Almost all real estate objects, houses, apartments, land, etc. are taxed. Their owners must annually transfer a certain amount of money. At the same time, some categories of payers have tax benefits.

??? In particular, land tax for pensioners falls into the preferential category. To take advantage of benefits in 2021, you must meet a number of requirements. The person must be in pensioner status. He also needs to collect some documents and contact the tax office at the location of the site. After this, the specified authority makes a decision to reduce the tax or exempt it from payment.

Land ownership

To initiate the procedure for obtaining land tax benefits, a person must have at his disposal the corresponding object.

Ownership of a plot is the ability to use the territory for its intended purpose. In this case, we are talking not only about property rights. That is, a person may not be the sole owner. A plot of land can be transferred to a person on the basis of the right of permanent perpetual use or lifelong inheritable possession.

Documentary evidence in most of these cases is a decision of a local government authority or a concluded agreement. It should be noted that those who use a land plot under the right of free, fixed-term use, or transferred to it under the terms of a lease agreement, are not tax payers. In relation to the territories that are part of the mutual fund, the management company must contribute the necessary amounts of money.

Meet Ivan Stepanovich, our good friend

The editors of Vyberu.ru have an acquaintance, Ivan Stepanovich. A couple of years ago he bought a dacha in the Moscow region. He built a small but substantial house there, a bathhouse, a gazebo, dug a well, and installed a greenhouse. In a word, he settled down firmly and loved the dacha with all his soul. His entire large family, together with his retired mother, three children and his wife, who had a talent for gardening, spent the summer at the dacha. The life of the bourgeoisie became too long. The picture would have continued to remain pastoral if taxes on the dacha had not arrived for two years with fines and penalties. And then SNT asked for money for public roads. Our friend was extremely indignant. His neighbor does not pay for his 6 acres at all, does not register his house and does not pay taxes. Why did so many things happen to Ivan Stepanovich?

Tax liability

The obligation to pay taxes applies to all individuals and legal entities that are not covered by benefits. Such an obligation arises subject to the availability of property, including a land plot. The current legislation defines cases when the payer is exempt from tax.

These include:

- Payment of tax.

- Death of an individual. In this case, confirmation will be not only the certificate issued by the civil registry authorities, but also the court decision declaring the person dead.

- The organization completely ceases its activities. The confirmation will be the decision of the authority and an extract from the Unified State Register of Legal Entities.

- Obtaining tax benefits.

In all of these cases, a person may be exempt from depositing funds. Tax must be paid in relation to a garden or dacha plot, land for agriculture, livestock farming and gardening.

Short answer

At the legislative level, all owners are equal - be it a young owner of a cottage with a land plot of several hectares or an old man with a country house on land of several hundred square meters. They all must pay the appropriate tax.

But it is impossible to compare the income of working citizens and people of retirement age with modest social benefits called pensions. Therefore, the Duma, at the instigation of the President, made changes to the Tax Code: a tax benefit for pensioners appeared. Its essence is that this category of citizens does not pay tax on 6 acres of land.

Let's show how this works with an example. Pensioner T. has real estate in the form of a dacha and a garage, built on a plot of land with an area of 10 acres. In accordance with the new rules, land tax will be charged only on 4 acres (10-6).

Pensioner status

According to the general rules, a person can receive pensioner status upon reaching a certain age, after which it is permissible to cease professional activities and retire to a well-deserved retirement with the right to receive monthly cash assistance.

It should be noted that many people stop working before the deadline. In such cases, you will still need to wait until you reach the established age to receive your pension.

The amount of assistance depends on the specifics of the person’s work. This also affects the age of retirement. For example, people who work in hazardous conditions have the right to retire earlier than others.

Tax benefits

A pensioner can count on benefits for the following types of mandatory payments:

- Property collection for one object.

- Tax on income from benefits of individuals.

- Property deduction when purchasing a home.

Additional types of benefits may be established by local authorities.

Types of benefits

Benefits, including those related to land tax, are expressed in the form of a reduction in the amount or complete exemption from contributions. It all depends on the status of the person concerned. The intended purpose of the land plot does not play a role in this case.

It should be noted that land taxes are allocated to a separate section of the Tax Code of the Russian Federation. For this reason, the list of beneficiaries will be slightly different, in contrast to payments for other real estate properties.

Liberation

The current legislation, namely Article 395 of the Tax Code of the Russian Federation, defines a list of persons who do not have to pay land tax.

