Mortgage lending today represents an opportunity to purchase real estate for those who do not have the full amount for its purchase or construction. Despite the need to pay interest in addition to the principal debt, this banking service, which gives a chance to significantly improve one’s living conditions, does not lose its popularity. Competition between banks is causing an increase in the variety of offers, which today cover the vast majority of the potential needs of their clients. Some of them can be called quite attractive. One of the schemes is that a mortgage is opened against existing real estate. This option allows you to apply for a loan without making a down payment. The features of this type of mortgage do not end there.

Choose the best mortgage

Types of mortgage secured by real estate

A mortgage is a loan in which the borrower purchases a home secured by property for a long term. Depending on the property being mortgaged, there are 2 options:

- A mortgage secured by the property being purchased. This lending option is suitable for borrowers who do not own any other living space. They purchase a house or apartment with a mortgage and live in it, paying off the debt for several decades. Real estate that remains as collateral with the bank, but although owned by the lender, restrictions are placed on it. Housing cannot be sold, exchanged, or given away until the mortgage is paid in full. And only after the bank’s encumbrance on the house or apartment is removed, transactions can be carried out without restrictions.

- Mortgage secured by existing housing. If there is no money for a down payment, the bank may increase the interest rate. To make the loan terms more favorable for the borrower, you can use existing property as collateral. The bank will approve the purchase of housing, the cost of which is 80% of the mortgaged property.

In addition, the option of a mortgage secured by existing real estate is suitable for the borrower when purchasing property abroad. In this case, the house in Russia will serve as collateral, and the money received on credit can be used to purchase housing in another country. Money from the bank can be spent on buying a plot of land, opening a business, or any other purpose.

Brobank: depending on the circumstances of the borrower, you can choose the most suitable mortgage option secured by real estate.

What type of borrowers can get a mortgage for non-residential real estate

You can apply:

- IP;

- small and large business owners;

- leading company managers;

- major shareholders.

Can an individual take out a mortgage on non-residential premises?

Commercial real estate mortgages are available to individuals subject to their registration as individual entrepreneurs. Managers or owners of a certain business, shareholders, and founders can also receive such a loan. In addition, the borrower must be a Russian citizen aged 21 to 65 years.

The bank pays attention to the credit history of the entrepreneur. It is important that the company has an unblemished reputation, pays taxes on time and keeps accounting records correctly. Otherwise, the chance of getting your application approved is significantly reduced.

Features of non-residential premises

When applying for a loan to purchase a property from a non-residential property, individuals will have to face some features relating to the property being purchased:

- real estate purchased with mortgage funds will become collateral;

- You cannot register in the apartment;

- payments for utility services in non-residential premises are many times higher, so an individual may experience financial difficulties;

- you cannot use maternity capital or other subsidies from the state to repay the loan debt;

- There is no tax deduction for this loan offer.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

It is impossible to obtain a loan for the construction of non-residential real estate without a large down payment, since there is a high risk of freezing or stopping construction.

Loan for the purchase of a garage

Individual entrepreneurs with the status of an individual have the opportunity to take out a mortgage for a garage. Borrowed funds can be used to purchase a finished garage or build one. An example is an offer from Sberbank, which also applies to the purchase of a parking space.

Since such a mortgage is not available at all financial institutions, an alternative may be a standard consumer loan.

Thus, Sberbank offers such a product under the following conditions:

- limit – up to 5 million rubles;

- interest rate – from 9.9%;

- Installment plan – up to 5 years.

Details can be found directly on the website.

A garage is not real estate unless it has a solid foundation.

Property with land

The land plot on which the building purchased with a mortgage is located automatically becomes collateral (Article 69 102 of the Federal Law “On Mortgage”). An exception will be land owned by municipal or state property. Also, the bank cannot impose an encumbrance on plots that have an area less than that established in a particular region (for example, the minimum is 2 acres) and owned by the right of permanent use.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

If the land plot, which the applicant owns by lease, becomes collateral with the bank, then even when a penalty is imposed on it, the creditor does not have the right to dispose of it as the owner. He will be able to act exclusively as a tenant.

