Buying an apartment using maternity capital: when to register rights

There are no apartments without owners. Information about all rights to real estate is stored in the state organization - Rosreestr. If the owner changes, the transaction is registered, and new information is entered into the database. All rules are described in the law “On State Registration of Real Estate”.

At the first stage, the seller and buyer enter into a purchase and sale agreement for the apartment. And then together they apply to Rosreestr to register new rights. In practice, you can come to the registration chamber, MFC or to a notary. Notarization is required if the seller’s apartment is in shared ownership (until August 2019), the owner is a minor or incapacitated. In other situations, it is voluntary - at the discretion of the parties.

Registration will take 7 days at Rosreestr, 9 days through the MFC and 3 days through a notary. The service fee is RUB 2,000. As a result, the new owner receives a contract with a registration mark and an extract from the Unified State Register of Real Estate, which will contain amended information about the rights to the apartment. From this moment on, the whole family takes ownership.

Only after this can maternity capital be used . The rules are dictated by law 256-FZ. With the received documents, the mother submits an application to the Pension Fund or MFC. There they check the transaction’s compliance with the law and after 1.5 months the money is transferred to the seller. When to transfer the remaining part, the parties agree themselves.

This is the simplest scheme. Additional steps appear when an apartment is purchased during construction or with a mortgage. Full ownership is issued only after the house is completed and the mortgage is paid off. You can dispose of maternity capital before this, but other documents will be needed to confirm the purpose of the expenditure. At the time of submitting the application, they should already be in hand, and with a mark from Rosreestr.

Video: rules for registering real estate rights

How to remove an encumbrance from an apartment

The encumbrance on an apartment due to maternity capital is not such an insurmountable obstacle. To do this, you should first contact the territorial department of Rosreestr. The institution’s specialists will check all the submitted documents and set a day on which it will be necessary to make a second visit to this structure to pick up certificates of removal of the encumbrance on the property.

To remove the encumbrance you will need to prepare a number of documents

Currently, there are several ways to contact the registering organization:

- Traditional personal visit. The applicant simply comes with all the necessary documents to the Rosreestr department and submits an application.

- Sending a registered letter with acknowledgment of delivery and a list of attachments. Please note that with this option, each document sent must first be certified by a notary. However, you won’t be able to get an answer via mail. You'll have to come for him in person.

- You can also submit all required documentation through the MFC. The procedure is identical to a visit to the registration authority.

- Sending an application and documents through the State Services portal. This method is only possible for those who have pre-registered on the site. But payment of state duty through it is carried out with a 30 percent discount.

Alternatively, a citizen who wants to remove the encumbrance from an apartment, but does not have enough time, can seek help from specialized law firms, whose specialists will carry out the procedure for a reasonable fee.

However, the applicant may be refused. In this case, it is advisable to take a written refusal in order to subsequently present it in court. That is, if the issue was not resolved positively in Rosreestr, and the applicant is confident that he is right, then he needs to draw up and submit a statement of claim to the court of first instance. This must be done at the location of the property.

The application must be accompanied by the same documents as during the visit to Rosreestr. It is important to understand the time frame within which the claim must be considered. If the submitted documents satisfy the judge, then a decision on the case must be made within two months. As soon as the decision comes into force, the plaintiff must receive it from the court office and then present it to Rosreestr.

It is important to fill out the document correctly

Who is the owner of an apartment purchased with maternity capital?

The requirement of the law is clear: the apartment must be in the common shared ownership of the entire family, including future children. The only question is the timing, and it depends on the specifics of the transaction.

Residential premises acquired (built, reconstructed) using funds (part of the funds) of maternal (family) capital are registered as the common property of parents, children (including the first, second, third child and subsequent children) with the size of shares determined by agreement.

clause 4 art. 10 of the law of December 29, 2006 N 256-FZ (as amended on March 18, 2019) “On additional measures of state support for families with children”

The law does not stipulate the size of shares. By default they are divided equally. For example, a family of four receives 1/4 of the right of shared ownership. If another child is born, they will be distributed 1/5. By agreement of the parents, this ratio can be changed: at least allocate the main share to one, and leave 1/1000 to the others. But it's not that simple.

The position of the authorities is that all family members have equal rights to maternity capital funds . This is a targeted subsidy, and the funds are government funds. Hence the conclusion: if you managed to buy an apartment for the amount of capital, then the shares are allocated equally to everyone. As for the rest of the money, there may be different rights to it.

An example from judicial practice. The apartment was bought with maternity capital (328 thousand) plus my husband’s money, which he received as a gift from his mother (3 million). This is his personal property, not joint property. In case of divorce, it is not divided in half with the wife. But the couple decided to divorce, and the wife insisted in court on dividing the apartment in equal shares with her and the children. The court did not agree with this and awarded the man a larger share. The rest - in proportion to maternity capital funds.

