After submitting a 3-NDFL declaration for a tax deduction to the Federal Tax Service, most citizens ask the question: When will I receive the payments due to me? Many people believe that in this matter everything depends only on chance and their own luck. In fact, there are established deadlines during which tax officials must review your 3-NDFL declaration, make a decision on the payment of money and, in case of a positive decision, transfer the funds to the details you previously specified.

Deadlines for payment of tax deductions after filing the 3rd personal income tax.

After submitting the declaration and all accompanying documents to the tax authority, it carries out a desk audit, which includes a direct check of the declaration itself, as well as all provided documents for their authenticity, by requesting information from the relevant authorities that issued these documents. Upon completion of the desk audit, the Federal Tax Service makes a decision on granting or not granting a tax deduction.

The decision to provide a tax deduction must be made within 3 months from the date of filing the declaration, in accordance with Article 88 of the Tax Code of the Russian Federation.

It would not be amiss to note that if you have a personal taxpayer account, you can monitor the progress of the verification of your declaration in the “Taxpayer Documents > Electronic Document Flow” section. After the Tax Service makes a positive decision on the payment of the deductions due to you, you must transfer funds to the bank account specified in the application.

In accordance with Art. 78 of the Tax Code of the Russian Federation, the transfer of funds may take up to one month.

In total, in the worst case scenario, you will have to wait no more than 4 months for a tax deduction. If the payment period has been delayed for a longer time, you can contact your tax office to find out the reasons.

What is a tax deduction and why do you get it?

A tax deduction is a certain amount of income that is not subject to tax, or a refund of part of the personal income tax (PIT) already paid in connection with some expenses incurred. The types of these expenses are determined by the Tax Code of the Russian Federation. Any citizen of the Russian Federation or a foreign citizen can receive a tax deduction if he lives in Russia for more than 183 days a year and pays tax on the income received.

Example!

Let's say you earned 1 million rubles in a year. and 13% was paid in income taxes. In the same year, you spent 100 thousand on your child’s education at the university. These 100 thousand are deducted from income, and it turns out that you had to pay tax not 130 thousand, but 13% of 900 thousand, that is, 117 thousand. The overpayment amounted to 13 thousand rubles - so they will return it to you.

When should the Federal Tax Service return the tax?

The deadlines for transferring tax deductions are specified in paragraph 2 of Article 88 of the Tax Code of the Russian Federation. The Federal Tax Service has three months from the date of submission of documents for a desk audit. After the end of the desk audit, the tax service is obliged to make its decision: to approve the tax refund or refuse. The taxpayer must be notified in writing of the results of the audit. Let's look at how to track your tax deduction below.

If the Federal Tax Service makes a positive decision, the citizen additionally submits an application for a refund of 13%. It contains his personal account and bank details. The tax office has one month to transfer the money. Thus, the maximum time for checking and transferring a refund takes four calendar months.

How to find out when the tax deduction will arrive? The easiest and most convenient way is to open a personal taxpayer account. To do this, you need to contact the nearest tax office with your original passport and TIN. It is not necessary to come to your place of registration; you can open a personal account at any tax office.

The taxpayer will be given a personal login and password. Using your personal account, you can check the status of your tax deduction. To do this, you need to go to the Federal Tax Service website using your username and password. It takes three days to create a taxpayer’s account. After that, it displays the status of the tax deduction refund.

If it is not possible to create a personal account, there is still a way to find out when the tax deduction for the apartment will be paid. The taxpayer has the right to call his tax office, give the TIN and receive verbally the result of the audit process of his tax return.

Child deduction: documents, procedure

To receive a “children’s” deduction, it is not necessary to go to the tax office. It is enough to contact the accounting department at your place of work with a corresponding application. The simple procedure makes this deduction the most popular among the population. Usually the employer is asked to apply for this deduction from the beginning of the year, but you can also claim it retroactively through the Federal Tax Service.

The deduction for a child (children) is provided up to the month in which the taxpayer’s income, taxed at a rate of 13% and calculated on an accrual basis from the beginning of the year, exceeded 350 thousand rubles. The deduction is canceled from the month when the employee’s income exceeds this amount.

