What documents are needed for an apartment mortgage? The question is relevant for everyone, especially if you submit an application to several banks with different requirements, buy a secondary home, or have income not related to work.

A mortgage is a large transaction and risky for the bank, so the borrower and the property are carefully checked.

The documents that need to be provided sometimes number in the dozens. It is difficult to collect everything at once the first time, given that some papers are short-term - during the collection of some certificates and statements, those collected earlier expire.

To avoid confusion, the entire mass is divided into four groups:

- Confirming the purity of the transaction;

- Containing information about the apartment;

- Personal documents of the borrower, co-borrower, guarantor;

- Proof of the borrower's employment, income and assets.

The article provides a complete list of documents required to take out a mortgage. Most banks in 2021 will not require even half. But for your personal peace of mind, papers from the first and second groups must be collected in full.

Certificate 2-NDFL was abolished from January 1, 2021

As of 01/01/2021, a new income certificate is in effect; the previous one has been abolished. Starting from 2021, tax agents provide information on income and tax amounts of an individual to the Federal Tax Service as an appendix as part of the annual 6-NDFL calculation. Employees are given a “Certificate of income and tax amounts of an individual.” The format and procedure for filling out both new forms were approved by Order of the Federal Tax Service dated October 15, 2020 No. ED-7-11/753. The new certificate is included in the required documents for a mortgage; 2-NDFL no longer appears in them.

More information about 2-NDFL: “Certificate 2-NDFL in 2021: form, codes and procedure for issuing to employees”

Choosing a bank and housing

For a mortgage, different banking institutions provide their own lending conditions. A loan can be taken out to purchase:

- New apartment;

- Housing under construction;

- Resale real estate;

- For the construction or purchase of a private house (the client wishes to independently engage in the process of constructing a residential property).

For borrowers, banks offer a wide variety of programs for purchasing real estate on the secondary market. It is worth emphasizing that these objects are always in demand. This popularity of secondary housing is explained by the following factors:

- There is no need to wait until the construction of the house is completed;

- You don’t have to buy a home in new buildings, where there may be all sorts of shortcomings due to the irresponsibility of the builders.

After receiving a positive decision on issuing a loan from the bank, the borrower has 90 days to choose a living space. Real estate on the secondary market must meet all the requirements imposed on it by the bank. They are as follows:

- The property cannot be classified as dilapidated housing;

- Not listed in the queue for major repairs;

- The apartment must not have any encumbrances;

- Housing is not part of the city administration's plans to demolish worn-out houses.

In the case of housing redevelopment, this fact must be officially recorded in the documents. All radical measures to renovate an apartment must be legal. The owners of the premises must have permission from the relevant authorities for these actions.

It is worth additionally asking what exactly the nature of the redevelopment is. If a violation of the load-bearing walls accidentally occurs, which could lead to instability of the structure, then the bank will refuse to issue a loan for the purchase.

In the absence of permission for such events, but with minor reconstruction of the living space, the bank may give permission to purchase housing. However, the condition must be met that a clause on the mandatory legalization of violations within a specified period will be included in the mortgage document.

When is proof of income required for a mortgage loan?

To apply for a mortgage loan from a bank to purchase a home, the borrower needs to confirm income. Sometimes banks require information from the employer (or several, if the person works part-time) in a form developed and approved by the credit institution itself, but more often an official form is used, which was developed and approved by the Federal Tax Service.

Using such a form has several advantages:

- it is easy for the bank to verify the accuracy of the information specified in the document;

- the document confirms official employment and the fact that income tax is withheld from the person.

The main purpose is to confirm the borrower’s source of permanent income, necessary for timely repayment of the mortgage. But in some situations, it is necessary to make a 2-NDFL certificate for a mortgage not for the bank, but for:

- visa processing;

- employment;

- calculating the amount of alimony;

- adoption or child guardianship;

- registration of benefits and pensions;

- registration of benefits.

Why does the bank need a copy of the work book?

A mortgage loan is usually issued for a large amount and for a long period. Therefore, a bank issuing such a loan to an individual needs to make sure:

- the borrower has a permanent job;

- absence of long breaks when changing places of work;

- desire to maintain or improve professional level;

- absence of disciplinary offenses among the reasons for dismissal.

All these points indicate that the borrower has a constant income at the time of consideration of the loan application, and he is taking measures to ensure that such income remains constant or grows.

That is, they allow the bank to regard him as a reliable payer. To obtain the above information, a copy of the work book is traditionally used, issued to the employee by his current employer and certified by him with the signature of the person responsible for this and the seal .

Methods for obtaining data on the income of individuals

There are several sources where you can get a 2-NDFL certificate for a mortgage:

- from an employer or other tax agent;

- on the State Services portal;

- in the taxpayer’s personal account on the Federal Tax Service website.

