When purchasing an apartment, the buyer needs to prepare an impressive package of documents. These documents must be provided by both the buyer and the seller to conclude a purchase and sale agreement and register the transfer of ownership in Rosreestr. What package of documents will be required is determined by the specifics of the transaction and depends on many factors.

Many real estate buyers make mistakes when preparing the required package of documents. We invite you to familiarize yourself with the design features and types of documents.

Main list of documents

The real estate purchase and sale agreement comes into force from the moment of registration of the transfer of ownership in Rosreestr. This means that the buyer of an apartment becomes the full owner not when signing the contract, but when making changes to the Unified State Register of Real Estate (USRN).

To do this, the buyer (with the obligatory participation of the seller) needs to collect a package of documents. Below are the documents that may be required when completing an apartment purchase transaction:

Passports

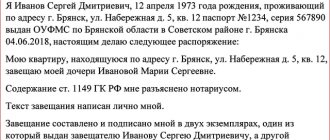

In order to confirm the identity of citizens and make appropriate changes to the Unified State Register, copies and originals of passports of each person participating in the transaction are presented. If the seller, the buyer, or both participants at the same time are represented by an authorized person, then a notarized power of attorney indicating all powers and his passport is attached.

Certificate of ownership

From July 15, 2021, the usual certificate confirming ownership of real estate is no longer used in circulation. As a replacement, an extended extract from the Unified State Register is used. To reduce the time it takes to receive it and speed up the transaction as much as possible, we recommend that you use the electronic service “KTOTAM.PRO”.

Contract of sale

It is drawn up in 3 copies - one original for the parties to the transaction (seller and buyer) and one for presentation to Rosreestr.

Mandatory clauses of the contract:

- date and place of signing;

- information about the seller and buyer;

- expression of the will of the parties;

- description of real estate;

- information on state registration of the seller’s rights;

- cost of living space;

- terms and procedure for making payments;

- information about the absence of registered residents;

- information that third parties do not claim the property.

The absence of one of the listed points is grounds for recognizing the contract as an improper document and refusing to register it. The contract must be accompanied by an apartment acceptance certificate confirming the actual fulfillment of obligations.

Certificate from the Federal Tax Service regarding the absence of tax arrears

Issued by the tax office at the place of residence based on an application and passport. If the taxpayer's last name has changed, the corresponding document (for example, a certificate of marriage or divorce) must be attached. The validity period of the certificate is 6 months from the date of receipt.

Title documents duly registered

Acting as the basis of the seller’s ownership of real estate, they are necessary when purchasing an apartment and re-registering the right. The following contracts can be used as legal documents:

- purchase and sale,

- barter,

- donations,

- annuities.

And:

- certificate of right to inheritance,

- a court decision recognizing the right to an apartment has entered into force,

- local self-government resolution on the provision of real estate.

The main condition is that the document must be registered in the prescribed manner, and information about it must be entered into the USRN database.

Extract from the Unified State Register of Real Estate

Its presentation is necessary when selling real estate, if the property is not registered in the cadastral register or when redevelopment is carried out in the apartment. If information about the apartment has already been entered into Rosreestr, then you do not need to provide an extract.

Attention! Technical passports are not needed to conclude a transaction - since 2008, they have formally and actually lost their legal force.

Written and notarized consent of the spouse to conduct the transaction

The buyer needs to make sure that the package of documents includes the consent of the husband or wife of the seller of the apartment. Otherwise, the transaction may be declared invalid in court. Consent must be certified by a notary upon presentation of a passport.

Copy of financial and personal account

In fact, it is a certificate confirming the absence of rent arrears. To complete the document, contact the accountant of the management company at the place of registration, at the MFC (multifunctional center) or at the cash desk of the EIRC (Unified Information and Settlement Center).

A copy of a personal account is issued on the basis of a passport and a certificate of ownership of real estate (or an extract from the Unified State Register of Real Estate). The validity period of the certificate of no debt is 10 days from the date of its receipt.

Certificate indicating the estimated value of real estate

The certificate indicates the inventory value of the apartment and the date of its issue. To obtain this paper, contact the MFC or directly the BTI, filling out an application and attaching to it a passport and a title document for the property.

The assessment procedure takes at least 2-3 weeks. Specialists from BTI conduct a full inspection of the property: measure the area, calculate the cost per square meter, assess the general condition of the living space, etc.

