Home › Questions and Answers ›

2020 made its own adjustments, rules and benefits. And some of them remained in 2021, so before we talk about the innovations of 2021, let's look at what remains relevant from last year, and since I already mentioned benefits earlier, let's start with them.

In 2021, one of the government support instruments was a preferential mortgage rate of 6.5% per annum for buyers of apartments in new buildings, and this program was extended until July 1, 2021. It is not yet known whether it will be extended again, but let’s remember the main conditions for obtaining a preferential mortgage:

- Have Russian citizenship

- The mortgage agreement must be concluded before July 1, 2021.

- Only apartments in new buildings are suitable

- The house can be either at the “pit” stage or already for rent

- The maximum amount varies from 6 million to 12 million rubles depending on the region.

- The rate is 6.5% per annum for the entire loan term.

- The down payment is at least 15% of the cost of housing.

- It is possible to use maternity capital or other types of government support.

It is important that the mortgage agreement must be concluded before July 1, 2021; this program applies to both ready-made apartments and apartments in the “pit” stage.

What is DDU

An equity participation agreement (EPA) is an agreement between the buyer and the developer for the purchase of an apartment in a building under construction. The buyer invests money, and the developer builds the house. After putting it into operation, the shareholder receives an apartment in accordance with the contributions paid.

There are two parties to a DDU agreement:

- Developer is a company constructing an apartment building.

- The shareholder is the buyer of the apartment.

During the construction phase, you can purchase a separate apartment, room, or non-residential premises.

Collection of penalties and refund

To draw up a penalty and go to court, it is best to use qualified legal assistance. However, even when drawing up a claim yourself, you should rely on the existing regulatory framework. The claim is drawn up on the basis of Articles 6 and 10 of Federal Law No. 214-FZ, Articles 309-310 of the Civil Code of the Russian Federation and with reference to the violated terms of the contract. The document is sent to the legal and actual addresses of the developer (it is better to find out the first for sure by ordering an extract from the Unified State Register of Legal Entities) and is delivered personally or by mail, by registered mail with a list of the attachments. A note indicating receipt of the claim by the developer is necessary for further proceedings in court.

The amount of the penalty is calculated based on the date the developer transfers the apartment to the investor under an equity participation agreement. Moreover, it is important to take into account both the period specified in the contract itself and the final amount of the penalty - if the plaintiff mistakenly overestimates it, the court will still make a calculation according to the law, but the final amount exceeding 1 million rubles entails mandatory payment of a state fee.

Participation agreement under Federal Law 214

In 2004, Federal Law No. 214 was adopted, which defines what a DDU is, what obligations the developer and buyer bear, and measures to take if the terms of the contract are not met.

According to the agreement, the developer undertakes to build a house using his own or other funds and, after its delivery, transfer his share in the form of the property to the buyer. The participant in shared construction undertakes to pay the amount established in the contract for the object and accept it after the house is put into operation.

The agreement is subject to mandatory state registration in the State Register and comes into force after completion of the procedure. The law provides for the possibility of concluding an agreement in electronic form, provided that the parties sign it with an enhanced qualified electronic signature.

In 2021, Law No. 151-FZ was adopted, which changed the procedure for participation in shared-equity construction of apartment buildings. The new model involves the use of escrow accounts.

Now the payer makes payments for an apartment in a house under construction not to the developer, but to a separate bank account, where they are deposited until construction is completed. The developer will be able to use the money only after the house is put into operation. If the developer violates the terms of the contract or does not comply with construction deadlines, the payer will be able to withdraw money from the account and terminate the contract.

What innovations have appeared in 2021?

The abolition of shared construction has been discussed for a long time, but this would be too risky a step. Therefore, in 2021, a decision was announced to make a smooth transition to a new model of participation in construction - project financing. That is, now the bank will act as a guarantor of the success of construction. Is it good or bad?

It is difficult to answer this question unambiguously; of course, this scheme looks the most transparent, if only because the money invested by investors “will not go anywhere”, but will be transferred to escrow accounts in banks; we will tell you what these accounts are a little later. Among other things, in the event of the developer’s bankruptcy, investors will have their deposits returned, because now the developer is obliged to build with finances “out of his own pocket,” which will certainly lead to a “cleansing” of the development market.

