A mortgage is a complex loan that can take several months to process. The procedure for obtaining a mortgage can be divided into 12 stages. We have prepared detailed instructions, after reading which you will see a complete picture of the entire process. In this article we will look step by step at how a mortgage transaction goes, we will analyze the basics and nuances of choosing a bank and program, searching for an apartment and preparing documents. We'll tell you about the pitfalls and controversial situations that borrowers face when applying for a mortgage loan and searching for housing.

Where to start designing

Banks, trying to take into account possible risks, put forward requirements for potential borrowers. The client should evaluate his financial capabilities. Attention should be paid to the following factors:

- Age

. You can take out a loan for real estate from the age of 21. Banks rarely sign contracts with students who cannot yet fully devote themselves to work. Also, financial and credit organizations are wary of pensioners. With rare exceptions, banks strive to ensure that the borrower is no more than 65 years old at the time of repayment of the mortgage.

- Financial situation

. The minimum down payment amount is usually 10 – 15%. It is also important for the bank to make sure that the client’s income is enough for monthly payments. It is more profitable for a financial institution to provide loans to families in which both spouses have a permanent job.

- Seniority

taken into account when purchasing an apartment or house with a mortgage. The client must work in one place for at least six months.

It is advisable to repay previous loans in full in order to increase the chances of approval of a new one.

How long can it take to obtain a mortgage?

The process of applying for a home mortgage can take several months . This may be due to several factors:

- The potential borrower provided the bank with an incomplete set of documents or submitted documents whose validity has already expired.

- The person does not inspire confidence in the bank, so the financial institution requires additional facts to certify that the person is reliable.

- The borrower cannot find an apartment that is suitable for both him and the bank.

- The borrower has been looking for a long time for an insurance company for whose services he would not overpay.

Clearly answer the question: “How long does it take to get a mortgage?” impossible. Some people can complete a deal in 3 weeks, while others will have to process it for several months.

But if the borrower has a positive credit history, he will not raise doubts in the bank, finds a good seller and a “clean” apartment, correctly submits all the necessary documents, then he will be able to get a mortgage in 3 weeks.

It is not possible to complete a transaction to purchase a mortgaged apartment in a shorter period.

Bank selection

If you meet the criteria described in the previous paragraph of the instructions entitled: “Where to start buying an apartment with a mortgage,” you can begin to study the conditions of banks. It is important to consider the following points:

- interest rate;

- maximum mortgage amount;

- an initial fee;

- availability of preferential programs;

- insurance.

Experts advise submitting a package of documents to several banks at once. Get three or four or more approvals, and then make your own choice of the most suitable conditions.

Stages of obtaining a mortgage for an apartment

You don’t have to take out a mortgage for your apartment yourself. Credit brokers and realtors can come to the rescue and take on some of the responsibilities. However, it will not be possible to completely shift your responsibilities to assistants. However, no specific actions are required from the citizen. You can figure everything out on your own, the main thing is to have an idea of your actions.

Where to begin?

It is recommended to start by choosing the bank where you plan to take out a mortgage. Today, many banks offer reduced rates for obtaining mortgages with government support. It is worth analyzing the supply market and finding several suitable options from different banks, which will increase the likelihood of mortgage approval. In addition, it is worth considering the general economic situation. For example, 2021 was the period with the lowest mortgage rates.

Please note that each bank imposes requirements on the borrower that relate to:

- Age (most often from 21 years at the time of registration to 70 years at the time of full payment);

- Employment (in most cases, at least 6 months of experience at the current place of work is required);

- Documents that the client can provide to the bank. Usually this is information about salaries and information about co-borrowers.

When choosing a bank, the borrower himself should pay attention to the interest rate and the maximum amount. However, the choice of bank may be based on other nuances. For example, its reliability, the possibility of early repayment or favorable mortgage payment conditions.

Application and its consideration by the bank

It is recommended to submit a mortgage application to several banks at once. If one organization refuses, there is a chance that another will approve. Since this is only the initial stage, approval of the application does not force the client to enter into a final agreement with this bank. The processing time for an application depends on the bank. The minimum period is 3 working days, but in some structures it can take almost 2 months. During this period, the bank checks the client's solvency, as this is a fundamental requirement for approving the application.

Apartment search

An approved application is not only a bank’s readiness to lend, but also the amount of money it is willing to provide to a specific borrower. As with a regular loan, the bank may offer an amount lower than what the client initially asked for, so it is recommended to start searching for an apartment only when the approved mortgage amount is known. It takes about 3 months to find a suitable apartment, but at the request of the borrower the period can be extended.

