The seller offers us, as buyers, to make an advance payment for his apartment in the amount of 1 million rubles. We consider his demand for advance payment, to put it mildly, not entirely acceptable. Tell me, how much is an advance payment for an apartment usually paid to an individual, what is the standard amount of advance payment accepted in the secondary market?

Usually, the size of the prepayment amount when signing an advance agreement is determined by the parties to the transaction in advance, but amounts exceeding 30-50 thousand rubles on the secondary market when making an advance for an apartment rarely appear...

In practice, very often sellers receive offers to make large significant sums as an advance; the owners offer to transfer 500 thousand, 1 million, and 1.5 million rubles in advance as part of signing an advance agreement. They justify their claims to such enormous sums with arguments that an advance of 50 thousand rubles is negligibly small and cannot guarantee a deal. And 30 thousand rubles, and even more so, is not a serious amount of prepayment for an apartment, and it cannot in any way serve as a guarantee of an upcoming transaction, and that to confirm their intentions to buy, they need something more from a potential client. However, sometimes the true reasons for such behavior, such unacceptable conditions and offers for advance payment and prepayment for an apartment for the buyer lie deep in the dark soul of the seller.

True, there are cases in the market when buyers themselves are extremely interested in purchasing a particular property and stick large, sometimes colossal, amounts of advance payment to the apartment seller under their noses, just so as not to miss out on a profitable option, independently tightening the noose around their neck. If you are exceptionally interested in a certain property, I recommend making no more than 100 thousand in advance; there is always a risk of losing money forever.

Advance payment for an apartment as the last trump card up your sleeve

It often happens that apartment owners try to solve all their financial difficulties under the guise of selling an apartment. Like a red rag in front of the eyes of a bull, they wave this last trump card that they have left in front of the noses of realtors, creditors, relatives, acquaintances and God knows who else, accumulating more and more money in debt, plunging deeper and deeper into the quagmire of lies and deceit. The end result of such systemic behavior boils down to the presence of a huge amount of debt to individuals and consumer loans. This is where a brilliant idea arises, as it seems to them, with the help of an apartment to extract from gullible buyers the necessary amount as an advance to cover all debts. This largely explains the owner’s desire to receive a huge amount of money as an advance payment for the apartment. And when they tell you that 50 thousand rubles as an advance is a ridiculous amount, and they offer to make an advance payment of about 500 thousand, often this cannot mean anything else - they want to deceive you. And where the curve will lead...

In such cases, for example, when they offer to make an advance payment for an apartment of 1 million rubles, the owners are often disingenuous; they are not going to sell anything, but with the help of the apartment they are trying, so to speak, to temporarily refinance and pay off their financial obligations to third parties. The price is set at a bargain price, below the market, very tempting. This doesn’t remind you of anything, maybe this is just your case?…

If on the eve of the transaction your price was raised

Unfortunately, this happens. In Moscow, a couple of days before the transaction, they can raise the price by 100,000–300,000 rubles. On the one hand, compared to the cost of an apartment, this is not much. It is possible to collect this amount from relatives and friends in two to three days. On the other hand, all plans collapse. The saddest thing is that the price before the transaction is most often raised by unscrupulous realtors. The owner of the apartment may not be aware of such tricks. Your options:

- Refuse the new price. You indicate that you are ready to purchase only on the terms that were previously agreed upon. There is a chance that the other side will show prudence and the deal will go through.

- Insist on the old price. If you and the seller have entered into an advance agreement, you have a tool for pressure. You have the right to file a lawsuit to force the seller to enter into a purchase and sale agreement on the terms described in the agreement. As a result, the court blocks the registration of the transfer of ownership of the object until the end of the consideration of the case. All this confuses the cards for the seller. It is likely that he has another buyer who is willing to pay a little more for the apartment. Or there are several such buyers, and they want to arrange an auction between them, at which the apartment will be sold to the highest bidder. (Yes, there is also such a method for selling an apartment: the initial price is lowered, buyers create a rush, an auction is held and... often the apartment is sold at a price above average. This is human psychology - excitement and emotions turn off the brain, which leads to a bad deal.) So Now, a lawsuit is freezing transactions with the apartment. The seller is wasting time, so he will most likely agree to your terms.

- Accept the new price. If the attractiveness of the property has not decreased with an increase in price, it may make sense to accept it. “Accept and forgive,” as the comedy character said. If you are communicating not with the seller, but with his realtor, then try to contact the seller. It is possible that the owner of the apartment is unaware of the manipulation.

