A mortgage for a share of an apartment in Sberbank involves taking out a loan to purchase not the entire living space, but a part (for example, a separate room). The presence of several owners of one residential premises does not contradict Russian legislation. In this case, the owners do not necessarily have to be related or married.

At Sberbank, such a housing loan can be taken out exclusively under the “Purchase of Finished Housing” program. In this case, the borrower must provide collateral in the form of other real estate or obtain the consent of other owners for the encumbrance. Due to the low liquidity of substandard housing, the bank thoroughly checks the applicant so that later there will be no difficulties in repaying the loan.

Features of shared mortgage

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

Applications for a mortgage for a share in an apartment (house) are checked more carefully by the bank. You must document your solvency. The form should be filled out carefully, without errors.

The procedure for lending funds to purchase a share of housing is almost identical to the standard one, with the exception of a number of features:

- it is possible to buy part of the property only with the consent of all co-owners that an encumbrance be placed on the apartment;

- another living space owned by the potential borrower is provided as collateral.

Since the bank takes a lot of risk in such a transaction, attention is focused on the personality of the borrower and his financial reliability. If your income does not meet the requirements, your mortgage will be denied.

Shared ownership and its types

We need to decide what types of shared ownership there are. Why is this necessary? This is important because banks are looking at housing and if it is not what is required, they will not finance it. The legislation considers the following types of ownership of part of the housing.

- Everyone who owns housing has equal rights regarding the use of housing shares. The size of the housing share is determined by the square meters belonging to the owner, and not by a certain part (common ownership right).

- Fractional ownership, which is essentially private property. It is necessary to add that the share is such only after it is registered in the Register. Without this procedure, housing or part of it is actually common ownership. An illustration of this type of share ownership can be the case of a communal apartment, when each tenant actually owns a section of the apartment and none of the other residents of the apartment uses this part.

As we see, problems with such a purchase can be caused by the fact that the apartment has more than one owner, and they may not like the fact that the property that belongs to them suddenly goes to a stranger. In addition, there are difficulties or even impossibility of designing this type. This is due to legal restrictions.

Documents required for shared mortgage

To apply for a shared mortgage, you must provide the bank with a certain package of documents:

- Russian passport with a mark of registration at a specific address;

- any second document confirming the identity of the applicant (SNILS, Taxpayer Identification Number, foreign passport, driver’s license);

- birth and marriage certificates (if available);

- certificate 2-NDFL (for the previous six months) or according to the form of a banking institution;

- copies of pages from the work book.

After receiving a positive decision on the mortgage application, you must submit a real estate insurance and purchase and sale agreement, a bank account statement confirming the availability of a sufficient amount for the down payment.

Difficulties with registration

As practice shows, bankers rarely say a positive decision. The case is in force majeure situations, if the payer is unable to pay the loan at one point. It is extremely difficult to sell part of the premises even through an auction if other owners also own the property.

The welcome will be given to those clients who plan to obtain full rights to dispose of all property in the future. In other situations, everything will depend on the credit policy of the institution.

Refusal will occur under the following circumstances:

- The share is acquired from the ex-husband (wife). Bankers will take into account whether both parties have a new registered relationship, as well as the time that has passed since the date of divorce.

- The agreement will be concluded between relatives. There is a risk that the operation is carried out for the purpose of cashing out money.

- The client plans to purchase shared housing, to which he is not entitled.

- The agreement does not promise a future transfer of full ownership rights over the pledged property.

Loan without refusal Loan with arrearsUrgently with your passportLoans at 0%Work in Yandex.TaxiYandex.Food courier up to 3,400 rubles/day!

We have collected original reviews on this topic here, reviews from real people, many comments, worth reading.

General scheme for obtaining a mortgage for a share in an apartment

The procedure for obtaining a mortgage loan against a share in an apartment:

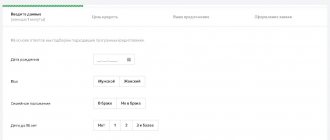

- Filing an application. This can be done at a bank branch or on the official DomClick online platform.

- Waiting for a response from the bank. The approval received is preliminary. If during the verification process the lender reveals fraudulent activity or false information, the loan may be denied.

