- home

- Services

- The layer's services

- The layer's services

The division of property upon the death of one of the spouses occurs according to the rules of inheritance enshrined in the civil code of the Russian Federation. Even if the deceased left a will, his will cannot always be executed in full; certain categories of citizens are assigned rights to an obligatory share of the inheritance. And this rule of law has greater legal force than the terms of the will. For spouses, this rule is even stricter, because their property has joint .

Inheritance by law

After the death of one of the spouses, the joint property is first divided. The second spouse receives half of what belonged to both of them. And the remaining half is divided among all the heirs who have declared their rights. Since inheritance occurs in order of priority, and the spouse is the heir of the first priority, the inheritance after death will be divided only between representatives of the first priority. The law also includes parents and children. Thus, the remaining half of the deceased's property will be divided in equal parts among all first-degree who claimed their ashes.

Unworthy heirs may be excluded from inheritance, including:

- citizens who tried to obtain an inheritance by carrying out illegal actions;

- parents who have been deprived of parental rights in relation to the inheritance of their children’s property;

- citizens who evaded their obligations to support the testator.

In addition, persons who have committed a crime against the health and life of the testator are not allowed to inherit.

Controversy

During the process of inheritance, various disputes may arise between relatives of the deceased person.

Some disputes are regulated by the Civil Code of the Russian Federation. In particular, we are talking about such disputes as:

- the primary heir for some reason missed the time period when it was possible to receive the inheritance;

- mistakes were made when drawing up the will, and it was declared invalid in court;

- documents for an apartment or other movable and immovable property were lost and problems arose when entering into an inheritance.

If we talk about the first case, then the heir urgently needs to contact the district court, since only he can help in this situation.

If the will was drawn up incorrectly and it was declared invalid, then the division of the inheritance is carried out according to the law.

In the latter case, you need to contact a lawyer who can help in your specific case. It all depends on what documents are left.

Inheritance by will

The deceased could not fully dispose of the joint property, therefore, if the will states that the property belonging to both spouses passes in full, for example, to a child, it cannot be fulfilled in full. Here, as with inheritance by law, the share of each spouse is first allocated, and only half of the deceased spouse is inherited according to his will. The second half immediately goes to the surviving spouse.

The division of property upon the death of one of the spouses does not occur at all if, according to the will, all the property is already assigned to the wife or husband.

What is inherited after the death of a husband/wife

If one of the spouses dies, the common property acquired during the marriage is inherited, namely:

- Movable property and real estate: apartment, country house, car, land, furniture, household appliances, etc.

- Property rights: shares of the deceased in the authorized funds and capital of enterprises and organizations, etc.

- Property obligations: debts and other obligations of the deceased.

Division of property upon the death of one of the spouses in kind

According to the law, all joint property of the spouses is divided between them in equal shares, which means that each of them owns half of the apartment, car, and TV. And in the case of inheritance of such half by several persons at once, the situation will worsen even more. The remaining wife can receive 3/5 or 9/11 of the total property. The notary will indicate in the certificate only the share in the inheritance after the death of the husband, and the heirs will be asked to try to decide on the allocation of their shares in kind. If they succeed, then the agreements reached can be enshrined in the agreement. If a dispute arises, then the right to divide property after the death of a spouse and allocate shares in kind goes to the court.

First heirs upon death of wife

Now let's look at who the first heir is after the death of his wife. Her immediate family will also claim her property:

- official spouse;

- children (natural and adopted);

- mother and father.

Heirs of the first priority

The grandchildren of the testator can also be considered heirs of the first priority, but only by right of representation. This means that grandchildren will receive the right to inheritance if their parent (child of the testator) died before entering into the inheritance.

In Art. 1142 of the Civil Code of the Russian Federation states that these persons are in the first line of inheritance and have priority over other relatives of the deceased.

Biological children of the deceased who were adopted by other people have limited rights to inheritance due to the loss of legal ties with their natural mother. An exception is if the child continued to communicate with her while living in a foster family. In such cases, the courts rule that children have the right to receive shares in the inheritance of their natural parents and adoptive parents.

Along with the primary heirs, dependents whom she supported during her lifetime for 1 year or longer can receive a share in the inheritance of the deceased.

In order for a dependent to have the right to inheritance, it is necessary to establish the fact of being a dependent and prove it. How to do this, see the next video

Division of property upon the death of one of the spouses

Common property acquired over the years of married life is divided according to the rules of inheritance (SC, CC), unless an agreement on the division of property was signed between the husband and wife.

What is considered common property and is subject to inheritance:

- joint income from business, work;

- financial receipts - pensions, financial assistance from the state, various payments;

- real estate and movable property purchased during the years of marriage - housing, cars, etc., regardless of whose name it was acquired;

- shares, shares, shares purchased during marriage.

What property is not considered common:

- securities, apartments, houses, cars inherited;

- property received under a gift agreement or deed of gift;

- things for personal use in accordance with Article 36 of the Family Code, with the exception of luxury items (precious items, precious stones are subject to inheritance).