For the first and second child, a deduction of 1,400 rubles is allowed; for the third and each subsequent child - 3,000 rubles. For each disabled child under 18 years of age, or a full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II - 12,000 rubles. parents and adoptive parents (RUB 6,000 for guardians and trustees).

General list of required documents:

- A written application addressed to your employer requesting a tax deduction for the child(ren);

- Birth certificate of the child (or children). This also applies to adopted children; here you need a copy of the adoption certificate;

- Certificates of child disability, if the child is one;

- Certificates from the child’s place of education (subject to receiving a deduction for a child over 18 years of age studying full-time at an educational institution);

- Marriage certificate.

Procedure:

- Write an application for a standard tax deduction for a child (children) addressed to the employer.

- Prepare copies of papers (see above).

- If the employee is the only parent, the kit must be supplemented with a copy of a document confirming this fact (perhaps the death certificate of the second parent).

- If the employee is a guardian or trustee, the kit must be supplemented with a copy of the document on guardianship or trusteeship.

- Contact your employer with an application for a standard tax deduction and copies of all papers.

Important!

If the taxpayer has several employers, he will have to choose. If there is only one parent, he is entitled to double the deduction. One of the spouses can also receive a double amount if the other refuses the deduction in writing. However, if the second spouse simply does not have taxable income, and therefore no right to deduction, then the first spouse cannot count on double the amount.

Procedure for returning a tax deduction

Let us remind you that in order to return 13% of the purchased property, you need to collect documents, fill out 3-NDFL and submit the finished package to the tax authority.

To receive a deduction for an apartment, prepare the following documents:

- certificate from work 2-NDFL;

- agreement for purchase or participation in shared construction;

- deed of transfer;

- certificate or extract of ownership;

- payment documents;

- loan agreement if there is a mortgage;

- application with bank details and personal account.

Based on the documents, the 3-NDFL declaration is filled out. You can compile it in two ways: on tax office forms or in a special Declaration program. With documents and a completed declaration, the taxpayer goes to the Federal Tax Service for registration and hands over the package.

According to the law, you will have to wait three months for a desk audit. If the declaration is drawn up correctly, there will be a receipt in the fourth month. But it happens that after a full four months the money is not transferred.

How to apply for a property deduction?

You can submit documents for the right to use a property deduction in one of the following ways:

- Personally. To do this, you need to find time and visit the Federal Tax Service at your place of registration. The disadvantage of this method is the waste of personal time and the need to answer possible questions from the tax inspector.

- By mail. It is better to send documents by a valuable letter with a list of attachments. The disadvantage of this method is that if the documents are not in order, then it will be possible to find out about this only after 3 months, allotted for conducting a desk audit.

- Through the taxpayer’s personal account by filling out the proposed declaration form online. Scans of documents confirming expenses for the apartment must also be attached to the declaration. The advantage of this method is that the taxpayer will be able to track the status of the return verification and the progress of the submitted tax refund application.

For more information about filling out the 3-NDFL declaration online, read the article “How can you submit a 3-NDFL declaration to the tax office.”

Delay in payment of tax deduction

If the money has not been received and the deadline for the desk audit has long passed, the taxpayer can contact the tax service for clarification.

A delay in payment means some kind of error in the declaration or in the documents provided. The tax service is obliged to notify about the presence of shortcomings during the desk audit. In practice, district tax inspectorates may not send notifications if there are errors. The taxpayer needs to independently control the progress of his business.

If a delay occurs, you should immediately contact the office department and find out when the money for the tax deduction will arrive. It is possible that not all documents were attached to the declaration. After eliminating the shortcomings, the tax inspector sends an order to transfer the refund. The taxpayer has the right to collect interest for violation of the return deadlines. All requests to the tax service should be submitted in writing to the head of the inspectorate.

The deadline for a desk audit cannot be accelerated. If the taxpayer wants to receive compensation faster, he is required to have a correctly completed declaration and a complete package of documents. This will avoid delays during the verification process.