But now let’s look at the same scheme through the eyes of a shareholder, let’s say you purchased an apartment at the “pit” stage, investors invest money in the developer, but in the middle of construction he closes the construction site and declares himself bankrupt. The bank reimburses all the money to investors, but what about shareholders? No, shareholders, unfortunately, cannot withdraw their money ahead of schedule; they will have the right to do so only when the company violates the terms of the project financing agreement.

But let’s not panic ahead of time, according to the adopted amendments to the law on shared participation in construction, in 2021 a company will be able to complete a project according to the old rules if:

- Buyers have made at least 10% of the investment, and the facility is at least 30% ready;

- The facility is 15% ready, but within the framework of the project, comprehensive infrastructure development is planned (for example, opening a kindergarten and school, opening a store or cafe)

- Readiness is from 6%, but the work is carried out by a large, reputable company.

Pros and cons, risks of DDU

Despite the fact that the buyer’s money is protected by escrow accounts, purchasing housing through an equity participation scheme carries higher risks than when purchasing a finished property. For example, a developer may go bankrupt, fail to put the house into operation on time, or the bank where the money is kept will have its license taken away. However, the advantages of the new procedure for shared construction minimize possible risks.

What are the advantages of DDU:

- If the developer does not fulfill his obligations, the buyer will be able to return the money.

- The money in the buyer's account is insured by the DIA.

- The agreement is registered in Rosreestr, so double transactions are completely excluded.

- The cost of apartments according to DDU is lower than for ready-made objects.

- If the house is not delivered on time, the developer is obliged to pay a penalty under the DDU.

- Availability of warranty obligations from the developer.

Along with the advantages, this method of purchasing an apartment also has disadvantages:

- The buyer will have to rent housing until the house is put into operation, this will increase the burden on the family budget.

- If you take out a loan to purchase an apartment, you will need to pay it back monthly.

- If you have a mortgage, there will be additional costs for liability insurance.

What is shared housing construction?

This is the construction of a house under an agreement concluded between shareholders and the developer.

The first (individuals and legal entities) give money to the second (contractor company), who, with these funds, undertakes to create an agreed upon facility within the agreed time frame and put it into operation. In essence, the one who wants to get an apartment becomes an investor and contributes his funds - under the protection of a contract regulating the rights and obligations of the parties, and Federal Law 214 of December 30, 2004.

This option became possible due to the fact that the real estate market is divided into two sectors:

- secondary - the owner already owned the living space (or belongs to him right now, and he is selling it);

- primary – new square meters, the original owner of which will be the investor.

Where will the house appear? On the land of a developer who has a plot, but no money to carry out the work. So he attracts legal entities and individuals who agree to become investors (because the bank will not give him the required amount, it is too large).

Why do people and firms even respond to such proposals? Because the price is 1 sq. m. at the same time minimal - the terms of cooperation seem mutually beneficial.

Why then do we need a regulatory law? To protect against scammers, to prevent situations in which an unscrupulous landowner will collect money and simply disappear.

From here it becomes clear what shared housing is: this is the apartment or other area that the investor receives in proportion to his participation. The latter, by the way, can be carried out according to several schemes. For example, both with stage-by-stage payment and with 100% prepayment. Naturally, it is more difficult to provide the entire amount of funds at once, but in this case the investor does not depend on inflation or other economic problems, whereas in the first situation the cost per square meter inevitably increases over time. Another option is an investment to offset existing property, for example, a car, which partially compensates for the amount (and the rest can be paid off in some other way).

Advantages and disadvantages

Although there is controversy surrounding this form of construction, although many consider it controversial, it is worth recognizing that for most people who do not want to get into a mortgage, this is almost the only method by which they can quite easily acquire housing. But it is important to objectively understand both the advantages and disadvantages that shared ownership has.

Pros:

- It is possible to spread out payments for the purchase of an apartment until the completion of construction, which greatly reduces the burden on equity holders.