In the first version, the information will be issued on a paper form, in the other two - in electronic format. The processing time varies depending on who is completing the registration:

- employer on the day of dismissal or within 3 days upon application;

- on the Federal Tax Service website or through the State Services portal within a few minutes on the day of application.

The electronic form 2-NDFL for a mortgage is equally valid as a paper form if it is certified by an enhanced electronic signature of a specialist.

IMPORTANT!

The number of requests for information about income to the employer and the Federal Tax Service is not limited by law. You are allowed to receive documents at least every month.

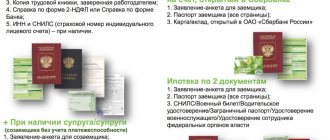

Personal documents required for a mortgage

Before applying for a mortgage, make sure that your documents are not expired and will be valid for at least another six months to a year. If you changed your last name, make sure that it appears the same everywhere. The co-borrower and guarantor provides the same package:

- Identity documents. Firstly, your passport. You will need copies of all pages, even blank ones. The second document may be a driver's license and/or military ID. If a man is under 27 years old, then a military ID is required.

- Marriage certificate. Marriage contract, if available. If you have children, birth certificates.

- Education documents. Required if you are participating in a social lending program for public sector workers - teachers and doctors.

- Certificate of assignment of TIN and SNILS.

How long is a document confirming the amount of salary valid?

Banks independently set the period for the 2-NDFL certificate for a mortgage - for some, information for the current year is enough, some want to have data for three years. The bank’s wishes regarding the period must be taken into account when submitting an application to the employer.

The document submitted to the bank must be recent. A certificate taken in January will not be suitable for submission to the lender in June. It is necessary to clarify this information with the credit manager of the bank where the mortgage loan is issued. Sometimes information received last month is not suitable, but it also happens that it is acceptable to provide information prepared 3 months ago.

Documents for registration of a mortgage confirming the purity of the transaction:

The bank (and the buyer too) must be sure that the transaction will not be challenged in the future by the seller’s relatives and other interested parties if, for example, the rights of one of the residents/registered in the apartment are violated. Therefore, ask the seller to prepare:

- Certificate of ownership with a round blue seal. Does the apartment have several owners? Make sure everything is included in the purchase and sale agreement. Is there a minor child among the owners? Then the consent of the guardianship and trusteeship authorities will be additionally required. It is advisable to request certificates of legal capacity of the seller(s). You don’t want to lose money just because you were embarrassed to voice a request and bought an apartment from a person declared incompetent?

- The certificate of ownership indicates the document on the basis of which this certificate was issued. Most often - a purchase and sale agreement, a gift, a certificate of inheritance, but there may be other grounds. Check the original of this document, and, what is important, that the actual name, date, and other details match those indicated in the certificate.

- An extract from the house register about the number of people registered in the apartment for the entire period. Indicate on what basis they were issued. At the time of registration of the contract with you, the housing must be free from the registered ones.

- Extract from the Unified Register of Property Rights (USRP). Necessary to ensure that there is no arrest imposed by bailiffs.

- A copy of the personal account, which indicates debts for payment of utility services.

- Consent of the seller's spouse to sell the apartment. If the seller is not married, make sure that this was the case at the time he purchased this apartment.

- Copies of all pages of the seller's passport (or birth certificates if the owner is a minor)

Getting a real estate loan without a salary document

There are cases when a potential borrower works without official employment and is not able to apply for a 2-NDFL to obtain a mortgage for the current period. In this case, he needs to negotiate with the bank, but usually financial organizations try not to violate the established procedure for providing loans for the purchase of real estate and do not make concessions. For those borrowers who are allowed to provide information about unofficial income, the mortgage interest rate is set an order of magnitude higher, as is the size of the down payment.

Banks warn that if it is not possible to obtain a 2-NDFL for a bank on a mortgage, you should not prepare the document yourself or buy it from third parties. Such actions fall under the Criminal Code of the Russian Federation as forgery of documents and fraud. The punishment is imprisonment for up to 3 years. If the bank detects fraud and writes a statement against the borrower, the forged document will become evidence in a criminal case.

Documents required for a mortgage containing information about the apartment

Is the purchase really worth the money? It is important for the bank to know that if the borrower fails to repay the debt, he will be able to sell the apartment at a price not lower than the amount of the loan issued, preferably with interest. For these purposes we request:

- A certificate from the BTI on the assessment of the cost of the apartment with a floor plan of the house and an indication of the place of the apartment in it.

- Cadastral passport. It is advisable that the physical wear and tear of a residential building does not exceed 60% - in this case, there will be no threat of resettlement of the house and the apartment that is pledged (and a mortgage in most cases is issued against the security of the purchased apartment) will remain intact.

- Technical passport with a plan of the apartment, an indication of the building material used for walls and ceilings.