Extract from the house register

Contains information about citizens living in the apartment. The document is issued at the passport office of the management company or HOA upon presentation of a passport and house register, if it is in the custody of the property owner. The certificate is issued within 7 days, but it is usually issued on the day of application. Validity period: 14 days from the date of registration.

Permission from the guardianship and trusteeship authorities to sell the apartment

It is mandatory provided that minors are registered in the residential premises. The permit is issued upon presentation of the passports of both spouses, a certificate of ownership (extracts from the Unified State Register of Real Estate), a child’s birth certificate and the entire package of documents for the residential space being sold (purchased).

The listed documents are attached to the application for state registration of the transfer of ownership of real estate. Forms and instructions for filling out are presented on the official website of Rosreestr. However, in practice, the application is drawn up by an employee of the registration authority, and subsequently signed by the parties.

Attention! The buyer of real estate must pay a state fee (1000 rubles) and attach a receipt to the application.

If the seller’s ownership of the property arose before 1999 and was not registered in the Unified State Register (Unified State Register of Real Estate) (currently replaced by the Unified State Register of Real Estate), then an application for registration of the right is additionally submitted to the registering authority.

Housing in a new building (primary market)

Documents when purchasing an apartment from a developer include an act of acceptance and transfer of the property, a certificate of repayment of debt to the company. It is important that in addition to the purchase and sale agreement there may be an investment agreement. However, the transaction itself is safer, less paperwork is needed, since there are no previous owners or history of ownership of the object.

Options for purchasing an object:

- At your own expense;

- For attracted resources.

In the first and second cases, the company’s accounting department must confirm that the money has been credited to the account. It doesn’t matter whether they came from the buyer or from the bank - it doesn’t matter for registration. If the purchaser of the property participated in shared construction, he needs the same certificate from the cooperative.

Important! During shared construction, money cannot be transferred in cash. They go only to the account of the developer or cooperative. The requirement to transfer funds in cash should alert you: this is one of the signs of impending bankruptcy.

Before going to Rosreestr you need to ensure:

- act of acceptance and transfer of the object (the buyer certifies that he agrees with the quality and volume of work performed);

- technical passport for the apartment (measurements of all rooms and drawing up a plan will be required).

Signing the acceptance certificate does not deprive the buyer of the opportunity to demand the elimination of certain deficiencies. But, as practice shows, after its registration, the company’s desire to eliminate shortcomings sharply decreases. Without such an act, the transaction cannot be registered with the Rosreestr authorities. If the developer does not eliminate the shortcomings for a long time, there is an option: sign a transfer and acceptance certificate with reservations, which indicates the deadline for completing the project.

Buying an apartment in a new building

When purchasing an apartment in a new building, the buyer must receive the following list of documents from the construction company:

Investment contract

It specifies the conditions for the construction of an apartment building, the responsibilities of the developer and the deadlines for their implementation.

Project declaration

Contains information about the owner of the land plot, cadastral information, information about the financial position of the construction company.

Construction permit

Issued by local authorities to the developer before the start of construction work. Make sure that the permit indicates a specific (your) property.

Documents for the land plot

The developer must own the land either as a freehold or as a long-term lease. Check whether multi-family residential buildings are allowed to be built on this site.

Insurance contract

Mandatory document since 2015. The insurance policy covers the construction company's expenses in the event of bankruptcy.

Constituent documentation

This includes the company’s charter, tax identification number, protocol on the appointment of a director, and an extract from the Unified State Register of Legal Entities. Check the information received from the developer with the data available to the Federal Tax Service. Make sure that the building and land permits are issued by this organization.

Conclusion of project documents

Contains information about the state examination and compliance of the project with legal requirements.

If the purchase of an apartment is carried out on the basis of an equity participation agreement (DPA), then it is attached to the given list of documents. It must contain information about the participants (the shareholder and the developer), information about the property, the timing of construction work and the cost of the apartment. The agreement is submitted to Rosreestr in 3 copies.

Housing in a finished house (secondary market)

You will need the same documents for purchasing a secondary housing apartment as for a new building. The buyer should definitely read the statement of personal account. It notes both registered residents and debts for payment of services. The certificate is valid for 30 days.