- The cost of purchasing real estate is quite low. If you purchase the same object after its immediate commissioning, the cost will increase significantly - so the savings in shared construction are obvious.

- The shareholder acquires a new apartment, and not an apartment that was previously used by someone else, with all the ensuing consequences.

Minuses:

- The possibility of falling for the above “gray” schemes.

- There is a chance that the quality of construction will be insufficient as a result. Legally, this aspect will be regulated by the contract, but the shareholder will lose time.

Purchasing an apartment under a shared participation agreement

What is required to conclude a DDU: passports of future owners, notarized consent of the spouse to the transaction, money for the down payment.

The procedure for acquiring a property under the DDU consists of several stages.

- Select a developer, construction project, apartment.

- Select the bank where the escrow account will be opened. The best option is a credit institution that provides financing to the developer.

- Conclude an agreement with the developer.

- Make a down payment or security deposit.

- The document is submitted for registration to Rosreestr.

If the buyer purchases an apartment using borrowed funds, after selecting the property, he will need to select a creditor bank, submit an application and receive preliminary approval of the transaction.

How to check the DDU and the developer

To do this, the company’s reputation, the presence of litigation, and experience in construction are checked. Information can be obtained from the developer’s website or from official sources. For example, you can check on the websites of the Federal Tax Service, the EDF about bankruptcy, and the electronic file cabinet.

What requirements does the law impose on developers?

Only those construction companies that operate within the framework of the law and fully comply with the requirements of the law can raise money. The developer must:

- have sufficient financial resources available (minimum 2.5 million);

- be a bona fide participant in public procurement and not be on any lists of unreliable suppliers;

- do not have tax debt of more than 25% of your assets;

- it should not be subject to liquidation or bankruptcy proceedings.

The developer must have a construction permit in hand, and a project declaration for the facility being built must also be published on its official website. Only after this the developer has the right to conclude deals and attract investments.

Even before signing the contract, the developer is obliged to insure its liability to each participant. He must have insurance or a surety agreement, and the developer may also be a member of a mutual insurance company.

For projects that began operating on January 1, 2021, a new way to ensure the responsibility of developers has been introduced - contributions to the compensation fund from each concluded DDU.

We are drawing up a DDU agreement - what to pay attention to

Typically, a DDU agreement is concluded in a standard form, but special attention should be paid to the following points:

- How much will the apartment cost, what additional payments are there?

- The deadline for putting the house into operation and transferring ownership of the apartment.

- What is the procedure for calculations in the event of a change in the area of the object.

- Procedure for filing claims.

- In what cases can the contract be terminated?

- Calculation of penalties under DDU for untimely fulfillment of obligations.

When signing a contract, be sure to check the authority of the person signing the document on the part of the developer.

Registration in Rosreestr

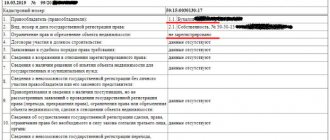

Rosreestr will require all documents of the transaction: passports of the parties involved, powers of attorney, constituent documents of the developer, documents for the house under construction, DDU, agreement on pledge of rights to real estate (if borrowed funds are involved in the transaction), receipt of payment of state duty.

The agreement will be registered within 7–9 days, depending on the method of application.

Further plan of action

After receiving the registration agreement, you need to fulfill your obligations under the agreement and wait for the deadline for registering ownership of the apartment.

Underwater rocks

The transaction has nuances that must be taken into account at the stage of making a decision on purchasing an apartment under the DDU.

Bankruptcy of a developer under DDU

In this case, the buyer is protected, his funds are in a separate escrow account. He will receive them in full, without loss.

Bank bankruptcy

From this side the buyer is also protected. Within 10 million rubles. the funds are insured by the DIA, so if the bank goes bankrupt, the depositor will not suffer.

Participation in a loan transaction

If the buyer has taken out a loan under a DDU agreement, this must be reflected in the agreement; the agreement for pledging rights to real estate is also subject to registration with Rosreestr. If the borrower does not fulfill his obligations to the bank, he has the right to foreclose on the pledged rights of ownership of the object.

How to become a participant in shared construction?