But it’s not just sellers who engage in arm-twisting before a deal. Sometimes the buyer is guilty of this too. Especially if he has cash and is the first in the chain of transactions, or “top” in realtor slang. Sellers change apartments - for example, they move from a one-room apartment to a two-room apartment. The owners of a two-room apartment, in turn, buy a three-room apartment. A chain of three to five alternatives is not unusual. If the “top” buyer demands a discount of 50,000–300,000 rubles before the transaction, then there is a high chance that the entire chain will reluctantly agree to his conditions.

Advertising

There is another extreme in choosing an apartment. Some buyers go to viewings for months, look for something, choose, but it never comes to an advance payment. Realtors call this type of buyer “tourists.” Found a great apartment? The metro is within walking distance, good parameters, clean documents. The seller is in a hurry to sell and is ready for serious bargaining. Here it is, you have to take it!

But the “tourists” are not completely satisfied. They are tormented by the thought: what if they come across an even better apartment! Let's wait a little and look. After a few weeks (and sometimes even months), they come to their senses. I didn’t find anything better, I’m tired of going to viewings, perhaps it makes sense to stay at that very first apartment. But it’s too late, the apartment is sold. As a rule, realtors sooner or later refuse such clients - time is expensive and irreplaceable. So perfectionism and the search for the ideal property in real estate are fraught with loss of time and disappointment. It is important to determine your priorities in advance and come to terms with the idea that the ideal is unattainable.

Is it necessary to make an advance payment when buying an apartment?

In the case when a transaction for the purchase and sale of secondary real estate takes place between close relatives and good friends, it is not at all necessary to make an advance payment for the apartment; you can completely do without prepayment for the apartment and take their word for it.

In other cases, an advance payment is most likely inevitable; it is unlikely that you will be able to break the foundations of business turnover accepted in the secondary market, however, it is worth noting that cases of optional payment of an advance payment for an apartment are not isolated...

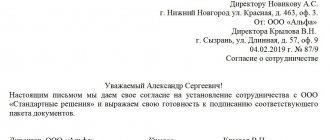

We draw up a receipt for the advance agreement

A receipt is required to certify that money has been transferred to the seller. It must be completed immediately at the time of payment. The seller writes the receipt in his own hand, indicating in it:

- date and place of commission, name “Receipt”;

- Full name of the parties to the transaction, passports, addresses;

- how much money you received and under what agreement, for what obligations;

- no complaints.

He signs it with his own hand, gives the original copy to the buyer, and keeps a copy for himself.

You can download free receipt forms below:

- sample receipt for PDKP (purchase of a secondary apartment);

- Sample receipt for advance contract.

We wrote more about drawing up receipts for different cases in this article.

Advance payment terms

For how long to make an advance payment, everyone decides for themselves individually. The standard period for making an advance is 1 month or 30 calendar days, but it can be shorter or longer - everything will depend on the readiness of all parties to enter into a transaction.

If, for example, at the time of concluding a preliminary agreement, the seller has all the necessary documents for the sale of an apartment, and the buyer has free money on hand, and all that’s left is to set the date and time of the transaction in the bank, then in this case, I don’t I see reasons to indicate the advance payment period is more than 2 weeks. This time is quite enough to find and agree on a bank to carry out a transaction for the purchase and sale of an apartment with a schedule that suits everything.

In the case when the buyer has a mortgage, and the seller does not have a single document for the apartment, then a month’s time for an advance may not be enough - until the BTI documents, extracts from the Unified State Register, archival documents arrive, while the appraisal album is being prepared for the bank, undergo internal checks, an insurance report, etc. - a lot of water will leak. With a margin, you can safely set the deadline for making an advance payment for an apartment at 2 months.

In the case of an alternative sale of an apartment, as well as with a mortgage, the terms for making an advance payment for an apartment can be quite long. It is almost impossible to predict in advance and indicate something specific. Sellers and buyers line up in a multi-step chain of transactions. But even in the alternative, the terms for making an advance payment for an apartment under the contract are rarely specified as more than 2 months.

What is a deposit when buying an apartment with a mortgage?

When purchasing an apartment with a mortgage, the buyer often transfers an advance or deposit to the seller, thereby confirming the seriousness of his intentions. According to Art. 380 of the Civil Code of the Russian Federation, we are talking about the amount of funds that the owner of the property receives to pay for it. Payment is made according to a preliminary agreement, which is drawn up in writing. The main feature of the deposit is that in case of violation of obligations, it will not be returned to the buyer, while the advance payment will be transferred back without any consequences.

Article 454 of the Civil Code of the Russian Federation regulates the procedure for transferring the subject of the transaction, and Article 381 - the consequences that may occur as a result of violation of the requirements of the preliminary agreement. The procedure for transferring money when purchasing real estate with a mortgage is regulated by a number of legislative acts.

