Maternity capital is significant assistance from the state that families receive when children are born. Most families use this money to purchase a new home. After the purchase, the question arises about obtaining a tax deduction, and here the happy new residents receive a refusal. In this article we will figure out why this happens and what you need to know if you want to use maternity capital to buy an apartment.

Why they may refuse and what to do in this case

According to the law, credit organizations cannot refuse to accept MSK in payment of debt on a mortgage loan. However, the application may still be rejected if there is no approval from the Pension Fund, due to an incomplete package of documents or if they contain errors.

Result: The pension fund refused. Why might this happen?

- The owner for some reason has lost the right to use the certificate

- Some documents are missing or errors were found in the documents provided. Add whatever is required to your application and resubmit.

- Real estate purchased with borrowed funds is classified as dilapidated or dilapidated housing (that is, there are doubts that the purchase contributed to the improvement of living conditions).

- Housing belongs not only to the certificate holder and his spouse, but also to someone else.

If you do not agree with the decision, then you have every right to appeal it in court or appeal to a higher authority.

Alina and Sasha did not have any problems during the paperwork process, and on July 10, the amount of maternity capital was credited to the CHD account, thanks to which the guys reduced the loan term by 3 years and will ultimately save 857,122 rubles on the purchase of an apartment (which, by the way, just over 13%).

Is it possible to get a deduction if maternity capital covered only part of the expenses?

In this case, you can receive a deduction, but only for that part of the expenses that you paid from your own savings. Don’t forget to subtract maternity capital funds from the total amount of expenses and claim the rest for deduction.

Examples:

The Semenovs became parents of many children and, having received maternity capital, bought a house outside the city. They did not invest their own money, all expenses were covered by maternal capital, so the Semenovs will not be able to receive a tax deduction for the purchase of housing.

The Mikhailovs bought an apartment in a new building for 4 million rubles. They covered part of the costs with maternal capital (600 thousand rubles), and the rest was their own savings plus a mortgage. The Mikhailovs will be able to receive a deduction from the amount of expenses paid with their own money, that is, from 3.4 million rubles. (4 million rubles - 600 thousand rubles).

Removal of encumbrance if the mortgage is completely closed

For my friends, this information is not yet relevant, but it may be useful to you - when the mortgage is completely closed, you need to request a confirming certificate from the bank and contact the Rosreestr branch or the MFC to remove the encumbrance on the property.

The removal of the encumbrance can be clarified on the Rosreestr website a week after submitting the application (about how long the information is updated). Read more about how to remove an encumbrance here.

VTB is the first to launch online mortgage repayment using maternal capital

VTB clients were the first to have the opportunity to manage their maternity capital to pay off their mortgage online. You can now submit an application without visiting a branch.

To apply for repayment of part of the mortgage using maternity capital, VTB clients now only need to fill out a pre-filled application in the “Public Services” section in the Internet version of VTB Online. The bank will send it to the Pension Fund of the Russian Federation to transfer the maternal payment to repay the loan. By connecting SMEV, the entire process from the moment of filing an application to the crediting of maternity capital is halved and will now be less than two weeks. By the end of summer, the service will be available in the mobile version of the VTB Online application.

The new system will be especially convenient in cases where maternity capital goes to the mother’s account, and the mortgage is registered in the name of the child’s father. Even in such a situation, a visit to the office is not required if both spouses are VTB clients. The status of the completed application can also be tracked in VTB Online in real time.

“Receiving social benefits in our country is becoming more and more accessible to the population. Now, for many of them, you do not need to independently collect a package of certificates and submit a written application to government agencies. Obtaining a maternity capital certificate is a striking example of the digitalization of this process. A message about the opportunity to use it is sent to parents proactively on the government services portal after the birth of the child. You can manage funds by contacting the bank directly, and now also by registering it directly in the mobile application, without visiting a branch. Thus, the issue of obtaining maternity capital funds will be significantly simplified for parents,” comments Alexey Sklyar , Deputy Minister of Labor and Social Protection of the Russian Federation.

“VTB’s strategic goal is to digitalize the most popular services among the population. That is why we are the first bank to transfer the process of receiving maternity capital funds to pay off a mortgage completely online. Family mortgages in Russia are now receiving an additional boost due to the expansion of the state program. We consider this area to be extremely promising and today we are ready to offer a new service to all our clients. Of course, it will be especially relevant for young mothers, who often have no time to come to the bank’s office in person,” comments Anatoly Pechatnikov, .

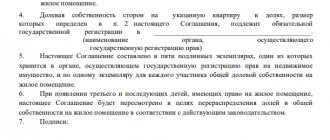

Allocation of children's shares after closing the loan

After the encumbrance is removed, you will have six months to allocate shares in the purchased property to your children.

There are no clear rules establishing the size of shares. But if they are unreasonably small, the owners in the future may have a reason to go to court regarding their redistribution.

Therefore, the safest option is to allocate shares in proportion to the amount of the certificate divided by the number of family members.

