Providing maternity capital is the most important form of material support for families with children. Using budget money, the provision of which has been extended until December 31, 2021, despite the financial crisis that has gripped the country, families can: improve their living conditions; provide education to the child(ren); purchase goods and services intended for social adaptation and integration of disabled children into society, and women for the formation of the funded part of their labor pension (clause 3 of article 7 of the Federal Law of December 29, 2006 No. 256-FZ “On additional measures of state support families with children”, hereinafter referred to as Law No. 256).

Until July 1, 2021, it was also possible to receive a one-time payment in the amount of 20,000 rubles using maternity capital funds. subject to receipt of a state certificate for maternity (family) capital by December 31, 2015 inclusive (Article 1 of the Federal Law of April 20, 2015 No. 88-FZ “On a one-time payment from maternal (family) capital”).

By virtue of paragraph 1 of Art. 3 of Law No. 256, the right to receive maternity capital arises for the following citizens of the Russian Federation, regardless of their place of residence:

women who gave birth (adopted) a second child starting from January 1, 2007; women who gave birth (adopted) a third child or subsequent children starting from January 1, 2007, if they had not previously exercised the right to additional measures of state support; men who are the sole adoptive parents of a second, third child or subsequent children who have not previously exercised the right to additional measures of state support, if the court decision on adoption entered into legal force starting from January 1, 2007.

Thus, persons who gave birth to a second child after January 1, 2007 have the right to receive maternity capital. The exception is cases when the birth occurred as a result of surgical intervention of a medical institution that does not depend on the mother (Definition of the RF Armed Forces dated June 3, 2011 No. 4 -B11-15). In such a situation, although the child was born ahead of schedule, and formally his family does not have the right to receive material support, maternity capital is still due to them, since the birth occurred ahead of time due to objective reasons beyond the control of the mother. This approach is consistent with the preamble of Law No. 256, the purpose of which is to create conditions that provide families with children with a decent life. This Law is aimed at solving the unfavorable demographic situation in the Russian Federation. However, a mother who had a second child, but in relation to her first child, was deprived of parental rights (resolution of the Presidium of the Chelyabinsk Regional Court dated December 23, 2015 No. 44g-106/2015) has no right to rely on maternity capital funds.

In addition, it must be borne in mind that even the fact of the death of the second child in the first week after birth does not prevent the receipt of a certificate for maternity capital (Determination of the Armed Forces of the Russian Federation dated June 17, 2010 No. 51-B10-9), since in order to resolve the issue of The fact that the child was born alive determines the allocation of this type of financial assistance from the budget (Appeal ruling of the Supreme Court of the Republic of Karelia dated November 13, 2015 in case No. 33–4355/2015).

The most common form of spending maternity capital is to improve housing conditions, since getting an education for born children is a more distant prospect, and financing the funded part of a labor pension may be of no interest to anyone. Under the improvement of living conditions by virtue of paragraph 1 of Art. 10 of Law No. 256 refers to the following operations:

acquisition (construction) of residential premises carried out by citizens through any transactions that do not contradict the law and participation in obligations (including participation in housing cooperatives), by non-cash transfer of the specified funds to the organization carrying out the alienation (construction) of the acquired (construction) residential premises, or to an individual carrying out the alienation of the acquired residential premises, or an organization, including a credit organization, which provided funds for the specified purposes under a credit agreement (loan agreement); construction, reconstruction of an individual housing construction project, carried out by citizens without the involvement of an organization carrying out the construction (reconstruction) of an individual housing construction project, including under a construction contract, by transferring the specified funds to the bank account of the person who received the certificate.

How to give children property rights to use maternity capital?

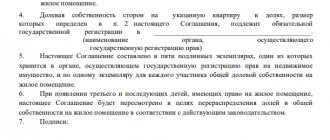

If the apartment was purchased as a common joint property, then the agreement can be in simple written form (not notarial). If upon purchase you immediately allocated shares, then subsequent operations (including donation, sale) can only be carried out under a notarized transaction, and this point can be skipped.

First of all, we draw up a share donation agreement.

The above agreement is as simple as possible, which has its advantages - there is less chance of making a mistake, which means there will be less need to go to the MFC. It is better to print the contract on one page, so as not to stitch it and not to certify it, which is why we have removed many provisions from the contract that are already in force by law and do not need to be included in the contract.