These include:

- Organizations and institutions of the criminal punishment execution system.

- Legal entities on the sites of which state public highways are located.

- Religious organizations, provided that buildings and structures for the appropriate purpose are located on their lands.

- Public organizations of disabled people, if they consist of at least eighty percent of such persons or their legal representatives. This also includes companies whose authorized capital consists of contributions of this category, if the number of people with disabilities is at least half of the total number of members.

- Organizations of folk arts and crafts.

- Indigenous peoples of Siberia, the North and the Far East, as well as communities of such peoples - in relation to land plots used to preserve and develop their traditional way of life, farming and crafts.

- Organizations located in a special economic zone, that is, in an area whose status differs from the rest of the country. It is often expressed in preferential tax or customs conditions for national or foreign entrepreneurs.

- Organizations that are management companies.

- Legal entities engaged in shipbuilding.

- Organizations located in a free economic zone.

Pensioners are not included in this list as a separate category. However, they may qualify for tax exemption due to their status. For example, if a person is a representative of the indigenous peoples of Siberia, the North and the Far East. That is, in this case, the age of a person does not matter. The determining factor for abolishing a tax is the status of the person concerned.

Also, a pensioner is exempt from tax if the area of his plot does not exceed six hundred square meters. This includes the entire territory of the site, including those located under buildings. If the area exceeds the specified size, then the person will pay tax only for the extra square meters.

Reduce rate

A tax benefit can be expressed in a reduction in the rate, and therefore in the amount that will be charged. The current legislation defines the categories that have the right to count on receiving benefits of this nature.

These include:

- Disabled people of the first and second groups, as well as those who received this status in childhood.

- Heroes of the Russian Federation and the USSR.

- Full Knights of the Order of Glory.

- Disabled people and veterans of World War II, as well as other military operations.

- Victims and liquidators of the Chernobyl accident.

- Those who took part in eliminating the consequences of nuclear weapons testing, as well as those who suffered illness or disability as a result.

At the regional level, pensioners may also be included in this list as a separate category.

Are greenhouses, bathhouses, outdoor toilets and other outbuildings subject to tax?

According to paragraph 1 of Art. 401 of the Tax Code of the Russian Federation, objects subject to taxation include residential buildings and other buildings, structures, structures. Buildings on land for personal farming, vegetable gardening and gardening are equal to residential buildings and are calculated in the same way.

However, the tax service does not have the resources to visit every gardening partnership, town, village and recalculate taxable objects on the spot. For calculations, they use data from the Unified State Register of Real Estate.

However, not everything is subject to registration in the Unified State Register of Real Estate, but only real estate. According to Art. 130 of the Civil Code of the Russian Federation it includes:

- Plots of land, subsoil and everything that is firmly connected to the earth. That is, objects that cannot be moved without damaging their purpose.

- Unfinished construction projects.

- Garages and parking spaces.

So, a permanent house and garage are definitely subject to registration and tax payment. Bathhouse or summer kitchen - depending on the capital and the presence of a foundation. A gazebo, toilet, greenhouse, barn - no, because they do not have a foundation and can be moved to any place without compromising functionality. The same applies to trailers that are placed on the site instead of a house.

Establishment procedure

The main categories of persons who enjoy tax benefits are indicated in the Tax Code of the Russian Federation. However, local authorities are also vested with powers of this nature. A decision is made to determine preferential categories. To do this, some work needs to be done. First of all, the economic situation in the region should be taken into account, since all benefits will be provided at the expense of the local budget. Then you need to consider the number of potential applicants and their status. Next, the selection criteria are determined. That is, it is necessary to determine a list of conditions that the interested party must meet.

Each payer has the right to refuse the benefits provided to him.

All information provided is the basis for making a decision. The document is drawn up based on the results of the meeting and signed by the head of the government body that issued it. Information must be communicated to all interested parties. To do this, it is placed on information stands at places of reception of citizens, as well as on information websites of government agencies. It should be noted that the establishment of benefits at the local level is the right of the administration, and not its responsibility. This also applies to the applicants themselves.

Features of taxation

Since this tax is regulated by regional regulations, taxation in regions may differ.

Pensioners enjoy various additional benefits, or, conversely, do not have them.

You can find out how things are in a particular locality by contacting the territorial branch of the Federal Tax Service or the website of the local department.

