According to the federal law “On Mortgage,” concluding a loan agreement when purchasing real estate is impossible without determining its liquid and market value.

There are a number of companies that carry out assessments and draw up an expert opinion indicating the approximate price of the property being purchased. Important! Delay in contacting an appraisal organization can result in disastrous consequences for the mortgage loan applicant. If the price of the purchased property, as a result of the work of an expert specialist, is lower than that stated by the seller, then the buyer will not have enough money. The size of a bank loan usually does not exceed the liquid value of the property.

When receiving initial bank approval, the borrower often does not think that the final amount of money allocated for the purchase of housing determines its value.

When applying for a mortgage, the real estate is collateral, and it is impossible for the sale value to be less than the total amount of the loan.

Loans for the purchase of apartments are most popular among clients of various banks. The documents required to provide a loan must include an expert’s opinion on the financial liquidity of the collateral housing space.

Positive price dynamics and a high percentage of sales of collateral real estate on the secondary market reduce the bank’s risks and, accordingly, increase the chances of issuing a loan.

What documents can't you do without?

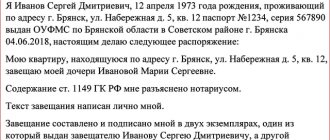

For a mortgage loan, the borrower will need at least two identification documents - a passport of a citizen of the Russian Federation and a second document of his choice. Banks independently determine what the second document should be. The following are used as additional identification:

- driver license;

- military ID;

- international passport;

- insurance number of the individual insurance account;

- passport of a sailor or military personnel.

The bank reviews documents in a simplified manner when initially applying for a mortgage. But after its approval, you will have to collect a whole package of other documents. You will also need all the papers that relate to real estate.

In most cases, the potential borrower is also asked to provide documentary evidence of the amount for the down payment. For this purpose, a statement of a deposit or current account, as well as a certificate of the balance on the card, may be suitable. In some cases, it will be necessary to prove that the account balance is irreducible and will not be used up before the start of the purchase and sale transaction.

Low estimated cost of the apartment

If, according to an expert assessment, the actual price of an apartment is less than that required by the seller, then it is worth thinking about the advisability of purchasing such real estate. At the same time, the reason for the difference may be the quality of the analysis performed.

When a loan issued by a bank is significantly lower than the amount required to purchase a home, the borrower can resort to one of the following actions:

- refuse the deal;

- contact another assessor;

- provide the bank with additional collateral (a car or additional real estate);

- ask the seller for a discount;

- take out a cash loan with a higher interest rate, this will cover the missing amount.

All documents that may be asked for

The client is interested in the bank approving the most favorable lending conditions, primarily the minimum interest rate. Therefore, it is important to collect as much evidence of solvency as possible.

All documents are divided into:

- those that relate to the identity of the borrower;

- those that confirm the sources and regularity of income.

Documents that confirm the borrower's income depend on the type of employment. For lawyers and notaries - one list, for individual entrepreneurs - another, for employees - a third.

Identification

A required document is a general passport. Some banks may request a document containing confirmation of registration in the region where the potential borrower plans to buy real estate.

The bank approves the second identification document by internal regulations. For some companies, this may be one or two documents to choose from. Others have compiled a whole list, and the client can choose any of the options that suits him. If, for example, the borrower does not have a driver’s license, then he can use SNILS. If a foreign passport is suitable for the bank, then the borrower can bring only two passports and no longer provide any other identification documents.

A complete list of documents that suits a potential lender is posted on the bank’s official website. Or you can check the list with a contact center employee via the hotline.

How to confirm income for an employee

The list of supporting documents for hired workers looks like this:

- Certificate in the form of a bank or 2-NDFL. If a potential borrower receives a salary from the same bank where he applies for a mortgage, then an account statement may be sufficient for him. But not all financial companies are limited to a bank statement or certificate. Some only accept for consideration a package of documents with a 2-NDFL certificate. They do this because this is the most informative way to confirm the client’s financial capabilities.

- Copies of all pages of the work book, certified by the employer. If not, then a copy of the employment contract from your last place of work.

- A certificate from the employer about the position held, the period of work in this place and the total length of service in the company.

- If a potential borrower combines work with several employers, you will need a copy of employment agreements and contracts from non-primary places of work.

- If housing is selected in advance, then the documents for it are an expert assessment, an extract on the absence of debt or seizure of property and other documents.

- For men under the age of 27, it is mandatory to provide a military ID.

- Documents for property that the potential borrower already owns if he or she will use that property as additional collateral.

