How to return 13 percent from the purchase of an apartment?

Since 2014, the procedure for returning 13 percent of the purchase of an apartment has changed slightly: now the property deduction can be used several times (when purchasing several real estate properties) within a limit of 260 thousand rubles.

This limit is 13% of the maximum deduction amount for the value of real estate, which cannot exceed 2 million rubles. If housing was purchased (built) using loan funds, the taxpayer has the right to reimburse the amount of interest paid to the bank, but not more than 390 thousand rubles.

Multiple personal income tax refunds when purchasing an apartment will be able to be made only by those taxpayers who have not used this tax benefit before, since before 2014 such a deduction could only be used once in a lifetime, regardless of the value of the property.

One more nuance should be taken into account: personal income tax compensation when purchasing an apartment can only be made in the amount of income tax actually withheld or independently paid by an individual. That is, if a person does not receive income and income tax is not withheld from him, then there is no source for tax refund.

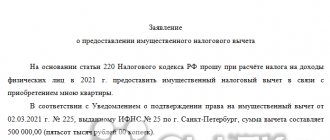

The right to a tax deduction is ensured by subsection. 3 p. 1 art. 220 Tax Code of the Russian Federation. The standard procedure for exercising the right to a property deduction is to contact the tax service at the place of registration of the taxpayer. In this case, you will need to collect a package of necessary documents (subclause 6, clause 3, article 220 of the Tax Code of the Russian Federation) and submit them to the Federal Tax Service. The waiting period for payment is 4 months, of which 3 are allocated for conducting a desk audit (clause 2 of Article 88 of the Tax Code of the Russian Federation) and 1 for making the payment itself (clause 6 of Article 78 of the Tax Code of the Russian Federation).

To receive a tax refund, several conditions must be met:

- an individual must be a payer of income tax in the amount of 13%;

- the deduction is given only for real estate purchased in Russia;

- to pay for the property, the taxpayer’s personal funds or money given to him under a mortgage loan were used;

- the parties to the purchase and sale transaction are not close relatives or other related persons.

The time that has passed since the acquisition of real estate does not matter for obtaining a property deduction; however, only the personal income tax that has been transferred to the budget over the last 3 years can be returned.

In this case, the taxpayer will need to submit a declaration in Form 3-NDFL for 3 years in order to calculate the amount of tax paid for this period. The article “How to fill out the 3-NDFL declaration for 3 years?” will help you with this.

The right to use the property deduction is also granted to the parents of a child who has not reached the age of majority, if an apartment is purchased specifically for him.

Does a child, upon reaching the age of majority, have the right to claim a property deduction if the parent purchased an apartment for him and has already taken advantage of the deduction? The answer to this question is discussed in detail in the Tax Guide from ConsultantPlus. Get trial access to the system and study the material for free.

Limitation period for receiving tax deductions

The right to receive a repeated tax deduction are those property owners who bought or built a property before 2001 and received the first tax deduction also before 2001.

The fact is that before this period, personal income tax refunds were made in accordance with the Law “On Personal Income Tax” dated December 7, 1991. The amount to be deducted was then relatively small.

Then the basis for the return of personal income tax became Art. 220 of the Tax Code of the Russian Federation, which allows you to apply a deduction first in the amount of up to 1 million rubles. (since 2003), and since 2008 - already in the amount of 2 million (at the personal income tax rate of 13%, the amount to be returned is 260 thousand rubles). When purchasing an object with a mortgage, you have the right to an additional property deduction of 3 million rubles. (amount to be refunded - up to 390 thousand rubles).

All the details of obtaining a property tax deduction for interest on a mortgage loan were reviewed by ConsultantPlus experts. You can access the explanations for free right now by signing up for a trial online access to K+.

The Constitutional Court of the Russian Federation, in its ruling dated April 15, 2008 No. 311-О-О, explained that if a person exercised the right to a tax deduction before the entry into force of Art. 220 of the Tax Code of the Russian Federation, this does not entail the loss of the right to use the deduction after the entry into force of this article.