- Market assessment carried out by an organization accredited by the bank. This assessment is also useful for you to find out the real cost of the apartment, which may be lower than that assigned by the seller. Good leverage in price negotiations.

Additional documents

Often, when choosing a mortgage loan program, banks request other documents. They are necessary for borrowers belonging to categories falling under various social programs.

Mortgage for maternity capital

Many families can take advantage of maternity capital, which is issued after the birth of a second child and subsequent children in the family. The amount of this subsidy differs in different periods. But it is always allowed to attract it as a down payment.

Only holders of this certificate will be able to obtain a loan. When issuing a mortgage of more than 200,000 rubles, an additional guarantee from another family member (husband or wife) is required. To the main documents, the family will have to add an extract from the pension fund indicating the presence of a balance in the account and approval for repayment of the down payment.

Mortgage without proof of income

This option assumes that the borrower is unofficially employed and owns the property provided as collateral. If a citizen works as a freelancer or sells certain products on the Internet, bank employees have the right to ask for a statement of the movement of money in his bank account.

Individual entrepreneurs bring a tax return. When the applicant is a bank client, managers independently check his account.

Mortgage for a young family

To participate in such a program, at least one parent must be under 35 years of age but over 21 years of age. A family is obliged to have children. A single parent is also recognized as a young family.

Applicants bring the following documents to the bank:

- Children's metrics;

- Marriage certificate;

- Housing documents.

At the same time, certificates are needed indicating that the family has funds for a down payment. They can be maternity capital or an account statement. If relatives become guarantors, such relationship must be confirmed.

Military mortgage

To receive a loan under the program, a serviceman must bring the necessary list of papers and submit an application. Additionally, the borrower needs the following certificates:

- Consent from the wife to participate in the program;

- Certificates of education;

- About the availability of other apartments, cars, land.

The serviceman is also required to give written consent to the processing of personal data. Difficulties arise here with the secret service.

Preferential categories

There are banks that practice issuing loans on preferential terms to scientists, doctors or teachers. All representatives of such professions cannot fall under this program. You can find out more about this from employees of financial institutions. Citizens who apply bring certificates and certificates that confirm their belonging to this type of profession.

Documents for making a transaction

When housing has already been found on the secondary market, the banking institution has approved the borrower’s choice, you can proceed with the transaction. When purchasing real estate on the secondary market, a procedure for its evaluation by a specialized company will be mandatory. This event will allow you to obtain reliable information about the cost of living space, the condition of the property and the apartment building itself, and assess the surrounding area (photos of the housing, house and entrance must be attached to the data).

The next step in obtaining a mortgage is insuring the borrower in case of loss of life or apartment. The client prepares the following documents for the financial institution:

- Photocopy of civil passport (yours and the seller’s);

- A copy of the cadastral passport;

- Photocopy of documents for the apartment;

- A document about all persons registered in it;

- Extract from the Unified State Register;

- If there are minors, you must obtain permission from the guardian.

After checking the submitted papers, the bank sets a time and date for signing the agreement. During this, all participants in the action:

- Once again familiarize yourself with the terms of the contract;

- An agreement on mortgage lending is signed indicating the date, it is certified by a seal and signatures.

Sometimes banks additionally require that they sign a mortgage on real estate.

After this procedure, the seller receives payment from the bank. The transaction is completed by signing the housing acceptance certificate. After this, the borrower becomes the owner of the property.

Advantages and disadvantages of such a home purchase

Obtaining a home loan has a number of advantages:

- The borrower becomes the owner without having any money to pay for housing. This allows many families to immediately solve their housing problem without waiting for the required amount to be collected.

- If some problems arise with payment, the apartment can always be rented out and receive income from it or resold with the approval of a financial institution. By purchasing a home on the secondary market, the borrower can move in immediately, without waiting several years, as is the case with the construction option.

The only drawback of such a program is the huge overpayment to the banking institution. On average, a borrower can pay an additional 35 to 300% of the appraised value of the apartment. And this is without taking into account the commission item, insurance and additional contributions.

With constant crises, the real estate market often collapses along with the cost of housing. If you try to sell it, it may bring a loss. Before contacting any financial institution, it is important to weigh everything so as not to end up in a debt hole.

Insurance

To conclude the signing of a mortgage when purchasing a secondary home, it is necessary to organize insurance of the collateral real estate against all possible risks of its loss or damage. Often financial institutions request a document for life insurance of a client.

The decision to enter into an agreement with additional types of insurance is the prerogative of the lender. It leads to the formation of hidden interest, that is, an increase in loan payments.

Applying for a mortgage is an important step in the process of purchasing residential real estate. For everything to work out, you must submit the necessary documents. You also need to have an amount for the down payment on the loan (at least 10–30% of the cost of the apartment). Compliance with all lender requirements increases your chances of getting your mortgage approved.