Home / Real estate / Purchasing real estate / Buying an apartment / Calculation when buying an apartment

Back

Published: 08/31/2016

Reading time: 8 min

0

3366

On January 1, 2014, the Government of the Russian Federation imposed a ban on cash payments for transactions worth more than 600 thousand rubles, which, naturally, entailed certain difficulties in drawing up contracts for the sale and purchase of residential premises.

This ban is aimed at stimulating citizens for non-cash transactions, as well as preventing numerous “black” fraudulent schemes.

- Pros and cons of this calculation method

- Which currency should I choose for payment?

- Restriction on cash payments

- How to bypass restrictions? Payment in currency

- Crushing into pieces

- Bank safe deposit box

- Letter of Credit

- Money orders

How does the purchase and sale of housing for cash work?

Let's look at the payment procedure when buying a home in cash. Cash payment means a purchase with personal funds, without the use of mortgage or other lending. In this case, the collection of documents and execution of the transaction falls entirely on the shoulders of the seller and the buyer.

For example, when applying for a mortgage loan, the financial institution also checks the legal cleanliness of the apartment. It is advisable to start by collecting documents - obtaining the necessary certificates will ensure prompt registration of a new property right in Rosreestr.

What documents are required?

We will divide all papers into main and auxiliary:

- The first group includes documents for the purchase and sale of an apartment, the presence of which will one way or another be required by Rosreestr at the time of registration.

- The second is optional certificates, but they allow the buyer to check the status of the apartment.

To the buyer

- Passport of a citizen of the Russian Federation.

- Notarized permission of the spouse.

- Contract of sale.

To the seller

Basic:

- Russian citizen passport.

- Permission from the guardianship and trusteeship authorities to sell the apartment (if there is a minor owner of the property). To sell real estate where minors were previously registered, permission is not required (we wrote about the specifics of selling an apartment with registered minors here).

- Notarized permission to sell an apartment from a spouse.

- The document on the basis of which ownership rights arise.

Additionally:

- Technical passport of the apartment.

- Extract from the personal account.

- Certificate of absence of debts for utilities, telephone, Internet.

- Extract from the house register about registered persons.

- Extract from the Unified State Register of Real Estate about the property.

- Certificate of legal capacity from a psychoneurological dispensary.

Contract for the purchase and sale of real estate for cash. How not to be left without money?

Restriction on cash payments

Since January 2014, you can only pay cash for an apartment in an amount not exceeding 600 thousand rubles.

The rest of the money will have to be transferred to the seller's bank account or use another payment method.

Thus, the use of cash when buying and selling residential premises is becoming a thing of the past. With such a restriction, the Government of the Russian Federation plans to combat shadow payments of citizens and, as a consequence, unofficial income.

In addition, if one of the parties to the agreement is a legal entity, then the limit is reduced to one hundred thousand rubles.

Learn about escrow accounts! The apartment rental agreement must take into account some mandatory nuances. You can read more about them in this article. Find out all the information about extracting from the house register in our material.

Rules for drawing up a policy

A real estate purchase and sale agreement must include the following essential terms:

- And you need to start by indicating the personal data of the parties:

- FULL NAME;

- passport details (including where and when issued);

- place and date of conclusion of the contract.

- In a separate paragraph “Subject of the agreement” the object of the agreement should be described:

- apartment address;

its cadastral number;

- area and individual characteristics.

- Another mandatory clause of the contract concerns the price and payment procedure. You should enter the price of the apartment, noting that the parties agreed on the price and it is final. Read about how to calculate the cost of an apartment and what value to indicate in the contract here.

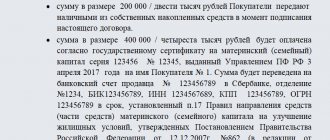

- To determine cash payment, the wording is used: “Payment under the agreement is carried out with the buyer’s own funds.” After this, the contract specifies exactly when and how payment will take place - before registering ownership, after registration, using a letter of credit or hand-to-hand.

Below are the details of the document on the basis of which the current owner acquired ownership. If there are persons left with the opportunity to continue to use the property, they should be indicated in this section.

The client's behavior is suspicious

In particular:

- hides or evasively answers questions about whether he is a public official (“Aren’t you the same Ivanov who is a deputy?”), what are the sources of money for the purchase of real estate (“Where can you earn so much, if it’s not a secret? "),

- checks with a notary or realtor whether they comply with the requirements of Law 115-FZ (“Do you report to Rosfinmonitoring?”),

- asks to speed up the transaction process without explaining the reasons, insists on payment in cash, and does not disclose the identity of the person in whose interests he is acting.

Which currency should I choose?

Note! The Civil Code of the Russian Federation provides for only one currency in which monetary obligations are expressed - rubles.

However, it is not prohibited to carry out actual calculations, for example, in dollars. If a foreign currency is selected, the price in the monetary policy should be indicated in ruble equivalent (taking into account the official exchange rate of the Central Bank on the day of the agreement), and in fact the transfer of money should be carried out in the selected currency.