The transfer of a deposit (advance payment) when purchasing an apartment with a mortgage is carried out in two stages:

- drawing up an agreement between the parties in writing;

- filling out a receipt confirming the fact of transfer of funds.

In this case, it is mandatory to comply with a number of rules:

- The agreement should indicate the amount of funds transferred to the seller, as well as the date and terms of payment for the entire cost of the apartment. In addition, the date of conclusion of the basic contract should be indicated here.

- It is important that all owners of the property being sold take part in the registration process, if there are two or more of them.

- The seller of the property must confirm ownership of it.

What functions does a preliminary agreement on a deposit perform when purchasing an apartment with a mortgage?

- Evidence-based . This agreement serves as confirmation that the contract for the sale of housing between the seller and the buyer has been concluded.

- Payment _ The deposit amount is counted towards the cost of the purchased apartment.

- Security . The agreement ensures the obligations of the parties when completing a transaction.

According to the law, an advance payment when purchasing an apartment with a mortgage can be transferred from the buyer to the seller without the presence of third parties. At the same time, experts recommend inviting a lawyer, a notary office employee or a real estate agency specialist who can act as witnesses in the event of controversial situations.

Advance - atavism or necessity

In the secondary market, there is a mixed opinion regarding the need to make an advance payment for an apartment. Some professional market participants consider this stage to be a long-outdated atavism and absolutely unnecessary, which smells of mothballs, while others are confident in the need for this intermediate stage.

Opponents of the advance payment argue that unnecessary movement in the process of buying and selling an apartment only complicates everything, and there is no need to make an advance payment.

Ardent supporters of an advance payment for an apartment give their weighty arguments - making an advance payment disciplines the buyer and prevents him from rash actions - if he refuses to buy, he may lose the advance payment.

It is impossible to absolutely agree with either one or the other...

In practice, there are indeed cases when making an advance seems unnecessary. I myself have repeatedly carried out transactions without making an advance. For example, an apartment in a new building that has already been commissioned is bare concrete, free for sale. A potential buyer came, looked, called the next day and agreed to buy. Real money - cash, without a mortgage and other hemorrhoids, everything was agreed upon by all interested parties over the phone, two days later the transaction took place in the bank. In such cases, it is quite possible to do without making an advance payment for the apartment.

Another thing is with the alternative sale of an apartment - here multilateral obligations arise, and in a complex transaction for the exchange of housing, serious guarantees are needed. Alternatively, prepayment can serve as such a guarantee of an upcoming purchase and sale transaction of a secondary property.

Differences between contracts

The advance agreement includes a standard list of provisions that makes it possible to understand and, if necessary, identify who signed the document and for what reason.

It is not necessary to indicate that we are talking about an advance; we can limit ourselves to the wording “advance payment.” Since in the Civil Code of the Russian Federation any prepayment that is not called a deposit will be considered an advance.

Another difference between an advance agreement and a deposit agreement is that the document does not necessarily indicate the methods and conditions for returning or not returning the money. Payment methods are specified in the preliminary contract with the wording about prepayment .

As mentioned above, in Russia the conditions for providing an advance are left to the parties to the agreement; they, if they wish, can prescribe a financial liability similar to the deposit for the advance or completely rid themselves of it.

Deposit for an apartment - essence and legal significance

The search and purchase of real estate has always been treated very carefully. Therefore, buyers often review dozens of housing options in the hope of purchasing the property they want.

Not everyone pays attention to new buildings. A significant portion of citizens buy housing on the secondary market, which is usually cheaper and most often suitable for living, since it has been renovated and has functioning life support systems.

When the purchase object is selected, inspected and satisfies the buyer in all respects, the process of discussing the upcoming transaction and its terms begins between the interested parties.

At this stage, everyone is concerned about when and how the purchase and sale agreement is concluded, and what will serve as a guarantee of its implementation.

After all, there are cases when people agree in words to purchase residential premises, without supporting the reached consensus with any actions and without creating a mechanism for implementing the issue in practice.

Therefore, unpleasant cases occur when residential premises are sold to another person instead of the original buyer, due to the fact that he offered a higher price.

To prevent such negative aspects from happening, the legislator developed a special legal instrument - a deposit.

How is this concept interpreted in legal literature? This is money that is transferred by the buyer to the seller of the property and indicates the desire of the participants in the upcoming purchase and sale agreement to conclude it on pre-agreed conditions.

The purpose of the transferred funds in material terms is to repay payments related to the execution of the transaction or they are sent to offset the cost of the purchased residential premises (Article 380 of the Civil Code of the Russian Federation).

