( 11 ratings, average: 5.00 out of 5)

In 2022, as in the previous year, a military mortgage from Sberbank is being provided, which can be obtained by military personnel participating in the NIS (savings-mortgage system) in accordance with 117-FZ of August 20, 2004 “On savings-mortgages...” (hereinafter referred to as Federal Law No. 117). Sberbank imposes certain requirements on borrowers and sets the rules and conditions for issuing such loans.

- Who is eligible for a military mortgage?

- The essence of NIS

- When can you take out a targeted loan from the state?

- Terms of military mortgage in Sberbank

- Requirements for military personnel

- Concluding a mortgage agreement with a bank and a list of required documents

- Actions of the borrower after drawing up a mortgage agreement with the bank

- Is it necessary to return to the state the money provided as part of a targeted housing loan?

Sberbank military mortgage programs

Preferential lending from Sberbank for military personnel serving in Russia, depending on the purpose and type of housing, is today available in the form of two programs: “Military mortgage for the purchase of housing under construction” (only for an apartment in a new building) and “Military mortgage for the purchase of finished housing” (for the purchase of an apartment, townhouse, house with a plot or room).

An applicant for a targeted military mortgage can be a Russian military personnel who has been a member of the NIS (savings-and-mortgage system) for at least 3 years, which is confirmed by the appropriate certificate and an open individual account for transferring payments from the state budget.

Immediately after joining the NIS, an annual contribution will be transferred to a special account, the amount of which is approved at the level of the highest authorities and does not depend on the region of residence of the participant, his length of service and rank. The amount accumulated over three or more years can be used to pay the down payment on a mortgage.

Actions of the borrower after drawing up a mortgage agreement with the bank

A serviceman to whom a mortgage was issued is obliged to act in accordance with clauses 18 - clause 30 of the Rules for providing participants in the savings-mortgage system..., approved by Government Decree No. 370 of May 15, 2008 “On the procedure...”.

First you need to submit to the territorial authorized body for the implementation of the NIS (Ministry of Defense in accordance with Presidential Decree No. 449 of April 20, 2005):

- a copy of the mortgage agreement certified by the lender;

- a copy of the bank account agreement opened by Sberbank for the purpose of making payments under the NIS;

- report on the assessment of real estate purchased with a mortgage;

- a copy of the serviceman's civil passport.

Next, you need to wait 10 working days - during this time, the Ministry of Defense will conclude a targeted loan agreement with the military and transfer the money to a bank account opened for the purposes of NIS payments.

After this, the following additional papers should be provided to both the bank (if necessary, if these documents are not at its disposal) and the Ministry of Defense:

- a copy of the policy document with a mark from Rosreestr;

- extract from the Unified State Register of Real Estate in relation to the purchased apartment;

- payment schedule certified by Sberbank.

The bank will then transfer the money to the property seller. The serviceman will be able to use the acquired real estate in accordance with its intended purpose. It will be impossible to alienate the apartment until the encumbrance is lifted. The apartment will be pledged:

- and at the bank;

- and from the Russian Federation in the person of the Federal State Institution “Rosvoenipoteka”.

The burden will be lifted:

- from the bank - from the moment the mortgage loan is fully repaid;

- in the Russian Federation - from the moment the circumstances specified in Art. 10 Federal Law No. 117 (that is, when the right to use funds accounted for in the savings account arises - after 20 years of military service or at 10 years, if the dismissal was for health reasons, general education or due to the age limit).

Conditions

The conditions for both mortgage programs for military personnel at Sberbank are almost identical:

- the amount of credit funds is no more than 85% of the price of the purchased object (minimum 300 thousand rubles);

- the term for concluding a loan agreement is up to 20 years, but not more than until the military person turns 50;

- first payment – from 15% of the cost of housing.

The purchased property must be pledged to Sberbank and is subject to property insurance against the risks of loss and destruction of property.

IMPORTANT! In addition to the accumulated funds in the NIS account, a serviceman can, if he wishes, invest his own funds, which will allow him to buy housing of greater value.

The program works extremely simply - Sberbank allocates the required amount for a period of up to 20 years, and repayment is made using funds from the savings account.

Maximum amount for a military mortgage at Sberbank in 2022

The difference between mortgage products for the military for finished and real estate under construction lies only in the maximum amount of borrowed funds. For the product for primary housing, the maximum loan amount cannot exceed for the product for finished real estate - 2.629 million rubles.

It is important to understand that we are talking specifically about the funds allocated by Sberbank, and not about the price of the purchased housing.

Repayment of mortgage debt

Payment of debt on preferential mortgages provided to military personnel participating in the NIS is carried out using an annuity system, i.e. equal monthly payments.

The payment schedule is fixed in the loan agreement. Funds from the savings account are automatically transferred to a credit account at the bank without the participation of the military personnel.

If the borrower wishes to repay part of the loan with his own funds, this can be done:

- In any branch of Sberbank;

- Through ATMs and self-service terminals owned by a credit institution;

- Through your personal account in online banking, having previously registered on the official website of Sberbank, incl. via mobile application.

Under this program, early repayment of the loan is also allowed. But this clause and conditions must be fixed in the loan agreement. Since the creditor bank provides only an annuity payment schedule for a preferential mortgage, it is recommended to make early payments in the first quarter of the loan period. In this case, you can significantly reduce the total amount of overpayment.

After making the final payment on the loan, the borrower must go to the lender’s office and get the appropriate certificate confirming the full fulfillment of his loan obligations, i.e. confirmation of the absence of mortgage debt. Based on this document, Rossreestr removes the encumbrance from the collateral real estate. Without this procedure, the owner of the property will not be able to sell it, rent it out, or issue a deed of gift to another person.

