Who can receive maternity capital

Maternity capital is also called family capital, therefore, contrary to the opinion of many, mothers, fathers, and even children in exceptional cases can receive it. For maternity capital, you need to obtain a special state certificate from the Pension Fund of the Russian Federation - if you have it, you can request money from the budget for certain purposes .

You can receive this state support in the following cases:

- The woman gave birth or the family adopted the first child after January 1, 2021, or the woman gave birth (the family adopted) the second, third and subsequent children after 2007.

- The man became the sole adoptive parent of a child after January 1, 2020, or adopted a second, third, etc. child in 2007 and later.

- If a woman loses the right to maternity capital, the right to dispose of the certificate passes to the father. For example, if the mother is deprived of parental rights, loses legal capacity, goes missing or dies.

- Even children can receive and spend maternal capital, but this is only possible if both the mother and father lose the right to dispose of it or are unable to do so. For example, in the event of the death of parents or deprivation of their parental rights. In this case, children must be under 18 years old or 23 years old if they are studying full-time. If there are several children, the money is divided between them in equal shares.

- In case of divorce, maternity capital is not divided between spouses . Even if the child remains with the father, the mother retains the right to dispose of the entire amount of capital.

- You can receive a certificate from the day of birth or adoption of a child. It does not matter what the age difference is between the children of the family. For example, if the eldest child has already reached adulthood, maternity capital for the newborn is still relied on in the same amount as for the second child.

- To receive state support, it is important that the woman (man) and child have Russian citizenship at the date of birth (adoption). It is also important that the parent is not deprived of parental rights.

What you need

To use maternity capital to pay off a mortgage, you need to obtain a Certificate from the Pension Fund. To do this, you need to submit an application to the Pension Fund, MFC or submit an application in your personal profile on the State Services portal.

In addition to the application, the following documents will be required:

- Passport.

- Birth certificate.

- Power of attorney, if the certificate is received by an authorized person.

As soon as the Pension Fund approves the issuance, the certificate will be automatically generated and sent to the user’s personal account on the Pension Fund website (pfrf.ru) or the State Services portal (gosuslugi.ru).

The amount of maternity capital in 2021

Maternity capital is indexed every year by a percentage equal to officially registered inflation. For example, from 2021 the amount of state support will increase by 3.7%. The amount of maternity capital depends on the date of birth of the child and the total number of children in the family.

| 2019 | 2020 | 2021 | |

| Maternity capital for 1st child | — | 466 617 | 483 881,83 |

| Matkapital for the 2nd child | 466 617 | 150 000 | 155 550 |

| Maternal capital for the 2nd child, if you did not receive money for the first | 466 617 | 616 617 | 639 431,83 |

Some constituent entities of the Russian Federation provide for regional maternity capital, which is paid from local or regional budget funds. Sometimes you can get it even if you do not have the right to federal maternity capital. To find out whether such support is available in your region and how to use it, study regional legislation.

How long is the unused part of maternity capital stored?

To obtain the right to maternity capital, it is necessary that the child who gives the right to the certificate be born before December 31, 2021. There are no time restrictions for obtaining the certificate and disposing of maternity capital funds: this can be done in five years, ten years, and later. The only restriction regarding the use of maternity capital funds is that if they are used to pay for a child’s education, the child’s age should not exceed 25 years. In other cases, families with a certificate in hand can use maternity capital funds at any time, regardless of the completion of the program or its extension.

How to get maternity capital

In 2021, it will be easier to receive and spend capital. Thus, the decision to issue a state certificate will be made in 5 working days, and not in 15, as now. An application for the use of maternal capital will be reviewed in 10 working days instead of a month, and the money will be transferred within another 5 days.

You can receive a certificate upon application or without an application. Without applications, certificates are issued for children born after April 15, 2021. In this case, the registry office itself transmits the data to the Pension Fund; parental participation is not required. But we still recommend calling and checking the process, as the system may malfunction. Previously, parents had to submit an application, collect documents and personally visit the Pension Fund or MFC to obtain a certificate.