Tax deductions have no statute of limitations

Tax legislation does not contain restrictions on the period for receiving a property deduction, therefore the right to a deduction when purchasing a home does not have a statute of limitations . You can claim a deduction either 10 years or 20 years after purchasing a home.

Example: In 2003, Degtyarev M.O. bought an apartment. In 2021, he learned about the property deduction, submitted the relevant documents to the tax office and received the deduction.

Example: In 2021 Kalacheva E.Z. I bought an apartment, but since the beginning of the year she has been on maternity leave to care for children and plans to stay on it for the next 6 years. Accordingly, at the moment Kalacheva E.Z. cannot receive a deduction (since he does not work and does not pay income tax). After she returns to work in 2026 and begins paying taxes, she will be able to exercise her right to a property deduction.

Despite the fact that there is no statute of limitations for receiving a property deduction, remember that you can only return taxes for the previous 3 years. More about this in the next paragraph.

General information

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Today there are several types of benefits. Deductions can be:

- standard - provided to categories of citizens strictly defined by law (low-income segments of the population, combatants, etc.);

- social - there is a return of part of the funds spent on treatment, training, etc.;

- in most cases, professionals are issued by people of creative professions;

- for securities - provided in case of losses of the taxpayer related to securities;

- property - can be used when purchasing living space.

To determine the return period, you will need to read Art. 78 Tax Code of the Russian Federation. You should also know that:

- such a benefit can be used only once in a lifetime, but after 2014 this right applies to several real estate properties;

- a tax return for receiving a property deduction is completed in the year following the transaction;

- the possibility of receiving compensation is not affected by the place where the real estate was purchased;

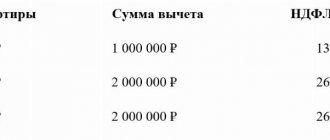

- the maximum amount for which a deduction is issued is 2 million rubles (accordingly, the taxpayer cannot claim payment of more than 260 thousand rubles);

- spouses have the opportunity to receive double compensation, provided they comply with all the rules established by law;

- when purchasing living space for an amount below 2 million rubles, a person retains the right to take advantage of the remaining percentage of the deduction when purchasing another property, provided that the right to receive the benefit was not used before 2014.

Who is entitled to a refund?

In order for a citizen to be provided with the described benefit, he must:

- be a citizen of Russia;

- have grounds for receiving a tax deduction;

- have official income and pay personal income tax.

If a person did not have official income at the time of purchasing real estate, the citizen has the right to submit an application asking for a refund after some time.

The following categories of citizens are not eligible for income tax refunds:

- persons who are not residents of the Russian Federation, that is, spend less than six months a year in the country;

- those undergoing fixed-term and contract military service in the army and navy;

- pensioners, if their three-year tax period has expired;

- children who have not reached the age of majority, but their parents can do this for them.

What are the conditions for a tax refund when purchasing an apartment? See here.

How to apply?

For 2021, processing the return of overpaid funds is a fairly simple operation that anyone can handle. A citizen may encounter some difficulties only when filling out the 3-NDFL declaration.

When preparing the document, you should pay special attention to the following requirements:

- in order to avoid refusal to pay compensation, only accurate information should be indicated in the declaration and other documents;

- filling out the documentation should be done in block letters, which allows tax officials to better understand the contents and also helps to facilitate the procedure for scanning the document;

- It is necessary to exclude any blots in the margins.

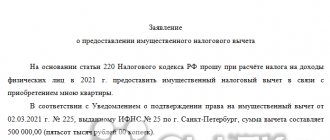

When the declaration is completed, the citizen should proceed to fill out the application. Because There is no single template established by law; the application can be filled out in any form.

However, it will be necessary to mention the following information:

- place of residence, full name and tax identification number of the applicant;

- the name of the tax transaction performed for which the citizen intends to receive compensation;

- the amount of money the person is claiming;

- bank account details where, if the tax authority makes a positive decision, the due amount will be transferred;

- the date of preparation of the document and the personal signature of the taxpayer, without which the application can be considered invalid.

