Citizens of the Russian Federation in most cases apply for a mortgage to purchase an apartment in a new building, a house or secondary housing. However, every year there is an increasing number of people who want to leave noisy cities and settle outside the city, which requires having their own plot of land. To bring these desires to life, you can also use a mortgage. According to the Mortgage Law, it is possible to pledge a land plot in a mortgage agreement if it is not excluded from land circulation and is not limited in circulation (Article 62). You can find out in detail about those land plots whose circulation is limited and lands withdrawn from circulation by consulting Article 27 of the Land Code of the Russian Federation. You can take out a mortgage on a land plot subject to additional conditions, the first of which is compliance with land law. You can draw up a land mortgage agreement at almost any bank in the Russian Federation.

Choose a profitable mortgage

How to obtain a mortgage on a plot of land

Preferential mortgage Gazprombank, Persons. No. 354

from 5.99%

per annum

up to 3 million

up to 30 years old

Get a loan

A mortgage on a house with a plot of land or simply on a plot of land can be issued with the involvement of a significant number of necessary documents. The process of collecting them is very labor-intensive.

First of all, you need to know that the Land Code of the Russian Federation regulates situations in which land plots can be sold using a mortgage. It is prohibited to pledge state or municipal land in a mortgage agreement. The minimum size of land is also taken into account, which is established in accordance with the regulations of the constituent entities of the Russian Federation and local governments. Dimensions may vary depending on the purpose of the land and are regulated in accordance with Article 33 of the Land Code of the Russian Federation.

Mortgage conditions for building a house

The issuance of housing loans for the purchase of finished properties or those being built by partner developers is on stream. Without any problems, you can buy an apartment on the secondary market, a finished private house, or an apartment in a high-rise building under construction.

But with the construction of a house, everything is not so simple. If the object already exists or will definitely exist (a DDU has been issued), the bank will be able to take it as collateral without any problems.

Collateral is a mandatory condition for issuing a home loan according to the law. An encumbrance is placed on the purchased object. If the borrower does not pay, the bank will simply take the apartment/house and cover the loss.

In the case of building a house, the object does not yet exist. This begs the question: what will then be formalized as security? This is why difficulties arise, and some banks completely exclude construction mortgages from their lines. This is too complex a product, the delivery of which requires some tinkering.

Requirements when applying for a mortgage on a plot of land

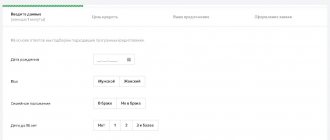

There is a certain list of conditions that all banks follow. The applicant must meet the following:

- Be over 18 and under retirement age;

- Be a citizen of the Russian Federation;

- Be registered where the pledgor's branch is located;

- Have a good credit history;

- Have a permanent job. Work experience in the last position must be at least 1 year;

- Have a stable income that will allow you to make monthly loan payments.

If a person meets all the points described above, in order to obtain a mortgage for the purchase of a land plot, he needs to collect and present the following list of documents:

Loan “New building with state support” TransCapitalBank, Lt. No. 2210

from 5.34%

per annum

up to 12 million

up to 25 years

Get a loan

- An act confirming the seller’s ownership of the land plot;

- A certificate with state registration of ownership of the claimed plot;

- Cadastral plan of the land, indicating all the necessary items, including number, location, category of the plot, its area and price;

- Title document;

- A certificate from the technical inventory bureau confirming the absence of buildings on the declared site;

- An expert report compiled by an independent appraiser;

- If the land plot is owned by both spouses, the consent of the second spouse to sell must be certified by a notary;

- In the case of co-ownership of a plot by a person who has not yet reached 18 years of age, permission from the guardianship and trusteeship authorities is required.

What kind of housing can you buy with a mortgage?

A mortgage loan can be taken out for the purchase of various real estate. Depending on the selected object, the bank determines the list of documents required to obtain a loan, as well as the procedure for conducting the transaction. Let's look at what housing options are available for purchase with a mortgage.