In practice, this means that, having bought an apartment, house or share before 2001 and returned the personal income tax, a person can once again return the personal income tax for a property acquired, for example, in 2002 and later. This rule also applies to the mortgage interest deduction.

What documents are needed to receive a personal income tax deduction when buying an apartment?

In accordance with sub. 6 clause 1 art. 220 of the Tax Code of the Russian Federation, in order to receive a personal income tax deduction when purchasing an apartment, the taxpayer must collect and submit the following documents to the Federal Tax Service:

- A contract of sale and purchase (exchange) for a residential property (apartment, room or share in them) and also a receipt for payment for it (subclause 7, clause 1, article 220 of the Tax Code of the Russian Federation). All documents are submitted in the form of certified copies.

- An agreement on shared participation in construction or a deed of transfer of such a construction project. The document is submitted as a certified copy.

- If an apartment was purchased as a property for a child under 18 years of age, then it is necessary to provide a copy of his birth certificate, as well as permission from the guardianship authority to complete such a transaction.

- You will also need a certified copy of the certificate of registration of ownership of the commissioned real estate (for housing under construction this document is not needed, the transfer and acceptance certificate of the property will be sufficient). From July 15, 2016, instead of a “pink” certificate, government agencies issue an extract from the Unified State Register of Real Estate Rights.

- Copies of the TIN assignment certificate and the applicant’s identity document.

- In addition, it is advisable for the taxpayer to submit a certificate of employment in Form 2-NDFL. This certificate is not named in the list of required documents, but controllers have the right to request it. See here for details.

See also the article “Where you can get (get) a 2-NDFL certificate.”

To receive a deduction through the tax department, you will need to submit a declaration in Form 3-NDFL. It is submitted starting from the first quarter of the year following the tax period in which the property was purchased.

ATTENTION! To reimburse personal income tax for 2021, fill out 3-NDFL using the updated form.

In order to indicate the chosen method of obtaining a property deduction, as well as the bank details of the taxpayer, an application for a personal income tax refund must be submitted. The deadline for submitting it is not regulated, but payments will begin only 1 month after its submission. In this regard, it is advisable to submit such an application along with a complete package of necessary documentation.

For a complete list of documents, see the article “Documents for tax deductions when purchasing an apartment.”

After the expiration of the allotted period for conducting a desk audit (3 months if the tax is returned by the inspectorate, and 30 days if the personal income tax is no longer withheld by the employer), the tax department will inform about its decision to provide a property deduction or a refusal. In most cases, the refusal to provide a property deduction is due to inaccuracies made when filling out the declaration. The taxpayer will be able to re-submit the return, but the deadline for conducting the desk audit will not change.

Find out how to get a property deduction when participating in shared construction in the authoritative opinion of ConsultantPlus experts. Get trial access to the system for free.

Deduction when purchasing property

Who can receive a property deduction

Deductions are provided for citizens who are tax residents of the Russian Federation, i.e. permanently residing in the Russian Federation for more than 183 calendar days a year. In addition, they must pay 13% personal income tax on their income, with the exception of income from dividends.

The property must be located on the territory of the Russian Federation, and the owner must have all the title documents. For a new building, it is enough to obtain an act of acceptance of the transfer; for secondary housing, an extract from the Unified State Register of Real Estate.

When real estate is purchased after marriage, both spouses are immediately entitled to a tax refund. The only obstacle can be a marriage contract.

How much can you get back from the budget?

The buyer of real estate can return:

- 13% of the cost, but not more than 260,000 rubles. (RUB 2,000,000 * 13%) and

- 13% of the amount of interest paid on a mortgage or target loan, but not more than RUB 390,000. (RUB 3,000,000 * 13%). Depending on the date of purchase, the size of the deduction and the procedure for transferring its balance change.

