According to the law of December 29, 2006 No. 256-FZ on measures of state support for families, you can buy shares in an apartment with maternity capital - there is no direct prohibition ; it is allowed to purchase them even from relatives (with certain conditions).

There are restrictions for transactions with parts of real estate:

- they must not contradict the law;

- the share should be allocated in the form of a room or be the remaining one in the housing - as a result of the transaction, the whole apartment will become the property of the family;

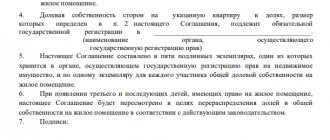

- the house in which the share is purchased should not be recognized as unsafe and subject to demolition (reconstruction).

Purchasing shares in an apartment from relatives may raise suspicions of an attempt to cash out capital through such a transaction, so it will be checked by the Pension Fund (PFR) and the prosecutor's office.

The procedure for acquiring a share will be as follows: having registered the transfer of ownership in Rosreestr, you need to submit to the Pension Fund an application for the disposal of maternity capital (MC) funds and the necessary documents.

Photo pixabay.com

Is it possible to buy a house or apartment from a relative for maternity capital?

Photo by Pexels

The procedure for providing state support measures in the form of maternity capital funds is regulated by the Federal Law of December 29, 2006 No. 256-FZ “On additional measures of state support for families with children.” In particular, Part 3 of Article 7 of this regulatory document provides a list of possible options for the direction of MK, one of which (clause 1) is improving housing conditions.

And Article 10 of this law establishes in detail the types of improvement of living conditions of families with children for which maternal capital can be used. According to the law, it is permissible to purchase residential premises through any civil transactions, if they do not contradict the law.

That is, the law does not contain a direct prohibition on purchasing housing from a relative using maternity capital , but there are a number of conditions that must be met in order for the transaction to be recognized as legal.

The law describes a number of conditions for conducting a transaction for the purchase/sale of housing using maternity capital. Including:

- the premises must be residential, not dilapidated or in disrepair, and have communications;

- real estate must be located on the territory of the Russian Federation, and you can buy housing in any region; it is not necessary to purchase it at your place of registration;

- within six months after the transaction or removal of the encumbrance (in case of purchase with a mortgage), the housing must be registered as shared ownership, shares are allocated in proportion to the cost of housing and funds invested at the expense of maternal capital;

- the parties do not have mental disorders and are legally competent (both the seller and the buyer).

The law does not contain requirements regarding the category of sellers for such transactions, which means that the Pension Fund of the Russian Federation has no grounds for refusing to transfer MK if family ties of the certificate holder with the real estate seller are discovered.

Maternity capital: improving living conditions and transactions with relatives

Since 2007, Russia has had a system of assistance for families in which two or more children were born - maternity capital.

Content

1. Indexation of maternity capital 2. What and how much can you spend on? 3. Is it possible to buy housing from relatives? 4. When the Pension Fund refuses to transfer funds 5. Position of the Supreme Court 6. Legal advice

✔️1. Indexation of maternity capital

The amount of maternity capital increases every year depending on inflation; now it is indexed by another 3% and amounts to 466,617 rubles. (Federal Law No. 380-FZ dated December 2, 2019). Please note that indexation applies to all amounts of maternity capital not spent by parents, regardless of the date the certificate was received: that is, if the certificate was received in 2021 and 50% of the amount was spent, the remainder increased by 3% from January 1, 2021. You can obtain accurate information about the balance of the amount at the Pension Fund branch at your place of residence.

✔️2. What and how much can you spend on?

To use maternity capital, you first need to obtain a certificate, and this can be done both through the MFC and through the Pension Fund of the Russian Federation, providing a certain application and attaching the required documents. According to Art. 7 Federal Law “On additional measures of state support for families with children” dated December 29, 2006 No. 256-FZ, people who have this certificate have the right to spend their maternity capital at once or in shares and strictly on certain tasks:

1) improvement of living conditions; 2) formation of a funded pension for women; 3) payment of education for the child (children); 4) purchase of various goods and services for disabled children; 5) receiving a monthly payment (for families in need).

In this case, parents have the right to choose one or more of the specified payment purposes, as well as spend the entire amount or only part of it at once.

✔️ 3. Is it possible to buy housing from relatives?