What is included in the inheritance

The hereditary property includes the following objects:

- apartment;

- car;

- House;

- company;

- land plot;

- vehicle;

- securities;

- stock;

- jewelry.

The marital share must be excluded from the inheritance. It includes ½ share of all joint property. To allocate the wife's property, you must contact a notary.

The specialist will issue a certificate of allocation of the marital share. Based on the specified document, the wife’s property is not subject to inclusion in the inheritance mass.

Important! Obtaining a certificate of allotment of the marital share does not deprive the wife of the right to inherit her husband's property.

Legislation

Inheritance is regulated by the following legislative acts:

- RF IC, Art. 33.34-38

- Civil Code of the Russian Federation, Art. 256, 1118, 1119, 1141, 1142, 1149, 1150

- Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 N 9, paragraph 33

- Fundamentals of the legislation of the Russian Federation on notaries.

The topic of inheritance is very broad, multifaceted, with many nuances.

Only a lawyer - a notary practicing in the sector of inheritance law - can understand all these complexities.

How is the inheritance divided?

Unless otherwise specified by the will of the deceased, the inheritance is distributed among the first-priority heirs in equal shares. The preferred option here would be to draw up an agreement. Only in this way can all inherited property be most rationally distributed: movable and immovable, land, securities, etc.

Example. The deceased left behind a house, a fishing boat and a plot of land outside the city. He did not make a will, and therefore his property was distributed between his two children and his wife. But since the objects are indivisible, and the relatives were on good terms, they drew up a settlement agreement, according to which:

- the fishing boat was left to the son, who shared his father’s hobbies;

- daughter's land plot;

- 1/2 of the house remained the mother's property (she allocated the remaining half as joint property, since the house was built during the marriage to the testator).

An agreement on the division of inherited property is concluded by the heirs after receiving a certificate of title from a notary and not before the birth of a successor conceived during the life of the testator.

In a situation where the parties cannot agree or the entire inheritance constitutes one indivisible object, its division occurs automatically. In this case, the car, apartment or land becomes the common property of the heirs.

But the court may rule otherwise. The justice body makes a decision on the division of the inheritance within the limits of the shares established by law or by will, indicating their actual content. If the value of the property determined by the judge to one of the heirs is less than expected, he is awarded monetary compensation from the heir who received more at his expense. This can happen if the specific successor:

- used an indivisible object as the main source of income;

- is the owner of part of the property;

- lived on the inherited living space at the time of the death of its sole owner and has no other housing.

If one of the successors is a minor or disabled citizen, the guardianship and trusteeship authority must be notified of all events related to the division of inherited property.

Example 1. The property of the deceased consisted of a two-room apartment, a car and a cash deposit. All this was assigned in equal parts to two heirs - the wife and son from the first marriage. The son was 11 years old at the time of the inheritance, so his interests were represented by his mother, the former wife of the now deceased. She did not want to meet the widow of the deceased halfway and enter into an agreement on the division of inherited property, according to which half of the apartment would go to the real wife, and the cash deposit and the car would go to the son.

The widow filed a lawsuit demanding that her interests be taken into account when dividing the property of her late husband and that she be awarded the second half of the living space. When making his decision, the judge took into account the following facts:

- the plaintiff lived with the testator in the disputed apartment for about 7 years and continued to live there after his death;

- she had no other place to live;

- the son of the deceased lived with his mother in her three-room apartment and was the owner of another two-room apartment.

Based on this request, the spouses of the deceased were satisfied. The rights to the living space were transferred to her in full; the car and bank deposit were inherited by her son. The distribution of property was made taking into account the established size of the inheritance shares, that is, equally.

Example 2 . Who will get the car after the death of her husband?

The widow and daughter of the deceased had a property dispute regarding the hereditary transfer of his car, which, together with the dacha, constituted all the personal property of the testator.

During her father’s life, his daughter almost constantly used the vehicle (driving it by proxy) and believed that she had the right to receive it as undivided property. But it turned out that according to the law, the spouse has priority in receiving a car. The reason for this is the following. The object of the dispute was acquired in marriage with the last wife, and therefore, according to Art. 256 of the Civil Code of the Russian Federation, is half its property. And, in accordance with Art. 1168 of the mentioned legislative act, when dividing an indivisible thing, the interests of the successor-co-owner are placed above those who simply used the inherited property.

The main stages of registering the acceptance of an inheritance

The Russian Civil Code (Article 1153) stipulates two methods for accepting an inheritance - in fact and with the help of notarization. In both cases, the parents will first have to register the right of inheritance to own property after the death of their son. You can arrange an inheritance after the death of your son/daughter by taking some steps.

Article 1153 of the Civil Code of the Russian Federation “Methods of accepting inheritance”

Where to contact

At stage 1, you will need to accept the property left after the death of the testator, and in its entirety.