Anyone can take part in shared construction. Weigh the pros and cons and start searching for a reliable developer and a place where you would like to buy an apartment.

- Search for a developer, house and apartment. Real estate portals host many developers who offer shared construction in Minsk and other cities. Explore all the options and choose the best one for you.

- Developer check. Before concluding an agreement with a construction organization, check the information about the developer. Rely on indicators such as: company experience; the objects she built; reviews from investors and buyers. Knowing the full name of the construction organization, you can also check the legal information about it. This can be done on the portal of the Unified State Register of Belarus. The Unified State Register database stores complete information about each organization: presence of tax debts; land ownership; compliance of the project declaration and documentation with state standards.

- Conclusion of an agreement. If you are satisfied with the developer and his conditions, feel free to enter into a shared construction agreement.

- Making payment. After concluding the contract, the developer gives you a special account number in one of the banks. Every time you transfer funds there, the bank makes sure that the money goes in the right direction. Control is carried out at all stages of construction.

- Transfer of apartment. When the construction of a house is completed, the developer is obliged to measure the footage of each apartment and recalculate the cost. During the construction process, some parameters may have changed, and, accordingly, the price. If your living space has more square meters, you will need to make an additional payment. In case of violations, the developer eliminates them within 3 months at his own expense. Upon transfer, an act of acceptance and transfer of living space is concluded, which is signed by both parties. The buyer is given the keys, and he receives the legal right to own the property.

How to conclude an agreement on shared construction?

When concluding an agreement, the developer must comply with certain requirements established by law. If the conditions of shared construction have not been met, he does not have the right to attract money from shareholders.

A standard agreement is concluded between the developer and the shareholder. Before signing, make sure that the agreement specifies the entire list of conditions for shared construction:

- Indication of the specific houses and apartments that will be built and transferred to you, as well as their characteristics*

- Bank details and numbers of special accounts where funds will be transferred

- Terms of construction and commissioning of housing

- Total cost of the apartment and price per 1 sq. m.

- Amount and procedure for depositing funds

- Warranty period for the apartment

- Rights and obligations of the parties

- Procedure for amendments and additions to the agreement

- The developer’s obligation to transfer the property to you after completion of construction (it must meet all technical and sanitary requirements, as well as contract norms)

- The procedure for acceptance and delivery of an apartment

- Procedure for early termination of the agreement

- Procedure for refunding money in case of early termination or failure to fulfill obligations

- Responsibility of the parties for failure to fulfill obligations

*The agreement must include the following information and characteristics of the construction project:

- Purpose

- Address

- Common and living area

- Number of rooms and their footage

- Total area of utility rooms

- Floor and wall material

- Availability of doors, windows, ceilings, sanitary and other equipment

- Availability and condition of interior decoration

- Type of residential building

- House material (block, brick, etc.)

- Construction series

- Availability of a technical floor, basements, attics, elevators, parking, shops, etc.

- Availability of utility networks for electricity, gas, water supply, sewerage, communications, etc.

- Apartment improvement and landscaping objects

The agreement must be registered with the executive committee. This is done by the developer himself within 3 days from the date of signing the document. Within another 3 days, the executive committee reviews the agreement and registers it. Both copies of the agreement are stamped. Within 3 days after registration, the developer must send one copy of the registered agreement to you. In case of changes in the main terms of the contract and the conclusion of additional agreements, they are also subject to registration with the executive committee.

Main provisions of the agreement

The relationship between the developer and the project participant is regulated by the DDU, concluded in strict accordance with Federal Law 214.

There is no single form of document; each company develops its own agreement. However, there are mandatory provisions, in the absence of which the contract is considered not concluded. The document must contain:

- detailed description of the transferred object;

- the exact date of transfer of housing to the shareholder;

- the price of the contract, the method and timing of its payment;

- guarantees for the construction project;

- a method of securing obligations by the developer.

These are just the main provisions of the DDU. There are a number of other important points that must be reflected in the contract. You can find out in more detail what the document should look like in the article “How to correctly draw up a shared construction agreement.”