The buyer, by handing over a deposit when purchasing real estate , shows the seriousness of his intentions to purchase the property being sold. In turn, the seller is also interested in receiving it, as he is determined to get rid of the apartment or house he owns.

The higher the amount transferred, the less likely it is that the parties to the legal relationship will refuse to conclude the transaction.

The main conclusion from the definition is that the concept in question acts as a guarantee of the agreement reached between people on an agreement on the upcoming purchase and sale of real estate and serves as a stabilizing factor in its execution.

How to draw up an advance agreement - sample

In order to correctly draw up a document on the transfer of an advance payment when purchasing real estate (on a mortgage or directly), it is advisable to have a sample agreement before your eyes. The contract states:

- Place and time of registration (at the top), that is, the name of the locality and the day of conclusion.

- Information of the parties - full names, addresses, information from the passport and telephone numbers.

- Information about the apartment - the object of the transaction, the price of housing and the date of execution of the basic contract.

- The amount of the deposit or advance (in numbers and text).

- Features of money transfer.

- Rights and obligations of participants (when filling out, the Civil Code of the Russian Federation, Article 381 is taken as a basis).

- Indication of the validity of the contract from the date of signing.

- Force majeure and its effect on the document.

- Details of the buyer and seller, as well as their signatures.

Subtleties of transferring funds and drawing up an agreement

When drawing up a preliminary agreement during the purchase process, it is important to specify the definition (nature) of the amount transferred. If the document does not stipulate that the money is a deposit, the court will consider the payment an advance. As a result, if the buyer refuses to purchase, the seller will be obliged to return the money, because they do not have the function of securing a transaction between the parties. The obligations of the participants in the purchase and sale (under the terms of Article 359 of the Civil Code of the Russian Federation) are secured by the guarantee of third parties, a pledge or a bank guarantee.

Payment amount

The size of the deposit is not specified by law, and the issue is resolved through agreement between the parties to the transaction.

Today there are two ways to determine size:

- As a percentage of the property price. As a rule, the advance amount is up to 5%, but there are situations when payments reach 10-12% of the housing price.

- In a fixed form. In this case, the size of the payment does not depend on any factors. As a rule, this amount ranges from 50 to 100 thousand rubles (by agreement of the parties). The size can change up or down (the law does not prohibit this).

In this case, the amount of the deposit (advance payment) must be indicated in the agreement between the parties.

How to issue a receipt?

When purchasing an apartment with a mortgage or directly (if a decision is made to transfer the contribution), the seller must write a receipt confirming receipt of the money. The document is drawn up on white paper and without a specific form. The main thing is that it reflects the following points:

- Document's name.

- Personal information of participants.

- The cost of purchasing real estate (determined taking into account the cadastral or market price).

- Day of transfer, scope, goals and reasons.

- Date of execution of the basic contract.

- Brief description of the object (address, numbers of documentation that establishes rights to real estate).

- Conditions for refund (in case of delays in the execution of the basic contract).

- The nuances of counting the transferred amount into the total cost of the apartment (including when applying for a mortgage).

Both parties sign the receipt (after checking the information specified in the document). The best option is if two people are present during the transaction, who, if necessary, will confirm the fact of the transfer of funds. The money is given immediately after receipt of the receipt. It is the responsibility of the recipient to ensure that the agreed amount has been transferred to him. The recount is carried out in the presence of witnesses.

Who is it registered to?

The advance payment is made by the buyer to the property owner after signing the documents and confirms the preliminary agreements. The advance can also be accepted by a trustee or real estate agency representing the interests of the owner. At the same time, it must have title documents for the property and have a notarized power of attorney.

To pay or not to pay?

Attention! If you buy an apartment for cash, you can do without drawing up preliminary contracts and advance payments.

The terms of the purchase are negotiated in advance between the parties to the transaction and then written down on paper. A specific day is appointed and the documents are submitted for registration at the MFC. After 10-14 days, the buyer receives documents and becomes the owner of the property.

The conclusion of various types of contracts and advance payments is required if the transaction is complex and requires time to prepare.

When signing documents, be careful and do not sign if something is not clear to you . Try to understand the terms of the contract and ask for clarification on specific points. Only after this can you sign and transfer the money. It also makes sense to involve a realtor or lawyer in the process.

Receipt

A receipt is an additional document confirming the transfer of money . How is it formatted? It is drawn up by hand by the seller of the apartment or in printed form. It states:

- passport details of the parties to the transaction;

- data about the property;

- transferred amount (in numbers and words).

By and large, a receipt is an analogue of an advance payment, only in a simplified version . At this stage, it is not always necessary and is drawn up if the buyer insists on it.