In Moscow and Moscow region

The situation in Moscow and the region is different. It makes sense to consider the situation by region:

- In the village of Bukaveskoye, Istrinsky district, pensioners with incomes below the subsistence level receive an additional 50% discount, as do pensioners who were former volunteers.

- The authorities of the village of Dmitrovskoye, Shatursky district, exempted liquidators of the Chernobyl Nuclear Power Plant, Heroes of the USSR or the Russian Federation, and participants in military operations in Chechnya and Afghanistan from taxes. Single pensioners with incomes half the subsistence level pay only 50% of the tax.

- In the village of Vasilyevskoye, a 50% discount has been established for labor veterans and low-income pensioners. It is worth considering that the first category enjoys benefits only for plots of a size no larger than that established by the local administration.

- In Medvezhye-Ozerskoye, Shchelkovo district, WWII veterans and concentration camp prisoners are fully exempt from this tax. A 30% discount was provided to pensioners on plots for individual housing construction and dachas, but the size of preferential plots is limited.

There are a lot of such examples; you should check the information for a specific locality with the local administration or the Federal Tax Service branch.

In St. Petersburg and Leningrad region

In St. Petersburg and the Leningrad region, the situation regarding benefits is different.

In the city, pensioners are exempt from tax under the following conditions:

- registration at the place of residence in the city;

- have a plot of no more than 2500 sq.m.

If the pensioner is additionally disabled of group 1 or 2, a WWII veteran or a Chernobyl survivor, then in accordance with the Law of St. Petersburg dated November 23, 2012 No. 617-105, restrictions on the size of the plot will be canceled.

Village councils also make their own decisions on the distribution of benefits. Often, the basis for providing discounts is the difficult financial situation of a pensioner, service in the Ministry of Internal Affairs, etc.

Other regions

The regions do not lag behind the capital:

- In Samara, a plot owned by a pensioner under a residential building up to 600 sq.m or under a garage up to 24 sq.m is not taxed;

- Syzran gives a 50% discount on land tax on plots of private houses, household plots and garden plots.

- Voronezh has exempted pensioners from taxes on plots for personal plots and SNT, while discounts are provided in the region.

- Crimea also provided discounts, but calculations based on cadastral value in the region will only be switched to in 2021.

In the Krasnoyarsk Territory, there are no additional benefits for pensioners yet.

Procedure for receiving benefits

The procedure for obtaining benefits itself consists of several successive steps that must be completed. This responsibility is assigned to the person concerned, in this case the pensioner. He is obliged to perform all necessary actions. First of all, you need to collect documents that will confirm the validity of the initiator’s appeal. Then you will need to fill out an application with the appropriate content.

The collected data must be sent to the tax office at the payer’s place of residence. At the end, the specified authority will make a decision. The person will be informed about the results of consideration of the appeal.

Drawing up an application

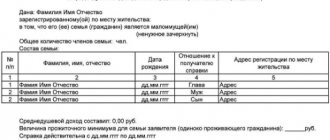

An application for tax benefits must be made in writing. For this, most often, a ready-made form is used. Although you can write a statement on a regular piece of office paper.

The text should indicate the following:

- The name of the tax authority and its code.

- Information about the type of benefit.

- Type of property.

- Information about the payer - last name, first name, patronymic, place of residence, contact phone number, TIN of the interested person.

- Cadastral number of the land plot.

- Reasons for its use. In this case, the agreement or decision of the local government on the allocation of the site is indicated.

- The name of the document giving the right to the benefit, namely the pensioner’s certificate, the name of the body that issued the certificate, validity date, series, number.

- Temporary period for providing benefits.

- List of attached documents.

- Date of application and signature of the initiator.

- Application registration number.

- Information about the person who accepted the application.

If his legal representative acts on behalf of the interested person, then the number and date of the power of attorney must be indicated.

When submitting an application, it is mandatory to indicate the type of object and its intended purpose. In this case it will be a plot of land. The application must be submitted before November 1 of the current year. Since the benefit is provided to a person for a certain period of time, after the expiration of the specified period it is necessary to confirm your right. Otherwise, the interested party may lose his benefit.

Filing with the tax office

The collected material must be sent to the Federal Tax Service. This is the absolute responsibility of the initiator. The latter can use several common methods.