Next, the citizen will be required to collect a package of necessary documents. In order to avoid a negative decision from the tax authority, this issue must be approached responsibly.

A sample application for a tax deduction for the purchase of an apartment is here.

A sample application for a tax deduction for treatment is here.

What documents are needed to receive a personal income tax deduction when buying an apartment?

In accordance with sub. 6 clause 1 art. 220 of the Tax Code of the Russian Federation, in order to receive a personal income tax deduction when purchasing an apartment, the taxpayer must collect and submit the following documents to the Federal Tax Service:

- A contract of sale and purchase (exchange) for a residential property (apartment, room or share in them) and also a receipt for payment for it (subclause 7, clause 1, article 220 of the Tax Code of the Russian Federation). All documents are submitted in the form of certified copies.

- An agreement on shared participation in construction or a deed of transfer of such a construction project. The document is submitted as a certified copy.

- If an apartment was purchased as a property for a child under 18 years of age, then it is necessary to provide a copy of his birth certificate, as well as permission from the guardianship authority to complete such a transaction.

- You will also need a certified copy of the certificate of registration of ownership of the commissioned real estate (for housing under construction this document is not needed, the transfer and acceptance certificate of the property will be sufficient). From July 15, 2016, instead of a “pink” certificate, government agencies issue an extract from the Unified State Register of Real Estate Rights.

- Copies of the TIN assignment certificate and the applicant’s identity document.

- In addition, it is advisable for the taxpayer to submit a certificate of employment in Form 2-NDFL. This certificate is not named in the list of required documents, but controllers have the right to request it. See here for details.

See also the article “Where you can get (get) a 2-NDFL certificate.”

To receive a deduction through the tax department, you will need to submit a declaration in Form 3-NDFL. It is submitted starting from the first quarter of the year following the tax period in which the property was purchased.

ATTENTION! To reimburse personal income tax for 2021, fill out 3-NDFL using the updated form.

In order to indicate the chosen method of obtaining a property deduction, as well as the bank details of the taxpayer, an application for a personal income tax refund must be submitted. The deadline for submitting it is not regulated, but payments will begin only 1 month after its submission. In this regard, it is advisable to submit such an application along with a complete package of necessary documentation.

For a complete list of documents, see the article “Documents for tax deductions when purchasing an apartment.”

After the expiration of the allotted period for conducting a desk audit (3 months if the tax is returned by the inspectorate, and 30 days if the personal income tax is no longer withheld by the employer), the tax department will inform about its decision to provide a property deduction or a refusal. In most cases, the refusal to provide a property deduction is due to inaccuracies made when filling out the declaration. The taxpayer will be able to re-submit the return, but the deadline for conducting the desk audit will not change.

Find out how to get a property deduction when participating in shared construction in the authoritative opinion of ConsultantPlus experts. Get trial access to the system for free.

Legislation

Legal regulation of obtaining tax deductions is carried out by the Tax Code of the Russian Federation, which contains detailed explanations regarding the various methods and options for providing the above benefits. Experts advise you to familiarize yourself with Articles 217, 218 and 220 of the Tax Code of the Russian Federation.

In January 2014, the legislation regarding the receipt of tax refunds underwent major changes. The adjustments affected many aspects relating to the process of providing funds, as well as the very concept of deduction.

Results

Individuals who pay personal income tax when purchasing an apartment can take advantage of the right to a refund of previously paid tax or benefits from exemption from the withholding of 13% on income received at the place of work. In order to exercise this right, you must collect a complete package of documents and submit them to your Federal Tax Service.

The maximum amount of property deduction provided once for life is 260 thousand rubles, and you can use your right to it as many times as you like until the limit is completely exhausted. This applies to residential real estate purchased since 2014, or cases where the property was purchased earlier, but the taxpayer did not use the right to such a deduction at all.

The waiting period for personal income tax reimbursement when purchasing an apartment is no more than 4 months, and the amount of tax declared as subject to reimbursement in the form of a payment to the taxpayer’s account will be transferred to him immediately, and receiving a deduction from the employer will take longer.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How long should I wait for a tax deduction?