An extract from the house register (about the composition of the family) will allow you to find out who is registered in the premises and who has the right to use it. Purchasing real estate in some cases gives the owner the opportunity to evict residents, but this is unnecessary trouble. You can require the seller to stop registering other persons.

Documents for purchasing an apartment on the secondary market include an acceptance certificate. This is especially important if the property is sold with furniture and additional equipment. Reflect the current state of the meters in order to remove responsibility for the debts of the previous user. The report is primarily necessary for the seller, but can serve as the basis for making claims if hidden defects are discovered.

Preferential conditions for purchasing an apartment

This table presents possible preferential options for purchasing an apartment and the documents required for this.

| Feature when buying an apartment | List of documents | Short description |

| Maternal capital | Certificate of right to maternity capital and an extract from the Pension Fund of the Russian Federation on the balance of funds in the account. | Maternity capital is used to make a down payment on a mortgage, pay interest on it, or for a direct transfer to the seller. To receive a certificate, you will need to submit an application and passport to the Pension Fund office |

| Young family | It is necessary to submit documents for participation in the “Young Family” program by writing an application and attaching certificates of marriage and birth of children. | Opportunity to buy an apartment on preferential terms (the age of the spouses should not exceed 35 years). The number of children in a family to participate in the program is determined at the regional level |

| Military personnel | To purchase an apartment on preferential terms, you must provide a certificate of NIS participant | Subsidies from the state for the purchase of an apartment are provided to citizens undergoing military service under a contract with the RF Armed Forces. Condition: they must be participants in the savings-mortgage system. A certificate of participation is issued to a military person based on an application and report from the leadership of the military unit |

| For a child | If a child between 14 and 18 years old needs the consent of one of the parents to purchase real estate. Until the age of 14, the purchase and sale agreement is signed by the parent, but on behalf and in the interests of the child. Additionally, the child’s birth certificate must be presented | The list of documents for an apartment purchased for a child is similar to the main list, but has slight differences depending on his age |

How and where does the transaction take place?

Registration of real estate transactions is carried out by Rosreestr, or rather its local branch. It is there that the collection, processing and storage of data on real estate rights in the region is carried out. Registration is also carried out there.

You can also complete a transaction to purchase an apartment at the “My Documents” MFC. The center's employees themselves hand over the papers to the Rosreestr office, pick them up and give them to the applicants themselves. In Moscow, since 2014, only the MFC has been involved in registering such transactions.

The employee of the institution who accepted the documents issues a receipt of their receipt with a complete list, date of receipt, and case number. You can use this number to track the progress of your registration.

The standard registration period is 10-12 days. But sometimes registration is suspended or even terminated. This can be caused by both technical problems and incorrect paperwork.

Text: Elizaveta Kobrina, Natalya Petrakova

Additional documents

The list of additional documents required to purchase an apartment differs depending on its features:

- If the seller is a legal entity, then the statutory documents of the organization are attached.

- If a share of real estate is sold, then a written refusal of the share owners to purchase the share or notification of all owners about the sale of the share is provided.

- If the property is mortgaged, then a written consent of the bank (mortgagee) to carry out the transaction is attached.

- If redevelopment has been carried out in the apartment, then a document confirming its legality is provided.

- If the title document is a gift agreement or a certificate of inheritance, a certificate from the Federal Tax Service on payment of tax is required.

The absence of one or another additional document may also serve as grounds for refusal to register the transfer of ownership.

What papers are needed to complete a purchase and sale transaction?

The set of documents consists of two parts:

- Basic part - for any transaction the same set of papers is submitted, only the number of copies can change.

- Additional documents are prepared in various variations, depending on the specifics of the transaction.

To avoid misunderstandings during a visit to the MFC or Rosreestr, it is better to discuss in advance with all participants in the transaction who will prepare what documents and take them to the transaction registration procedure.

Useful recommendations for collecting documents

Document collection services are provided on a paid basis by professional lawyers. If you decide to prepare a list of papers yourself, then consider the following subtleties:

- When submitting documents for registration of the transfer of ownership, the buyer must make sure that the technical description of the apartment completely matches the information specified in the purchase and sale agreement.

- A property purchased with borrowed funds under a mortgage lending agreement becomes the subject of bank collateral. When registering ownership of an apartment, the buyer provides a pledge agreement with the lender, on the basis of which information about the existence of an encumbrance is entered into the Unified State Register of Real Estate. Additionally, a loan agreement and the consent of the spouse to apply for a mortgage are submitted.