The developer is obliged to take care of ensuring its obligations to the participant. To do this, he must either obtain a bank guarantee or enter into an insurance agreement. The DDU includes information about the insured or guarantor, whom the shareholder can invoice if the construction company does not fulfill its obligations to it.

The DDU acquires legal force only after undergoing mandatory registration with Rosreestr. Citizens who decide to take part in the construction of housing need to know that they need to make any payments under the contract only after it has been registered. The actions of a developer who demands money before this deadline are illegal.

How to terminate a shared construction contract?

Both the developer and the shareholder can terminate the contract. Moreover, the developer has the right to do this in cases where:

- The buyer paid funds late or not in full for 2 consecutive months.

- The buyer does not agree with the justified price change (if the price was indexed).

Each shareholder has the right to terminate the agreement early and return the money paid at any time. To return the money, the buyer must provide the developer with the following documents:

- Copies of payment receipts

- Copies of granted loans

- Bank certificate about loan debt

- Certificate from the executive committee regarding subsidies for loan repayment

The refund amount is indexed, i.e. recalculated to the actual date of return. Refunds occur within 3 months from the date of termination of the contract.

Other features of participation in shared construction:

- Payments are made by bank transfer.

- In case of late payment, the shareholder is obliged to pay a penalty: 0.02% or 0.002% of the overdue payment amount for each day of delay.

- The apartment is transferred to the shareholder only after full payment of the apartment (even if other shareholders have debts).

- Within 3 months, the received apartment must be registered with the BTI, receive a passport and a certificate of registration of the apartment.

Whether to enter into shared construction or not is everyone’s business. Thanks to state protection of the rights of shareholders, the danger of losing money and housing has been reduced to a minimum. And the list of benefits has only grown. But no matter what guarantees Belarusian legislation provides, always check the reputation of the construction organization. This way you will protect yourself and your property.

FAQ

What does assignment of rights under the DDU mean?

The sale of an apartment by assignment of rights under the DDU is possible if the rights to the real estate were purchased by a third party (investor). He transfers them to buyers for a small percentage.

Is it possible to terminate a voluntary service agreement?

The DDU agreement can be terminated by mutual decision of the parties or unilaterally. The buyer can terminate the contract in the following cases: when the developer does not comply with the deadlines for putting the house into operation and the delay is more than 2 months; in case of violation of quality requirements; if the company refuses to eliminate deficiencies that prevent you from moving into the apartment for residence. The agreement may also provide for other cases. The developer terminates the contract unilaterally if the buyer delays payment for more than 2 months.

What is electronic registration of preschool education?

This is a way to send documents for registration to Rosreestr electronically. In this case, you will not need to visit the MFC, prepare paper documents, and the registration time is halved. The state fee is paid online.

The service is offered by special Internet platforms for registering all real estate transactions. They are also involved in the preparation of DDU agreements.

How to protect yourself

Risks cannot be completely eliminated, but minimizing them is quite possible. To do this you need to perform several steps:

1. Check the second side - go to the official website and see how many, when and what objects the company has delivered, and whether it has a project declaration. Then you should look on the Internet to see what kind of reputation this organization has, whether it met the deadlines, and whether its reporting is in order.

2. Study all the information regarding the future building - find out on what basis the developer owns the site, whether he has issued all the permits; If possible, you should familiarize yourself with photos and video materials to understand what stage the project is at.

3. Make sure that there are no prerequisites for bankruptcy - ask the Arbitration Office if there are any claims, penalties or open enforcement proceedings against the other party.

Well, then, if everything suits you, you can personally meet with a representative of the contractor company and find out in detail how to enter into shared construction in this particular case, and see the land in person. Again, it is best if you are accompanied by an experienced lawyer.

What to do if the developer is unscrupulous

If the other party has not fulfilled its obligations, you have the right to:

- upon acceptance of the object, demand that deficiencies and defects be eliminated as soon as possible. It is permissible to involve independent specialists to assess and control quality;

- insist on reducing the final cost if the actual area does not correspond to that specified in the DDU; or in the event that the level of finishing or other work does not meet modern standards;

- compensate for your losses in court or through an amicable settlement of the claim.