These include:

- Personal delivery. This option provides for independent transmission of information. In this case, a person does not need to draw up an appeal on his own. He can do this directly at the tax office by seeking the help of a service specialist. The convenience of this method lies in the fact that the initiator has the opportunity to eliminate the mistakes made immediately, as well as receive clarification on all issues of interest. Another advantage of this method is the fact that a person can personally verify that his appeal has been registered and accepted for circulation.

- Transfer through a legal representative. This method is similar to personal delivery. The legal representative will have to have a passport and a power of attorney, indicating the scope of his powers.

- Postal forwarding. This option is convenient because a person does not need to come to the tax office on their own. In this case, it is more correct to use registered mail. The initiator will be notified that the request has been delivered to the initiator. However, this option has its drawbacks. Firstly, a person must complete the application himself. He will not be able to resort to the services of a tax specialist. Secondly, the initiator will not have the opportunity to eliminate the mistakes made immediately. Thirdly, it is impossible to get advice during the process of transferring documents.

- Internet forwarding. In this case, you need to register on a special website of the tax office as a payer, create a personal account and confirm your entry. After this, the initiator will have access to all the capabilities of the resource. To send an appeal, it is necessary to convert all documents and the application into digital format. The person will receive a notification about the results of the operation in his account.

- Submitting an application through the MFC. This option allows you to contact government authorities for any reason, including issues related to taxation. A person will only need to contact the multifunctional center. The specialists will do the rest themselves. During the application process, the person will be provided with an application form and assistance in filling it out. Also, a person will be able to eliminate any inaccuracies and obtain information on issues of interest to him. It should be noted that the MFC acts as an intermediary. That is, the center does not make a decision on providing benefits, but only performs actions related to providing assistance in filling out an application and sending information to its destination.

A person determines any of these options independently, based on the characteristics of the current situation and his capabilities.

After all the data has been received, it is subjected to detailed analysis. Then a decision is made to provide benefits to the pensioner for the period specified in the application, provided that it was sent in a timely manner. If the initiator had the right to reduce payment earlier, a recalculation will be made. This rule applies to the thirty-six months preceding the due date for paying the tax. To do this, you will need to submit another request for recalculation. It indicates the timing and reasons for non-use of benefits, as well as the fact that the person has not previously used benefits.

The citizen must be properly informed about the results.

In practice, the response is sent to the person by mail or delivered against signature. In some cases, the initiator may request that he take the answer himself. However, if he does not appear in person, then the notification is sent by mail to the address specified in the appeal. In any case, it would be correct to obtain documentary evidence of the fact that the initiator received the information. In some cases, a person may be refused. This applies to situations where the information was incomplete or unreliable, or the benefits did not apply to the initiator.

What if the cadastral value is too high?

Our hero was lucky, and the cadastral value was not overestimated, and accordingly, the tax will be calculated correctly.

If it turns out that instead of one and a half million the cadastral value is more than two, then it is worth taking action. When comparing, focus on the market value at the valuation date. First, find out what the error is. Perhaps there was incorrect information about real estate in the Unified State Register. For example, the intended use, location or disrepair of the building.

To find out, you need to contact the territorial body of Rosreestr and request the data that was used in the assessment.

The cadastral and market values must be compared at the date of the assessment. For example, the assessment was made in 2021, and in 2020 the market price fell sharply. This is not a basis for revising the cadastral value if they coincided in 2021. An application for review will not be accepted.

List of documents

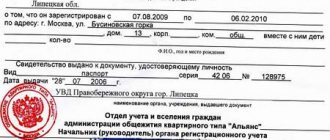

To exercise their right to benefits, the interested person must attach some papers to the application. First of all, this is a passport of a citizen of the Russian Federation. Another document is a pensioner’s certificate. It is drawn up according to the template established by law. Its issuance is within the competence of the Pension Fund.

Next, you will need an individual tax payer number. You can find it out at your local FSN department. You will also need documents for the land plot. This may be an agreement or a decision of a local government authority. All data can be provided in the form of certified copies. In this case, the tax specialist has the right to demand the originals from the initiator for reconciliation.

Where to look for cadastral value?

Rosreestr is responsible for cadastral valuation and registration of real estate. The data is publicly available, so finding it is not a problem. For example, we open the Rosreestr card and enter the address of our Ivan Stepanovich or the cadastral number, if it is known. We find the necessary data. In this case, the cadastral value is 1,816,386 rubles, which is quite consistent with the market value.

The cadastral value of the house can be found on the Rosreestr website also by address or number.