Other properties for exclusively commercial purposes

It is more difficult for individuals to buy commercial real estate with a mortgage than for legal clients. The bank offers the latter to purchase warehouse, office or retail space at an inflated rate, which is unprofitable for individuals. Therefore, such loans are issued exclusively to citizens conducting business activities. Then they take into account the company’s profit and the prospects for business development. The borrower must submit for review, in addition to the standard package of documents, the company’s financial statements.

Typically, such loan offers imply stricter conditions for the client.

In what other situations do they take out a mortgage secured by existing housing?

To apply for a regular loan from a bank, you need to collect documents that will confirm your stable income. But this is not always easy to do. Banks are reluctant to cooperate with entrepreneurs, self-employed or seasonal workers. There are cases when a potential client's income is enough to pay monthly payments, but for the bank this is too big a risk, so borrowers are refused. In this case, it is better to take out a loan secured by real estate.

The second option, when you may need a mortgage secured by an existing apartment, is the presence of several other existing credit obligations.

If most of the official income is spent on paying off loans, then another payment per month will be a risky decision for the new lending bank. In this situation, the borrower will be refused. But if he offers the lender liquid collateral, the potential client may be met halfway and the application approved.

Without collateral, there is a chance that the bank will approve a loan, but only on unfavorable terms. Most likely, the interest rate for such a client will be much higher, the amount will be smaller, and the term will be shorter. Registration of collateral reduces the risk of the lender. Even if the borrower is unable or unwilling to repay the debt, the bank will be able to sell the pledged property and compensate for its costs.

Pros and cons of commercial real estate mortgages for individuals and businesses

Advantages of a commercial mortgage for individuals:

- there is an opportunity to promote your business by expanding the area;

- the lender provides a deferment on the payment of the first installment for a period of 6 months to a year, which allows the entrepreneur to increase production turnover and begin to receive income from the purchased property;

- The businessman immediately receives a substantial amount in cash.

The disadvantages include:

- high loan rates;

- a large list of required documents;

- the need to make a down payment of at least 30%, otherwise the interest will be even higher;

- more stringent requirements for the applicant than for a regular residential mortgage;

- short loan term – up to 15 years.

When choosing a mortgage program for the purchase of non-residential real estate, you must first calculate the benefits of lending. The conclusion is made based on a comparison of the following indicators:

- interest rate;

- repayment period;

- the amount of the monthly contribution.

If loan payments are less than rent, then it is easier to buy a non-residential property.

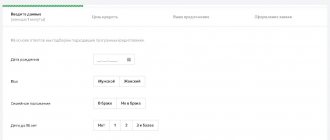

Requirements for the borrower when applying for a mortgage

Basic requirements for borrowers when applying for a mortgage with a bank as collateral for other real estate:

- having citizenship of the Russian Federation;

- minimum age – 21 years;

- maximum age – 75 years at the time of making the last payment;

- having a confirmed stable income.

The collateral can be not only housing, but also commercial real estate, a plot of land, even if they belong to third parties, who are usually relatives. If they do not mind, then the borrower can place their property as collateral. This is done in cases where a citizen does not meet any of the bank’s requirements, and his immediate relatives can apply for a loan. In order not to re-register property to other people, you can leave a relative’s property as collateral.

Mortgages secured by an apartment may not be issued to very young or elderly people. The most suitable age of the borrower, according to the bank, is from 30 to 40 years, when the client still has enough time to fulfill his obligations to the lender.

When applying for a mortgage secured by another home, it is not necessary to have a perfect credit rating. The pledged property already serves as a guarantee of the return of money to the bank, so employees will be more loyal to the borrower when evaluating it. However, the credit rating can affect the interest rate; the more often the client has made delays and the longer they were, the worse the conditions the lender will offer him.

Choose a mortgage without proof of income →

How to get a commercial mortgage on favorable terms

When conducting any business activity, you cannot do without premises - they are needed to accommodate employees, production facilities, warehouses and trading areas. But often a beginning individual entrepreneur does not have available funds for such a purchase. Then you can take out a mortgage for commercial real estate. It is drawn up in almost the same way as other business lending products.