Also, lawyers often draw up an act of acceptance of the transfer of shares. But since this is a transaction with one’s own children, it does not play a special role, and there is no need to provide it for registration. It is most important to fill out the contract without errors and clerical errors in order to avoid suspensions and refusals in registering the transfer of rights.

After signing, you submit this agreement to Rosreestr through the MFC to register the transfer of rights. After receiving the documents from Rosreestr, you can celebrate the “equator” - you are halfway there.

How to cash out capital for home renovation?

In some cases, a property needs to improve central utility networks, rather than major improvements to walls and ceilings. However, such actions are not provided for by law. In view of this, the owner of the premises can seek free legal advice.

Read also: Sick leave for grandmother to care for her grandson

As a rule, you need to visit a lending institution to cash a certificate for home improvement work. In this case, the funds are given to the holder in the form of cash some time after the application. Employees of such cooperatives recommend how best to complete the paperwork. In addition, employees are not interested in whether the funds were used for their intended purpose or not.

Let us highlight two main provisions:

— you can apply for a certificate from the Pension Fund of the Russian Federation (PFR) directly to the territorial division of the PFR or through multifunctional centers (MFC) of your city;

— from the documents you must provide: an application, a passport (or other document confirming your identity and place of registration), birth (adoption) documents in relation to the child (children), in connection with whose birth (adoption) you are applying for the issuance of maternity capital; a document confirming that the child has Russian citizenship; if documents are submitted through a representative - a notarized power of attorney.

You can also receive an application at the MFC - it is prepared by an employee. The main thing is to collect all the necessary documents.

Please note that at first the Pension Fund will only issue you a certificate for receiving maternity capital. To use this certificate and receive money, you will have to contact the Pension Fund with an application during the transaction itself.

It is impossible not to note the following conditions regarding the purchased apartment:

- housing is purchased for the whole family;

- the apartment (like the house itself) should not be in disrepair;

- the apartment should not belong to your closest relatives;

- all payments for the transaction must be made in cashless form;

- At the time of contacting the Pension Fund of Russia, the transaction for the purchase of an apartment must be registered with Rosreestr.

Perhaps many will ask numerous questions regarding the last point - we can’t blame you for that. But this works in practice, because if you request financial capital before registering a transaction, you may be refused. The Pension Fund is primarily concerned that the funds are used to purchase the initially agreed upon property, and that parents do not change their minds at the last moment or buy another apartment, the purchase of which the Pension Fund did not approve.

But don’t be alarmed - often all mutual settlements in such transactions are made after the agreement is registered, so you only need to worry about the patience of the seller. Otherwise, you can provide for an installment payment, deferment of payment of part of the amount, or simply repay part of the loan amount for the apartment with maternity capital.

Now you need to find an apartment and contact the seller to agree on the transaction, check all the documents, and also discuss the terms of the transaction. Such things are trivial, so we will not dwell on them, but we will note important points about the transaction.

Firstly, the purchase and sale agreement must contain a condition that part of the price is paid from maternity capital;

Secondly, children must appear in the sales contract as parties to the transaction;

Thirdly, you need to carefully check all the documentation provided by the seller, and if something is missing, request it.

Documents for registration of MSC funds for reconstruction

In order to spend maternity capital on apartment renovations in 2021, which involve increasing the area, the applicant needs to collect papers. The prepared documents are sent to the branch of the Russian Pension Fund at the address of residence:

- application for the use of funds as part of the renovation of a residential premises;

- parents' passports and children's birth certificates;

- mother's SNILS;

- papers indicating ownership of the property;

- bank statement about personal account;

- a receipt certified by a notary about the transfer of property in the possession of all family members;

- permission to carry out reconstruction from BTI.

Review of papers is carried out no later than 5 working days from the date of registration of the application.

The certificate holder has the right to receive compensation for previously carried out reconstruction of not only the house, but also the dacha. To do this, you need to document the increase in living space. As a rule, two types of cadastral passport are provided - before and after repairs. Accordingly, the new passport must record the expansion of the area.

How to find out whether maternity capital was used by the seller when buying an apartment?

First of all, you can look at the passport of the apartment seller and find out how many children he has. If there are two or more people and the apartment was purchased after 01/01/2007, then there is a high probability that part of the money was paid from maternity capital. This is often written about in the apartment purchase agreement itself. Nevertheless, there are situations when an apartment was purchased on credit and the financial capital was used to repay this same loan after the conclusion of the purchase and sale agreement. In this case, the contract is unlikely to mention maternity capital. If the children do not have property rights and the seller swears that he did not take maternity capital, then to confirm his words he can provide you with a certificate from the Pension Fund stating that the certificate for maternity capital was not really issued or, for example, was used for other purposes . But if the seller does not want to provide such a certificate, this is a reason to think about his integrity and refuse to purchase this apartment.