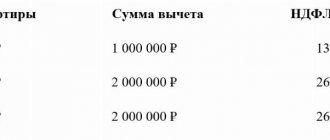

| Date of purchase | Property deduction | Property deduction from mortgage interest |

| From 01/01/2003 to 01/01/2008 | The deduction limit is 1,000,000 (the maximum tax refund is 130,000 rubles), the lost balance is not transferred to other objects. | no size limit |

| From 01/01/2008 to 01/01/2014 | The deduction limit is 2,000,000 (the maximum tax refund is 260,000 rubles), the lost balance is not transferred to other objects. | no size limit |

| after 01/01/2014 | The deduction limit is 2,000,000 (maximum tax refund is 260,000 rubles), the lost balance can be transferred to other objects. | limit 3 million rubles. |

The balance of the deduction can be transferred to other properties only when purchasing an apartment after 2014. This will not work with mortgage interest - this deduction is given only for one property.

When to apply for a deduction

Option 1 - Within the next year after receiving the title documents (in the case of a purchase and sale agreement - this is the Unified State Register of Real Estate, in the case of a DDU agreement - the transfer and acceptance certificate).

Whenever you purchase an apartment or other housing, after receiving ownership rights, you can claim a tax refund even after 2 years, even after ten years.

But at the same time, you can only return the tax for the last three years. For example: you bought an apartment in 2021, but decided to apply for a property deduction only in 2021, 5 years later. This means you can file tax returns for 2021, 2021, 2021. And further, if you have any unused deductions, for 2021 and subsequent years.

Pensioners can return personal income tax for four years at once: for the year in which the purchase was made and the three preceding ones.

Option 2 - Apply for a deduction to the employer in the year of the purchase and registration of documents for the property. Only citizens working under an employment contract can afford this. Please note that the date you applied for a refund does not affect the rule for distributing deductions from 2014.

SberSolutions will help you prepare your declaration and send documents to the tax office without leaving your home.

Apply for a deduction

How to get a property deduction

If you choose the second return option, you must act through your employer. To do this, you need to receive a notice of the right to deduction from the tax office and take it to your place of work. Accounting will stop withholding personal income tax from current earnings, and will also return the tax withheld from the beginning of the year.

Submitting a declaration yourself allows you to return a large amount at once . To do this, during the year we collect income certificates from all employers, prepare documents confirming the purchase, and fill out the 3-NDFL declaration. A desk tax audit should not exceed 3 months, then another 30 days remain for transfer to a bank account.

With the introduction of a simplified procedure for obtaining personal income tax deductions in May 2021, the need to prepare and submit declarations has not completely disappeared. The simplification applies only to certain expenses:

- costs of new construction, acquisition of an apartment, house, room, shares in them, land for individual housing construction;

- interest on mortgages and other targeted loans;

- as well as for an individual investment account.

In addition, the simplified scheme will only work if the bank and local authorities transfer information about the purchase of real estate to the Federal Tax Service. Therefore, you should not rely on such conditional process automation. It is safer and faster to apply for a personal income tax refund yourself.

What errors prevent you from receiving a refund:

- Submission of documents by a person who does not have the right to deduction . Close relatives of the seller cannot receive a tax deduction. Recipients of maternity capital do not have the right to include it in the amount for deduction.

- Errors in paperwork. You can confirm the purchase costs with a handwritten receipt, receipt, payment slip or bank statement. The receipt does not need to be certified by a notary, but if you are confirming expenses with a purchase and sale agreement, it must be certified and contain a clause stating that the seller received the money.

- Missing the deadline for filing a declaration. There is no statute of limitations for property deductions, but there is a limit on the number of years for which you can submit Form 3-NDFL and get the money back. Therefore, if you did not file a deduction immediately, but want to do it later, then remember that you can submit a declaration for no more than three previous years.

- Using the wrong form 3-NDFL . The Federal Tax Service periodically updates declaration forms, so it is important to use the form that was in force in the corresponding reporting year.

How to fill out a tax return?

To obtain the right to a property deduction, an individual taxpayer will need to fill out a tax return 3-NDFL. For the report for 2021, the form was approved by order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

5 pages of the reporting document must be completed: title page, sections 1 and 2, appendix 1 and appendix 7.

There should be no difficulties in filling out the title page, because it contains personal information about the individual and the tax authority to which the declaration will be submitted.

Features of filling out the declaration:

- Section 1 contains the final results of tax calculations: for reimbursement or additional payment.

- Section 2 shows the entire sequence of calculating the tax base and the final tax amount.