In addition to this list, each borrower:

- fills out a questionnaire according to the bank’s form;

- gives written consent to the bank to request personal information and process data from the credit history, which is stored in the BKI;

- provides originals and photocopies of passports of all co-borrowers, guarantors, if any.

If the co-borrower is a pensioner, he provides a certificate indicating the amount of the monthly pension payment. Working co-borrowers provide a certificate of their salary or 2-NDFL.

You can find out what documents are needed to apply for a mortgage at Sberbank on its official website.

How to confirm income for other categories of borrowers

Lawyers and notaries who want to obtain mortgage approval collect:

- License to provide your services.

- A work book, which is drawn up indicating all periods of work.

- The main state registration number is OGRN.

- Taxpayer identification number - TIN.

- Certificate 2-NDFL, if taxes are paid through a tax agent.

- A declaration submitted to the tax authority for the previous year.

- Annual balance sheet with data on lawyer or notary practice.

- Receipts or payment orders showing all tax payments made to the budget.

In addition to the required ones, the bank may request additional documents:

- bank account statement for six months or a longer period;

- an explanatory note or information certificate describing the activities of the office;

- a certificate from the bank indicating the current balance on the current account at the time of applying for a mortgage;

- photocopies and originals of a patent, license or certificate issued in the name of the borrower;

- institution charter and staffing table.

The bank also requests other clarifying information about the future borrower. To apply for a mortgage, individual entrepreneurs or founders

- A copy of the state registration certificate.

- A copy of the balance sheet.

- A return submitted to the tax office for the previous year.

- Receipts or payment orders confirming the payment of taxes to budgets of various levels.

- OGRN and INN.

Additional documents will be the same as those provided by notaries. But the bank will not necessarily request all of them.

Documents on financial status

If the bank approves only the highest mortgage rate based on income, the borrower can bring additional evidence of his financial stability. Suitable for this:

- document on the right of ownership of real estate - dacha, apartment, house, non-residential real estate;

- ownership of a car or other movable property;

- confirmation of ownership of securities and other assets.

In some situations, the bank also takes into account other sources of client income - dividends, scholarships, pensions and other income from investments and assets.

An indirect confirmation of financial status can be a diploma of education, as well as certificates, licenses and other evidence of professionalism.

The bank may reduce the interest rate on a mortgage loan if the borrower pays 50% or more of the cost of the home with his own money. An additional reason for reducing the mortgage interest is consent to all types of insurance offered by the creditor bank: health, life, title insurance.

Remember that only insurance of the collateral, that is, the housing itself, is mandatory. All other insurances are voluntary. But often the refusal of other types of insurance entails an increase in the interest rate. Calculate in advance what is more profitable - payments for all insurance policies or an increase in the rate by 1-2% for 25 years of lending. Only then make a choice.

In what form should documents be provided?

To submit documents for a mortgage pre-approval, you can provide scanned copies of all listed documents. This option may be sufficient for the bank’s credit committee to make a preliminary assessment of a potential borrower. But after the application is approved, you will need to bring the originals of all documents.

All documents must be dated, details clearly visible, stamped and other required attributes. The certificates must contain the details of the person who signed them: full name, position and signature. Some certificates have a limited validity period, so they are brought last or resubmitted.

What you need when applying for a mortgage

To apply for a housing loan, the borrower must meet the bank's requirements and collect an impressive package of documents. The conditions for issuing differ depending on the selected bank. For example, some issue funds only if you have Russian citizenship, while in others foreign citizens can also take out a mortgage.

In general, the list of requirements for the borrower comes down to the following characteristics:

- The client's age is from 21 to 75 years at the time of repayment. Some banks may lower the lower limit to 18 years.

- Availability of permanent registration on the territory of the Russian Federation. In this case, the purchased object may be located in another region.

- Solvency. It is necessary to have a sufficient official income to repay the client’s mortgage and other obligations. Solvency is confirmed by a certificate in form 2-NDFL or an account statement if you receive wages on the card of the bank where the mortgage is issued. The total amount of monthly payments should not exceed 40% of income. If it is necessary to increase the level of solvency, you can attract co-borrowers.

- Seniority. As a rule, in order to receive a housing loan, the borrower must work in his current place for at least 6 months and have a total work experience of at least 1 year over the last 5 years. The duration of employment is confirmed by a copy of the work record book certified by the employer. If the client receives wages on the card of the creditor bank, then in this case 3 deposits are enough, that is, you need to work only 3 full months (supporting documents are not required).