For whom is this possible?

Repaying a mortgage early or on time with MK funds is possible for all borrowers who are eligible to receive government support. This can be done without waiting until the child turns 3 years old.

Moreover, it does not matter to whom the certificate is issued, to a spouse. For example, if the title borrower of the mortgage is the spouse, and the spouse received the certificate, they can repay the mortgage in the standard way. This is possible if the spouses are officially married.

When and how can you spend your certificate?

According to standard rules, maternity capital can be used three years after the birth of the child for which the certificate was received. But the law provides for a number of exceptional cases in which money can be spent even immediately after birth: a down payment or paying off a mortgage debt, paying for kindergarten, Putin payments, buying things for the social adaptation of a disabled child.

After the child turns three years old, it will be possible to buy a home without a mortgage, build a house, pay for a private school, clubs, university, or use the money for the mother’s pension.

You cannot spend maternity capital for other purposes; cashing out is also prohibited. For spending funds on buying a car, renovating a house or updating furniture, criminal liability may be imposed under Art. 76.2 and 159.2 of the Criminal Code of the Russian Federation.

The entire maternity capital can be divided, rather than spent on one goal. For example, give 50,000 rubles to pay for an art school, 300,000 to pay for a university, and save another 100,000 for your mother’s pension.

An application for the use of maternity capital must be sent to the Pension Fund in person, by mail, through the MFC, through government services or the Pension Fund website. You need to attach a passport and a number of other documents to it, the list of which depends on the purpose of spending the maternity capital.

About full and partial repayment

If your mortgage debt balance is small and MK capital is enough to completely close it, you can do this. You can use the entire MK or part of it. In financial terms, you will gain a little, because with a small balance of debt with an annuity, the main interest has already been paid and the money will be used to repay the loan body. But you will be free of debt and will be able to think about further acquisitions, for example, taking out a loan to buy a car.

If the mortgage was issued not long ago and the debt is large, you can make a partial repayment of the mortgage with maternity capital. This will reduce overpayments under the contract. The payment schedule will be recalculated for you. You can shorten the loan term or reduce the amount of the monthly payment, pay interest on the use of borrowed funds. To calculate which is more profitable, you can use an online mortgage calculator. Practice shows that if the mortgage was issued recently, then it is more profitable to use microcredit to reduce the loan term.

Early repayment of the mortgage with maternity capital must be carried out in accordance with the bank's requirements for early repayment of the loan. Typically, the borrower must notify the lender of his intention at least 30 days before the expected payment date.

Using maternal capital to improve living conditions

The most common use of maternity capital is a down payment on a mortgage or repaying part of the debt on a home loan. From 2021, you will be able to apply for the use of maternity capital for these purposes directly at the bank. The credit institution itself will transfer all the information to government agencies, so you can do without unnecessary visits to the MFC or Pension Fund. However, not all banks accept such applications, so please consult by phone in advance.

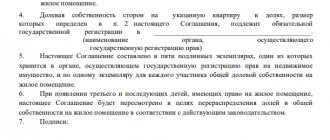

Keep in mind that one of the main conditions for using maternity capital to improve housing conditions is the registration of the acquired real estate in the common shared ownership of the family . The shares must be received by the owner of the certificate, his spouse and all children. From 2021, the agreement on determining the size of shares does not require notarization.

Maternity capital does not insure against risks that may arise when purchasing real estate. To protect yourself, check the apartment for liens, liens and other encumbrances. A report based on an extract from the Unified State Register will help with this. It can be ordered around the clock in the EGRN.Reestr and received within 0.5-6 hours. a report based on the USRN extract in PDF format by email

Text: Elizaveta Kobrina

Procedure and required documents

How to repay a mortgage with maternity capital - step-by-step instructions:

- You can receive a certificate for MK in electronic form.

- Contact the creditor bank for a certificate of the balance of the debt.