Receiving credit funds makes it possible not to withdraw money from circulation, but to use it for other work purposes. Despite the fact that such offers are available to both companies and individuals, it will be more profitable for the latter to take out a commercial mortgage. It has more favorable conditions and a lower interest rate. You can also count on benefits if you make a down payment of more than 20% of the declared amount.

The procedure for obtaining a business mortgage consists of several stages:

- The borrower submits an online application on the lender's website.

- The manager makes an appointment, introduces the list of required documents and answers all questions.

- The client, together with a bank employee, fills out a loan application form.

- The applicant collects documents and submits them to the bank.

- After checking the provided documentation and analyzing the client’s financial and economic activities, the bank makes a decision on whether to issue a loan or refuse it.

No encumbrance is placed on a real estate property purchased with borrowed funds until the ownership rights are transferred to the borrower from the seller.

Popular methods of obtaining a mortgage for commercial real estate

The procedure for obtaining a loan for non-residential premises is not as well established as compared to issuing conventional residential loans. Commercial lending implies an increase in risks for both parties to the transaction (borrower and financial institution).

To protect themselves as much as possible, banks have developed several reliable lending schemes:

- First, the borrower enters into a purchase and sale agreement, then a preliminary mortgage agreement with the bank. This is followed by the signing of the main mortgage agreement. Next, the transaction is registered in Rosreestr, including the collateral object. After this, the seller is finally settled.

- The first step is to formalize the purchase and sale, then register the mortgage. After this, the entire amount due is given to the seller.

- The transaction is concluded before the complete transfer of ownership of the purchased premises for an office, warehouse or other business facility. The collateral here will be other valuable property owned by the applicant: a car, real estate, precious papers, shares, etc. It is on him that the bank imposes an encumbrance.

Regardless of the option for obtaining a commercial mortgage, the bank conducts a thorough check of the company, co-borrowers, guarantors and the real estate itself.

What kind of real estate for business can citizens buy on credit?

Using borrowed funds from a commercial mortgage, you can purchase objects for:

- trade;

- production;

- office;

- warehouse;

- placement of catering establishments, consumer services, etc.

From the point of view of the law, not every premises can be considered real estate, but only those that meet certain criteria:

- has a strong connection with the earth;

- cannot be transported without harm to the condition.

For example, so-called “shell” garages are not included in the category of real estate unless they are built of brick and do not have a strong foundation. As for the land plot, it is real estate. If any permanent structure is purchased on it, the land is also subject to encumbrance by the bank (Article 35 of the Land Code of the Russian Federation).

Requirements for collateral

The main requirements of banks for real estate that will be registered as collateral with the bank:

- The building should not be in disrepair.

- The age of the building is no older than 50-60 years.

- Housing must be located within the city in a seismically safe zone.

- The walls can be made of brick, reinforced concrete, monolith.

- It is advisable that the apartment is not on the first or last floor.

- All redevelopment carried out must be legalized.

- No arrears in payment for services.

Banks will not accept housing whose walls are made of adobe, frame-reed, as collateral.

If it is not your own living space that is offered as collateral, but property owned by third parties, it must also meet all the listed requirements. In some situations, this choice may be the most convenient, but the consent of relatives will be required.

Is it really possible to remain homeless?

According to the terms of mortgage lending, it is possible to be left without pledged property, but in practice this is very rarely encountered. The bank has no goal of depriving the borrower of housing. It is much more important for lenders to return the amount with interest on the terms specified in the mortgage agreement.

When registering real estate as collateral, the living space remains with the borrower. You can live there and continue to be an owner. But the bank limits some options until the debt is paid in full.

If the borrower does not repay the loan, delinquencies appear, for which the bank charges fines and penalties. The credit institution will try to resolve the issue so that the borrower repays the debt. Only as a last resort will the bank go to court to obtain the right to sell the property at auction to compensate for its losses.

