Who can receive maternity capital

Maternity capital is also called family capital, therefore, contrary to the opinion of many, mothers, fathers, and even children in exceptional cases can receive it. For maternity capital, you need to obtain a special state certificate from the Pension Fund of the Russian Federation - if you have it, you can request money from the budget for certain purposes .

You can receive this state support in the following cases:

- The woman gave birth or the family adopted the first child after January 1, 2021, or the woman gave birth (the family adopted) the second, third and subsequent children after 2007.

- The man became the sole adoptive parent of a child after January 1, 2020, or adopted a second, third, etc. child in 2007 and later.

- If a woman loses the right to maternity capital, the right to dispose of the certificate passes to the father. For example, if the mother is deprived of parental rights, loses legal capacity, goes missing or dies.

- Even children can receive and spend maternal capital, but this is only possible if both the mother and father lose the right to dispose of it or are unable to do so. For example, in the event of the death of parents or deprivation of their parental rights. In this case, children must be under 18 years old or 23 years old if they are studying full-time. If there are several children, the money is divided between them in equal shares.

- In case of divorce, maternity capital is not divided between spouses . Even if the child remains with the father, the mother retains the right to dispose of the entire amount of capital.

- You can receive a certificate from the day of birth or adoption of a child. It does not matter what the age difference is between the children of the family. For example, if the eldest child has already reached adulthood, maternity capital for the newborn is still relied on in the same amount as for the second child.

- To receive state support, it is important that the woman (man) and child have Russian citizenship at the date of birth (adoption). It is also important that the parent is not deprived of parental rights.

The amount of maternity capital in 2021

Maternity capital is indexed every year by a percentage equal to officially registered inflation. For example, from 2021 the amount of state support will increase by 3.7%. The amount of maternity capital depends on the date of birth of the child and the total number of children in the family.

| 2019 | 2020 | 2021 | |

| Maternity capital for 1st child | — | 466 617 | 483 881,83 |

| Matkapital for the 2nd child | 466 617 | 150 000 | 155 550 |

| Maternal capital for the 2nd child, if you did not receive money for the first | 466 617 | 616 617 | 639 431,83 |

Some constituent entities of the Russian Federation provide for regional maternity capital, which is paid from local or regional budget funds. Sometimes you can get it even if you do not have the right to federal maternity capital. To find out whether such support is available in your region and how to use it, study regional legislation.

An application for disposal may be refused in the following cases:

1. termination of the right to additional measures of state support; 2. violation of the established procedure for filing an application for disposal; 3. indications in the application for direction of the use of maternity capital funds not provided for by Federal Law; 4. indications in the application for the disposal of an amount or its parts in the aggregate exceeding the full amount of maternity capital funds, which the person who submitted the application for disposal has the right to dispose of; 5. restrictions of persons in parental rights in relation to a child, with the birth of which the right to additional measures of state support arose, on the date of the decision on the application for disposition filed by the specified person (until the restrictions on parental rights are lifted in the prescribed manner); 6. removal of a child, in connection with whose birth the right to additional measures of state support arose, in the manner prescribed by the Family Code of the Russian Federation (for the period of removal of the child); 7. if housing purchased using mat capital funds is recognized as unsafe or the apartment building is subject to demolition or reconstruction.

How to get maternity capital

In 2021, it will be easier to receive and spend capital. Thus, the decision to issue a state certificate will be made in 5 working days, and not in 15, as now. An application for the use of maternal capital will be reviewed in 10 working days instead of a month, and the money will be transferred within another 5 days.

You can receive a certificate upon application or without an application. Without applications, certificates are issued for children born after April 15, 2021. In this case, the registry office itself transmits the data to the Pension Fund; parental participation is not required. But we still recommend calling and checking the process, as the system may malfunction. Previously, parents had to submit an application, collect documents and personally visit the Pension Fund or MFC to obtain a certificate.

What is maternity capital

Maternity capital is a state social program that has been operating in Russia since 2007 and was introduced to support Russian families. It provides for the payment of money for the second, third or subsequent children born or adopted.

The right to maternal capital is confirmed by a personal certificate. You can receive it if a person meets certain conditions, and the funds can only be spent on specific purposes. The certificate itself can be either in paper form or electronic, and from April 15, 2021 it is issued without applications. According to the Ministry of Labor, more than 10 million certificates were issued during the state program.

When and how can you spend your certificate?

According to standard rules, maternity capital can be used three years after the birth of the child for which the certificate was received. But the law provides for a number of exceptional cases in which money can be spent even immediately after birth: a down payment or paying off a mortgage debt, paying for kindergarten, Putin payments, buying things for the social adaptation of a disabled child.

After the child turns three years old, it will be possible to buy a home without a mortgage, build a house, pay for a private school, clubs, university, or use the money for the mother’s pension.