Accordingly, the law allows you to choose your own currency. Commitment to one or another option is related to the economic situation in the country. It is believed that euros and dollars are more stable and not subject to crisis. On the other hand, you can lose a significant amount by converting banknotes.

When choosing a currency, we advise you to think about how to use it - if you are a seller. Such a deal will be profitable for the buyer if he collected money for the apartment in foreign currency and now does not want to convert it.

Will hard bargaining work when buying an apartment?

Step-by-step process instructions

A real estate transaction involves two main stages:

- Signing of an agreement between the parties.

- Registration of property rights.

If it were not for the need to register a new property right, this stage would be the last. But the transaction is considered completed only after receiving a certificate from the state.

When and at what point is money transferred for cash?

When should I transfer money upon purchase? This feature of the purchase and sale agreement has led to the emergence of two main options for cash payments:

- before registration of property rights;

- after registration of ownership.

Any of these options involves significant risks for one of the parties. Therefore, buyers and sellers often use tools that allow them to guarantee the transfer of the amount at a certain moment - we are talking about a safe deposit box and a letter of credit.

On a note. If it is possible to connect a bank as an intermediary, some of the risks are removed.

Letters of credit and safe deposit boxes are usually used for the "first transfer of ownership - then payment of the transaction" scheme. Hand-to-hand payment is often carried out immediately before submitting documents to Rosreestr with an already signed contract in hand.

Why do you need a receipt for receipt of funds and how to draw it up?

The receipt confirms that the buyer has transferred or personally transferred the required amount, fulfilling his obligations to the seller. The receipt is written by the former owner of the property who received the money. This document is legal insurance against claims from the seller in the future.

There is no form of receipt approved at the legislative level in the Russian Federation.

- The paper is written by hand, indicating:

- exact amount;

- the dates on which it was received;

- Full name of the buyer and seller;

- characteristics of the transaction itself.

- The home seller puts his signature under the main text.

Pros and cons of this calculation method

Cash payment when drawing up a purchase and sale agreement can be carried out in two ways:

- The transfer of money occurs before the parties submit documents to Companies House for processing. At the same time, the signing of the purchase and sale of housing transaction and the act of acceptance and transfer are carried out. In this case, all issues regarding the transfer of money are resolved based on an agreement between the seller and the buyer.

- The transfer of money occurs after submitting the necessary documents to the Companies House. After this, the parties draw up a transfer deed to the apartment purchase and sale agreement.

Regardless of when exactly the buyer pays the money (before the purchase and sale transaction is completed or after), cash payment has a number of advantages:

- First of all, this is the seller’s opportunity to immediately use the amount of money received at his own discretion.

- The next advantage has a purely psychological meaning - paper bills in your hands are incomparably more pleasant than an abstract amount of money in a bank account.

- The last, but no less significant advantage of paying in cash when buying an apartment is the ability to pay in any foreign currency, of course, by prior agreement with the other party to the purchase and sale of housing transaction.

However, not everything is so smooth.

Paying in cash, in addition to its advantages, has a number of disadvantages:

- For the buyer, it may be somewhat difficult to receive funds from his account, since most banks set limits on large monetary transactions;

- There is a risk for the seller of receiving counterfeit banknotes. To avoid this, you will need expensive banking equipment, the rental of which will require significant costs;

- When recalculating a large amount, you can make a mistake in the calculations. If the error is discovered after the contract is signed, it will be almost impossible to prove anything;

- There is a risk of losing cash or becoming a victim of street robbers;

- Transferring funds requires their recounting, which takes much longer than an instant bank transfer from one account to another.

Another nuance that is difficult to attribute to advantages or disadvantages, since all people perceive it differently, is fraud - that is, an indication in the contract of an overestimated or, conversely, underestimated cost of housing.

In the first case, this is done to obtain a larger tax deduction; in the second, to save money on tax contributions.

Features of a mortgage transaction

When applying for a mortgage, the bank becomes a full-fledged participant in the transaction and dictates certain conditions to the client. Monitors the financial organization and the settlement process. Most often, banks choose to use a safe deposit box and sometimes enter into agreements to open a letter of credit. It is rare to see a mixed type with prepayment - the buyer transfers some part to the owner before registration, and credit funds - after.

Transferring money from hand to hand, even with a receipt written by the creditor, is not encouraged. In any case, the buyer should be prepared for the fact that he will have no alternative. It is advisable to clarify this issue in advance in order to reach an agreement with the seller.

Payment to the seller is a strategically important stage of the transaction and must be approached responsibly. Now you know when it is better to pay money and what tools you can use to reduce existing risks.

In any case, ask the seller to draw up a receipt, if necessary, use the services of intermediary banks and indicate the procedure for transferring money in the main purchase and sale agreement. Reducing potential risks is also facilitated by checking the legal purity of the purchased property.

The transfer of money when buying an apartment from the seller to the buyer is the final and very important stage of the real estate purchase and sale transaction. The parties try to come to an agreement that would minimize the risks for each participant in the legal relationship.