Mortgages on commercial real estate for individuals are associated with a number of difficulties in the registration process, since such offers have been practiced in banks not so long ago. Despite this, it is no less relevant than the usual option - buying residential premises with borrowed funds. Not only individuals, but also businessmen can apply for this type of loan. This is a real chance for most beginning entrepreneurs to realize their plans and increase profits, since commercial real estate in all its diversity can become a profitable investment.

How to get a commercial mortgage on favorable terms

When conducting any business activity, you cannot do without premises - they are needed to accommodate employees, production facilities, warehouses and trading areas. But often a beginning individual entrepreneur does not have available funds for such a purchase. Then you can take out a mortgage for commercial real estate. It is drawn up in almost the same way as other business lending products.

Receiving credit funds makes it possible not to withdraw money from circulation, but to use it for other work purposes. Despite the fact that such offers are available to both companies and individuals, it will be more profitable for the latter to take out a commercial mortgage. It has more favorable conditions and a lower interest rate. You can also count on benefits if you make a down payment of more than 20% of the declared amount.

The procedure for obtaining a business mortgage consists of several stages:

- The borrower submits an online application on the lender's website.

- The manager makes an appointment, introduces the list of required documents and answers all questions.

- The client, together with a bank employee, fills out a loan application form.

- The applicant collects documents and submits them to the bank.

- After checking the provided documentation and analyzing the client’s financial and economic activities, the bank makes a decision on whether to issue a loan or refuse it.

No encumbrance is placed on a real estate property purchased with borrowed funds until the ownership rights are transferred to the borrower from the seller.

Popular methods of obtaining a mortgage for commercial real estate

The procedure for obtaining a loan for non-residential premises is not as well established as compared to issuing conventional residential loans. Commercial lending implies an increase in risks for both parties to the transaction (borrower and financial institution).

To protect themselves as much as possible, banks have developed several reliable lending schemes:

- First, the borrower enters into a purchase and sale agreement, then a preliminary mortgage agreement with the bank. This is followed by the signing of the main mortgage agreement. Next, the transaction is registered in Rosreestr, including the collateral object. After this, the seller is finally settled.

- The first step is to formalize the purchase and sale, then register the mortgage. After this, the entire amount due is given to the seller.

- The transaction is concluded before the complete transfer of ownership of the purchased premises for an office, warehouse or other business facility. The collateral here will be other valuable property owned by the applicant: a car, real estate, precious papers, shares, etc. It is on him that the bank imposes an encumbrance.

Regardless of the option for obtaining a commercial mortgage, the bank conducts a thorough check of the company, co-borrowers, guarantors and the real estate itself.

What kind of real estate for business can citizens buy on credit?

Using borrowed funds from a commercial mortgage, you can purchase objects for:

- trade;

- production;

- office;

- warehouse;

- placement of catering establishments, consumer services, etc.

From the point of view of the law, not every premises can be considered real estate, but only those that meet certain criteria:

- has a strong connection with the earth;

- cannot be transported without harm to the condition.

For example, so-called “shell” garages are not included in the category of real estate unless they are built of brick and do not have a strong foundation. As for the land plot, it is real estate. If any permanent structure is purchased on it, the land is also subject to encumbrance by the bank (Article 35 of the Land Code of the Russian Federation).

They do not check permits and declared characteristics of the object

Commercial real estate is purchased for a specific purpose, and it is necessary that these purposes be ensured by the characteristics of the object, and there are permits for them. For example, you bought a car service, and only then discovered that it did not have approval from environmentalists. Or we purchased premises to rent out as offices, and then it turned out that there was not enough electrical power to connect computer equipment.

How to avoid mistakes?

Before concluding a transaction, ask the seller for the originals of all permits. Check the technical documentation for the building for illegal redevelopment. Analyze whether the declared characteristics of the object correspond to reality, and to what extent they correspond to the purposes for which you are buying it.

What type of borrowers can get a mortgage for non-residential real estate

You can apply:

- IP;

- small and large business owners;

- leading company managers;

- major shareholders.

Can an individual take out a mortgage on non-residential premises?

Commercial real estate mortgages are available to individuals subject to their registration as individual entrepreneurs. Managers or owners of a certain business, shareholders, and founders can also receive such a loan. In addition, the borrower must be a Russian citizen aged 21 to 65 years.

The bank pays attention to the credit history of the entrepreneur. It is important that the company has an unblemished reputation, pays taxes on time and keeps accounting records correctly. Otherwise, the chance of getting your application approved is significantly reduced.

Features of non-residential premises

When applying for a loan to purchase a property from a non-residential property, individuals will have to face some features relating to the property being purchased:

- real estate purchased with mortgage funds will become collateral;

- You cannot register in the apartment;

- payments for utility services in non-residential premises are many times higher, so an individual may experience financial difficulties;

- you cannot use maternity capital or other subsidies from the state to repay the loan debt;

- There is no tax deduction for this loan offer.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

It is impossible to obtain a loan for the construction of non-residential real estate without a large down payment, since there is a high risk of freezing or stopping construction.