- Write a statement to the Pension Fund about the order of the MK.

- Submit an application to the creditor bank for early repayment of the mortgage, indicating how to recalculate the schedule.

- After the funds are transferred, the bank will make the necessary transactions.

- The borrower visits the credit institution to obtain a new schedule or certificate of final repayment of the loan.

Today, in order to repay the mortgage loan from Sberbank, VTB, Rosselkhozbank and a number of other credit institutions, there is no need to visit the Pension Fund. Everything can be arranged at the creditor bank. The bank carries out all requests to the Pension Fund independently.

An application for early repayment can also be submitted online, in your personal online banking account or mobile application. There you can get a new schedule or check that the debt is fully repaid.

If you complete the transaction online, you will not need to collect documents to pay off the mortgage with maternity capital. When registering offline, take your passport and child’s birth certificate with you to the PF.

Samples and procedure for drawing up applications

Sample applications can be viewed and downloaded on the PF website.

From what point is the use of funds allowed?

Article 7 of Federal Law No. 253 indicates the main terms for the use of state support for large families:

- The most common is the disposition of financial support 3 years after the appearance of a minor in the family. Then one of the adult family members must go to the Pension Fund and submit an application with supporting documents.

- If a child does not have parents or they do not have parental rights, then he remains in the care of the state and has the right to independently receive maternity capital. The funds will be at his disposal upon reaching 18 years of age .

The only exception is specified in clause 6.1 of the law on maternal capital. If a family lives in unsatisfactory housing conditions and can document this, they will receive social benefits. help at any time. In this case, the funds are used either to repay mortgages and loans, or to compensate for activities already carried out.

The main inconveniences with receiving maternity capital after 3 years

The government's decision to issue capital only after 3 years of waiting is due to the lack of reasons for early investment among most families. For example, it is allowed to be spent on the funded part of the mother’s pension, which is not an urgent need.

In fact, some families experience inconvenience due to the inability to receive funds immediately after the birth of the child, including:

- if parents are in a difficult financial situation and would like to use part of the maternity capital for daily needs;

- since social assistance is provided to the whole family; it can be used for the education of the eldest child, but it is not always possible to wait 3 years.

Articles 10-12 of the Federal Law define 4 main purposes for using maternity capital:

- Education of any of the children.

- Improving the condition of the property or purchasing a new living space.

- Increasing the funded part of a woman’s pension.

- Payment for activities aimed at the social adaptation of disabled children, approved by their attending physician (introduced in 2016).

In 2021, the government is discussing new areas of application of maternity capital. Among the options are the purchase of a car, payment of a car loan, payment for the services of individual entrepreneurs, including private nannies and kindergartens, and other services for the supervision of minors.

The expansion of the scope of use of maternity capital until the child reaches 3 years of age . For example, one of the arguments is the opportunity to spend money on children’s education. If the family is forced to wait until the minor’s third birthday, they will not be able to pay for the nursery. Also, it will not be possible to spend money on training an older child if he is already studying on a paid basis.

The law allows funds to be spent on construction, improvement or reconstruction of property only after 3 years , while the family is forced to live in uncomfortable conditions.

The only thing the government provides in case of reconstruction or construction of a house is compensation. If parents can document the work or purchase of materials (for example, by keeping receipts), then after 3 years the state will pay the amount for the costs incurred. In this case, it is also necessary to submit the application to the Pension Fund.

In what cases is it prohibited to spend immediately?

If a family has taken out a consumer loan, the document must indicate that the funds will be used for the purchase or construction of real estate. In cases where parents took out a loan to improve their living space, but this is not indicated in the papers, the application for maternity capital will be rejected. It is recommended to clearly separate consumer and targeted lending , as well as specify the intended purpose of funds in contracts and sales transactions.

Transactions for the purchase and sale of property in installments are not grounds for the premature use of capital. It does not matter whether the family uses mortgage financing or not. Only those contracts under which parents borrow money are considered.