Available real estate options

Banks issue mortgages for the following real estate:

- •

private residential buildings and townhouses;

- •

apartments and apartments in apartment buildings;

- •

country houses, garages;

- •

parking places

- •

buildings and structures for conducting commercial activities

Alfa-Bank provides mortgage loans for:

- •

apartments and apartments in apartment buildings

- •

private residential buildings built together with a land plot;

- •

townhouses

Is it possible to buy a plot of land with a mortgage? Yes, if it is not municipal or state property, and its area exceeds the minimum dimensions established by the standards of individual Russian subjects. For example, in St. Petersburg and the Leningrad region, the minimum size of a land plot for individual residential construction is 300 m².

Land plots: mortgage features

When registering a mortgage on land, the right of pledge applies only to the site, without affecting the buildings and structures located on it. But many banks issue a mortgage loan simultaneously for both the land plot and the objects located on its territory.

To get a land mortgage, you may need:

- •

an act indicating that the site belongs to the category of individual housing construction land;

- •

cadastral plan indicating the number and location of the site, land survey plan;

- •

title documents (from the seller);

- •

an assessment report indicating the real value of the site;

- •

a certificate from the BTI confirming the absence of buildings on the declared site.

In the process of considering the application, the bank has the right to request additional documentation, for example, permission from the guardianship and trusteeship authorities or notarized consent of the second spouse for the sale.

Mortgage on a house or cottage

You can also buy a private house with a mortgage. Does this purchase have any special features? Many banks approve such loans only if there is other collateral. Thus, lenders are more willing to issue a mortgage if the potential borrower has provided an apartment or room as collateral.

The difficulty of obtaining a mortgage for suburban real estate is associated with resolving land issues. In addition, the liquidity of private houses is often lower than that of city apartments. Such transactions are associated with great risks, so it is not possible to take out a mortgage for the purchase or construction of such housing from all banks.

A mortgage for the construction of an individual residential building has a number of features:

- •

you will need an approved project, estimate, as well as documentation of all stages of construction;

- •

the site must belong to the category of land where the construction of individual houses for permanent residence (IHC) is permitted;

- •

Collateral in the form of other real estate may be required.

The land plot for the construction of the facility must belong to the borrower as property. A finished residential building can only be built in the region where the offices of the creditor bank are located.

Some banks issue loans for home construction in tranches after completion of each stage of construction.

Alfa-Bank issues mortgage loans only for ready-made country houses along with a land plot. Loans for building a house or just for a plot are not issued.

Requirements for a residential building:

- Is owned by the seller (in this case, ownership must be registered as for a real estate property completed by construction);

- The area of a residential building is at least 60 square meters. m and no more than 300 sq. m;

- wall material - brick/concrete (including concrete-based materials: aerated block, foam block, twin block, etc.), timber/laminated veneer lumber;

- year of construction - no more than 20 years before the date of assessment (for a house made of timber/laminated veneer lumber, year of construction - no earlier than 2000);

- presence of glazing of window openings, entrance doors installed;

- equipment with the following utilities:

- •

connection to the electrical network, electrical wiring has been installed;

- •

connection to central heating or equipment of an autonomous gas heating system (a gas heating boiler running on main gas is installed), pipes for the coolant are laid out and heating radiators are installed;

- •

connection to an all-season water supply or to a well, water supply pipes have been laid out;

- •

connection to the sewer network or local treatment plant, sewer pipes have been laid out.

Requirements for the land plot:

- is owned by the seller;

- category of land use - land of populated areas/settlements/agricultural purposes. Permitted use of a land plot - any type of use for the corresponding category, provided for by the legislation of the Russian Federation and permitting the construction of a residential building;

- should not be located in a water protection zone, reserve zone or national park zone;

- the area of the land plot should not be limited by the dimensions of the residential building and exceed 5000 square meters. m.

Is it possible to buy two apartments with a mortgage?