Loan for the purchase of a garage

Individual entrepreneurs with the status of an individual have the opportunity to take out a mortgage for a garage. Borrowed funds can be used to purchase a finished garage or build one. An example is an offer from Sberbank, which also applies to the purchase of a parking space.

Since such a mortgage is not available at all financial institutions, an alternative may be a standard consumer loan.

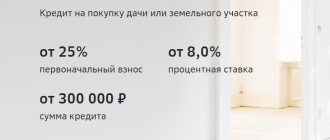

Thus, Sberbank offers such a product under the following conditions:

- limit – up to 5 million rubles;

- interest rate – from 9.9%;

- Installment plan – up to 5 years.

Details can be found directly on the website.

A garage is not real estate unless it has a solid foundation.

Property with land

The land plot on which the building purchased with a mortgage is located automatically becomes collateral (Article 69 102 of the Federal Law “On Mortgage”). An exception will be land owned by municipal or state property. Also, the bank cannot impose an encumbrance on plots that have an area less than that established in a particular region (for example, the minimum is 2 acres) and owned by the right of permanent use.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

If the land plot, which the applicant owns by lease, becomes collateral with the bank, then even when a penalty is imposed on it, the creditor does not have the right to dispose of it as the owner. He will be able to act exclusively as a tenant.

Other properties for exclusively commercial purposes

It is more difficult for individuals to buy commercial real estate with a mortgage than for legal clients. The bank offers the latter to purchase warehouse, office or retail space at an inflated rate, which is unprofitable for individuals. Therefore, such loans are issued exclusively to citizens conducting business activities. Then they take into account the company’s profit and the prospects for business development. The borrower must submit for review, in addition to the standard package of documents, the company’s financial statements.

Typically, such loan offers imply stricter conditions for the client.

Types of real estate fraud

Double sale

An owner can sell the same property to two or three buyers.

Encumbrances

At the time of sale of real estate, it may be under an encumbrance (for example, pledged to a bank). The purchase of such an object is considered illegal. As a result, the buyer will lose both the object and the money he paid for it.

Both fraudulent schemes can be easily calculated using an extract from the Unified State Register of Real Estate.

Conditions and requirements for borrowers

You can take out a commercial real estate loan on the following standard conditions:

- the maximum amount issued is up to 200 million rubles. (depending on the bank);

- installment period – from 5 to 15 years;

- annual interest – from 11.5%;

- down payment – within 20-30% of the property value;

- the bank issues a loan secured by the property being purchased or any other liquid property owned by the borrower (the encumbrance can be removed only after the debt is fully repaid).

The mortgage rate for individual entrepreneurs will be lower (about 10%) if you take out a loan in foreign currency.

Due to the high cost of non-residential properties purchased for commercial activities, it is unlikely that a mortgage can be obtained without a down payment. The bank may make concessions if the collateral is significantly more expensive than the property being purchased.

The requirements for borrowers are almost identical for all banks:

- registration of organizational and legal status (individual entrepreneur, LLC and others);

- the location of the company and the registration of the borrower must be in the same region where the lending bank is located;

- Russian citizenship;

- age limit – from 21 to 65 years;

- availability of a working telephone number (this may be a valid mobile number).

Bank requirements for purchased real estate

Depending on the bank, the requirements for borrowers for a mortgage loan for the purchase of commercial real estate for legal entities and individuals may differ, but not significantly.

But we can highlight some general points:

- the facility must be located within the Russian Federation - the same region as the bank (no more than 100 km from the branch);

- Any restrictions on access to collateral are unacceptable (for example, a security facility);

- It is mandatory to have all the documentation necessary to evaluate the premises;

- absence of encumbrances, arrests;

- the building must not be state owned.

The selected building must have the status of a capital building. When taking out a commercial mortgage, the property is subject to compulsory insurance.

The bank will refuse to issue a loan if the proposed building is in disrepair and is subject to demolition, does not have a registered address and its internal layout differs from that indicated in the technical passport.

Necessary documents for execution of the contract

To obtain a commercial mortgage, you must provide the following documents:

- passports of all participants in the transaction;

- statement;

- questionnaire;

- documents indicating the type of activity of the applicant;

- income certificate (tax return 3-NDFL);

- certificate of registration in the Unified State Register of Legal Entities and tax registration;

- company charter;

- license (if required due to the specific nature of the activity);

- minutes of the general meeting confirming the appointment of the borrower to a managerial position;

- order on the appointment of a chief accountant;

- financial statements;

- documentation for the purchased property.

Duration and procedure for registering the purchased property

The final stage in the process of obtaining a commercial loan is registration with Rosreestr. This procedure takes no more than 15 working days.

You will first need to pay a state fee of 1000 rubles. – Individual entrepreneur, 4000 rub. – a legal entity.