You cannot receive only part or refuse it, including debts. The actual method of inheritance is used in certain cases:

- inheritance, for example, an apartment, is used after the death of a son/daughter and is adequately supported by parents or other successors;

- the property is safe and secure, ensured by the heirs;

- the son/daughter died, and the father/mother (recipients of the inheritance) assumed the share of the inheritance and all obligations, including debts.

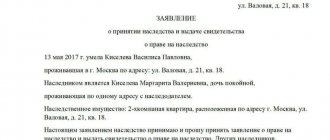

When contacting a notary, you must meet the necessary deadlines for entering into your inheritance rights. The period required for their adoption is 6 months from the day the testator died. In order for parents to enter into rights to the inheritance of their deceased daughter/son, they need to make actual acceptance within the specified time frame or draw up an application on a special form. Moreover, this can be done either in person, by coming to the office, or delivered with a proxy or sent by mail (documents - an application and a power of attorney for the proxy to act - must be notarized).

According to Art. 1115 of the Civil Code, an inheritance case is opened in a notary office located closer to the place of last registration of the deceased or the largest property (for example, residential premises). Inheritance cases can be distributed among notaries, in accordance with the letter with which the surname of the deceased begins.

To find this office and notary, you can go to the region’s website and look at the list with all contacts. A phone call will help clarify where and who exactly is involved in the inheritance matter.

Read also: Post-mortem psychological and psychiatric examination

The presence/absence of a will is reported by a notary on the day of death of its maker. If the date is uncertain, it will be made public upon the fact that he is declared dead in court. A will can be open or closed. In the first case, acquaintance with him is possible through family ties. In the second, only in the presence of all persons determined by the testator himself before the death.

Article 1115 of the Civil Code of the Russian Federation “Place of opening of inheritance”

Required package of documents

Having moved to the second stage, in order to receive an inheritance after the death of their son/daughter, parents first of all need to obtain a certificate confirming the fact of the death of the testator. And also collect the following documents:

- extract from the house register (last registration);

- a copy of the DM from the Criminal Code;

- a certificate of family composition and all persons registered in the living space of the deceased owner;

Family composition certificate form - a copy of the will;

- papers with proof of relationship between the successors and the testator;

- applicant's passport;

- information about the presence of other applicants for the inheritance;

- plan and explication of housing from the BTI and Rosreestr;

- documents on the testator's property: extract from the Unified State Register or certificate;

- other documents of title for ownership of property (court decision, contract, etc.);

The required package of documents also includes an application filled out in person at a notary's office by the parent who enters into the inheritance after the death of their son/daughter.

State duty upon entering into inheritance

The duty is paid in accordance with the Russian Tax Code (clause 22, article 333.24), since the mother/father’s share in the inheritance after the death of the daughter/son is acquired profit. The amount of the duty established by the state depends on the degree of relationship with the deceased and the size of the inherited property received or its share:

- 1st and 2nd priority (parents, children, spouses, brothers/sisters) - 0.3% of the inheritance valuation amount (not more than 100 thousand rubles);

- the rest - 0.6% of the assessed amount (no more than 1 million rubles).

The law provides for tax benefits. Persons who are heirs are exempt from it:

- living space and at the same time lived on it together with the deceased;

- property of citizens who died in the performance of public duty;

- property of victims of political repression;

- cash on bank deposits, from pension payments and rewards for intellectual abilities;

- insurance payments resulting from death and industrial accidents.

Those who do not pay the state fee include children under 18 years of age and incompetent persons. Disabled people of groups I and II can apply for a discount of 50% of the fee.

Article 333.24 of the Tax Code of the Russian Federation “Amount of state duty for performing notarial acts”

Deadline for inheritance

At the last 4th stage, the notary examines the inheritance case within the six months approved by law.

When it is closed, all successors established by the fact of inheritance are issued a certificate. It confirms the right to accept an inheritance. This document is the basis for re-registering the received property in your name. The six-month period can be extended upon the opening of an inheritance for new persons who have received this right due to:

- refusal of one of the heirs (the period of entry into legal ownership is 6 months from the date of refusal);

- non-acceptance of inheritance by other persons (additional 3 months as soon as six months have passed from the date of death of the owner of this property).

If the deadline for acquiring legal ownership of the property has been missed, and no one has refused it and there has been no failure to accept the inheritance, you can negotiate with the heir so that he agrees to be included in the list of successors.

In the event that the opening of the inheritance did not take place due to the fact that no one showed up or the only successor was late on the date of entry, the property, as escheated, goes into the state fund or into the ownership of municipalities. In this case, the issue will have to be resolved in court. To do this, a claim is filed, but there must be a good reason for the delay (ignorance, serious illness, illiteracy, etc.). The defendants are those who are currently the heir.

Read also: How to prove relationship with the deceased

Step-by-step instructions for opening an inheritance case to restore rights without a will and in the absence of disputes:

- oral and written consent of all legal successors, certified by a notary;

- the notary redistributes the shares of the inherited property;

- certificates of inheritance rights issued previously are canceled and new ones are issued;

- re-registration in the state register.

As a rule, the fact of reviewing an inheritance case is decided not by agreement, but in court.