- Before submitting documents to the registration authority, make sure that they are compiled correctly, do not contain grammatical errors, corrections or abbreviations in addresses - all significant information is written down in full.

It is important that documents drawn up by hand should not be signed in pencil or have additional marks in the margins.

Checking the VIN at the dealership

The condition of the basic equipment of the machine can be checked at the dealer. Ask the car owner to go with you to the dealership with all the documents for the car. An inspection officer will check the vehicle.

For example, if you buy a Ford Focus sedan, and as a result of checking the VIN belongs to an Audi, the number is fake, and the car may be stolen. The description of the basic configuration must match the characteristics of the car being sold.

If everything is in order with the documents for the car, and the seller inspires confidence, you can negotiate a deal. Let's consider two ways of concluding transactions - with a private owner and a car dealership.

How to submit documents?

After collecting an impressive list of documents, the question arises of submitting them to the registration authority. There are 5 possible options for this action:

- Personal visit to the registration authority.

Contact the territorial body of Rosreestr, having previously clarified its work schedule. The best option in terms of saving time is for the specialist to immediately inform you of the refusal to accept documents if you collect an incomplete list or if mistakes are made. Additionally, he will help with filling out the application and advise on other issues.

- Contact the MFC.

Please note: MFC is not a registration authority. He is an intermediary between the parties to the purchase and sale transaction and the Rosreestr branch. The disadvantage of applying to the MFC is that it takes a long time (including sending documents).

- Sending the application and documents by mail.

They are sent to the territorial body of Rosreestr by registered mail with a list of attachments. All copies of documents and the signature on the application for registration of ownership must be notarized. A significant disadvantage is that you will learn about the absence of some papers or errors in their execution no earlier than 2 months from the date of departure.

- Electronic service “Submit an application for state registration of rights.”

It operates on the official website of Rosreestr and provides the opportunity to send an application and a list of required documents. Decisions of the registration authority employees on registration or refusal to register property rights are sent to the applicant’s personal account. The advantage of using the service is the presence of step-by-step instructions, the disadvantage is the need to certify documents with an enhanced qualified electronic signature.

- Through representatives.

Trustees may act on behalf of the participants in the purchase and sale transaction. If there are identification papers, the documents are sent by them to the registration authority in one of the following ways. Additionally, a notarized power of attorney indicating powers and a passport (if sent by mail - a notarized copy of the passport) must be attached.

The choice of the method of submitting documents depends entirely on the will of the parties to the transaction (seller and buyer).

Receipt for receipt of documents for state registration

When submitting a package of documents for registration of a transaction with an apartment (both at the MFC and at the territorial offices of Rosreestr and the Cadastral Chamber), the employee accepting the documents is required to issue a receipt for receipt of documents for state registration.

This receipt contains a list of accepted documents (indicating originals and copies), the registration period is indicated, as well as the registration case number, which can be used to obtain information about the completion of registration.

The procedure for returning personal income tax when purchasing an apartment. 2 ways. List of documents.

Obtaining an extract from the Unified State Register of Real Estate on the KTOTAM.PRO website

An extract from the Unified State Register of Real Estate is a document without which a purchase and sale agreement cannot be concluded and ownership rights cannot be registered in Rosreestr. From January 1, 2021, it replaces the cadastral passport, serves as an alternative certificate of ownership of real estate and allows you to verify the integrity of the seller.

To speed up the purchase and sale transaction, we recommend that you issue this document electronically on the KTOTAM.PRO service. Here in 30 minutes you can receive a standard or extended extract from the registry. The user only needs to indicate the full address of the property (region, locality, street, house and apartment) or the cadastral number of the property.

Among the key advantages of the KTOTAM.PRO service:

- work 24/7,

- no queues,

- various payment options,

- fast interface,

- SMS-informing users,

- instant registration,

- Possibility to print the statement.

The portal is intended for use by individuals and legal entities. On it you can get 100% reliable information from the official database of the Unified State Register of Real Estate. The state fee is only 250 rubles.

The KTOTAM.PRO service was created for those who value time and reliability.