Grade

Banks do not carry out fictitious transactions

, therefore, you cannot simply write down any figure for the cost of housing in the contract. This figure is indicated by the appraiser. Some banks offer an appraisal service as part of a mortgage; in others, the buyer must independently order an expert assessment of the value of the home from an independent company. The final figure will be affected by the condition of the apartment, its location, number of floors in the building and many other factors. The result of the assessment will be a conclusion that is provided to the bank.

Please note that the bank does not pay the full cost of housing

. It provides up to 85% of the appraised value, the remaining amount is paid as a down payment. This point must be clarified at the stage of choosing a bank, since different organizations provide different interest coverage for the loan. For the purchase of an apartment, the greatest assistance is provided from the bank.

Approval of an apartment by the bank

The apartment should please not only the buyer, but also the bank. Credit institutions refuse transactions with illiquid real estate. This means that the chosen housing must comply with residential premises standards

:

- The apartment must be connected to utilities (electricity, running water, central heating);

- The building where the apartment is located should not be dilapidated.

Such requirements are due to the fact that if the borrower is unable to pay the mortgage, the bank will have to sell the property in order to recoup the costs. It is difficult to sell a dilapidated building and, especially, a house for demolition to a new tenant.

The bank also checks the property for possible difficulties with transfer of ownership. For example, the presence of debts for utility services or registered minor children or other persons who in the future may protest the purchase and sale agreement. If, after checking, no such incidents are identified, the bank begins the next stage of cooperation.

Loan agreement

Signing the loan agreement becomes the main stage. From this moment on, the bank and the borrower are assigned certain rights and obligations. The loan agreement consolidates the cooperation between the parties. The remaining stages will go by fairly quickly.

Receiving funds

Depending on the terms of the loan agreement, the money can be transferred to the owner’s account or left in a deposit box. Other methods of transferring money may also be used. However, almost all of these cases bypass the borrower, that is, he does not see or receive this money. This ensures the safety of funds and also guarantees that the transaction is completed.

Notarization

Notarization of the transaction is not a prerequisite for drawing up a purchase and sale agreement. However, some banks require this certificate as a guarantor. Notarization also becomes mandatory in cases where housing is purchased from shared ownership. For example, an apartment belongs to 2 people in equal parts. Notarization endorses the absence of claims for the execution of the contract from each participant.

Even if the bank does not require notarization of the transaction, the buyer is recommended to initiate it himself. This is a paid service, but it provides guarantees that there are no claims against the contract that will arise later.

State registration and mortgage registration

After the purchase and sale agreement is completed, the property must become the property of the new owner. This status is confirmed by registration of housing. The result of the procedure will be a document of ownership. Since a mortgage is most often a loan pledged as collateral for the purchased property, the document of ownership can be taken into custody by the bank as a guarantor of the return of funds. The state registration procedure lasts up to 1 month.

Insurance

Real estate purchased with a mortgage is subject to compulsory insurance. This is a mandatory condition of the bank, which guarantees that in the event of damage to real estate, the bank will be able to return its funds. Also, some banks may require life insurance for the borrower and co-borrowers as additional guarantees.

The insurance procedure does not necessarily follow after registering the home to the new owner. This stage can be postponed to an earlier date. For example, immediately after drawing up a loan agreement. Some banks offer customers discounts when purchasing insurance through their organization.

Further actions

The mortgage holder's further actions are to comply with the loan agreement with the bank. This means you need to make regular payments on time to pay off your mortgage. As for housing, you can move into an apartment immediately after registering ownership rights.

We collect a package of documents

So, you have decided to take out a home loan. But how to get a mortgage, where to start? The standard list of documents is the same for different banks, but there are some peculiarities. It is necessary to study the requirements of a particular institution on the website, by phone or during a personal visit. Here's what's included in the basic package:

- borrower's passport;

- insurance certificate;

- data on marital status;

- information about the borrower’s income (certificate 2-NDFL);

- a copy of the work book.

Often financial and credit institutions ask to provide evidence of additional sources of income and profit. Documents confirming income to the family budget will only be a plus.

Is it possible to speed up the process?

You can make the processing of your application at your chosen bank faster. To do this, it is advisable to become a salary client of this financial institution, and you can get a mortgage by providing only two documents.

Also, the borrower’s application will be considered faster if he has previously made deposits here, taken out small loans and repaid them on time, and has an excellent credit history. Accordingly, it is advisable to apply for a mortgage loan from the bank that previously served this client.

You can speed up the process using the documents provided. Type 2-NDFL certificates have a great influence on the speed of consideration of the application. In this case, the client verification will be carried out faster.

But if the applicant submitted documents that included a certificate of income received in a bank form or in free form, the verification will take much longer. The lender must make sure how solvent and reliable the client is.

Such documents may be fake, so they are checked more carefully.

