General approach

At the instigation of the Russian Ministry of Finance, legislators have simplified and accelerated the procedure for obtaining personal income tax deductions. This is Federal Law No. 100-FZ dated April 20, 2021, as amended by the Tax Code of the Russian Federation. For some of them, supporting documents and a visit to the tax office are not required.

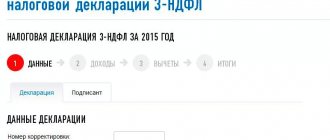

For example, the mechanism for receiving deductions valid until May 2021 requires filing a tax return in form 3-NDFL with documents confirming the right to deductions. Only after this a person can return 13% income tax on the amount of the mortgage loan and interest paid.

The simplified procedure involves contactless communication with tax authorities through your personal account on the Federal Tax Service website. Tax authorities will check the right to receive a deduction in this format themselves using an automated information system.

EXAMPLE

Tax deduction when purchasing real estate: if a citizen buys property using banks, the tax office takes data from credit organizations, pre-calculates the deduction and posts it in his personal account. All that remains is to choose which account to transfer the funds to. This applies to deductions for purchases, interest on loans, and investment deductions from IIS.

Employers will begin to receive confirmation of social/property deductions directly from the tax office, and not from the employee.

The new approach reduces the time required for processing and receiving deductions from 4 to one and a half months.

The specified Federal Law of April 20, 2021 No. 100-FZ comes into force on January 1, 2022, but many key norms are already in place from May 2021.

How to get a tax deduction: a step-by-step guide

The package of documents varies slightly depending on the type of deduction.

The standard deduction for children will require the preparation of the following documents:

- Application to the employer for a tax deduction.

- Birth or adoption certificate.

- Certificate of disability (if the child is disabled).

- Certificate from the educational institution (if the child is a student).

- Document confirming the marriage of parents.

Naturally, there will be certain nuances in cases where you are raising a child alone or are a guardian. In this case, you need to check with the FMS offices what other documents need to be provided.

A deduction for treatment can be obtained if you spent money on medical services for yourself, parents, spouse, children under 18 years of age in a licensed medical institution. You can also count on a deduction if you bought medications or took out a voluntary health insurance policy. Important! Not all services can be deducted, and for insurance you will get back part of the money only if you took it out from a company that has the appropriate license.

Documents required for treatment deduction:

- Declaration 3-NDFL.

- Certificate of payment for medical services.

- Agreement with a medical institution.

- Certificate from the accounting department at the place of work.

- Receipts confirming your expenses.

A tax deduction for training can be obtained if you yourself, as well as your child, brother, sister under 24 years of age, have undergone training. Personal education can be “compensated” by a deduction, regardless of whether it was full-time or part-time; for a child (brother, sister), a deduction is obtained only for full-time full-time education. Important! In this case, it is not necessary to consider only higher education; you can get a deduction for school or kindergarten tuition.

Documents required to receive a tax deduction for education:

- Declaration 3-NDFL.

- A document confirming payment for education services.

- Agreement with an educational institution.

- Certificate from the accounting department at your place of work.

A property deduction can be obtained if you purchased an apartment, house, room in a communal apartment, or land.

To obtain it, you will need the following documents:

- Declaration in form 3-NDFL.

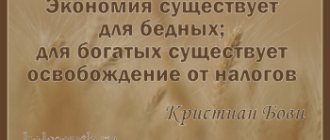

- Application for a tax deduction.

- Application for transfer of money - it must indicate bank details.

- Certificate 2-NDFL – for the year for which you want to receive a property deduction. You can obtain such a certificate from the accounting department at your place of work.

- Agreement for the sale and purchase of an apartment, house, plot, room in a communal apartment.

- Certificate of ownership or extract from the Unified State Register of Real Estate.

- Bank statements that confirm that you transferred money for the property to the seller's account.

- A copy of all pages of the passport.

Important! If you are buying an apartment as a gift to a child under 18 years of age, you must also provide the child's birth certificate.

What types of deductions are covered by the new procedure?

These are several types of personal income tax deductions:

| TYPE OF DEDUCTION | STANDARD of the Tax Code of the Russian Federation |

| Investment deduction in the amount of funds deposited during the tax period into an individual investment account (IIA) | Subp. 2 p. 1 art. 219.1 Tax Code of the Russian Federation |

| Property deduction in the amount of actual expenses for new construction or purchase of residential houses, apartments, rooms or share(s) in them, acquisition of land plots or share(s) in them provided for individual housing construction, and land plots or share(s) in them , on which the purchased residential buildings or share(s) in them are located | Subp. 3 p. 1 art. 220 Tax Code of the Russian Federation |