Author: project Who Is There

4.4

58893

1

Rate this article

Housing secured by real estate

A mortgage is the best way to solve the housing problem for most families. The law allows you to purchase housing on the primary and secondary markets, leaving the right to approve the transaction to the bank. Do not confuse a mortgage with leasing: in the second case, the property remains with the entity financing the transaction. The participation of the bank (debt to it) is necessarily reflected in the registration documents.

A transaction involving bank funds is somewhat more complicated:

- an agreement is concluded with the developer for the purchase of real estate;

- an application is submitted to the bank with a request for a loan;

- after receiving the funds, the developer issues a certificate stating that the buyer (shareholder) has no debt on the property;

- option - the seller of a secondary market apartment certifies the fact of receipt of money.

Next - the same procedure: you need to collect documents for the object and apply for registration of the transaction. A new apartment also requires a technical passport, and the contract must include an act of acceptance of the premises into operation. As a rule, developers have a sales department that helps collect the necessary papers.

Attention! After registering the transaction, you must notify the bank within the period specified in the agreement. Failure to comply with this requirement will result in sanctions for the borrower. Until the bank provides a certificate of debt repayment to Rosreestr, no actions can be taken with the real estate.

If housing is purchased on the secondary market, additional documents will be required to purchase an apartment with a mortgage . These include a real estate appraisal document, and it is required at the stage of obtaining a loan from a bank. This is done in order to avoid fictitious transactions when the property is sold at an inflated price.

It should be noted that the bank will not accompany the client’s transaction, limiting itself to financial participation in the process. But control will be complete and comprehensive, and if the terms of the contract are violated, the institution may demand a refund of the entire amount.

What happens if all formalities are not followed?

Some documents can be requested for insurance, but precautions will not be superfluous, because we are talking about large sums. For example, if housing was purchased during marriage, consent to its alienation by the “other half” is required. It happens that a person marries and divorces several times, and traces of his ex-wife are lost.

If you do not make sure that other persons are not claiming the apartment, the transaction may be challenged in the future. This is also true for real estate acquired by inheritance. Any of the successors who, for good reasons, have not declared their rights, may do so in the future.

Attention! When purchasing a home on the secondary market, you should seek the help of realtors for a comprehensive review of the transaction. Organizations bear financial responsibility for the quality of the service provided.

The registration file stores the entire package of documents for the previous transaction. Professional market participants have the right to obtain it and examine it. Of course, there is no point in doing this in relation to newly created real estate. But if the object has passed through at least one hand, precautions will not be superfluous.

Where errors may appear

It is important for the buyer of real estate to make sure that he is purchasing exactly the property that was shown to him. Before checking the documents when buying an apartment , you need to compare the addresses. There have been cases when, instead of one premises, another was sold. Another important aspect is the area of the structure. Old data sheets may contain errors and inaccuracies. The purchaser has the right to make sure that he is paying for real “meters” and not air.

Common problems:

- invalidity of the passport (for example, after a change of surname);

- technical errors in the data sheet;

- information about property rights (registered with violations);

- problems with the privatization of the facility (carried out illegally).

These documents must be checked if in doubt

Features of buying a home using a certificate

As you know, maternity capital is paid for the birth of the first (from 01/01/2020), second and subsequent children. It can be implemented to improve the living conditions of the family. The main rule is the allocation of shares, where the child will also receive his part. Therefore, documents for purchasing housing using maternity capital first of all include a certificate giving the right to financial support.

Other conditions will also be required:

- Consent of the guardianship and trusteeship authorities (in case of parallel sale of the property where the child is registered);

- Reflection in the agreement of the fact of transfer of the share to each child for whom capital was received, with subsequent registration.

First you need to contact the Pension Fund (at the territorial office or through the State Services portal). The issued certificate is suitable for payment of the transaction in whole or in part on both the primary and secondary markets. The participation of the Pension Fund cannot be avoided, because money will be transferred to the account of the real estate seller by the specified department.

To complete the transaction, you will need documents confirming the presence of children: birth certificates. The buyer should not be deprived of parental rights in relation to his son or daughter. Supervisory authorities monitor the correctness of the transaction. However, if there are errors, they will not challenge the agreement itself, but only the legality of the transfer of funds under the certificate.

Important! Matkapital can be used to pay the down payment on a loan or to repay part of the debt and interest. Detailed instructions on the disposal of funds can be obtained on the Pension Fund website.