Application to the bank

Buying an apartment with a mortgage is not a quick process. As soon as you have collected the necessary documents, immediately submit them to the bank. This can be done in person at the office or through the website of a financial and credit organization. Try to provide accurate information. Remember that the lender will verify the information.

At Rosbank Dom you can calculate and get a positive decision on a loan without visiting the bank. The mortgage rate in a financial and credit organization is from 6.80%. A preliminary decision is issued within 10 minutes.

The bank will launch a data verification procedure. A response to the application is issued within five days. Having received a positive response to your application, you can begin searching for real estate. Up to 3 months are allocated for these purposes.

conclusions

The stages of a mortgage transaction depend on the bank’s rules, but each borrower must go through 12 basic steps.

Follow the recommendations of the article, and you will receive a mortgage loan and become the owner of a clean apartment:

- Choose your credit institution and program wisely.

- Select and analyze real estate carefully.

- Look neat when meeting with your mortgage advisor.

- Carefully check the seller, make sure that he is not registered with dispensaries.

- Read and double-check all documents, meet deadlines and stay in touch.

- Choose a secure payment method.

- Don't try to deceive the bank and make payments on time.

Property selection

Many people answer the question “Where to start the mortgage process” that the main thing is to find suitable real estate. At this stage, the borrower needs to start choosing an apartment or house. Both the client and the bank should like the housing, because it acts as collateral. The selected property is assessed and the cost is specified in the mortgage loan agreement. The bank will provide a list of appraisers it trusts. The client has the right to choose another organization.

As part of the assessment, the liquidity of the apartment is determined. It almost always differs from the market value. This takes into account the location, year of construction, and availability of infrastructure. The liquidity of an apartment in a building under construction, a new building and secondary housing will differ.

Requirements for the apartment

Home is more than just a place to relax.

The way our home is furnished affects the quality of life. The time it takes to travel from home to work or school and back, the availability of infrastructure nearby, hospitals and shops within walking distance - all this is important to take into account when choosing an apartment. What else you need to pay attention to:

- How far are schools and kindergartens located if you have children.

- Are there grocery stores, pharmacies, hospitals, parks, etc. nearby?

- Is this a good area? Your peace of mind depends on its safety. So that women are not afraid to return home from work, and grandmothers are not too worried if their grandchildren are late at school.

Advice: look at the entrance, it always shows what kind of people live there.

Masha Samodelkina lived in a hallway where cigarette butts lay on the window sills, paint was peeling off the walls, and spiders lived in the corners. Sometimes at night she was woken up by noisy neighbors.

Sasha’s childhood entrance is an ideal of cleanliness and neatness. The floor was always clean, the paint was fresh, and there were flowers growing on the windowsills. But as soon as someone caused trouble, an unknown well-wisher would throw threatening notes under the door. Maybe in the house you choose there is a person who strictly monitors order.

- Evaluate the quality of the house itself. Find out whether the pipeline often breaks or plugs fly out, whether the room is well ventilated, what the thermal conductivity of the housing is. If you do not take this point into account, then you will have to spend money on a water heater or an electric battery, and this is only the minimum.

Obtaining a bank decision

After a positive response to the transaction is received, the period of settlement with the seller and registration of ownership of the apartment begins. After the registration procedure, money is transferred. Until then, the entire amount is stored in the borrower’s account or in a safe deposit box.

The time frame for the purchase and sale of real estate to be completed depends on several factors:

- deadline for collecting papers;

- the time during which the bank verifies documents;

- internal procedures for obtaining a mortgage.

The services of a realtor will help speed up the process of purchasing an apartment with a mortgage. You can search for real estate on your own, through friends and acquaintances, on specialized websites or at a real estate agency.

Selecting a program and calculating loan terms using a calculator

Banks are trying to speed up and simplify the conclusion of a transaction. They offer to use a loan calculator to reduce the time it takes to apply for a mortgage. With its help, you can independently calculate loan parameters online without visiting the bank on basic or preferential terms, as well as taking into account special programs.

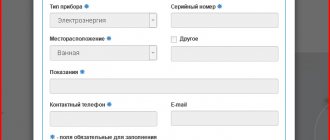

The mortgage calculator form displays the following loan parameters:

- sum;

- the amount of the down payment;

- loan terms;

- cost of the object;

- interest rate.

Preferential new building from 4.49%

The stars have aligned for those who dreamed of buying an apartment in a new building

From 15% down payment

For a period of up to 25 years

To learn more

If previously it could take a whole day to visit the bank and consult with a specialist, now you can pre-calculate a loan in a few minutes. For the calculation it is also necessary to indicate the type of property and the area of purchase. The result is displayed on the screen instantly. After choosing the optimal program and conditions, the application can be submitted online on the bank’s website.