The increase in property taxes in recent years has hit socially vulnerable segments of the population the hardest: pensioners, disabled people, and people with many children. That is why the tax benefits that the state provides to such categories of citizens are very relevant. In this article we will look at what tax breaks families raising three or more children can count on.

If you have any questions about calculating and paying taxes, it is best to contact a tax law specialist for advice.

Do you want to figure it out, but don’t have time to read the article? Lawyers will help

Entrust the task to professionals. Lawyers will complete the order at the cost you specify

63 lawyers on RTIGER.com can help with this issue

Solve the issue >

What is a large family

The Family Code of the Russian Federation does not determine which family is classified as large. Each subject uses its own interpretation of the concept in accordance with regional legislation and customs.

The provisions of GOST R 52495-2005 determine that a large family is a family with three or more children in accordance with the threshold for large families, which is established by regional executive authorities.

Children who are not taken into account for recognition as a large family:

- those who have reached 18 years of age, excluding those studying full-time under the age of 23;

- in respect of which parents are deprived of their rights or have their rights limited;

- under guardianship;

- on state support.

Assigning the status of having many children is not related to whether the child is natural or adopted.

State guarantees of a social nature can be monetary or in kind. The number of children determines the types of social guarantees and their sizes.

Which families are considered large

To find out what tax benefits are available to parents with children, you need to figure out which family in Russia is considered to have many children. This issue is delegated by legislation to the regions. Therefore, a family with three children may or may not be assigned the status of a large family in different places of the Russian Federation. The fact is that in a number of regions only parents who have given birth or adopted a fifth child are considered to have many children.

The same applies to tax benefits. The law provides only a general list of tax benefits for parents with three or more children. These include transport tax, property tax and land tax. In what cases and in what amount a tax benefit will be provided is decided by the local municipality. The only tax that is exempt for families with many children throughout the country is personal income tax.

In most cases, a family with three or more children under the age of 18 is considered large. This applies not only to biological parents, but also to adoptive parents and guardians. In some cases, tax breaks are extended if a child under the age of 24 is a full-time student at a higher educational institution.

Federal benefits: personal income tax deduction

The federal legislative level makes it possible to count on tax benefits for large families under personal income tax.

State aid is provided in the form of a deduction. This means that the person will not receive the money in hand, and the taxable base - the amount of funds on which a tax of 13% is levied - will decrease by a certain amount. As a result, upon payment of income tax, a member of a large family will have a larger salary on hand.

Personal income tax deduction for children is given to the following categories:

- legally married parents;

- stepfather or stepmother;

- a person who pays alimony after a divorce;

- guardian, adoptive parent, trustee.

In 2021, the amount of deduction:

- 1400 rubles - for the first two children;

- 3000 rubles - for the third and subsequent ones.

If the payer is raising a disabled child, a separate deduction amount is established:

- 12,000 rubles - for a parent;

- 6000 rubles - for an adoptive parent or guardian.

Deductions are made for each disabled child under 18 years of age, and if he or she is studying full-time, up to 24 years of age. This type does not cancel deductions based on the order of children. For example, a third disabled child will be entitled to deductions in the amount of 15,000 rubles.

The deduction applies to the third and subsequent children even if the previous children became adults and lost the right to such a measure of support.

The amount of support measures doubles if children are raised by one parent (for example, the death of a spouse has occurred). In case of divorce and refusal to pay alimony, the amount does not increase.

A double deduction is possible if the second parent voluntarily refuses his deduction. It must be borne in mind that such a refusal is impossible if:

- no official work;

- the person is on parental leave;

- the citizen is registered with the employment service.

The start of the use of the deduction is the month of birth (adoption), the end is the age of majority, as well as the excess of the established limit by the amount of the parent’s income. In 2021 - 350,000 rubles, that is, in the month when the total income exceeds the named amount, the use of the deduction will stop.

How to apply

Registration takes place at the place of work. An application should be sent to the employer with a request to apply the deduction, listing existing children and noting their age and status.

The following must be attached to the application:

- birth (adoption) documents;

- medical certificate (if the child is disabled);

- a certificate from the place of study confirming its full-time course;

- passport.

The single parent also provides:

- documents on the death of the spouse;

- a court decision declaring the second spouse missing;

- certificate by f. 25 (when entering information about the father from the words of the mother into the birth certificate);

- passport.

Guardians (trustees) provide papers confirming their status.

An individual entrepreneur with many children can also receive a deduction by contacting the tax office.

Transport tax

The size and procedure for calculating transport tax are also determined by the regions. For example, in the Nizhny Novgorod region, a large family may not pay tax for one car whose power does not exceed 150 hp. In Moscow, one of the parents does not pay for his car, regardless of its capacity.

The tax benefit is also issued by the Federal Tax Service. It is enough to submit documents once. It will be valid until the car is sold or until the status of a large family is lost. If the spouses purchase another car and decide to re-register the deduction for it, they must contact the tax office again.

Regional benefits

The Tax Code of the Russian Federation does not establish transport, property or land benefits for members of large families at the Federation level.

