The ability to use maternity capital when purchasing an apartment in a new building greatly facilitates the purchase of housing for young families.

In 2015, it became possible to use maternity capital not only to repay debt and interest on loans for the purchase of residential real estate, but also to pay the down payment for a mortgage. This program to support families raising children has been in effect since 2007.

It is worth noting that the government’s new initiative was received ambiguously by some developers. The fact is that attracting maternity capital to pay for the share participation agreement was associated with an increase in the responsibility of developers to shareholders. However, for conscientious companies this has never been a problem.

During the program, millions of Russian families were able to improve their living conditions. According to optimistic forecasts, its validity will be extended several times. However, you should not put off buying an apartment for a long time, counting solely on a “bright future.” Today there are many interesting offers on the real estate market, including >New Izmailovo and New Izmailovo-2, UP-quarter "Skolkovsky" and >UP-quarter "Western Kuntsevo". In general, you can use maternity capital when buying a home in any of the facilities being built.

Residential complex "Novoye Izmailovo"

Citizens of the Russian Federation have the right to a one-time receipt of maternity capital:

- Women who have given birth or adopted a child, starting with the second;

- Men who have adopted a child (starting with the second) and are raising him alone.

Simply put, second, third, etc. a child in the family gives the right to receive maternity capital. If for some reason the child’s mother is deprived of the right to use maternity capital, this does not mean that the child is deprived of financial assistance. The right to use maternal capital in this case passes to the father. If both parents are deprived of this right, the children themselves can use maternity capital.

Residential complex "Novoye Izmailovo-2"

The amount of maternity capital is indexed and reviewed annually. In 2015, the amount of maternity capital amounted to RUB 453,026.00.

The rules for using maternity capital are also periodically adjusted, which is due both to the imperfections of the original version of the rules and to the fight against misuse of budget funds.

How to give children property rights to use maternity capital?

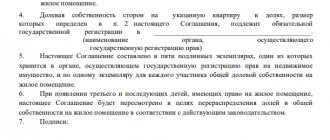

If the apartment was purchased as a common joint property, then the agreement can be in simple written form (not notarial). If upon purchase you immediately allocated shares, then subsequent operations (including donation, sale) can only be carried out under a notarized transaction, and this point can be skipped.

First of all, we draw up a share donation agreement.

The above agreement is as simple as possible, which has its advantages - there is less chance of making a mistake, which means there will be less need to go to the MFC. It is better to print the contract on one page, so as not to stitch it and not to certify it, which is why we have removed many provisions from the contract that are already in force by law and do not need to be included in the contract.

Also, lawyers often draw up an act of acceptance of the transfer of shares. But since this is a transaction with one’s own children, it does not play a special role, and there is no need to provide it for registration. It is most important to fill out the contract without errors and clerical errors in order to avoid suspensions and refusals in registering the transfer of rights.

After signing, you submit this agreement to Rosreestr through the MFC to register the transfer of rights. After receiving the documents from Rosreestr, you can celebrate the “equator” - you are halfway there.

Possible liability

After the transaction and the transfer of funds to the seller, Pension Fund employees can monitor the fate of the sold property for some time, for example, check whether all family members were actually included in the list of shareholders, and whether the family actually lives in the purchased property (by the way, residence is not required condition). If it turns out that the alienation turned out to be fictitious, and its purpose was to cash out and receive funds from maternity capital, the case materials will be transferred to law enforcement agencies to initiate a criminal case on the fact of fraud.

Let us highlight two main provisions:

— you can apply for a certificate from the Pension Fund of the Russian Federation (PFR) directly to the territorial division of the PFR or through multifunctional centers (MFC) of your city;

— from the documents you must provide: an application, a passport (or other document confirming your identity and place of registration), birth (adoption) documents in relation to the child (children), in connection with whose birth (adoption) you are applying for the issuance of maternity capital; a document confirming that the child has Russian citizenship; if documents are submitted through a representative - a notarized power of attorney.

You can also receive an application at the MFC - it is prepared by an employee. The main thing is to collect all the necessary documents.

Please note that at first the Pension Fund will only issue you a certificate for receiving maternity capital. To use this certificate and receive money, you will have to contact the Pension Fund with an application during the transaction itself.

It is impossible not to note the following conditions regarding the purchased apartment:

- housing is purchased for the whole family;

- the apartment (like the house itself) should not be in disrepair;

- the apartment should not belong to your closest relatives;

- all payments for the transaction must be made in cashless form;

- At the time of contacting the Pension Fund of Russia, the transaction for the purchase of an apartment must be registered with Rosreestr.