- Appendix 1 contains information about income from a certificate issued by the employer in Form 2-NDFL.

- Appendix 7 contains information about the purchased apartment, as well as the amount of property deduction.

If the declaration is filled out manually, then on the printed form the entered data should be aligned to the left. If the declaration is filled out using a computer program, then along the right edge. Double-sided printing is not permitted, and pages should not be stapled to avoid damaging the bar codes on the left.

Read more in the article “Filling out the 3-NDFL declaration for property deduction.”

How to apply for a property deduction?

You can submit documents for the right to use a property deduction in one of the following ways:

- Personally. To do this, you need to find time and visit the Federal Tax Service at your place of registration. The disadvantage of this method is the waste of personal time and the need to answer possible questions from the tax inspector.

- By mail. It is better to send documents by a valuable letter with a list of attachments. The disadvantage of this method is that if the documents are not in order, then it will be possible to find out about this only after 3 months, allotted for conducting a desk audit.

- Through the taxpayer’s personal account by filling out the proposed declaration form online. Scans of documents confirming expenses for the apartment must also be attached to the declaration. The advantage of this method is that the taxpayer will be able to track the status of the return verification and the progress of the submitted tax refund application.

For more information about filling out the 3-NDFL declaration online, read the article “How can you submit a 3-NDFL declaration to the tax office.”

Results

Individuals who pay personal income tax when purchasing an apartment can take advantage of the right to a refund of previously paid tax or benefits from exemption from the withholding of 13% on income received at the place of work. In order to exercise this right, you must collect a complete package of documents and submit them to your Federal Tax Service.

The maximum amount of property deduction provided once for life is 260 thousand rubles, and you can use your right to it as many times as you like until the limit is completely exhausted. This applies to residential real estate purchased since 2014, or cases where the property was purchased earlier, but the taxpayer did not use the right to such a deduction at all.

The waiting period for personal income tax reimbursement when purchasing an apartment is no more than 4 months, and the amount of tax declared as subject to reimbursement in the form of a payment to the taxpayer’s account will be transferred to him immediately, and receiving a deduction from the employer will take longer.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Unused balance

The Tax Code of the Russian Federation sets an upper limit on the amount that can be returned from the budget:

- 260 thousand rubles. for the purchase or construction of an object;

- 390 thousand rubles. for an object purchased with a mortgage.

But the actual amount to be refunded depends on the individual’s income. It often happens that a taxpayer can return only part of the amount allowed for refund, because he did not pay a sufficient amount of personal income tax on his income to the budget.

In this case, the homeowner has an unused deduction balance, which can be received later. Thus, you can apply to the Federal Tax Service for a deduction not only once, but until the entire available limit is exhausted.

However, when applying to the Federal Tax Service again, you should keep in mind several nuances.

First, you need to take into account the year you purchased your home. If it was purchased between 2003 and 2007, you can return only 13% of 1 million rubles. If the property was purchased in 2008 or later, you can return 13% of 2 million rubles. Therefore, the amount of the unused deduction balance must be calculated correctly.

Secondly, when purchasing an object before 2014, the deduction can be obtained only for it, without transferring the balance of the deduction to another object. Since 2014, you can return the balance of the deduction when purchasing another home.

Same with the mortgage deduction. When purchasing an apartment with a mortgage before 2014, the deduction could only be used together with the main deduction and only for the same apartment.

But if a citizen purchased a property with a mortgage in 2014 or later and did not previously use the mortgage loan deduction, then it can be used when purchasing a new home (even if the main deduction was received before 2014). This is confirmed by officials (letter of the Ministry of Finance of the Russian Federation dated May 14, 2015 No. 03-04-07/27582). Thus, an individual has the right to receive an additional 390 thousand rubles.

If both deductions are used, then the owner’s spouse can receive a second deduction, provided that:

- the spouse has not yet exercised his right to deduction;

- the home was purchased during marriage.

Controversial issues related to a spouse receiving a property deduction for personal income tax when purchasing housing are discussed in the Encyclopedia of Disputed Situations regarding Personal Income Tax. You can get a free trial access to K+ and see how such controversial situations are resolved.