Property deduction in the amount of actual expenses for interest repayment:

| Subp. 4 paragraphs 1 art. 220 Tax Code of the Russian Federation |

| Social deduction in the amount paid for their education (up to 120,000 rubles, taking into account other social deductions), children under 24 years of age, wards under 18 years of age - full-time, but not more than 50,000 rubles. for each in the total amount for both parents (guardian or trustee) | Subp. 2 p. 1 art. 219 Tax Code of the Russian Federation |

| Social deduction for medical services provided by medical organizations, individual entrepreneurs, individuals, their spouses, parents, children (including adopted children) under 18 years of age, wards under 18 years of age, as well as in the amount of the cost of medications prescribed by the attending physician and purchased using own funds | Subp. 3 p. 1 art. 219 Tax Code of the Russian Federation |

Simplified receipt of property and investment deductions

What to follow

A simplified procedure for obtaining investment and property tax deductions (for the purchase of housing, payment of interest on a mortgage and the amount of money deposited into IIS) from May 20 (21), 2021, is regulated by a new article. 221.1 Tax Code of the Russian Federation. As for social deductions for training, treatment and voluntary insurance, the rules about them have simply been clarified.

The new procedure applies to deductions, the right to which arose for an individual from January 1, 2020 . That is, the norms of Art. 221.1 of the Tax Code of the Russian Federation have retroactive effect (Federal Law dated April 20, 2021 No. 100-FZ).

Statement

To receive deductions in a simplified manner, you need to submit an application.

The filing deadline is at the end of the tax period (calendar year), no more than 3 years preceding the year of filing the application.

The condition for providing deductions in a simplified manner is that the tax authority has information about the income of an individual and the amounts of tax calculated, withheld and transferred by the tax agent to the budget. These are calculations in Form 6-NDFL and income and tax certificates submitted by the employer(s) for the relevant periods.

To receive a deduction for depositing money into an IIS, the tax authority must have information confirming that the payer has transferred funds to this account. They are reported by the tax agent.

In the application for a refund, you must indicate the details of a bank account opened by an individual (not to be confused with the number on a bank card).

The application is filled out and sent through the taxpayer’s personal account in the format approved by the Federal Tax Service of Russia.

The very possibility of receiving a deduction in a simplified manner will be indicated by an automatically pre-filled application for deduction in your personal account on the Federal Tax Service website, generated based on the results of a 20-day verification of information received from the bank. There you can also track the process of receiving the deduction - from the moment you sign the pre-filled application until your personal income tax is returned.

Thus, before the pre-filled application appears in your personal account, no action is required from the taxpayer.

Please note that a new approach has been in effect since 2021: the right to a property deduction arises from the moment of state registration of ownership, and not from the moment of receipt of a document (certificate) for the object.

As a general rule, other documents are not needed to obtain property and investment deductions in a simplified manner. As part of the exchange of information, the tax office receives the necessary and up-to-date information from tax agents, banks, and Rosreestr. The list of participating banks will be updated in a special section on the Federal Tax Service website.

Application processing time

First, the tax authority, based on available information, places data in your personal account (PA) for automatically filling out an application or sends a message through it about the impossibility of obtaining a tax deduction in a simplified manner, indicating the reasons within the following time frame:

- no later than March 20 of the year following the expired tax period - in relation to information submitted by the tax agent or bank before March 1;

- within 20 working days after the day of submission of information - in relation to information submitted by a tax agent or bank after March 1 of the year following the expired tax period.

A desk audit of an application is an analysis by tax authorities of compliance with the requirements of Art. 221.1 of the Tax Code of the Russian Federation and other conditions for obtaining tax deductions. As a general rule, it lasts 30 calendar days from the date of filing the application.

The period for checking an application for deductions can be extended to 3 months if, before its completion, the tax authority establishes signs indicating a possible violation of tax laws. Such a decision will be reflected in your personal account within 3 days from the date of adoption.

If an application (several applications) and a 3-NDFL declaration are submitted simultaneously for one tax period, a desk audit in relation to each document begins from the date of registration according to the order in which they are sent to the tax authority.

Decision on the application

| IF NO VIOLATIONS | THERE ARE VIOLATIONS |

| The tax authority makes a decision on granting a tax deduction within 3 days after the end of the audit. | The tax office makes one of the decisions under Art. 101 Tax Code of the Russian Federation:

And also one of the solutions:

|

The law does not provide for the opportunity to provide explanations or make appropriate corrections to the deduction application.

The remainder of the property deduction can be used in a simplified manner.

Return of deduction

If there is arrears of personal income tax, other taxes, arrears of penalties and/or fines, the tax authority independently offsets the amount of tax to be refunded in connection with the provision of a tax deduction. The deadline for making such a decision is 2 days after the day the decision was made to grant the deduction in whole or in part.

sends it to the territorial body of the Federal Treasury within 10 days He, in turn, makes a refund within 5 days .