Perhaps many will ask numerous questions regarding the last point - we can’t blame you for that. But this works in practice, because if you request financial capital before registering a transaction, you may be refused. The Pension Fund is primarily concerned that the funds are used to purchase the initially agreed upon property, and that parents do not change their minds at the last moment or buy another apartment, the purchase of which the Pension Fund did not approve.

But don’t be alarmed - often all mutual settlements in such transactions are made after the agreement is registered, so you only need to worry about the patience of the seller. Otherwise, you can provide for an installment payment, deferment of payment of part of the amount, or simply repay part of the loan amount for the apartment with maternity capital.

Now you need to find an apartment and contact the seller to agree on the transaction, check all the documents, and also discuss the terms of the transaction. Such things are trivial, so we will not dwell on them, but we will note important points about the transaction.

Firstly, the purchase and sale agreement must contain a condition that part of the price is paid from maternity capital;

Secondly, children must appear in the sales contract as parties to the transaction;

Thirdly, you need to carefully check all the documentation provided by the seller, and if something is missing, request it.

Is it possible to buy a house or apartment from a relative for maternity capital?

Photo by Pexels

The procedure for providing state support measures in the form of maternity capital funds is regulated by the Federal Law of December 29, 2006 No. 256-FZ “On additional measures of state support for families with children.” In particular, Part 3 of Article 7 of this regulatory document provides a list of possible options for the direction of MK, one of which (clause 1) is improving housing conditions.

And Article 10 of this law establishes in detail the types of improvement of living conditions of families with children for which maternal capital can be used. According to the law, it is permissible to purchase residential premises through any civil transactions, if they do not contradict the law.

That is, the law does not contain a direct prohibition on purchasing housing from a relative using maternity capital , but there are a number of conditions that must be met in order for the transaction to be recognized as legal.

The law describes a number of conditions for conducting a transaction for the purchase/sale of housing using maternity capital. Including:

- the premises must be residential, not dilapidated or in disrepair, and have communications;

- real estate must be located on the territory of the Russian Federation, and you can buy housing in any region; it is not necessary to purchase it at your place of registration;

- within six months after the transaction or removal of the encumbrance (in case of purchase with a mortgage), the housing must be registered as shared ownership, shares are allocated in proportion to the cost of housing and funds invested at the expense of maternal capital;

- the parties do not have mental disorders and are legally competent (both the seller and the buyer).

The law does not contain requirements regarding the category of sellers for such transactions, which means that the Pension Fund of the Russian Federation has no grounds for refusing to transfer MK if family ties of the certificate holder with the real estate seller are discovered.

How to find out whether maternity capital was used by the seller when buying an apartment?

First of all, you can look at the passport of the apartment seller and find out how many children he has. If there are two or more people and the apartment was purchased after 01/01/2007, then there is a high probability that part of the money was paid from maternity capital. This is often written about in the apartment purchase agreement itself. Nevertheless, there are situations when an apartment was purchased on credit and the financial capital was used to repay this same loan after the conclusion of the purchase and sale agreement. In this case, the contract is unlikely to mention maternity capital. If the children do not have property rights and the seller swears that he did not take maternity capital, then to confirm his words he can provide you with a certificate from the Pension Fund stating that the certificate for maternity capital was not really issued or, for example, was used for other purposes . But if the seller does not want to provide such a certificate, this is a reason to think about his integrity and refuse to purchase this apartment.

Is it possible to buy a share of housing from relatives for maternal capital?

The law does not contain an unambiguous answer as to whether it is possible to purchase shares of a residential building or apartment on a residential property; however, the answer to this question is indirectly formulated in the legal act: the object of a purchase and sale transaction can only be residential premises. Now let’s look at the definition of the concept of “residential premises” according to the Housing Code: residential premises are isolated premises suitable for citizens to live in.

Pexels Photos

That is, there is no talk about shares directly in the law, as well as a direct prohibition on purchasing a share. However, it is worth paying attention to the concept of “isolated”. That is, the acquisition of a share is actually allowed if its size suggests the possibility of allocating in kind an isolated part of the property. Those. in practice, it will not be possible to purchase ½ of a one-room apartment, since it is impossible to insulate half of the room. But with private houses the situation is simpler: here you can organize a separate entrance for almost any room, and sometimes it even exists, it’s just not decorated. As practice shows, when purchasing a share, it is enough to indicate that you are purchasing an isolated premises. A housing plan is attached to the contract, and the contract specifies which rooms are allocated to the buyer during the transaction. If in fact the house is for two owners, but in fact it is shares, then buying half is also possible: the contract is accompanied by a building plan and an explanation that the housing has a separate exit and is isolated from neighbors.