The procedure for transferring maternity capital for housing reconstruction

The transfer of financial support for the reconstruction of residential premises is carried out in two stages:

- Documentation is submitted to obtain permission from the Russian Pension Fund. The certificate holder then awaits a decision. The application review period is five days. If a positive verdict is made and there are no violations, the family should expect an additional ten days. During this period, a payment in the amount of 50% of the amount of maternity capital is made to the bank account.

- The second part of the funds is transferred after providing supporting documents on the completion of work to improve the area of the property. This act is a certificate from the BTI. The text of the document reflects the expansion of the area by at least 1 sq.m. m., per person. The remaining money is credited in the same way as the first payment.

Transfer of funds for previously completed work is carried out in a simultaneous payment in the amount of 100% of the certificate amount.

Let's summarize briefly:

- You must fall under one of the categories of persons entitled to receive maternity capital;

- To obtain maternity capital, you must contact the Pension Fund (the easiest way to do this is through the MFC) with an application and attach the necessary documents;

- At the time of filing the application, the transaction must be registered with Rosreestr;

- After receiving the certificate, make sure that the child has a minimum share;

- Purchase a new home with a child participating in the transaction;

You can learn how to sell an apartment correctly from the second article, which touches on the topic of maternity capital, but it is important to know: in the contract for a new apartment, the child must appear as the buyer of a share exceeding the current one. From the example - 57/1000, which means in the new one it could be 80/1000, etc., but this condition must be met.

Questions? Leave a request for a consultation and we will tell you in more detail.

more than 15 years of experience in court . We have something to share with you.

Contact us. Our contacts and work schedule are here.

What can be included in the reconstruction

Reconstruction is a series of works aimed at increasing the area of the house, provided that the minimum accounting standard for housing is achieved. Such a requirement means that upon the birth of a child, an additional 18 sq.m. will be allocated for him. Using this standard, employees of the Russian Pension Fund identify the level of security of the family living in the house.

Accordingly, maternity capital can be spent on home renovations if the work involves increasing the living space. It is noteworthy that in individual regions of the Russian Federation the expansion criteria are different. The norm is established by the municipal authorities of the locality.

Matkapital for improving living conditions

What is the difference between state and regional maternity capital?

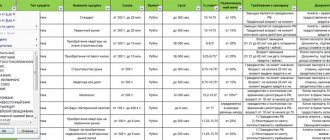

A federal certificate can be obtained by parents who have had a second child (or subsequent ones). At the same time, at least one of the parents must have Russian citizenship. The payment amount for 2021 is set at 453 thousand rubles. They are transferred from the pension fund. Such family capital can be spent on three main purposes:

- purchase of housing (including mortgage lending) or expansion of living space (construction);

- education fee;

- mother's funded pension.

With the exception of cases of purchasing a home or paying off a mortgage loan, you can use the payment if the child for whom the state certificate is issued is 3 years old.

Regional (regional, governor's) maternity capital can be received by families where both the first and third child were born. It is available in 72 constituent entities of the Russian Federation. The amount of payments is set for each region separately and can be either 30 thousand rubles or 300 thousand rubles. To receive payments, parents must only be Russian citizens and reside in the region (have registration) for at least 3-5 years (depending on the region). You can use the money for a wider range of purposes:

- expansion of living space;

- home renovation and construction;

- payment for education;

- buying a car;

- acquisition of real estate (including land plots);

- buying furniture;

- medical services and treatment;

- spending on personal needs.

At the same time, the list of purposes for the allocation of gubernatorial maternity capital may change according to the procedure established by the regional authorities, since these funds come from the regional budget.

For example:

In Moscow, in addition to federal assistance, there are programs of compensation payments (from 5 thousand to 50 thousand rubles, depending on the number of children from 1 to 3) and the “Luzhkovsky” allowance (from 75 thousand rubles to 151 thousand rubles, respectively, from 1 to 3 children). They are relied upon if both parents have a residence permit in the capital. You can spend money for almost any purpose.

In turn, in the Komi Republic, regional maternity capital is intended exclusively for families where the 3rd child was born. Payments amount to 150 thousand rubles. They can only be spent on expanding the living space, paying for the child’s education and treatment, carrying out repairs and remodeling the home.