In some situations, a family cannot take out a mortgage and must use a consumer loan to improve their living conditions. For example, a small official income may cause a mortgage loan to be rejected. However, for the Pension Fund this will not be the basis for issuing maternity capital. Using funds for early repayment of consumer loans is a violation of the law .

Repayment of principal and interest

The first step to receive funds ahead of time is to collect and submit documents to the Pension Fund. Branch employees decide whether to approve or reject an application, so it is recommended to document the grounds and purpose of using maternity capital.

Decree No. 862 of 2007 regulates the list of mandatory documents. They can be supplemented depending on the purposes for which the funds are taken. The law allows you to immediately receive capital in order to pay off your mortgage . In order for the Pension Fund to confirm the legality of the actions, the applicant brings the original and a copy of the mortgage loan agreement. The organization then transfers the established amount to the bank.

The Resolution stipulates that any legal transaction involving real estate is considered the basis for the issuance of maternity capital. For example, a family can join a housing cooperative, participate in shared construction, or buy property.

The list of documents varies depending on the type of transaction. Each applicant will need to provide:

- a copy of the loan agreement with the bank;

- a certificate from the financial institution about the balance of funds and interest debt that the applicant is obliged to pay;

- a copy of the property pledge agreement that has passed state registration;

- a certificate from Rosreestr, which confirms the applicant’s right to real estate (if the apartment is located in housing under construction or finished housing);

- any papers that confirm the applicant’s right to real estate under construction, including: an agreement and a copy of shared construction;

- if mortgage lending was used to repay the share or entrance fee, then a certificate from the register of members of the cooperative;

- a certificate of the applicant’s obligation to include each family member in the share, including minor children;

- if the house is not yet in use, then a certificate of permission to build your house.

A complete list of documents can be obtained from a Pension Fund employee. If additional paperwork is required, the applicant will be notified within 10 days . When MK funds arrive in the financial institution's account, the monthly mortgage payment will be reduced.

It is important to take into account that maternity capital for building a house is allowed to be used only if the family already has a plot of land. Parents will receive funds ahead of schedule provided they attract mortgage lending if there is an agreement with the bank. The purchased property must be located on Russian territory.

Methods of use for building a house

Documentary confirmation of all actions is the main condition for the early use of MK for building a house. All papers are given to the Pension Fund employee. There are 4 ways to build a house using social support, but it is not always possible to receive funds immediately:

- Construction of property without contacting specialized organizations. If a family has the means, knowledge and their own plot of land, they have the right to carry out all the work independently . To do this, the applicant must go to the city's Architectural Institution and obtain a building permit. This certificate is submitted to the Pension Fund. However, compensation for construction is allowed only after 3 years .

- Real estate construction when working with a contractor. Working with professional builders, the family receives a guarantee of the quality of the work performed. However, the Pension Fund will take several months to transfer family support to its account. In the contract, the contractor must agree to carry out construction work without waiting for funds to be received. In this case, maternity capital is allowed to be received ahead of schedule .

- Repayment of a mortgage issued for the construction of real estate. The main condition is the intended purpose of the loan . The Pension Fund transfers the capital to the account of the financial organization. Microfinance institutions do not participate in the social program. assistance to the population. Repayment of a consumer loan with MK funds is not provided. In this case, funds are also issued ahead of schedule .

- Compensation for funds used for real estate construction. The applicant brings to the Pension Fund documents confirming the amounts spent and receives a refund using the specified details. Compensation is possible only when the child reaches 3 years of age .

What is maternity capital and why is it needed?

In the same year, the Federal Law “On additional measures of state support for families with children” was adopted in Russia; it was this law that provided for maternity (family) capital - federal budget funds transferred to the budget of the Pension Fund of the Russian Federation for the implementation of additional measures of state support for families, having children. The program has been in effect since January 1, 2007 and, prior to the amendments proposed by the president, was calculated until December 31, 2021.