It is also possible that one of the parents who owns an apartment complex is the owner of a share in the apartment, and the owner of the other share is the child’s grandmother or grandfather or another relative). In this case, a citizen has the full right to purchase a share (for example, a room) in an apartment or house, provided that after the transaction they become the sole owners of the property (or, at a minimum, the acquired share can be allocated in kind, for example, as a separate room) .

In addition, a share from relatives can be purchased with maternity capital, even if the family has previously lived in the apartment it is buying. After the acquisition, parents and children become full owners, thus, it turns out that the family’s living conditions are improved, therefore the main condition for purchasing housing for MK is fulfilled.

Let's summarize briefly:

- You must fall under one of the categories of persons entitled to receive maternity capital;

- To obtain maternity capital, you must contact the Pension Fund (the easiest way to do this is through the MFC) with an application and attach the necessary documents;

- At the time of filing the application, the transaction must be registered with Rosreestr;

- After receiving the certificate, make sure that the child has a minimum share;

- Purchase a new home with a child participating in the transaction;

You can learn how to sell an apartment correctly from the second article, which touches on the topic of maternity capital, but it is important to know: in the contract for a new apartment, the child must appear as the buyer of a share exceeding the current one. From the example - 57/1000, which means in the new one it could be 80/1000, etc., but this condition must be met.

Questions? Leave a request for a consultation and we will tell you in more detail.

more than 15 years of experience in court . We have something to share with you.

Contact us. Our contacts and work schedule are here.

Legislative acts and latest changes for 2021

According to current legislation, maternity capital can be used after the child reaches the age of three, if we are not talking about repaying an existing mortgage loan. All financial transactions with MK are carried out only in non-cash form. The money is transferred to the bank account of the lender (if MK covers a mortgage or other loan), or the certificate owner himself (if MK covers the costs).

Federal Law N256-FZ regulates the list of purposes for which a family has the right to spend government assistance. Goals:

- improvement of living conditions;

- acquisition of real estate;

- construction or reconstruction of housing (on your own or under a contract);

- payment for children's education;

- making a down payment for a mortgage, etc.

A common way to spend subsidies is to buy an apartment. About 2/3 of all households use money in this way.

A family can get a discount on purchasing a home through the process of doubling maternity capital, which is used by many organizations as a publicity stunt. But the legislation does not contain any information about a possible increase in family subsidies.

The amount allocated to a family under the maternity capital program is fixed and increases only by government decision. So in 2021 it will be 466,617 rubles. for the firstborn and another 150,000 rubles. for the second child.

Ways to double your capital

Some developer companies accredited to work with maternity capital offer special discounts for young families.

Apartment purchase

Advantageous offer to “double” the mat. capital - purchasing a large multi-room apartment on credit. In this case, the state subsidy is used to pay off the down payment, and the buyer will only need 500,000 rubles to buy the apartment without financial costs. For large families, this is the best possible option to use maternity capital, since children will need their own rooms in the future. And also the funds saved on the mortgage will be useful for household needs in the future.

Legal advice

Recommendations from lawyers on any topic related to property transactions always focus on the same thing: you must carefully select the developer with whom you plan to enter into a transaction. And if he also offers a lucrative deal, you need to be doubly careful, because there is a possibility that the purchased property will turn out to be unfit for habitation.

To avoid becoming a victim of speculators, you need to consider the following:

- The developer must, upon request, provide permits for state accreditation of construction work, as well as a document confirming the right to land (a deed of land ownership or a purchase and sale agreement for a plot).

- It is recommended to read comments and reviews of people about the company on the Internet. Conscientious developers usually have a certain client base, which in reviews will tell about their personal experience with the developer.

- You need to study the company's latest projects. If the developer has not yet delivered the house, the construction of which began many years ago, then it is not safe.

Even if there is no doubt about the developer’s integrity, the client may face the following problems:

- The Pension Fund of the Russian Federation may refuse to dispose of maternal capital;

- home loans are subject to high interest rates;

- some companies may offer an illegal scheme to sell public funds before the child turns 3 years old. You should beware of such schemes, since they violate the law and threaten the customer with criminal charges.