- Credit history. Clients with a positive reputation can count on approval of their application at reduced interest rates. If your credit history is damaged, then you will have to face a bank refusal. In this case, assistance in obtaining a mortgage can be provided by mortgage brokers who will select a lender with the most favorable conditions.

- Availability of a down payment. Taking into account the chosen mortgage program, it can range from 10 to 50% of the cost of housing.

If co-borrowers are involved in the transaction, then similar requirements are imposed on each of them. Spouses are required to act as co-borrowers even in the absence of income and permanent place of work.

To obtain a mortgage, certain requirements apply to the property being purchased. Housing is assessed from the point of view of the materials used to construct it, the availability of infrastructure, communications, access roads, and territorial location. Based on all these factors, the degree of liquidity of the property and the possibility of pledging it are determined. Also, applying for a mortgage loan will require the provision of documents for the purchased property, namely:

- draft purchase and sale agreement;

- cadastral passport;

- documents confirming ownership of finished housing;

- assessment report.

If you purchase real estate during the construction phase, you must collect a package of permits from the developer.

Mortgage for programs with state support

The state provides support to young families with children and other preferential categories of citizens in purchasing living space. For them, when applying for a mortgage, in addition to the main list of documents, additional documents are provided. The list differs depending on the program the borrower is counting on.

Family mortgage

Preferential mortgages for families with children are issued at a rate of 6% per annum. The state directly compensates the bank for everything that goes above this rate. The program has been in effect since 2021, and since April 2021 its conditions have become more attractive. According to experts, about 600 thousand Russian families can take advantage of this type of state support.

Families in which the second, third or subsequent children were born between 01/01/2018 and 12/31/2022 can apply for participation. Mandatory conditions are Russian citizenship for the parent and children, and housing must be sold on the primary market. The interest rate is not limited in duration, as it was at the very beginning of the program. Now the borrower pays 6% throughout the entire loan period.

The bank will need:

- confirmation of participation in the program;

- original and copy of the marriage certificate, but if there is no father or mother, then this document is not provided;

- proof of income;

- copies of passports and birth certificates: parents, children and those who act as co-borrowers;

- a draft agreement with a legal entity for the purchase of housing on the primary market or a house with a plot of land;

- confirmation of the availability of 20% of the value of the property for a down payment;

- other documents as required by the bank.

Not all banks approve family mortgages. The list of lenders who issue loans under this state program is approved by the Ministry of Finance. Families who qualify for the program can take out a family mortgage or apply to refinance a loan that was previously taken out through Dom.rf, the former AHML.

Certificate for maternal capital

State support in the Russian Federation is received by families in which the second and subsequent children were born, starting from 01/01/2007. From 2021, the program continues to operate after the birth or adoption of the first child from the beginning of this year. The main condition is that the parent and child have Russian citizenship.

The amount of the maternity capital certificate entitles you to 466.617 thousand rubles for the first-born and 150 thousand for the second child. In total, families can receive 616.617 thousand rubles starting from 2021. In the future, they plan to index the amount by the inflation factor. The program is planned to be extended until 2026.

If a certificate for maternity capital has already been received and a mortgage using it has been chosen, then the lending bank will need:

- a completed questionnaire developed by the bank for this type of mortgage;

- a passport with a registration mark, if it is temporary, then a document at the place of stay;

- confirmation of income, depending on what type of employment the borrower has;

- marriage and birth certificates;

- permission for the bank to request and analyze personal data, this right is given for any type of lending;

- notification from the Pension Fund of the Russian Federation about the unused amount of maternity capital;

- certificate for maternal capital;

- confirmation of the amount for the down payment, which is provided for under the lending program - 10-20 or 30% of the cost of housing.

Banks sometimes accept documents for consideration without a certificate for maternal capital. The creditor can already see this right from the identity cards and documents for the children. But if your mortgage application is approved, you will still have to bring the original certificate. Therefore, you can submit documents to the Pension Fund for maternal capital in parallel with the mortgage package.

Mortgage for military personnel

Russian military personnel are also included in the government subsidy program. Active military personnel can apply to the bank for a mortgage to purchase housing under construction, a finished apartment or a residential building with a land plot attached to it. When applying for a loan, the bank will ask:

- completed application form according to the approved template;

- civil passport of the potential borrower and his spouse, if available;

- a confirming document on participation in the savings-mortgage system (NIS), which indicates the onset of the military’s right to participate in targeted housing lending;

- permission for the lender to request and analyze personal data of a potential borrower;

- marriage certificate, if there was one, or divorce certificate, if the marriage was dissolved;

- notarized consent of the spouse for lending;

- all documents that relate to the purchase and sale object, their list depends on the chosen housing.