Of course you can, both an apartment or a house as a whole, and a share in the ownership of them. There are no direct prohibitions on such transactions in the law. Housing purchased or built with the help of maternal capital should be registered as the common property of both parents and all children and the size of the shares should be determined by signing an agreement (Article 10 of the Federal Law “On additional measures of state support for families with children” dated December 29, 2006 N 256-FZ). What you definitely shouldn't do:

1) enter into transactions with a spouse;

2) spend maternity capital on the purchase of apartments, since this property is not considered residential.

The key thing to remember when concluding a deal is that as a result, the children’s living conditions should improve in reality, and not just on paper.

✔️ 4. When the Pension Fund refuses to transfer funds

The Pension Fund may refuse to transfer funds if it suspects fraud. Quite often this concerns the purchase of housing from parents. So, a young family with children lives with the mother (father) of one of the spouses and wants to buy an apartment (share) from their parents and continue to live together, and the money transferred to the parents will eventually be spent on something else (for example, on repairs) dachas or buying a car). In fact, living conditions very often are not even planned to be improved, and the Pension Fund of the Russian Federation refuses such transactions, because this is an inappropriate cashing out of maternity capital and, in fact, fraud.

✔️ 5. Position of the Supreme Court

The Supreme Court of the Russian Federation confirms the legality of transactions using maternal capital between relatives. Thus, in its Ruling No. 84-KG15-8 dated September 15, 2015, the Supreme Court indicated that the plaintiff lawfully used maternity capital to pay for a deal with his parents, because as a result, the children’s living conditions were indeed improved. The court separately indicated that it was coming to this conclusion because the purchase and sale agreement between the co-owners established the procedure for the use of each living room in the apartment, and most importantly, for M.A. Strunkova. and her minor children were given two living rooms for use, which means the deal was legal.

✔️ 6. Legal advice

In order for your contract for the purchase and sale of housing (share) from your relatives to be more likely to be approved, it is necessary to include such conditions that clearly define how your living conditions and the living conditions of the child will actually change for the better (for example, the child will have a separate room).

But if the Pension Fund of the Russian Federation still does not give you permission to use maternity capital to purchase housing from your relatives, you must receive an official refusal with an explanation of the reasons, which will allow you to subsequently appeal this refusal of the Pension Fund in court. You might be interested in:

- Division of property without court

- Division of property through court

- Termination of the contract at the initiative of the customer

- Additional agreement on termination of the contract

Most popular articles:

- Driver's rights when stopped by the traffic police

- Benefits when paying for housing and communal services

- Benefits for paying for housing and communal services in the regions

- Benefits for pensioners

- New laws for 2021 (29 most important changes)

- New 2021 Laws for Mom (and Dad)

- Benefits for pensioners in the regions. Part 1

- Benefits for pensioners in the regions. Part 2

- Law changes in 2021 in the capital

Read us where it is convenient for you:

- Yandex.Zen

What other conditions must be met?

The most important and first thing is that maternity capital funds can be used to improve living conditions only after the child turns 3 years old. This refers to a child whose birth gave the family the right to receive maternity capital.

A way around this condition is to contact consumer cooperatives and receive loans against capital. This is quite legal and is in great demand, but for the “services” the cooperative will definitely take its percentage, and most often – not a small one. The second method is a purchase with deferred payment, when part of the funds is contributed from one’s own budget, and the remainder is specified in the contract and transferred by the Pension Fund after the child turns three years old. In this case, it is necessary that the standard contract for the purchase and sale of an apartment with deferred payment be filled out in accordance with all the rules, otherwise the Pension Fund of the Russian Federation may refuse to transfer funds subsequently (the right to maternal capital will remain, the seller will simply not receive the money).

By the way, buying with a deferment for a transaction with relatives is practically an excellent option, because it is the long-term nature in this case that confirms the seriousness of intentions.

Another condition is the mandatory registration of purchased housing as shared ownership . That is, among other documents, the buyer is obliged to provide the Pension Fund with a written undertaking to register the purchased property as shared ownership of all family members. There is a six-month period for fulfilling the obligation, after which the Pension Fund has the right to conduct an inspection, and if the obligation is not met, open a criminal case against the owner of the certificate for maternal capital.

This leads to the following problem: children are indirectly involved in the transaction, and according to the law, a compensated property transaction in principle cannot be carried out between a minor child and his close relative. In this case, relatives are meant:

- directly the child’s parents themselves;

- stepfather or stepmother in relation to the child;

- adoptive parents in relation to adopted children;

- grandfather or grandmother in relation to grandson/granddaughter;

- brothers or sisters in relation to each other, including not full-blooded, that is, having a relationship through only one of the parents.