The main amount of time that a citizen is forced to wait for a decision from the tax authority regarding the registration of benefits is spent on:

- verification and review of documents by the tax service;

- decision of a special commission to provide a refund or refuse to issue funds.

If the decision is positive, a certain amount of time will be spent on transferring funds to the taxpayer’s personal account. Some time may be spent sending documents if necessary.

For purchasing an apartment

When figuring out how long to wait for a refund of a tax deduction for the purchase of an apartment, a person should know that the tax authorities take approximately 2 to 4 months to consider the application. The exact timing depends on the individual nuances of the current situation.

With a mortgage

If a citizen is interested in how long to wait for a tax deduction when using mortgage lending funds, he should know that in this case he can qualify to receive money from the interest overpaid on the loan. The period for providing benefits will be standard.

After submitting documents

After 3 months from the day the citizen submitted the documents, a desk audit must take place at the tax service, after which the person will be officially notified of the decision made on his issue.

If the tax service delays the inspection and decision-making for a longer period, the citizen has the right to file a complaint with the appropriate authorities.

After desk check

Within a month after the inspection, funds must be transferred to the account whose details were indicated by the citizen in the application, if the answer is positive. Otherwise it is considered a violation.

Leading regions in terms of the number of tax deductions provided (thousands)

Moscow

| 296,6 | |

| Sverdlovsk region | 294,4 |

| Tatarstan | 292 |

| Saint Petersburg | 254,1 |

| Moscow region | 248,3 |

Source: Federal Tax Service, data based on the results of 2021.

There are five types of personal income tax deductions:

- Standard (for children, veterans of the Great Patriotic War, disabled people, Chernobyl survivors, “Afghans”, Heroes of the USSR and Russia with state awards);

- Social (for charity, training, treatment, pension contributions to non-state pension funds, additional insurance contributions for funded pension);

- Property (sale, purchase, construction of housing, acquisition of land);

- Professional (for royalties, income of individual entrepreneurs, persons engaged in private practice);

- Investment (for the sale of securities).

It is permissible to claim a tax deduction for a specific year in several categories at the same time, for example, to receive it immediately for children, treatment, charity and sale of housing. You can apply for a deduction within three years after the tax period. That is, for example, in 2021 it will be possible to return money for 2021, 2017 and 2021.

Reasons for increasing deadlines

The deadline for receiving a tax deduction may be increased by the Federal Tax Service if a citizen has submitted incorrect documents or made a mistake in completing the application.

Is it possible to obtain a tax deduction for the treatment of a retired wife? Information here.

How much is the tax deduction for studying? Details in this article.

Ways to receive a refund

The main way in which overpaid funds are returned is payment through the employer.

There is also the possibility of transferring a certain amount to the taxpayer’s personal account. The choice of method depends on the personal desire of the applicant.

Deduction for training: documents, procedure

The standard package for applying for a tax deduction for education includes:

- Copy of Russian passport;

- Tax return in form 3-NDFL;

- A certificate of income for all places of work in the reporting year where the employer paid income tax for you (form 2-NDFL) is issued by the accounting department of the organization where you worked;

- A copy of the agreement with the educational institution addressed to the payer;

- A copy of the license of the educational organization, certified by its seal (if there is information about the license in the contract, this copy does not need to be attached);

- Copies of receipts, checks or other payments confirming payment for educational services;

- An application to the Federal Tax Service with a request to return the tax amount and details where it should be transferred.

Procedure:

- Fill out a tax return (form 3-NDFL) at the end of the year in which tuition was paid.

- Obtain a certificate from the accounting department at your place of work about the amounts of accrued and withheld taxes for the year in form 2-NDFL.

- Prepare a copy of the agreement with the educational institution for the provision of educational services, which specifies the details of the license to carry out educational activities. If the cost of training increases, a copy of the document confirming the increase in cost, for example, an additional agreement to the contract.

- Prepare copies of payment receipts confirming funds paid for training (cash register receipts, cash receipt orders, payment orders).