According to the legislator, such additional measures should provide families with children with a number of opportunities, including:

• improvement of living conditions; • getting an education; • social adaptation and integration into society of disabled children; • increasing the level of pension provision.

Scheme of work of a cooperative with maternity capital

Since until the child reaches 3 years of age, with whose birth the family has the right to maternity capital, the funds can only be used to repay a loan or a loan for the purchase/construction of housing, cooperatives operate according to the following scheme:

- The owner of the certificate becomes a member of the CCP;

- Selects an object that he plans to purchase using maternity capital funds;

- Fills out an application for a targeted loan for the purchase of finished or construction of new housing;

- The credit committee of the cooperative makes a decision on the application; if approved, the funds are transferred to the borrower’s account;

- The borrower enters into a transaction and, after the transaction, submits an application to the Pension Fund of the Russian Federation for the disposal of maternity capital funds, in which he asks to send funds to repay the targeted loan to the cooperative;

- The pension fund considers the application, if approved, sends MSK funds to the cooperative - if the debt under the loan agreement is equal to the balance of MSK funds, then the agreement will be fulfilled;

- The cooperative removes encumbrances from the facility;

- The borrower-shareholder submits an application to leave the cooperative.

Let's look at each stage of work in more detail:

Joining a cooperative

When joining a cooperative, an application is written addressed to the chairman of the board, usually on KPK letterhead, and entrance and share fees are paid. The amount of contributions is set by the cooperative itself; these can be symbolic amounts of 100 or 200 rubles, or more tangible ones. The voluntary share contribution will be returned after the shareholder leaves the cooperative. Some cooperatives accept shareholders only after prior approval of a loan application.

Selection of object

The object can be selected by the borrower independently, but some cooperatives offer this stage as an additional service, or refer them to a realtor with whom KPK cooperates.

The object can be a share in an apartment (the room must be isolated and the purchase and sale agreement defines the procedure for using common areas), a room in a communal apartment, a communal apartment, a house, or part of a house. The property should not be included in the register of dilapidated and emergency housing. If a house is purchased, the cooperative may additionally request a certificate from the administration about the suitability of the house for habitation.

If a loan is issued for construction, then the land plot must be owned or under long-term lease and the borrower must have a construction permit in hand.

Loan application

As a rule, it is issued at the cooperative office. Attached to the application are documents confirming the right to government support for the borrower and his family members, and documents for the purchased object. The list in different PDAs may differ, so it is worth checking the list in advance.

Application decision

The application approval stage can take from one hour to several days. It depends on how the work is set up within the cooperative itself and on the completeness of the documents submitted by the borrower. During the consideration of the application, the cooperative may request additional documents, ask to replace the object, or additionally provide 1-2 guarantors if the borrower’s solvency is in doubt.

If the application is approved, after signing the loan agreement, funds can be transferred to the borrower’s account immediately or after registering the transaction. This point should be clarified immediately in the CCP, since it determines at what stage the real estate seller will receive the funds. Cash can be issued only if the loan amount does not exceed 100,000 rubles.

Submitting an application to the Pension Fund of the Russian Federation

An application for disposal of maternity capital funds can be submitted to the territorial division of the Pension Fund, through a multifunctional center, or through the State Services portal. It is preferable to submit documents through the MFC, since when applying through State Services, you will in any case have to take copies and originals of documents to the Pension Fund.

List of required documents for consideration of an application for disposal of maternity capital:

- Identification documents of the applicant;

- Application and information about the application (on PF form);

- Loan agreement;

- An account statement confirming receipt of the cash account from the CCP;

- Contract of sale;

- Extract from the Unified State Register.

In some regions, they are asked to provide an extract from the protocol on the borrower’s acceptance as a member of the CPC, as well as a payment order for the transfer of funds by the Cooperative.

Consideration of the application by the Pension Fund

Within 10 days, the Pension Fund makes a decision on whether to satisfy or refuse the application for disposal of maternity capital funds. If approved, the funds will be transferred to the PDA within 10 days.