That is, based on this, the following is obtained: the seller can only be a relative who is not in direct connection with the buyer himself or his children (future co-owners of the property). You cannot purchase a house or apartment from your child’s older adult sister, his grandmother, etc. using maternity capital.

However, this condition can also be bypassed: simply, only one of the spouses acts as the buyer. The transaction is carried out as follows:

- the second spouse writes consent to purchase a house for maternity capital;

- a purchase/sale transaction is carried out, during which the spouse becomes the sole owner of the property;

- the ownership right is registered in Rosreestr (today it is not necessary to do this yourself; the notary’s office also helps to register the right to an object in Rosreestr through a system of interdepartmental interaction);

- an obligation is drawn up (also with a notary) that the buyer undertakes to allocate the shares to the children and the second spouse within six months from the date of transfer of funds by the Pension Fund of the Russian Federation;

- After this, the buyer, with ready-made documents, contacts the Pension Fund and writes an application for the disposal of maternity capital funds.

It turns out that children are not involved in the transaction, which means it cannot be considered illegal.

When parents purchase with the participation of children (that is, their direct participation in the transaction, when the whole family is the buyer), there is a risk, because such a transaction is a priori invalid. And, the fact of relationship can only be discovered theoretically (For example, if well-wishers write to the authorities, etc.). But that comes later, after the deal. The Pension Fund itself will not establish such family ties, simply because the agency does not have such powers.

How to buy a house using maternity capital

Lawyer Yuri Kapshtyk recommends the following purchase procedure to parents.

- Select housing and agree on the price. If a family already has an apartment or house where minor children are registered, the area of the new housing should not be smaller. Otherwise, the guardianship authorities will not approve the deal. Improving living conditions means increasing the space for each family member.

- Warn the seller that you are planning to buy a house using maternity capital. This must be done for the reason that the Pension Fund transfers money from the mother’s personal account upon completion of the transaction, that is, after the conclusion of the purchase agreement. This means that the seller will receive part of the money from the buyer immediately, and the second part from the capital funds - a little later, after reviewing the documents by the Pension Fund. This can be scary for some property owners who worry that they will be left without a home and money. But there is no reason to be afraid if the transaction is completed correctly and without violations.

- Conclude a purchase and sale agreement. The agreement stipulates that part of the amount will be paid with funds from maternal capital, and also that children will become co-owners of the property.

“I recommend concluding an agreement with notarization,” says lawyer Yuri Kapshtyk. “This is not necessary, but in order to avoid mistakes when preparing documents and for personal peace of mind, it is better to notarize the transaction.”

- Provide documents to the Pension Fund. This year, the deadlines for reviewing documents have also changed. Instead of the previous month, employees of the Pension Fund of Russia branch must meet the deadline in 10 days.

After approval by the Pension Fund of the Russian Federation, the money is transferred to the seller’s account. Parents just have to submit the purchase documents for state registration and move to a new home.

Federal News Agency /

Is it possible to buy a share of housing from relatives for maternal capital?

The law does not contain an unambiguous answer as to whether it is possible to purchase shares of a residential building or apartment on a residential property; however, the answer to this question is indirectly formulated in the legal act: the object of a purchase and sale transaction can only be residential premises. Now let’s look at the definition of the concept of “residential premises” according to the Housing Code: residential premises are isolated premises suitable for citizens to live in.

Pexels Photos

That is, there is no talk about shares directly in the law, as well as a direct prohibition on purchasing a share. However, it is worth paying attention to the concept of “isolated”. That is, the acquisition of a share is actually allowed if its size suggests the possibility of allocating in kind an isolated part of the property. Those. in practice, it will not be possible to purchase ½ of a one-room apartment, since it is impossible to insulate half of the room. But with private houses the situation is simpler: here you can organize a separate entrance for almost any room, and sometimes it even exists, it’s just not decorated. As practice shows, when purchasing a share, it is enough to indicate that you are purchasing an isolated premises. A housing plan is attached to the contract, and the contract specifies which rooms are allocated to the buyer during the transaction. If in fact the house is for two owners, but in fact it is shares, then buying half is also possible: the contract is accompanied by a building plan and an explanation that the housing has a separate exit and is isolated from neighbors.