- Inspection and evaluation of the purchased object. The appraiser's services are paid and fall entirely on the borrower. You can select an appraisal company (Sberbank partner) on the DomClick portal in the section “class=”aligncenter” width=”1380″ height=”649″[/img]

- Signing an agreement with the seller.

- Concluding a transaction with the bank regarding the issuance of a loan and making a down payment.

- Registration of the purchased object in Rosreestr. Electronic registration is possible through the DomClick service (section “).

Cases in which Sberbank can provide a mortgage for a share in an apartment

Sberbank issues a loan against a share in an apartment, but with caution. At the same time, the lender refuses to take the share as collateral, and only considers options with the whole apartment. This is due to the fact that the liquidity of some real estate is quite low. Therefore, there may be problems with implementation in the future.

If they give a loan to purchase a share in a communal apartment, they must take into account the year the building was erected and its technical condition. Typically, such housing is in disrepair, so it is not suitable as collateral.

In the case of purchasing part of the living space in a dormitory or communal apartment, the written consent of the neighbors and the ownership of the residential squares from the seller are required.

When a potential borrower wants to take out a mortgage to buy out a share in a full-fledged apartment, it is necessary that the other owners are not against the imposition of an encumbrance. Otherwise, the lender will refuse.

Sberbank issues loans for the purchase of part of residential real estate only on the secondary market.

Conditions put forward by the bank:

- the smallest loan amount is 300 thousand rubles, the maximum is 85% of the value of the collateral;

- loan term - up to 30 years;

- down payment amount - from 15%;

- annual rate – from 7.3%.

Reasons for refusal

When considering the application, the bank may make a negative decision. Possible reasons include the borrower’s negative credit history, insufficient solvency, etc. If you understand that your income level does not allow you to obtain a mortgage for the property you are interested in, involve co-borrowers, their income will be taken into account when considering.

The reason for refusal may be the share itself. For example, if it does not meet the bank’s criteria, is located in a dilapidated house, the lender doubts its legal purity. If the client is satisfied with the lender, but the property is not, you can simply choose another purchase option.

If you have any questions or need help applying for a mortgage loan for a share of an apartment, please consult the Rosbank Dom specialists.

Possible reasons for refusal to apply for a shared mortgage

Theoretically, it is possible to obtain consent from Sberbank to issue mortgage funds to buy out a share in an apartment, but in practice, borrowers often encounter difficulties.

The main reason for refusing a mortgage for the purchase of a share in an apartment is that the person already owns part of the property being purchased , but even after the transaction it will not become his full possession. The bank runs the risk of not getting its money back if the borrower loses its solvency, since it will be difficult to sell the collateral due to low liquidity.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

In such a situation, Sberbank requires the provision of collateral in the form of a full-fledged apartment, which the applicant already owns.

Features of the loan

In practice, everyone has the opportunity to get a loan for shared real estate, but not every lender is ready to finance this business.

In any case, the following points will be taken into account:

- After the purchase and sale transaction, the property will become the full property of the borrower. This option is possible when a person already owns some part of the house, and then plans to buy the house in full. The answer will definitely be positive.

- The client has the primary right to purchase the 2nd share in the future.

- A mortgage is issued for the purchase of other shares of home ownership from other owners.

Loan without refusal Loan with arrearsUrgently with your passportLoans at 0%Work in Yandex.TaxiYandex.Food courier up to 3,400 rubles/day!

It is in these situations that you can contact lenders, otherwise there are too many risks for the bank.

Mortgage loan for the last share

The last share means the part of the apartment that the borrower wants to buy in order to become the full owner. The bank treats such applicants more loyally, and refusals rarely occur.

In this situation, the consent of all shareholders is not required. If the borrower refuses to fulfill his debt obligations, the bank will be able to sell the loaned living space.

Mortgage for a share for two

When registering a mortgage in this way, the bank attracts an additional co-borrower who bears the same debt obligations. Usually the second payer is a close relative.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

Ownership of the housing being registered is determined by shared participation. If members of the same family participate in the transaction, a joint form of ownership is provided.