In an apartment purchased with maternity capital, according to documents, shares must be allocated to all family members

A common practice is to allocate the smallest possible shares to children. And here's why: if they have to change housing again, the guardianship service will make sure that their living conditions do not worsen. Officials will compare the total area and the size of shares in them. Any less and the exchange will not be approved. And if the services of a notary are required, small shares will save on fees. The minimum of each share is calculated according to the proportion: percentage of invested maternity capital in the total cost of the apartment / number of family members.

Adults can refuse their share - this is their right. But it’s better to do this after using the subsidy and completing all the documents for the apartment. The pension fund does not always approve such transactions and transfer money. The argument is the same: the money is public and must be spent according to the rules. Alternatively, the spouses can have their share in joint ownership, while each of the children has their own.

Children cannot be deprived of their share under any pretext. When they become adults, they will have the opportunity to manage their property independently. Until then, their rights must be respected by their parents. Including the right to a share in a shared apartment.

Features of apartment design in different situations

The basic rule is that shares must be allocated to everyone no later than 6 months from the time the right to do so becomes available. When purchasing an apartment, it is convenient to do this right away. In order for everything to go smoothly, the contract stipulates that the apartment is purchased as common shared ownership. And indicate the size of each share. Then Rosreestr will register everything. In other situations, the process and moment when the right arises depend on the form of the transaction.

It is advisable to determine the size of the shares of future owners immediately in the contract

Apartment with a mortgage

The mortgaged apartment is issued in the name of the borrower or together with co-borrowers (in our case, this is mom and dad). They are already the owners, but until the end of payments, the apartment will be pledged to the bank. It will not be possible to make transactions with her without his approval. This is all formalized by the following documents: a purchase and sale agreement between the seller and the buyer, mortgage and pledge agreements with the bank. The rights are registered in Rosreestr, and an extract from the Unified State Register is issued, where there will be a note about the encumbrance with a mortgage.

According to all documents, the mortgaged apartment will be owned, but pledged to the bank

The bank will not give permission to allocate shares to children in a mortgaged apartment. This is his guarantee: if the family does not repay the loan, the apartment is transferred to the bank, and it is simply impossible to evict the child owners - this will result in difficulties for the lender. But the requirements of the law must be observed. Therefore, after concluding all contracts, the mother must formalize an obligation to allocate shares to everyone.

If the matter comes to court, for example in a divorce, children are still allocated shares in the mortgaged apartment. The courts protect the interests of children and give priority to the law on state payments rather than to the interests of the bank.

From this moment on, you can use maternity capital. Moreover, in different options: as a down payment, to pay off payments, including on a mortgage taken out before the birth of children. The specifics depend on the terms of the bank and the agreement.

As soon as the mortgage is paid off, you need to contact the bank with an application. There they will issue a mortgage note with a note about the repayment of the loan. They go with her to Rosreestr or MFC. Or without a mortgage, but with a bank representative. There the encumbrance is removed, and that’s it - you can fully dispose of the apartment. All that remains is to allocate shares to the whole family.

Apartment under a shared participation agreement

At the construction stage, the apartment does not yet exist as a real estate object. There can be no right to it. Therefore, an agreement is concluded with the developer not for sale, but for equity participation (DPP). In the future, it will allow you to receive and register an apartment. If maternity capital is used, the contract can only be concluded with the mother or her husband. The law does not require that all future owners appear in the DDU, but the developer can include such a clause. If there is one, all family members will fit in.

The DDU specifies all the parameters of the future apartment from the address to the finishing.

The agreement is registered in Rosreestr. The mother formalizes an obligation to allocate shares to the family. Only after this can you manage the funds of the maternity capital.

When construction is completed, shareholders are notified of the need to accept the apartment. Specific deadlines are specified in the contract, and notification must arrive no later than a month before the delivery of the house. The apartment is accepted according to the act. When the house is put into operation, the owner will be issued a cadastral passport. Now you can register your apartment with Rosreestr and immediately allocate shares.

With a house under construction, there is always a risk that it will not be delivered on time. The six-month period for allocating shares begins to count from the moment the documents for the apartment are transferred. And not before. That is, not from the estimated period specified in the DDU.

If an apartment is purchased immediately under the DDU and with a mortgage, you must wait until all restrictions are completed before allocating shares. Previously, we paid off the mortgage - we receive the mortgage and are waiting for the house to be delivered. Previously, we accepted the apartment - we register ownership of the mother (or both parents) with an encumbrance.

Apartment through a cooperative

It all starts with one of the parents joining the cooperative and paying share contributions. There is no talk of ownership yet, but maternal capital can already be disposed of. It will be transferred to your membership based payments. You just need to write an obligation to allocate shares.