It is also possible that one of the parents who owns an apartment complex is the owner of a share in the apartment, and the owner of the other share is the child’s grandmother or grandfather or another relative). In this case, a citizen has the full right to purchase a share (for example, a room) in an apartment or house, provided that after the transaction they become the sole owners of the property (or, at a minimum, the acquired share can be allocated in kind, for example, as a separate room) .

In addition, a share from relatives can be purchased with maternity capital, even if the family has previously lived in the apartment it is buying. After the acquisition, parents and children become full owners, thus, it turns out that the family’s living conditions are improved, therefore the main condition for purchasing housing for MK is fulfilled.

Buying an apartment or house from relatives: documents and details of registration

The procedure for registering a transaction to purchase real estate for maternity capital from relatives, including close ones, does not differ in any way from a regular purchase/sale transaction. The procedure is implemented according to general rules and involves the conclusion of an agreement and subsequent application to the territorial body of the Pension Fund of the Russian Federation.

To purchase housing (or a share) from relatives using maternity capital, you must:

- Draw up a correct and complete purchase/sale agreement (it is recommended to contact a lawyer). The terms of the contract stipulate that part of the price (or the full price) will be paid at the expense of maternal capital. The transfer of own funds is confirmed by a receipt. Conclude a deal with a notary.

- The next step is to sign the real estate acceptance certificate.

- Register ownership of purchased housing in Rosreestr. In this case, the buyer receives an extract from the Unified State Register of Real Estate (USRN) about the rights to the purchased apartment (house, share).

- Submit an application to the Pension Fund for the disposal of maternity capital funds along with the required documents.

To apply to the Pension Fund, the following documents are required:

- a statement on the disposal of MSC funds, the purpose of spending the funds is “improving housing conditions,” namely, the purchase of a specific residential property;

- certificate giving the right to receive MSK (original required);

- passport of the certificate holder;

- SNILS of the certificate owner;

- marriage certificate with your spouse (or divorce certificate);

- birth certificates of all children;

- court decisions on adoption (if there are adopted children in the family;

- contract of sale of an apartment;

- an extract from the Unified State Register of Real Estate confirming ownership of the apartment (in the name of the buyer);

- cadastral and technical passport for the apartment;

- a notarized obligation to register housing as shared ownership;

- details of the seller's current account to which funds should be transferred if the application is approved by Pension Fund employees.

Is it possible to buy a share in an apartment with maternity capital?

The law on maternity capital does not prohibit the purchase of a share in an apartment. The main condition is that it must be large enough so that it can be allocated in kind in the form of one or several rooms, or after its acquisition the entire living space .

Housing purchased using maternity capital must be located on Russian territory.

Acquiring a share in an apartment should not be contrary to the law . Illegal transactions include:

- imaginary and feigned transactions (Article 170 of the Civil Code of the Russian Federation);

- void and voidable transactions (Articles 168-179 of the Civil Code of the Russian Federation) - directly contrary to the law or the principles of morality, concluded by persons who do not have the right to do so (children under 14 years old, incompetent, etc.), concluded under the influence of deception, threat or misconceptions, etc.;

- acquisition of a share in a dilapidated house that is subject to demolition, or in premises unsuitable for habitation (Clause 8, Part 2, Article 8 of Law No. 256-FZ, introduced by Law No. 37-FZ of March 18, 2019).

The Pension Fund verifies the data provided by the owner of the certificate when applying for the disposal of maternal capital:

- on recognition of the purchased housing as unsafe;

- on deprivation and restriction of parental rights, cancellation of adoption, removal of a child from parents;

- about committing a deliberate crime against the person in relation to your child.

If there are suspicions of illegal use of maternity capital, the Pension Fund will refuse to send the funds and will contact law enforcement agencies. The prosecutor’s office also regularly checks transactions that have already been carried out for legality.

What is the difference between a share and a room?

According to Part 1 of Art. 10 of the law on maternal capital, with state support funds you can purchase residential premises, which include apartments, houses and rooms in them - the share itself is not included in this list.

According to Art. 16 of the Housing Code, a residential premises, including a room, has the following characteristics:

- is an isolated building or part of it;

- suitable for permanent residence;

- connected to engineering systems: electrical networks, ventilation and heating, as well as gas, water supply and sewerage, if such networks are installed in a populated area;

- meets established sanitary and technical standards.