Distribution of shares between co-borrowers

The co-borrower spouse automatically becomes a co-owner of a share of the purchased property. If a related or other person is involved in the transaction, a special agreement must be drawn up.

When the relationship is built on trust, in the future it is possible to reclaim the due part of the property through the court. It is enough to provide receipts for mortgage payments.

Buying out shares from relatives

The rules for purchasing a share of real estate from a relative are not regulated by law. But in practice, Sberbank often refuses borrowers such registration. The reason is suspicion of fraud. Participants in the transaction can divide the money received and hide so as not to pay the bank for this share of the apartment.

Buying a room in a communal apartment

The bank is more loyal to mortgage borrowers who want to buy out the last share in a communal apartment. But the lender also allows the option of purchasing a separate room under certain conditions:

- there is other property in the property for collateral;

- the purchased living space complies with all sanitary and technical standards;

- communications are in good working order: sewerage, ventilation, heating system, electricity supply, bathroom;

- room area more than 12 sq. m;

- construction without wooden floors;

- The building was erected no later than 1970.

Only in this case will the bank consider an application for a mortgage in a communal apartment.

Allocation of part of housing to children

A separate issue is when the borrower’s children will appear in the transaction. Here we are talking about allocating a share to a minor child. The family’s ability to move to a new home will depend on this.

In this case, everything will be decided depending on the specific situation:

- The acquisition of property with the involvement of maternal capital, which means that the child will have to allocate a share according to the law. Otherwise, the bank will refuse.

- The purchase of housing will be carried out in a household where part of the property already belongs to the child. Then the mortgage agreement takes into account the fact that the minor will become the legal owner of the property in the future.

Benefits for young families

Sberbank currently cannot offer targeted preferential shares for the purchase of a share in an apartment. But potential applicants can take advantage of the “Young Family” program, which operates as part of mortgage lending for the purchase of secondary housing.

Terms of a mortgage loan from Sberbank for a share of an apartment for young borrowers:

- for a family of two people there should be 42 sq. m of total area, of three - 18 sq. m for each;

- the occupied living space does not meet established sanitary and technical standards;

- the borrower's family lives together with a person suffering from a serious illness (the latter is supposed to live separately);

- spouses must not be older than 35 years (each).

If all these requirements are met, the applicant can count on a subsidy from the state in the amount of up to 40% of the cost of the purchased object. The amount of the benefit is determined on an individual basis.

Advantages and disadvantages of obtaining a shared mortgage

A loan issued by a bank to buy out a share in an apartment has its pros and cons for the borrower:

|

|

|

|

This type of transaction is unprofitable for the bank, since there are risks - a possible loss of the client’s solvency and difficulties in selling illiquid property.

What alternatives are there to shared mortgages?

Suppose the bank refuses to issue funds for a mortgage. Then here is an alternative option that may suit you. This is a registration of a consumer loan, which is characterized by a higher rate, and also cannot be done without registration using a gift agreement. People do this quite often, because the owners do not want to mortgage their home so that someone else can buy a share.

There is still an opportunity when a mortgage is issued on the security of real estate that the person who applies to the bank has.

Alternative options for purchasing a share of housing

To begin with, you can consider the offers of other banks, for example:

| Bank | Loan amount, up to | Bid | Mortgage term |

| up to 30,000 rub. | from 9.8% | up to 30 years old | Go |

| up to 30,000 rub. | from 8.7% | up to 25 years | Go |

| up to 30,000 rub. | from 8.7% | up to 25 years | Go |

If Sberbank refused to issue a mortgage to buy out a share in the apartment, you can take out a consumer loan and purchase part of the living space for cash. There is no need to confirm the purpose of receiving the loan. The downside is the high interest rate (from 9.9%) and the short installment period (up to 5 years).

Since the procedure for obtaining a mortgage for the purchase of part of an apartment is quite labor-intensive, most financial institutions do not approve the transaction. The exception is Sberbank, in which it is possible to buy a share of real estate under the “Purchase of Finished Housing” program. The main thing is that all apartment owners are not against the imposition of an encumbrance. An alternative would be to provide another valuable object as collateral.