KEEP IN MIND

If the deadline for returning the deduction is violated, from the 16th day after the decision to provide it is made, interest is accrued at the Central Bank refinancing rate that was current on the days the return deadline was violated.

Cancellation of the deduction decision

A tax agent or bank can provide updated information leading to a reduction in the amount of tax returned to an individual in connection with the provision of a deduction. Then the Federal Tax Service within 5 days makes a decision to cancel in whole or in part the decision to provide a deduction in whole or in part.

Within 3 days, such a decision with the amount of tax and/or interest to be refunded by the individual is posted in your personal account.

The excess received as part of the deduction must be reimbursed to the budget within 30 calendar days from the date of sending the specified decision through your personal account.

KEEP IN MIND

Interest is charged on amounts that an individual must repay at the Central Bank refinancing rate during the period of using budget funds. This occurs from the date of receipt of money in the account or the date of the decision to offset until the date of the decision to cancel the deduction.

In case of non-payment or incomplete payment within 30 calendar days , a request for payment of tax and/or interest will be sent to your personal account within 20 days If you ignore it, the tax office will launch a collection procedure under Art. 48 Tax Code of the Russian Federation.

If the taxpayer’s access to his personal account is terminated, the Federal Tax Service will send documents by registered mail.

How to get your income tax back

Income tax refund (NDFL)

You can complete your return online and get your income tax refunded.

In Russia, the income tax rate is 13%. This means that when working officially, that is, under an employment or civil contract, the employer withholds 13% of the salary every month and transfers it to the budget.

Any employee of an enterprise has the right to contact his employer (most often, the accounting department) and request a certificate in form 2-NDFL, and it is completely free. The certificate reflects all the employee’s income by month for the year at a specific place of work. Including income in the form of material assistance, the cost of gifts (for example, New Year's, for children) and any other payments.

At the very bottom of the certificate, information is provided regarding the accrued and withheld personal income tax (income tax) to the budget for the year.

In some cases, employees are entitled to receive so-called tax deductions.

For example, as a rule, almost all employees who have children receive a standard tax deduction at work, that is, the employer reduces the employee's income by a certain amount each month, on which tax is not withheld and therefore not paid.

| Example 1: Let's say Petrov A.A. salary is 25,000 rubles per month. The employer withholds and transfers 13% to the budget monthly, that is, 3,250 rubles. Consequently, Petrov A.A. receives 21,750 rubles. But, if Petrov A.A. brings the child's Birth Certificate and the corresponding application to his employer, then the latter will provide him with a monthly tax deduction in the amount of 1,400 rubles (depending on the number of children and many other factors, the deduction can reach several tens of thousands of rubles per month). This means that, in this case, the tax will be calculated as follows: (25,000 – 1,400) *13% = 3,068 rubles. This is how “children’s” deductions work. |

But, in addition to children's deductions, there are also so-called social and property tax deductions, for which a tax refund is possible.

So how do you get your income tax back?

A tax refund, in essence, means that the employee, for some reason, for a particular year had the right not to pay personal income tax for a certain amount, but the employer made the payment. Consequently, an overpayment has arisen and the employee has the right to return it through the tax office.

You can return previously paid tax on expenses for education, treatment, purchase of an apartment, charity, and others.

To receive a tax refund, you must fill out a 3-NDFL tax return and provide documents confirming the expenses incurred.

It should also be noted that only for the costs of purchasing an apartment, you can return the tax every year up to the full amount due for a refund. And, for example, for expenses for treatment or training, you can only return for the year in which the corresponding expenses were incurred.

And, if, for example, for a specific year when these expenses occurred, the amount of tax paid was 10,000 rubles, and according to calculations, according to the 3-NDFL declaration, 15,000 are due for refund, the balance is burned out and is not carried over to the next year. Let us remind you once again that such balance of expenses for the purchase of an apartment does not expire and is carried over to the following years until full repayment.

Features of simplified receipt of social deductions

With deductions for training, treatment and contributions to voluntary life insurance, the procedure is somewhat different. According to the new version of Art. 219 of the Tax Code of the Russian Federation, to obtain them you need not only an application to the tax office, but also supporting documents .

The application and documents can be submitted in 3 ways:

- in writing;

- electronically via TKS;

- through your personal account on the Federal Tax Service website.

The period for consideration of the application is 30 calendar days from the date of submission. At the same time, the tax office reports via the personal account the results of the review, and also provides the tax agent (and not the payer, as now) with confirmation of the right of the individual (employee) to receive social benefits. Naturally, a negative outcome is also possible when it is revealed that there is no right to such a deduction.