List of banks that issue commercial mortgages

List of the most popular banks issuing loans for business:

| Bank | Loan amount, up to | Bid | Mortgage term |

| up to 30,000 rub. | from 9.8% | up to 30 years old | Go |

| up to 30,000 rub. | from 8.7% | up to 25 years | Go |

| up to 30,000 rub. | from 8.7% | up to 25 years | Go |

Typically, banks do not provide mortgages for commercial real estate without a down payment. But this does not mean that it is impossible to reach an agreement on an individual basis. The likelihood of approval will increase if you offer collateral that is worth more than the amount requested.

Attracting a reliable guarantor will also have a positive effect on the decision, especially when the state acts in this capacity (under a special program). If the bank takes such a risk, it will be necessary to make a down payment exceeding 40% of the loan amount.

To choose the most profitable offer for yourself, you should use an online calculator.

They don't check the seller

Often, after carefully checking the property, the buyer forgets to check the seller. Or checks it only in that part that concerns the given object. But it may turn out that his right to solely dispose of the property rights is challenged by a third party - a former spouse, a business partner. You may end up getting bogged down in lengthy legal proceedings.

How to avoid mistakes?

Try to get information not only about the property, but also about the seller. Look at what year he has owned the property you are interested in, and whether he has been divorced during this period of time. If the IP is being sold by a company, make sure that there is no corporate conflict.

If you do not want to become a party to litigation, check for possible interest in real estate from third parties

Pros and cons of commercial real estate mortgages for individuals and businesses

Advantages of a commercial mortgage for individuals:

- there is an opportunity to promote your business by expanding the area;

- the lender provides a deferment on the payment of the first installment for a period of 6 months to a year, which allows the entrepreneur to increase production turnover and begin to receive income from the purchased property;

- The businessman immediately receives a substantial amount in cash.

The disadvantages include:

- high loan rates;

- a large list of required documents;

- the need to make a down payment of at least 30%, otherwise the interest will be even higher;

- more stringent requirements for the applicant than for a regular residential mortgage;

- short loan term – up to 15 years.

When choosing a mortgage program for the purchase of non-residential real estate, you must first calculate the benefits of lending. The conclusion is made based on a comparison of the following indicators:

- interest rate;

- repayment period;

- the amount of the monthly contribution.

If loan payments are less than rent, then it is easier to buy a non-residential property.

Buy at an inflated price

More often this happens to individuals who do not know the commercial real estate market and trust the owner, who convinces them of a quick return on investment. There is a high risk of overpaying for a property when it is purchased together with a tenant paying an inflated rate. This could be either an accident or a conspiracy between the seller and the tenant.

The buyer should be wary if the property is sold at a price with a payback period of 7–8 years, and the lease agreement with the anchor tenant is concluded for 1–3 years. It is also a bad sign if the contract at a high rate was concluded less than a year ago and for a short period. In this case, there is a high probability that the tenant will not renew it, and the prospect of recoupment of the property will not be so rosy.

How to avoid mistakes?

Don't believe everything the seller says. Talk to your tenants to see if they are planning to move out. Ask the seller for documentation of rent payments to see how regularly they are being received and if there are any outstanding payments. Another way to find out the market price of an object is to order a calculation of its payback from an organization that provides support for commercial real estate transactions.

Sample agreement concluded with a bank

The clauses of the mortgage agreement may vary depending on the terms of the loan. However, as standard, the document should contain the following information:

- information about the applicant;

- full name of the creditor bank;

- terms of provision of borrowed funds;

- rights and obligations of the parties to the transaction;

- method of loan repayment (the option of early repayment of the entire amount is also stipulated).

A full sample of a mortgage agreement can be found at the following link:

Possible difficulties during registration and registration

Today, banks are not very willing to issue loans for the purchase of non-residential premises. This is due to the riskiness of the transaction, which is why more stringent requirements are imposed on applicants. Failure to comply with at least one item from the standard list leads to refusal.

Reasons why a bank may reject an application:

- false information was provided;

- the borrower is already heavily financially overburdened with other unclosed loans;

- there are arrears on past loans;

- there is no possibility to make a down payment;

- the organization's profit is seasonal;

- "youth" of the business.

Expert opinion

Irina Bogdanova

Expert in the field of mortgage lending.

Credit will be denied to persons whose business is related to the production of alcohol and tobacco products, as well as goods whose production causes environmental damage.

The bank's decision may also be influenced by the property chosen for purchase. For example, a novice businessman wants to take out a loan to purchase premises to open a store. The building is located on the outskirts of the village, far from transport routes and other points of trade. The lender will refuse such a borrower, since the business is not initially promising and does not guarantee stable payments on the loan in the future.

Object risks

And of course, you cannot buy real estate, even with excellent profitability indicators, without first assessing the risks. This may be the risk of loss of liquidity, legal risks of restriction or deprivation of rights to the purchased object, risks associated with the construction site (environmental zone, violation of development rules, etc.), other features that the seller is in no hurry to “advertise”.

Real Group carefully checks properties before offering them to buyers. When choosing a rental business in our catalog, you can be sure of its liquidity and reliability.