This happens because transport tax is the responsibility of the subjects, and land and property tax is the responsibility of the local area of responsibility. In this regard, the authority to introduce additional support measures has been given to the legislative bodies of regions or municipalities.

To the ground

Land support measures are provided in several options. It can be:

- discount on payment of up to 50%;

- reduction of the calculation base;

- exemption from payment.

For example, in the Rostov region in many areas large families do not pay tax. Benefits are relevant for residents of the capital, where prices for plots are high. For example, in Moscow, the tax base can be reduced by 1 million rubles, and in many areas of the region there is a 50% discount applied when the average income for each family member is below the subsistence level.

Transport

Transportation benefits are the region's diocese. Subjects have different algorithms:

- waiver of collection for machines of a certain capacity;

- exemption from payment of one of the parents;

- discount on amount.

Transport tax support measures do not need to be confirmed regularly. They are announced only once. Their validity is prolonged for the period of ownership of the car or loss of status by the person.

Property taxation

Many regions practice exemption from property tax. Thus, Ryazan made it possible not to pay a fee for 1 object for each type of property. This means that the benefit can be provided for an apartment, a dacha, or a garage at the same time. The condition is that the income of family members is below the regional subsistence level.

How to apply

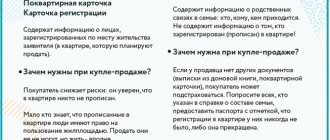

Information on benefits for the category of families under consideration is contained in local legislative acts. You can contact the Federal Tax Service department with this question and register it there. To do this, you need to send a package of documents to the tax office:

- application in the prescribed form (can be found on the Federal Tax Service website);

- documents confirming family status;

- identification document of the applicant;

- birth documents of children.

The application can be submitted in person, sent by mail, or completed through the taxpayer’s account on the website.

Thus, there are no uniform tax benefits, so citizens need to closely monitor changes in legislation in their region of residence.

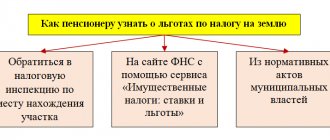

Tax benefits on land plots

In the general procedure for land tax, according to the Tax Code, parents with three or more children can count on a deduction for the cost of 600 square meters. meters from the cadastral value of the plot. This rate may vary by region. For example, in Moscow the tax is reduced for one of the parents. And in Krasnoyarsk, mothers and fathers with three or more children do not pay land tax at all.

In order to receive such a relief, parents should contact the Federal Tax Service inspectorate at their place of residence. You must have identification documents for all family members (passports, birth certificates), ID cards for a large family, and papers for a land plot. It is better to check the exact list of documents with your tax office.

Common mistakes made by large families when applying for tax benefits

Error 1. Many Federal Tax Service Inspectors recommend applying for benefits (property deductions) before the beginning of June. This is motivated by the fact that it is after this date that the general calculation of taxes for the corresponding period begins. So, for example, according to the recommendation of the Federal Tax Service Inspectorate for the city of Pavlovsky Posad, in the Moscow region, this year the optimal application period was until 06/01/2021.

Meanwhile, if a beneficiary is conditionally “late” in submitting an application for an additional deduction, missing June 1, 2021, he can still apply for it after the deadline. If necessary, the Federal Tax Service will recalculate the tax and send the addressee an updated tax notice, which will take into account the required benefit.

Legislation

The main legislative document in the tax sphere in general and in regulating land tax in particular is the Tax Code of the Russian Federation, which establishes the basic federal rules for the calculation and collection of this fee. Its separate chapter 31 is completely devoted to this issue, and its provisions must be taken into account when taxing.

At the same time, land tax belongs to the category of local tax, which implies not only the specifics of its payment (it is paid to the local budget), but also the possibility of additional legislative regulation by regional authorities.

Each subject of the Russian Federation has the right to develop and enact bills dedicated to this fee, with the conditions for its accrual and payment established at the local level.

In this case, the provisions of federal legislation must also be taken into account. In particular, local authorities can only improve the situation of payers (reduce the rate, introduce additional preferential categories, provide tax deductions), but they do not have the right to establish conditions worse than in the Tax Code of the Russian Federation.

As for the federal benefits established by Art. 395 of the Tax Code of the Russian Federation, then in relation to individuals who are payers, full exemption from payment is provided only to representatives of one category - indigenous residents and peoples of the Far North and Siberia of the Russian Federation. All other tax abolition situations apply only to organizations and institutions of certain types of activities.

Some features when calculating tax are noted in Part 5 of Art. 391 of the Tax Code of the Russian Federation - the subjects listed there are not completely exempt from paying it, but can slightly reduce the size of the tax base (namely by 10 thousand rubles). They mainly include certain categories of disabled people, heroes of the Russian Federation and the USSR, Chernobyl victims and persons who received radiation while carrying out activities related to nuclear installations.

As for large families, they are not included in any preferential category of payers, therefore, at the federal level, a reduction in the amount of tax for them or a complete exemption from its payment is not provided.

In this case, payers of this category must refer to the local legislation of the region where their land plot is located.