The result of the application arrives at the address specified in the application; the result can also be viewed on the State Services portal in the corresponding section of the site.

Thus, the maximum period for transferring funds by the Pension Fund to the cooperative is 20 days from the date of filing an application for disposal of maternal (family) capital funds.

Removal of encumbrances from real estate

Since real estate is purchased with borrowed funds, Rosreestr automatically imposes a “mortgage by force of law” encumbrance on the object. After the loan agreement is executed, the borrower will need to contact the cooperative to remove this encumbrance. The cooperative cannot remove the encumbrance on its own, since this stage requires the participation of both parties (Updated: The cooperative independently removes the encumbrance by submitting the appropriate application).

Leaving the cooperative

Cooperatives do not like to “inflate” the number of shareholders, since this complicates the process of holding general meetings and requires the formation of additional management bodies. And, despite the SRO’s comments about unfair practices, shareholders are excluded immediately after the loan is repaid. There are cases when cooperatives are asked to write an application for joining and leaving with an open date even before submitting an application for a loan. When leaving the cooperative, the shareholder's share contributions are returned.

Loan against capital

In the past, consumer credit cooperatives and microfinance institutions worked with maternity capital funds and issued loans that could be repaid with the help of MK.

However, in addition to the benefits available to large families, these organizations provided ways to break the law. For example, a family could cash out maternity capital and use it for purposes prohibited by Russian law.

To prevent the misdirection of social support, the state adopted Federal Law No. 53 in 2015, which prohibited microfinance organizations from accepting maternity capital funds. A number of requirements have been introduced for CCPs that they must comply with:

- registration in the register of the Central Bank of the Russian Federation;

- conducting official activities for at least 3 years from the date of registration;

- joining self-regulatory organizations.

To meet the above conditions, MFOs moved into existing cooperatives. This gives them the right to accept government support funds as loan repayments.

The main advantage of the CPC is the short terms for which the loan is issued. The average loan period is several months, which is enough for the Pension Fund to transfer maternity capital. Employees of the organization do not place high demands on candidates and do not require a large package of documents. CCPs insure their funds in other ways.

The downside is the increased interest rates and share contributions that are collected from all participants. To take out a loan from a CPC, you must become a shareholder . Before issuing funds, a KPK employee will check the property being purchased. Dilapidated and other types of property unsuitable for habitation are not grounds for issuing a loan.

Additional Information

- Read more in this article: “Loan for maternity capital.”

Step-by-step instructions for early receipt

In order to use state support funds in 2021 without waiting 3 years, you must complete 4 actions :

- Prepare papers that confirm the identity of the applicant (passport and copy) and the purposes for which the capital will be spent.

- Go to the Pension Fund at your place of residence and fill out an application for early use of the maternal certificate. The pension fund is given 10 days to make a decision, then the applicant will receive a response. If it is positive, the process of transferring maternity capital to the account of the applicant or organization will begin. If negative, the response will indicate the reason for the refusal and ways to correct the situation.

- If the applicant intends to use maternity capital to repay a mortgage loan, then it is necessary to go to the bank and discuss ways for the financial institution to receive funds.

- When bank employees have given their consent, the Pension Fund will send the funds to the specified account. It is important to note that it is prohibited to receive maternity capital in cash.

If part of the funds is spent, the rest will wait for the applicant at the Pension Fund. If MK indexation is carried out after 2021, the remaining amount will be increased.

Pros and cons, possible risks

The procedure has no disadvantages, and the advantages are obvious:

- You will be able to pay off your debt ahead of schedule.

- Reduce the burden on the family budget.

- Reduce your loan overpayment.

A good advantage is that you can pay off your debt online, without going through various authorities.

Please note the possible risks:

- Apartments purchased with MK funds are more difficult to sell.

- Reduce the amount of tax deduction.

- The bank may refuse to refinance the debt.