Then the applicant will waste not only time, but also money.

FAQ

Is it possible to divide the costs of treatment between husband and wife if there is only one contract?

Let's assume that the spouses expect a tax deduction in the amount of 120,000 rubles. The husband and wife can distribute the costs of treatment that they both incurred in any proportion. To do this, you need to draw up an application for the distribution of expenses under one certificate. But both spouses must sign it.

If the treatment was partially paid for by the employer, is it possible to get a tax deduction for it?

In this case, only the amount paid by the employee can be deducted. Money for expenses paid by the employer cannot be returned.

A man bought an apartment and began to receive a tax deduction for it, but before receiving the full amount, he sold the property. Will he continue to receive a tax deduction?

Will. Selling an apartment does not interfere with receiving a deduction.

What is the priority order for receiving deductions?

It is best to first receive social and then property deductions. The citizen must write a statement indicating their priority. It is important to have time to receive the social deduction, since next year, unlike the property deduction, it will expire.

Can a citizen receive a deduction for the purchase of an apartment if he did not officially work?

It cannot, since a tax deduction is a refund of personal income tax paid by a resident. If a person does not work, then he does not pay tax, which means there is nothing to deduct the amount from. To receive the deduction, you need to get a job and pay income tax.

If a person purchased an apartment from his parents or children, can he count on a tax deduction?

Can not. According to the Tax Code of the Russian Federation, a property deduction is not provided in the case of a purchase and sale transaction between interdependent individuals.

Example 3: Deduction for training along with other social deductions

Conditions for receiving the deduction: In 2021 Popov A.A. paid for his university education in the amount of 100 thousand rubles and dental treatment in the amount of 50 thousand rubles.

Income and income tax paid: In 2020 Popov A.A. earned 50 thousand rubles a month and paid a total of 78 thousand rubles in personal income tax for the year.

Calculation of deductions: Dental treatment is not an expensive treatment (Resolution of the Government of the Russian Federation No. 201 of March 19, 2001) and the maximum amount of social deductions for the year cannot exceed 120 thousand rubles. Therefore, return Popov A.A. will be able to maximum 120 thousand rubles. * 13% = 15,600 rubles. Since Popov A.A. paid more than 15,600 rubles in income tax, then he will be able to return this amount in full.

Conclusion

Let us briefly summarize the review article:

- A tax deduction can be received by a citizen of the Russian Federation who paid personal income tax for one of his types of income for the previous year.

- Tax deductions can be: property, social, professional, investment, standard.

- The tax deduction can be paid by the tax office by transferring money to an account or by the employer, who will not withhold personal income tax from the salary.

- To receive most deductions, you need to submit a 3-NDFL declaration with accompanying documents. From 2022, recipients of investment and property deductions are exempt from submitting documentation.

- For most tax deductions, the return is filed in the year following the year in which the expenses were incurred.

- The period for checking the declaration and returning money to the tax office can be up to 4 months.

- You can use the services of intermediaries to file your tax return. But not all of them will provide the desired result.