To take out an amount sufficient to buy two apartments, you need to have the required level of income and confirm your solvency with the bank. Applying for a mortgage loan for two properties has a number of features. This is due to the nuances of processing such transactions: a separate application and a separate mortgage agreement are drawn up for each apartment, two packages of documents are prepared, etc. You can apply for a mortgage either in two different banks or in one.

When purchasing two apartments with a mortgage, the lending bank will check both properties, which will take more time. You also need to take out two separate insurance policies and make a larger down payment.

When deciding to issue a mortgage for two properties, the bank takes into account the borrower’s solvency. If your income is not enough for approval, it is worth attracting co-borrowers. Thus, Alfa-Bank considers mortgage applications involving from one to three additional borrowers. Other decision-making criteria for the bank:

- •

credit history, timely repayment of previous loans, duration of delays, if any;

- •

availability of official employment, duration of work in one place, payroll system;

- •

number of dependent persons;

- •

the amount of the down payment, the amount of debt on the first mortgage loan;

- •

current market value of the collateral property.

Requirements for housing quality

Since an apartment or other real estate is the subject of collateral, it must meet the following criteria:

- •

be located on the territory of Russia;

- •

do not have uncoordinated redevelopment and re-equipment;

- •

not included in the plans for demolition under the renovation program;

- •

have wear of no more than 65%;

- •

be connected to central utility networks;

- •

not be in pledge, under encumbrance or arrest.

Country houses should be no more than 50-100 km away from large populated areas and should not be classified as architectural monuments.

Alfa-Bank offers mortgages for apartments in new buildings and secondary housing at a minimum rate of 5.99% per annum. All you need to do at the first stage is to leave an online application and wait for approval. Alfa-Bank loan programs are available to citizens of the Russian Federation from 21 to 70 years of age with a total work experience of at least one year. We issue mortgages to employees, individual entrepreneurs and business owners, as well as specialists in private practice.

Real estate insurance

One of the key features of taking out a mortgage loan is purchasing insurance. Real estate insurance reduces the risks of the bank and the borrower in case of unforeseen situations: damage to the collateral, deterioration of the borrower’s health, etc.

What documents need to be provided

First, you need to get a decision from the bank about whether it can lend money at all. To do this, the borrower provides income certificates, a copy of the employment record, documents on marital status, and land papers. If we are talking about spouses, they are considered as co-borrowers, the bank takes into account the income of both.

If the bank approves, it announces the amount. Within its framework, you can create an estimate or place an order with a construction company. The further package of documents directly depends on how the private house will be built.

What do you need:

- contracts for the construction of a house, installation of communications - if the construction will be carried out by a company;

- future house project;

- a full estimate from the construction company, on the basis of which financing will be carried out;

- building permit;

- documents for the property that will be pledged.

Based on these documents, the bank decides whether to approve the transaction and how much to issue. If everything is in order, he makes a positive decision. After signing the documents, money is issued and construction can begin.

Please note that when applying for a construction mortgage, as with any other housing loan, mandatory insurance of the property pledged is required. In addition, the borrower will be recommended to subscribe to voluntary life insurance. If it is absent, the rate usually increases.

Who will build the house

When planning to take out a mortgage for building a house, you need to initially decide how the house will be built. There are two options:

- Concluding a turnkey contract with a construction company. As a result, the loan amount is the cost of the work together with materials under the contract. And it is the construction organization that will receive the money from the bank.

- Self-construction. To do this, it is necessary to draw up the most detailed estimate, financing will be based on it.

If you are planning to build a house without involving a turnkey construction company, it is better to contact a specialized company that can take into account all the nuances to draw up a project and a house. It is extremely difficult to make a correct document yourself.

If during the construction process the costs exceed the estimate, these costs will be borne by the borrower, and the bank will not provide additional financing.

Terms for consideration of a loan application for a mortgage on a land plot

This mortgage lending option is the most risky for the bank, so the applicant is checked more thoroughly, which prolongs the waiting period for a decision on the application. The standard review period is 8 working days.

Verification steps:

- Entering the provided information into the general database – 1-2 days. But in practice, the questionnaire data is entered on the day of sending. If it was a day off, the procedure is postponed until the first working day.