You cannot spend maternity capital for other purposes; cashing out is also prohibited. For spending funds on buying a car, renovating a house or updating furniture, criminal liability may be imposed under Art. 76.2 and 159.2 of the Criminal Code of the Russian Federation.

The entire maternity capital can be divided, rather than spent on one goal. For example, give 50,000 rubles to pay for an art school, 300,000 to pay for a university, and save another 100,000 for your mother’s pension.

An application for the use of maternity capital must be sent to the Pension Fund in person, by mail, through the MFC, through government services or the Pension Fund website. You need to attach a passport and a number of other documents to it, the list of which depends on the purpose of spending the maternity capital.

Using maternal capital to improve living conditions

The most common use of maternity capital is a down payment on a mortgage or repaying part of the debt on a home loan. From 2021, you will be able to apply for the use of maternity capital for these purposes directly at the bank. The credit institution itself will transfer all the information to government agencies, so you can do without unnecessary visits to the MFC or Pension Fund. However, not all banks accept such applications, so please consult by phone in advance.

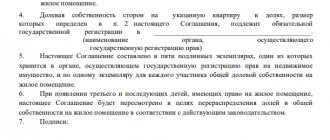

Keep in mind that one of the main conditions for using maternity capital to improve housing conditions is the registration of the acquired real estate in the common shared ownership of the family . The shares must be received by the owner of the certificate, his spouse and all children. From 2021, the agreement on determining the size of shares does not require notarization.

Maternity capital does not insure against risks that may arise when purchasing real estate. To protect yourself, check the apartment for liens, liens and other encumbrances. A report based on an extract from the Unified State Register will help with this. It can be ordered around the clock in the EGRN.Reestr and received within 0.5-6 hours. a report based on the USRN extract in PDF format by email

Text: Elizaveta Kobrina

Basic documents provided simultaneously with the application:

1. certificate for maternity (family) capital or its duplicate;

2. identification documents, place of residence (stay) of the person who received the certificate; 3. insurance certificate of compulsory pension insurance of the person who received the certificate; 4. Marriage certificate - if the spouse is a party to the transaction or obligations for the purchase or construction of housing. Documents for sending MK funds to pay a down payment when receiving a loan or loan for the purchase (construction) of housing:

- a copy of the credit agreement (loan agreement) for the purchase (construction) of housing;

- a copy of the mortgage agreement that has undergone state registration in the prescribed manner, if its conclusion is provided for in the credit agreement (loan agreement).

Documents for sending MK funds to pay the principal and interest on loans or loans for the purchase (construction) of housing:

- copy of the loan agreement. If maternity capital funds are used to repay a loan that was taken out to refinance a loan (loan) for the purchase or construction of housing, then it is additionally necessary to provide a copy of the previously concluded loan agreement (loan agreement);

- a certificate from the creditor (lender) about the amount of the balance of the principal debt and the debt to pay interest for using the credit or loan;

- a copy of the mortgage agreement that has undergone state registration in the prescribed manner, if its conclusion is provided for in the credit agreement (loan agreement);

- an extract from the Unified State Register containing information about rights;

- if the individual housing construction project has not been put into operation: a copy of the agreement for participation in shared construction, which has passed state registration in the prescribed manner, or a copy of the permit for the construction of an individual residential building;

- if the credit (loan) was provided to pay the entrance fee and (or) share contribution to the cooperative: an extract from the register of members of the cooperative confirming membership in the cooperative of the certificate owner or his spouse (a document confirming the filing of an application for admission to membership in a housing savings cooperative, or decision on admission to membership in a housing, housing-construction cooperative);

- a document confirming receipt of a loan by non-cash transfer to an account opened by the person who received the certificate or his spouse (wife) in a credit institution.

Elena Emelyanova, head of the department of social payments of the OPFR in the Krasnoyarsk Territory

, noted:

From March 12, 2021, in accordance with Federal Law No. 35-FZ dated March 1, 2020, a notarial obligation to allocate shares to all family members no longer needs to be attached to an application for the use of maternal (family) capital to improve housing conditions. At the same time, residential premises acquired (built, reconstructed) using maternity capital funds must in any case be registered as the common property of parents and children; now this requirement is contained in Part 4 of Art. 10 Federal Law No. 256-FZ of December 29, 2006 “On additional measures of state support for families with children.”

The branch of the Russian Pension Fund in the Krasnoyarsk Territory, from January 1, 2021, issues a certificate for maternity capital within 5 working days, considers applications for the disposal of funds - no more than 10 working days

. In some cases, these deadlines can be extended, respectively, to 15 and 20 working days, if other departments do not respond in a timely manner to the request of the territorial bodies of the Pension Fund of the Russian Federation for the information necessary for making a decision. Let us remind you that previously no more than 15 working days were allotted for the issuance of MSK, and no more than 30 days for the consideration of the application for the disposal of funds.