A share is not a residential premises because it represents an abstract part of real estate: a share in the right of ownership, and not a specific room.

Owners of housing divided into shares use it jointly and with agreement, while the law on maternal capital implies that the family must fully own the premises purchased on the MK, therefore the abstract part of the real estate cannot . That is why, when purchasing a share, it must be allocated in kind or be the last one in the apartment, so that after its acquisition the entire living space will be owned by the family.

Is it possible to buy a share in an apartment from relatives for mat capital?

The law on maternity capital does not prohibit buying a share in an apartment from relatives - you can purchase housing (including part of it) through any transactions that do not contradict the law, as confirmed by the Pension Fund.

Despite the above, there are restrictions on purchasing a share in an apartment from relatives:

- In the course of purchasing housing or part of it from them using maternity capital, its funds should not be cashed out . The prosecutor's office regularly checks the legality of the use of maternal capital, and if violations are detected, initiates a criminal case under Art. 159.2 of the Criminal Code “Fraud in receiving payments.”

- Buying a share from a spouse . Such transactions are prohibited by law if the apartment was in common ownership - the right to the real estate does not actually transfer, because the buyer already owned it. But when using maternity capital, you also cannot purchase real estate that was in the sole ownership of the spouse. For example, the prosecutor's office of the Saratov region opened a criminal case against a mother with many children who cashed out state support funds by “purchasing” a house from her husband.

- Acquiring a share in an apartment from close relatives with participation in the transaction minor child: according to Part 3 of Art. 60 of the Family Code and paragraph 3 of Art. 37 of the Civil Code of the Russian Federation, that is, if a child under 18 years of age is specified in the contract, the owner of the certificate cannot buy a share from:

- parents;

- children;

- brothers and sisters;

- grandparents;

- grandchildren and granddaughters.

How to buy a share in an apartment using maternity capital?

The procedure for purchasing a share using maternity capital funds will be as follows:

- Agree with the seller on the terms of the transaction and that the price will be partially or fully paid by mother capital.

- Draw up a purchase and sale agreement indicating what part of the share is paid for using the certificate.

- Draw up a transfer deed, which is required for state registration.

- Register the transfer of ownership in Rosreestr, after which the buyer will receive an extract of rights to the share from the Unified State Register of Real Estate (USRN).

- Submit an application to the Pension Fund for the disposal of maternity capital with the required documents - the Pension Fund will consider the application within a month.

The most important condition for purchasing a home or a share using maternity capital is registering the acquired property as a common shared property of the family. This can be done immediately, indicating both parents and children in the agreement, or after the completion of the transaction, but then the owner of the certificate will have to give a written obligation to allocate shares, certified by a notary.

It is necessary to allocate shares to family members within six months after registering the purchase in Rosreestr or repaying the loan for the purchase of housing.

What documents are needed?

According to clauses 6 and 8 of the rules approved by Government Decree No. 862 dated December 12, 2007, it is necessary to provide to the Pension Fund:

- passport of the certificate holder or other document confirming identity and registration at the place of residence (stay);

- a copy of the purchase and sale agreement;

- an extract from the Unified State Register of Real Estate on the applicant’s rights to the purchased housing;

- an obligation certified by a notary to allocate shares if the property is not purchased for all family members or with a mortgage;

- spouse’s passport and marriage certificate, if he is one of the parties to the transaction;

- passport and notarized power of attorney for the representative, if the application is submitted not in person, but through him;

- a certificate from the seller about the amount of the unpaid amount if the apartment is purchased in installments.

According to clauses 12 and 13 of the rules, if a share is purchased with credit or borrowed funds (including a mortgage), then you will also need:

- credit agreement or loan agreement;

- a registered mortgage agreement, if the loan or loan is a mortgage;

- a certificate from the bank or from the lender about the balance of the principal debt and interest, if MK funds are used to repay them.

Possible liability

After the transaction and the transfer of funds to the seller, Pension Fund employees can monitor the fate of the sold property for some time, for example, check whether all family members were actually included in the list of shareholders, and whether the family actually lives in the purchased property (by the way, residence is not required condition). If it turns out that the alienation turned out to be fictitious, and its purpose was to cash out and receive funds from maternity capital, the case materials will be transferred to law enforcement agencies to initiate a criminal case on the fact of fraud.