- Submit a completed tax return with copies of all collected papers to the tax authority at your place of residence.

Important!

The deduction is due only when paying for full-time education. You will be able to reimburse expenses for your education, the education of your children, including those under your care, as well as brothers and sisters. But for grandchildren, nephews, spouses - it’s impossible.

Evgeny Kozichev

How long to wait for a tax deduction

After filing a 3-NDFL return for tax deduction with the Federal Tax Service, most citizens ask the question: “When will I receive the payments due to me?” Many people believe that in this matter everything depends only on chance and their own luck. In fact, there are established deadlines during which tax officials must review your 3-NDFL declaration, make a decision on the payment of money and, in case of a positive decision, transfer the funds to the details you previously specified.

How to fill out a tax return?

To obtain the right to a property deduction, an individual taxpayer will need to fill out a tax return 3-NDFL. For the report for 2021, the form was approved by order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

5 pages of the reporting document must be completed: title page, sections 1 and 2, appendix 1 and appendix 7.

There should be no difficulties in filling out the title page, because it contains personal information about the individual and the tax authority to which the declaration will be submitted.

Features of filling out the declaration:

- Section 1 contains the final results of tax calculations: for reimbursement or additional payment.

- Section 2 shows the entire sequence of calculating the tax base and the final tax amount.

- Appendix 1 contains information about income from a certificate issued by the employer in Form 2-NDFL.

- Appendix 7 contains information about the purchased apartment, as well as the amount of property deduction.

If the declaration is filled out manually, then on the printed form the entered data should be aligned to the left. If the declaration is filled out using a computer program, then along the right edge. Double-sided printing is not permitted, and pages should not be stapled to avoid damaging the bar codes on the left.

Read more in the article “Filling out the 3-NDFL declaration for property deduction.”

How long to wait for a tax deduction after submitting documents

In general, of course, the money in the tax deduction field account should arrive 3 months after submitting the application to the tax service; in the first month, the tax service must check the authenticity of all the documents you provide, and only then make deductions.

- Documents confirming the citizen’s rights to the deduction are submitted to the Federal Tax Service department;

- an application is drawn up indicating the need to obtain a certificate;

- This notice is issued after approximately 30 days;

- it, along with other documents, is brought to the place of work, after which, starting from the next month, the accountant will not collect personal income tax from the employee’s salary until he receives the entire deduction.

Deduction for treatment: documents, procedure

General list of required documents:

- Copy of Russian passport;

- Tax return in form 3-NDFL (to be completed by the taxpayer);

- Certificate of income from the main place of work (form 2-NDFL), certificates of part-time income (if any, issued by employers);

- An application to the Federal Tax Service with details (on bank letterhead with a stamp) to which the tax will be refunded.

When treated in a hospital or clinic:

- Agreement with a medical institution (there must be an exact amount paid for treatment) - original and copy;

- A certificate from the hospital/clinic/medical center confirming payment under the contract (must contain the patient’s medical card number and TIN, as well as the treatment category code: “1” - ordinary, “2” - expensive);

- A copy of the medical institution's license.

When purchasing medications:

- The original prescription with the stamp “For tax authorities”, issued by a doctor or the administration of a medical institution;

- Checks, receipts, payment orders confirming payment for drugs;

- If a patient purchased expensive medications necessary for treatment because they were not available at the medical institution, a certificate about this must be drawn up from the administration of the medical organization.

When concluding a voluntary health insurance agreement by an individual:

- A copy of the voluntary insurance agreement;

- A copy of the insurance company's license;

- Receipt for payment of insurance premium.

Procedure (when contacting an employer):

- Write an application to receive a notification from the tax authority about the right to a social deduction.

- Prepare copies of papers confirming the right to deduction (see above).

- Submit an application to the tax authority at your place of residence for notification of the right to a social deduction.

- After 30 days, obtain a notification from the tax authority about the right to a social deduction.

- Submit a notice issued by the tax authorities to the employer; it will become the basis for non-withholding of personal income tax from the amount of paid income until the end of the year.