If you can’t cope with paying your mortgage due to temporary financial difficulties, contact the bank employees and apply for a mortgage holiday. You can also consider restructuring or refinancing your mortgage on more favorable terms with another bank.

Life and health insurance for the borrower will help reduce the risk of loss of ability to work or work. You can refuse insurance, but then the bank will increase the interest rate. But you cannot refuse home insurance that will be offered as collateral.

Sample agreement concluded with a bank

The clauses of the mortgage agreement may vary depending on the terms of the loan. However, as standard, the document should contain the following information:

- information about the applicant;

- full name of the creditor bank;

- terms of provision of borrowed funds;

- rights and obligations of the parties to the transaction;

- method of loan repayment (the option of early repayment of the entire amount is also stipulated).

A full sample of a mortgage agreement can be found at the following link:

Advantages and disadvantages of a home mortgage

Pros and cons of lending secured by real estate:

| Advantages | Flaws |

| For a mortgage secured by real estate, the bank can approve an amount greater than for a conventional loan | Restrictions are placed on the collateral property; it cannot be fully used until the mortgage payments are completed. |

| The loan term is longer – 20-30 years | Collateral property must be insured, so the borrower incurs additional costs |

| High probability of application approval. The collateral serves as a guarantee for the bank, so the risks are lower than with unsecured lending | Instability of prices in the real estate market. At the time of mortgaging the property, there could be a decline in prices, and therefore the amount can be received less than its real market value |

| A secured mortgage has a lower interest rate if everything is in order with the borrower’s solvency and credit history | The amount of money on credit is limited to the value of the collateral housing. The bank will refuse to issue an amount more than 70-80% of the property price |

Taking into account all the positive and negative characteristics of a mortgage secured by real estate, you can decide whether this type of lending is suitable or not.

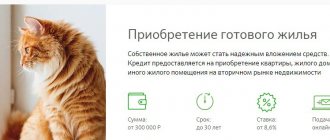

List of banks that issue commercial mortgages

List of the most popular banks issuing loans for business:

| Bank | Loan amount, up to | Bid | Mortgage term |

| up to 30,000 rub. | from 9.8% | up to 30 years old | Go |

| up to 30,000 rub. | from 8.7% | up to 25 years | Go |

| up to 30,000 rub. | from 8.7% | up to 25 years | Go |

Typically, banks do not provide mortgages for commercial real estate without a down payment. But this does not mean that it is impossible to reach an agreement on an individual basis. The likelihood of approval will increase if you offer collateral that is worth more than the amount requested.

Attracting a reliable guarantor will also have a positive effect on the decision, especially when the state acts in this capacity (under a special program). If the bank takes such a risk, it will be necessary to make a down payment exceeding 40% of the loan amount.

To choose the most profitable offer for yourself, you should use an online calculator.

Is a down payment required?

Lending secured by real estate is a non-targeted type of loan, and a mortgage is a targeted one. In the first case, the borrower can spend the money on whatever he wants. It is not necessary to buy only real estate; you can buy a yacht, an expensive prestigious car, or for travel.

Find a loan secured by real estate on the best terms →

Under these lending conditions, a down payment may not be required. If the available loan amount is not enough for the purchase, the borrower can add his own funds.

If we are talking about taking out a mortgage secured by real estate, you won’t be able to spend money on anything other than housing. The bank controls all stages of the transaction between the seller and the buyer of the living space. In addition, the borrower will have to contribute part of the funds as a down payment, so he should already have accumulated an amount for this purpose.

Reasons for refusal to issue a shared mortgage

The applicant will receive a negative decision on the loan in the following cases:

- low income;

- bad credit history;

- the property does not meet the bank's requirements;

- the borrower’s age exceeds the permissible limit (taking into account the loan term);

- no down payment;

- the citizen is not officially employed.

The financial institution is not required to explain the reasons for the refusal.

The buyer has the right to attract a co-borrower, his income will also be taken into account. The property will be divided into parts, the owners themselves will determine the size of the shares.