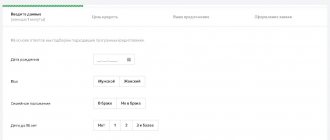

Requirements for a military personnel

A military person applying for a preferential mortgage from Sberbank must meet the following minimum requirements:

- Russian citizenship.

- Participation in the savings system for at least three years.

- Age limit – at the time of submitting the application, the military personnel must be at least 21 years old.

NOTE! The recipient of a military mortgage from Sberbank can be not only a military man with a valid contract with the RA, but also persons dismissed for good reasons. The main condition is participation in the NIS.

Purchase of finished housing

To find housing that meets the lender's requirements, the applicant can use:

- Services of specialized agencies;

- Private offers offered on the secondary market;

- Online services, incl. mobile application from Sberbank.

The main requirement: a residential building must have all the necessary communications for comfortable year-round living and not require major repairs.

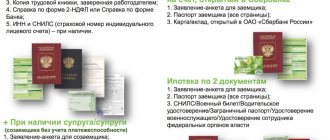

Documents for military mortgage

The package of required papers for a military person will be minimal. You will need to provide:

- Russian passport;

- application form;

- NIS participant certificate (it confirms the military’s rights to receive a preferential housing loan);

- documents for the purchased property.

Confirmation of income from a military personnel in Sberbank will not be required.

You should know that when purchasing a secondary home, the client will be required to provide an appraisal report from an appraisal company accredited by Sberbank. This service is paid for by the borrower himself, since funds from the budget are not allocated for such purposes.

Important point! Sberbank takes into account the borrower’s credit history and may refuse to approve a military mortgage if its quality is poor.

How and where to apply

An application for a Sberbank military mortgage can be submitted in two ways: remotely through the DomClick portal or at the bank’s authorized mortgage center. In 2022, the bank will accept a mortgage application if the serviceman has a NIS participant certificate and the required package of documents, including real estate papers.

Since Sberbank is loyal to this category of borrowers, such applications are considered in the shortest possible time. Usually it does not exceed 2 working days.

Interest rate

The government controls the level of interest on loans and prohibits financial institutions from exceeding the rate limit of 12%. Sberbank has approved a mortgage rate of 9.5% for the military for 2021.

For comparison, below are the rates for other Russian banks for the same housing assistance program for military personnel:

- Gazprombank: interest rate - from 9.5%, down payment - from 20%, maximum loan amount - 2.4 million rubles.

- Svyaz-Bank: 9.95% per annum, down payment – no less than 20%, maximum amount – 2.326 million rubles.

- VTB 24: 10.1% per annum, down payment – from 10%, maximum loan amount – 2.450 million rubles.

- Zenit: interest rate - 11.5% per annum, down payment - from 20%, maximum loan amount - 2.8 million rubles, and for military spouses - 5.4 million rubles.

Based on the given data valid in 2021, Sberbank offers one of the lowest rates. Another bank, Gazprombank, also offers a similar program.

Procedure for receipt and service: stages of the transaction

The process of obtaining a mortgage for military personnel at Sberbank includes the following stages:

- Careful study of lending conditions (many military personnel at this stage consult with Rosvoenipoteka regarding the choice of the most suitable bank and the timing of the transaction).

- Selecting a property for purchase (this stage should be approached as seriously as possible, since not every item of collateral will be approved by the bank and Rosvoenipoteka).

- Preparing a set of documents and filling out an application form (usually this process does not take much time, since the package of papers required is minimal).

- Submitting a loan application to Sberbank and making a final decision (the decision is valid for 90 days from the date of announcement).

- Concluding an agreement with the housing seller (it must stipulate the terms of purchase using the military mortgage program and the procedure and payment terms).

- Opening a special account in Sberbank in the name of the seller, to which the down payment will be credited from NIS savings.

- Conclusion of a loan agreement with Sberbank with a mandatory attachment in the form of a payment schedule.

- Concluding a targeted housing loan agreement, which will become the basis for the allocation of funds from the state budget (concluded with Rosvoenipoteka).

- Providing Rosvoenipoteka with the necessary package of papers for further transfer of funds to the borrower’s account.

- Transfer of the first payment to the seller's bank account.

- Registration of insurance for the purchased property (insurance is paid by the borrower exclusively at his own expense).

- Registration of the transaction in Rosreestr and encumbrance of housing in favor of Sberbank.

- Final settlement with the seller (non-cash).

Since the procedure for obtaining a military mortgage involves the participation of government agencies, you should be prepared for the fact that the terms differ significantly compared to a standard mortgage loan. Study, analysis of documents by Rosvoenipoteka, transfer of money and the inevitable human factor - all this adjusts the time for registering a transaction upward. Customer reviews also indicate that the entire process of obtaining a military mortgage, as a rule, does not take less than one month.

After the final stage of the military mortgage, its gradual repayment will begin using contributions from the state. Once a month, the military borrower’s loan account will receive money calculated as 1/12 of the annual savings contribution received to his personal account.

Despite the fact that the program provides for government participation and the allocation of funds from the budget, early repayment of the loan is allowed upon a preliminary application. This can be done by agreement with Sberbank and Rosvoenipoteka. There are no penalties (commissions, penalties, etc.) provided.

Purchase of housing under construction

You can purchase housing for development only from construction companies accredited by Sberbank. The developer must guarantee the timely commissioning of the residential building, otherwise the military mortgage will be denied.

Therefore, it is recommended that you first check with the financial and credit organization for a list of construction companies with which the lender cooperates.