- Studying your credit history – no more than 3 hours.

- Identification of the applicant – 2 days. Passport data, work activity, marital status, and presence of children are checked.

- Security checks take about 2 days. Here all persons involved in the transaction are studied.

- Underwriting – up to 3 days. At this stage, the bank calculates possible risks and sets acceptable conditions for issuing a loan.

Mortgage for construction from Rosbank

In addition to Sberbank, Rosbank also offers this type of offer. For reference: until recently, there was a mortgage bank called DeltaCredit on the market, which has now become Rosbank. Therefore, this organization offers interesting and non-standard offers for mortgage borrowers.

The terms of the loan are selected individually for each borrower; to clarify the information, you must contact the bank. Rosbank is ready to accept as collateral only real estate owned by the borrower.

What can become collateral

The ideal option is a mortgage for the construction of a private house secured by real estate that the borrower already owns. For example, a family lives in an apartment and wants to build their own house. She takes out a mortgage for the apartment and receives money for construction.

In this situation, the borrower has a place to live, while he simultaneously builds a house himself or with the involvement of a construction company. Upon completion of construction, the security will be the house itself, and restrictions on the apartment will be lifted. As a result, it can be sold and the mortgage loan for construction can be closed.

But there are also disadvantages:

- you must have your own property without any restrictions. For example, if there are children's shares in it, the bank will not accept it as collateral. If there are other co-owners besides the spouse - similarly;

- You can get no more than 80% of the price of the mortgaged property on credit, and construction is an expensive proposition. If there is not enough money to implement the project, you will have to shell out a round sum here and now for a large down payment;

- In addition to the real estate for collateral, you must own the land on which you plan to build a house. Or you need to enter into an agreement with a company that sells the land and builds a house on it.

If you don’t have your own real estate, things become more complicated. But some banks are ready to make concessions and offer alternative options. For example, a pledge is issued for the land on which construction will be carried out.

In the case of land, its price is usually several times less than construction costs. Therefore, after the first tranche is spent, the pledge is reissued. The land with the house already partially built is being assessed. Real estate is already more expensive, so the bank issues a new pledge and issues the next tranche. This can be done several times.

Since a mortgage for the construction of a private house is a more complex and risky product, the rates on it are higher than for a classic home loan for the purchase of a finished property.

How to get a mortgage payment deferment

If financial difficulties arise during construction, you can contact the bank with a request to provide a deferment on loan payments. Sberbank can give it for up to 2 years. In this case, 2 options are offered:

- temporary exemption from principal payment, but interest remains;

- extension of the loan period with reduced monthly payments.

To obtain approval from the bank, the borrower must have strong documentary evidence of his insolvency.

Mortgage for construction from Sberbank

It is Sberbank, as the main bank of the country, that is ready to offer Russians a mortgage for building a house. Unfortunately, there are fewer and fewer offers; in 2021 you can literally count them on the fingers of one hand.

Sberbank offer parameters:

- issuance amount - from 300,000 rubles. The maximum is limited to 75% of the collateral price or the cost of building the house;

- down payment, that is, personal contributions from the borrower - at least 25% of the construction price;

- the interest rate is fixed - 8.8% per annum for salary borrowers and 9.3% for others. If you cancel life insurance, the rate increases by 1 point.

Sberbank has standard requirements for a borrower. A citizen over 21 years of age can apply for a mortgage. At the time of repayment of the loan, he should not be more than 75 years old. The borrower can attract up to 3 co-borrowers. Their income will also be taken into account, but at the same time they receive rights to the object and obligations to repay the loan.

As collateral, Sberbank is ready to consider land, other real estate of the borrower, or simply accept a guarantee. In the latter case, after the construction of the house, the house will become collateral, the guarantee will be canceled (in this situation, the bank may raise the rate).

But in any case, you must first contact the bank and get advice on possible security for the transaction. For example, you can call the Sber hotline at 900. Such issues are resolved individually.