Read more about military mortgages in Brobank's article.

What is an apartment appraisal?

The appraisal of an apartment occurs quite quickly and takes approximately 3-4 days.

To obtain an expert opinion on the cost and liquidity of the property being purchased, a potential borrower should follow a certain sequence of actions:

- select an appraisal organization;

- draw up an agreement for the provision of expert services;

- pay for the services provided by the contractor;

- provide the appraisal company with the documents necessary for the analysis;

- provide conditions for the unhindered work of the expert in the apartment;

- receive a report on the current cost of the proposed housing.

How much do valuation services cost? Payment for services to identify the real value of an apartment is made entirely by the borrower. Prices for this type of service can vary greatly.

This depends on the region in which the examination is carried out. For the central regions of Russia, such as Moscow and St. Petersburg, the amount will be 3000-5000 rubles, and for the regions - 2000-3000 rubles. Important! Some companies provide . This allows the customer to receive all the necessary papers within 24 hours after signing the contract with the contractor. The price for expedited analysis is approximately twice the usual price.

How to choose the right appraiser or appraisal company?

There are a huge number of companies involved in appraising apartments.

When choosing an expert organization, the client should be guided by a number of parameters:

- legitimacy , confirmed by a certificate of membership in the SRO;

- availability of a civil liability insurance policy in the amount of 300,000 rubles or more. This document guarantees payment of compensation in favor of the customer if the expert makes a mistake.

- The low cost of appraising an apartment is a reason to think about it, since there are quite a lot of unscrupulous performers who want to profit from unsuspecting clients.

Most banks, when considering an initial mortgage application, provide the client with a list of recommended appraisers.

Choosing one of the companies offered by the bank has a number of advantages:

- no need to agree on the candidacy of the selected third-party contractor with the lender, which significantly speeds up the consideration of a loan request;

- having extensive experience in cooperation with the customer’s potential lender, which allows the expert to give a more complete and clear assessment of the apartment.

- The bank cannot insist that a potential borrower use the services of a specific appraisal company.

Valuation of an apartment for a bank

Assessment methods

To determine the real cost of an apartment, an expert can use various methods.

In practice, there are three main approaches:

- Comparative (market) – comparison of all similar closed transactions taking into account special adjustment factors, the value of which is formed depending on the general parameters of the housing in question.

- Costly – the main factor influencing the calculation of the real value of real estate is the cost of building a new similar facility.

- Profitable - calculation of the potential profit that the appraised apartment can bring if it is used as a source of income. Most often used to evaluate collateral real estate when obtaining a mortgage.

Regardless of which method the expert uses to evaluate a home, there are some characteristics that experts always pay attention to:

- location, in terms of prestige, ecology, etc.;

- availability of social infrastructure;

- technical condition of the building;

- landscaping of the courtyard area.

The following parameters must be determined for the apartment:

- total area;

- layout;

- quality of external finishing;

- state of communications;

- floor.

- The presence of unauthorized redevelopment will significantly complicate the procedure for obtaining a loan.

When to contact a broker

Particularly busy clients or those who have a strong fear of any legal subtleties entrust the mortgage processing to a broker so as not to deal with this issue themselves. Such a specialist will find a suitable bank program, study all the borrower’s documents, check the availability of benefits and select several housing options to suit the client’s needs. But the potential borrower is able to resolve all these issues himself.

It is more difficult to do without the help of a broker if:

- selection and purchase of housing takes place in an unfamiliar city;

- several banks have already refused to issue a mortgage, you should not risk even more by receiving refusals from other banks, because this will inevitably affect your credit rating;

- there is no time or desire to delve into the details and the decision was made to pay for the services of an experienced specialist.

Citizens sometimes turn to brokers because they know that banks set more favorable rates for their clients than for borrowers who come on their own.

5 / 5 ( 1 voice )

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

We receive a technical passport for an apartment in the MFC - instructions for 2021

Article updated: December 24, 2021

Mitrofanova SvetlanaLawyer. Work experience - 15 years

Hello. In my experience, a technical passport is issued in the MFC branches in the same way and no matter where it is located. Therefore, the ordering instructions below are universal.

(click on the pictures to enlarge them)

A small digression - if you need a free consultation, write online to the lawyer on the right or call (24 hours a day, seven days a week for all regions of the Russian Federation) Moscow and the region; 8 (812) 425-62-89 — St. Petersburg and region; all regions of the Russian Federation.