The cooperative buys an apartment for the family using common funds. It will be possible to move in, but register it in your name only after the cost of the apartment has been paid. When this happens, the shareholder will receive a certificate and, based on it, will register ownership in Rosreestr. At once for everyone.

Certificate of payment of share - a document on the basis of which the apartment will become the property of the family

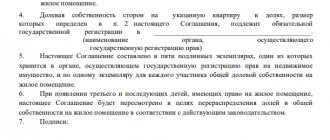

Obligation to allocate shares

A commitment is a written document by which the mother takes responsibility to allocate shares of the property when possible. A sample (text) of the document will be issued by the Pension Fund upon request. In general it is standard, only the details differ. There is no need to enter the specific size of the shares, because it can be revised, and other children may be born. It is important to clarify the moment from which the obligation begins: receipt of a cadastral passport, removal of an encumbrance, etc. It depends on the circumstances.

The obligation to allocate shares is drawn up by a notary

The obligation is certified by a notary. Only the mother signs it; the participation and presence of others is not necessary. The service costs 1,000 – 2,000 rubles. (depends on the region). The original document is given to the Pension Fund when an application for the use of maternal capital is submitted. You can keep a copy for yourself.

How to allocate shares for an obligation and subsequent children

From a legal point of view, there are two forms to transfer shares to family members:

- Owners agreement. It is concluded between all adults (mother, father and adult children).

The agreement is signed by all adult family members

- Donation agreement. According to it, the owner disposes of his part of the property. This is the only option if there is only one owner or one adult in the family.

The donor can be mom or dad

You can compose the text of the documents yourself or ask for help from the MFC. For such a service they charge about 1,000 rubles. For independent work, all that remains is the calculation and distribution of shares - no one will decide for the owners how best to do this. In both options, it is important to mention that the share is transferred upon fulfillment of an obligation, and not by personal decision. Otherwise, the obligation may be considered unfulfilled. And if the agreement can be rewritten, then the gift agreement cannot be canceled after registration.

If before the transfer of shares there was only one owner, you can go to Rosreestr and register new rights. The same applies to parents whose apartment is jointly owned (not in shares).

It’s more difficult when the apartment was bought by mom and dad in shares: notarization is still required. And this is not cheap: a notary will charge 500 rubles. duties + 0.5% of the cadastral value of the allocated shares + technical work. All this costs between 8 and 25 thousand. Not only the parents, but also the authorities considered this state of affairs unfair: they have to pay simply to redo the documents for their own apartment. In May 2021, amendments were made to the law on real estate registration (Article 5 N 76-FZ dated 05/01/2019). From July 31, 2019, shared owners will have the right to dispose of their shares without the participation of a notary. Simply through registration in Rosreestr with a contract or agreement.

Main types of encumbrances

The law provides for several types of encumbrances on real estate:

- For mortgage lending. In this case, all rights and opportunities to manipulate the apartment must be stipulated in the agreement that the citizen concludes with the bank. That is, it is the financial organization that can give or not permission to conduct any legal transactions with housing. First of all, for sale and purchase.

- Rent. Regardless of whether the maintenance agreement is permanent or lifelong, no one has the right to make real estate transactions until they receive the written consent of the rent recipient, certified by a notary, since the apartment becomes the property of the rent payer only if certain conditions are met. With a life annuity, this will be the death of the recipient of the maintenance, and with a permanent annuity, this will be the payment of the entire ransom amount.

- Seizure of real estate. Such an encumbrance becomes possible only after the court makes a decision on this issue. As a rule, the situation becomes possible after the appearance of serious debt to the bank or organizations providing housing and communal services. Accordingly, the right to dispose of housing comes after the repayment of debt obligations and a new court decision.

- Long-term lease agreement. This type of encumbrance, along with the previous one, is considered quite relative in the legal field. But, one way or another, it will not be possible to sell the property without resolving this issue between all parties (landlord, tenant and buyer).

- The presence of citizens who have permanent registration in the house. If such a situation arises, the apartment owner who wants to sell his property has the right to file a claim with the court asking for forced deregistration. However, for a positive decision in favor of the plaintiff, a number of requirements must be met. And if there are registered minor children, such a procedure becomes simply impossible.

- The property, which is intended for the transaction, is in disrepair. That is, it is unsuitable for living. In this case, the object (apartment building or apartment) is not important.

- Easement. This type of encumbrance is when third parties have the right to use the property. This encumbrance does not prevent transactions with real estate, but it cannot be alienated from the apartment without the consent of all persons involved in it. That is, when sold to another owner, the easement remains

- Use of maternity capital. This circumstance assumes that when purchasing real estate, a minor child automatically becomes one of the owners. And until he reaches the age of 18, housing transactions are impossible without the consent of the guardianship authorities.

Renting out real estate is a type of encumbrance

The presence of different types of encumbrances suggests that the methods of getting rid of them will be different.