Is this necessary?

It would be easier not to draw up a notarized document, in the sense that it is cheaper. The services of a notary are now not cheap, and it is this person who can give force to the document in question. Alas, the law does not allow a mortgage to be issued without the consent of the borrower’s husband or wife.

This conclusion follows from the analysis of the following legal norms:

- Art. 35 IC RF. It states that the approval of a particular transaction by the second spouse is implied, but with the exception of the case when the procedure for disposing of family property is subject to the state. registration by force of law.

- Art. 20 Federal Law “On Mortgage”. It states that obtaining a mortgage loan is exactly the kind of transaction that must be registered by the competent authorities.

- Art. 7 of the above law, which confirms that a loan cannot be issued without permission from all property owners.

Important: the fulfillment of the mortgage obligation rests with both spouses, regardless of who is the borrower, unless otherwise provided by the marriage contract or other agreement.

Spouse's consent to a real estate transaction. Lawyer for an hour #4

In what cases may it be necessary?

Legal consent is always required when taking out a mortgage . Article 35 of the Family Code states that all transactions requiring state registration must be notarized.

Reference! A mortgage loan falls into the category of procedures that require registration. Accordingly, it is necessary to provide notarized consent to complete the transaction.

In addition, Article 7 of the Law “On Mortgage” states that the consent of all owners is required to complete a transaction.

Thus, the document is required in all cases when taking out a mortgage.

There is one exception. If the spouses have a prenuptial agreement that specifies cases in which consent is not required, then it is not necessary to provide it. A prenuptial agreement can be drawn up before marriage or during cohabitation.

Compilation requirements

The spouse’s consent to purchase real estate with a mortgage must meet the following requirements:

- Must be done in writing. Simply saying that there are no objections is not enough. As they say: “you can’t attach words to action.”

- The document must be certified by a notary.

Where to go?

To obtain a document, you must contact a notary office. Which one exactly? There is no indication in any regulatory act that you need to go to a specific notary. People often believe that they should contact the designated official at their place of registration. It's a delusion.

Is it necessary for one of the spouses to purchase real estate?

During an official marriage, personal property cannot be acquired. Everything that is purchased by one will be considered common, jointly acquired property. Therefore, when purchasing an apartment, consent from the second spouse is also required.

Important! With a mortgage loan, the debt to the bank is measured in millions of rubles. The second spouse must know and agree to such a procedure. Therefore, banks are increasingly requiring a mandatory form certified by a lawyer.

Even if the husband takes out a mortgage and his personal property serves as collateral, consent from the wife will be required. Since she will act as a co-borrower on the loan. And if her husband is unable to pay the debt, she will have to pay it. That is why you cannot make a purchase without such a form.

What happens if you don’t register?

Let's imagine that one of the spouses somehow signed all the mortgage papers without providing the consent of the other spouse to complete the transaction. What are the consequences? In general, if the bank and the Rosreestr authorities are loyal to this issue, then nothing bad will happen. The transaction will be formalized, the property will become the property of the family, but with an encumbrance - collateral when buying an apartment, there will be an obligation to repay the loan. But, if the second spouse does not want to become a debtor, then he has the right to apply to the judicial authorities to declare such a transaction invalid . What should be done?

A statement of claim is submitted to the justice authorities, in which:

- the current situation is described in detail;

- It is emphasized that no consent was given for the mortgage.

The plaintiff has every chance to invalidate the transaction and return everything to its original state.

In practice, the bank usually does not allow such a situation, requiring consent or using other completely legal schemes. Today it is difficult to find a credit institution that will be willing to take on the risk and provide funds without receiving a document stating that the second spouse agrees to the transaction.

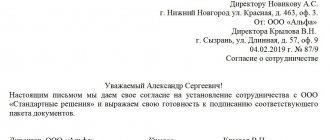

Sample of a notarial consent of a spouse for the purchase of an apartment with a mortgage

There is no strictly mandatory form of notarial consent of a spouse to purchase an apartment on a mortgage, however, based on established practice, in almost all cases they use approximately the following type of document:

Spouses do not have to compile it themselves. It is enough to entrust this moment to a notary and then simply carefully check all the points.

Depending on the situation, the procedure for obtaining consent from a spouse for a mortgage loan may be associated with a number of problems. They can be resolved with the help of an experienced lawyer. At a free consultation, specialists clarify frequently arising controversial issues, and they can also act as client representatives, accompanying the entire process of applying for a loan.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

(

1 ratings, average: 5.00 out of 5)

Author of the article

Natalya Fomicheva

Website expert lawyer. 10 years of experience. Inheritance matters. Family disputes. Housing and land law.

Ask a question Author's rating

Articles written

513

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

4

Agreement for the purchase and sale of an apartment using a mortgage and credit funds

The apartment purchase and sale agreement is the main document when concluding a transaction. Especially…

16

How to check an apartment for cleanliness before buying it yourself

A transaction involving the alienation of housing for a fee always involves certain risks...

17

How does the purchase and sale of an apartment through a safe deposit box work?

The purchase and sale transaction of an apartment involves many risks, one of which is...

62

What expenses do the buyer and seller bear when buying or selling an apartment?

Purchasing an apartment is associated with high costs. The lion's share of the buyer's expenses...

2

Buying an apartment with a mortgage encumbrance

When applying for a mortgage loan, the bank requests collateral. They can perform...

10

Termination of the preliminary agreement for the purchase and sale of an apartment

In case of expropriation of an apartment for compensation, the Seller and the Buyer may not…

Who pays the mortgage in a divorce?

Consent to purchase real estate on credit and under its security is necessary if the property becomes the common property of the spouses. Accordingly, the responsibility to repay the debt falls on the shoulders of both the husband and wife.

This rule is reflected in Part 2 of Art. 45 of the Family Code of the Russian Federation. We are talking about joint and several liability. If, for example, the husband paid the mortgage after the divorce, then he has the right to demand compensation for half the amount of money spent. This is a general rule to which there are exceptions.

Some banks take a different route: they require the spouses to enter into a prenuptial agreement, which would indicate that the property will belong only to the husband or exclusively to the wife. This simplifies the procedure for collecting overdue debt and foreclosure on the collateral.

If there is a prenuptial agreement, then the property is no longer considered joint property, but personal property. Accordingly, there is no need to seek money from the second spouse, especially since he may be insolvent. There will be no problems with the division of real estate - the bank simply takes away the personal property of the husband or wife in full.

How is a mortgage divided in a divorce? / Legal advice / MY RIGHTS

You may be interested in: How to get a rural mortgage in 2021 - step-by-step plan

Permission to sell an apartment if the owner is a wife

When selling a mortgaged apartment, the family will receive a large amount of money, but will lose one piece of real estate. It is wrong from a legal point of view to ignore this fact and not inform the spouse.

Therefore, consent to the sale of a mortgaged apartment is necessary . It doesn't matter who the owner is. The spouses are co-borrowers on the loan, and therefore must repay the debt jointly. Consent will be required in any case.

If the apartment was purchased outside of marriage and the second spouse is not a co-borrower, then only the owner can dispose of the apartment. He doesn't need any consent. Such property is considered personal, therefore the owner can dispose of it at his own discretion.

If there is a marriage contract, consent may not be required . If it stipulates the conditions for the sale of the apartment, then consent is not required. But banks are wary of such transactions. They do not consider them safe, since if controversial issues arise, the terms of the contract may not be taken into account.