The fulfillment of this obligation is controlled by the pension fund, guardianship authorities and the prosecutor's office. Violation can lead to serious consequences, including:

- you will have to return your “mother’s” money to the state;

- further transactions for the sale of housing will be canceled, and buyers will be deprived of ownership rights or will be required to allocate shares to other people’s children.

How to use maternity capital for a mortgage

Money allocated by the state as part of the social program to support families can be used in the following areas:

- Make a down payment. Maternity capital can be used if the family does not have the funds for the down payment on the mortgage, which is usually 15% of the cost of housing. However, not all banks allow the use of a certificate, and the lack of initial savings can become an obstacle and limit the purchase of an apartment. The “Mortgage with Maternal Capital” program from “Rosbank Dom” provides the opportunity to use public funds for a down payment, and it can be 10% lower compared to the terms of standard programs.

- Pay off interest and some of the mortgage debt. It is necessary to notify the credit institution of your desire to partially repay the mortgage early and write a corresponding application to the Pension Fund. The state will transfer the funds to the bank within 1 to 2 months.

- Pay off the balance of the mortgage with maternity capital. Before paying off the remaining balance of the debt, you need to find out from the bank whether there is a fee for full early repayment. If it is not available, you can use maternity capital for a mortgage; to do this, you should contact the Pension Fund with a request to transfer funds to the bank.

Credit organizations may establish a number of restrictions on the implementation of state benefits for repaying a mortgage loan. You should learn more about the conditions for using the certificate from a representative of a particular bank.

What are the risks?

Maternity capital is a really good measure of support. Thanks to the certificate, you can reduce the monthly burden on the family budget and even close the loan completely ahead of schedule.

However, it is worth assessing not only the savings, but also the possible risks.

Reducing the amount of tax deduction

A 13% tax deduction is allowed only on the amount of personal expenses for the purchase of real estate, which is not maternal capital. Therefore, if you have already issued a refund, then the interest received from the MSK amount will have to be returned.

Difficulties in selling real estate

It is more difficult to sell housing in which shares are allocated to children. If there are minors in the family, then the consent of the guardianship authority will be required to conclude the transaction. If you cannot convince officials that the children will receive at least equal shares in other housing, then you will have to forget about the sale.

A tax deduction is not a “gift” from the state

For some reason, many people believe that a tax deduction is a “bonus” that you can get for nothing. But this is a mistake. A tax deduction temporarily exempts you from paying income taxes or allows you to get back the amount of tax you previously paid. This follows the basic rule: in order to receive a deduction, you must pay tax.

Let us remind you that in order to receive a tax deduction you must pay tax only on certain types of income and only at a rate of 13%.

You can receive a deduction if you:

- you receive an official salary (that is, you work under an employment contract or a civil law agreement has been concluded with you);

- rent out your own property or sell it;

- provide various services and receive compensation for it;

- you have other income taxed at a rate of 13% (which is included in the calculation of the deduction).

Please note that tax is not paid on government benefits, payments, pensions, etc. Matkapital is also not subject to tax; when you receive it, you do not need to pay personal income tax on it. At the same time, maternity capital money is actually state money, not yours (earned), and a tax deduction can only be obtained from your own funds spent on the purchase of an apartment.

Using maternity capital for a mortgage: what documents are needed

The set of documents for obtaining a loan using a certificate differs slightly from the standard one. The process of collecting them is divided into two stages:

- submitting an application to the bank;

- concluding a purchase and sale transaction and issuing a mortgage loan.

At the first stage, the borrower will be required to:

- passports;

- children's birth certificates;

- income certificates;

- a certificate from the Pension Fund about the balance of maternity capital in the account;

- state certificate;

- photocopies of work records and contracts of both or one of the parents;

- confirmation of registration of the main borrower in a constituent entity of the Russian Federation;

- application form.

At the second stage, after receiving bank approval for the loan, you need:

- real estate documents;

- appraiser's report;

- insurance of property (and, perhaps, health and life of the main borrower);

- a written obligation of parents to allocate shares in the purchased housing to children, certified by a notary;

- contract for the sale and purchase of a house or apartment.

What kind of housing can you spend maternity capital on?

The procedure for registration and implementation of targeted financial assistance to families with a child is strictly controlled by the Pension Fund. Answer to the question “Is it possible to use maternity capital for a mortgage to purchase a house or dacha in a rural area?” will be ambiguous.

The state imposes strict requirements on the property it helps purchase:

- housing must be located on Russian territory and have an address;

- the house must be suitable for living all year round;

- a private home must have electricity, heat and other amenities;

- the object should not be old, dilapidated or in disrepair;

- It must be possible to register in an apartment or house.

If the above conditions are met, you can use maternity capital for a mortgage to buy not only an apartment, but also a dacha or a house in the village. Each property purchased through a mortgage loan and with the help of government support is strictly checked by the bank and the Pension Fund.