The Multifunctional Center itself (My Documents) is only an intermediary that accepts documents and transfers your application for the production of a registration certificate to the BTI. In principle, the document is ordered in the same way in both cases, only the registration certificate is issued through the MFC a little longer. This is understandable, first the MFC transfers the application to the BTI, then the BTI transfers the registration certificate to the MFC.

Not in all cities you can order a technical passport through the MFC. For example, in St. Petersburg only in PIB. Therefore, I advise you to first call the MFC hotline and clarify everything. MFC phone numbers can be easily found on the Internet.

Only apartment owners, tenants/tenants (if the apartment is municipal) and heirs who need to obtain a technical passport for a notary when opening an inheritance can receive a technical passport (they must provide a special certificate about the opening of an inheritance). This also applies to secondary housing and apartments in new buildings. An authorized person can also order a registration certificate if a notarized power of attorney has been issued for him.

- Pay for the service, provide documents and sign the application.

First, you need to get the details from an MFC employee to pay for the production of a technical passport and a coupon with the queue number, if the queue is electronic. Pay for the service at the cash desk, which is usually located in the MFC building itself; you can check with the same employee. The order costs from 900 rubles. The cost is not established by law, so it is set by the BTI department, from where the MFC orders the registration certificate. It all depends on the urgency and whether a technician is needed.Then, in order of priority, provide the MFC employee with a receipt for payment and the following documents:

- passport of a citizen of the Russian Federation;

- Document for the apartment.

If the apartment is privately owned, then bring a certificate of ownership. If there is no certificate, then an extract from the Unified State Register of Real Estate for the property will do. The property in our case is the apartment for which you want to order a registration certificate. This extract can be ordered at the same MFC. It costs 460 rubles and is done in 3 working days. Therefore, if there is no certificate, then come to the MFC, order this extract, pick it up and order a registration certificate on the same day. If the apartment is municipal, then bring a social tenancy agreement or a warrant;

Other articles

If you need a technical passport to sell an apartment, then this link contains a complete list of required documentsIf you just want to order a copy of the registration certificate, then this list of documents is enough. Continue reading from here. The following are additional documents depending on why the technical passport is needed:

- if it is for registration of redevelopment, then the list of documents may differ - it depends on what specific step the registration takes place.

We have a separate section about the design of apartment redevelopment. In this section you will find links about the design of such redevelopments as: - combining a bathroom; - combining a room with a kitchen with an electric stove or gas stove. In these articles you will find both instructions and necessary documents. Also, my general article on the legalization of redevelopment was published at this link and it also lists the necessary additional documents and certificates in a particular case;

if a technical passport is needed to register an inheritance, then additionally bring a special certificate from a notary about the opening of an inheritance, an original and a copy of the owner’s death certificate, a passport of the heir(s) and a document that confirms ownership of the apartment. This document may be a certificate of ownership, and if it is not there, then an extract from the Unified State Register of Real Estate for the property will do. The property in our case is an apartment. You need a paper extract, how to order it, read here;

- if for privatization of an apartment, then additionally you need certificate No. 7, a social tenancy agreement or a warrant. Certificate No. 7 is taken from the passport office and is called “Characteristics of residential premises”;

- If the technical passport is ordered by a trusted person, then his passport and a notarized power of attorney are needed.

- Next, the MFC employee will issue a receipt stating that he has received the documents and will set a day for issuing the technical passport .

If a technician is needed, the employee will also set a day for his arrival. In practice, the processing time for a registration certificate at the MFC is from 10 working days. If you need to call a technician, it will take even longer. If you need a technical passport as soon as possible, sometimes the MFC can do it for a fee. Please specify this when ordering. - On the appointed day, pick up the registration certificate . Have your passport and receipt with you. They will also give back the documents that the MFC took for the production of the registration certificate.

After receiving the documents, the employee will fill out an application that must be signed . If there have been no changes to the apartment, for example, after redevelopment and you just want to order a registration certificate, then tell the employee that you need an application without calling a technician.

If the apartment has undergone redevelopment or a technical passport is being ordered for the first time (for example, for an apartment in new buildings), then fill out an application with a technician visiting. A technician is needed to inspect the condition of the apartment, record and send this data to the BTI.

Other articles

Documents for apartment privatization in 2021

Did you like the article? You know what to do

Have questions? You can consult for free. Use the online consultant window, the form below or phone numbers (24 hours a day, 7 days a week):

8 (499) 938-45-78 Moscow and region.

8 (812) 425-62-89 St. Petersburg and region.

8 (800) 350-24-83 all regions of the Russian Federation.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya