Taxes are a serious expense for every citizen. This is not directly felt, but if you carefully look at your payslip, which indicates the salary received, you can make sure that contributions to the budget amount to 13% of the total accrued income. However, it should be remembered that under certain circumstances the state undertakes to return the amounts of income tax paid in whole or in part. This is especially true for those who have incurred large expenses. In particular, we will consider the case when an income tax refund occurs when purchasing an apartment, and how you can take advantage of this type of benefit.

Take out a mortgage to buy an apartment

The concept of tax deduction

Working Russians pay 13% to the budget in the form of income tax. Typically, this amount is calculated by the employer’s accounting department from the employee’s accrued salary, and then transferred by personal income tax to the tax office.

A tax deduction is part of the amount of taxes withheld earlier or calculated in the current month, which can be returned or not deducted if a number of conditions are met. If the legal requirements are met, the individual will be transferred the amount to a bank account or for a certain period will not be charged income tax when issuing wages.

To receive a deduction, the buyer must be a tax resident of Russia and pay personal income tax. It is important that the rate is 13%. If the application is submitted by an individual entrepreneur, pay attention to which taxation system he is in. All options except the main mode will not work. An entrepreneur will not be able to receive a property deduction. Also, the costs of self-employed people or other tax residents whose tax rate is more or less than 13% are not compensated.

To receive compensation from the budget, you will need to provide evidence that the money was spent on something truly necessary. This could be a house, apartment, paid education or treatment, as well as charity. If you do not pay personal income tax yourself or through your employer, then there will be nothing to return compensation from.

In addition to the deduction that can be issued when purchasing an apartment or house, there is also a return from the sale of housing. These compensations from the state are not mutually exclusive. But different conditions must be met for them. When selling a home, pay attention to the period of ownership of the property. If it exceeds 5 years, and in some cases 3 years, then the tax office will not withhold personal income tax.

When calculating deductions for the purchase of a house or apartment, two concepts are used:

- The volume of the tax deduction is the amount by which a reduction in income is permissible when buying and selling housing - for 2021 it is equal to 2 million rubles.

- Refundable tax - money that will be returned from the budget - this year it is 260,000 rubles.

To an applicant who meets all the conditions, the tax service will return an amount in the amount of 13% of the deduction.

How the volume of tax deductions received in Russia grew (billion rubles)

| 170,8 | 11 | |

| 2014 | 121,9 | 7,4 |

| 2011 | 56 | 6,1 |

Russian tax legislation provides two ways to obtain a tax deduction:

- through the tax office;

- through the employer.

First way

involves the return of tax paid in the past to the person’s bank account.

In the second option

the tax deduction is repaid by canceling income tax deductions from the employee’s salary. Which one is more convenient is up to you to decide.

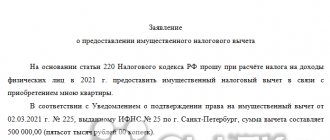

Procedure:

- Fill out a tax return (form 3-NDFL).

- Obtain a certificate from the accounting department at your place of work about the amounts of accrued and withheld taxes for the year in form 2-NDFL.

- Collect copies of papers confirming the right to housing (see above).

- Collect copies of payment documents (see above).

- When purchasing an apartment in joint ownership, collect copies of the marriage certificate and a written statement about the agreement of the parties involved in the transaction on the distribution of the amount of the deduction between the spouses. The deduction distribution agreement does not need to be notarized.

- Submit a completed tax return with copies of all documents to the tax authority at your place of residence. The tax office will let you fill out an application (request two copies, one will be left for you) and send the documents for a three-month audit. It is convenient to monitor the result in your personal account on the Federal Tax Service website - information about overpayment of tax will appear there. After this, you can wait for the money to arrive in your account - no more than a month.

When does the right to return 13% appear?

In order to be approved for a property deduction when purchasing a home, several conditions must be met:

- The applicant for the deduction is a tax resident of the Russian Federation. At the same time, they live at least 183 days during each year in the territory of any of the constituent entities of the Russian Federation.

- The home buyer has all the supporting documents . Part of the funds can only be returned based on the amount of actual payment for the property. If it was inherited or given as a gift, you cannot receive a deduction, since there were no expenses. Military personnel who participate in the NIS program will also not be able to receive a full deduction. For them, part of the rent is paid by the state. The same restrictions apply to using maternity capital to pay for a mortgage.

- There are documents confirming the right to the purchased housing . If you purchased an apartment in a new building, the proof will be the transfer and acceptance certificate. You cannot use a share participation agreement, it does not matter whether the entire payment has been made or only a part. When purchasing an apartment on the secondary market, you can certify ownership rights with an extract from the Unified State Register of Real Estate. In this case, real estate documents can only be issued personally to the buyer or his legal spouse.

- The former owner of the apartment and the buyer are not closely related. If the transaction takes place between relatives, no deduction is given. It is impossible to hide kinship. The Tax Inspectorate checks the interdependence of the parties to the transaction using its databases, including with the involvement of the Civil Registry Office. Therefore, you can buy a house from your father or brother, but you cannot get a deduction. And from your mother-in-law or niece’s husband you can not only purchase housing, but also get the right to a deduction.

- Before this appeal, the property deduction had never been used. When applying for this type of tax deduction, the limits for one citizen are taken into account. If you have already sold it once and used the entire amount of 2 million rubles, you will not be able to claim the deduction again.

Also, one of the most important conditions is that housing must be located on the territory of the Russian Federation.

Conditions for tax deduction when purchasing an apartment 2021: there are changes

Law No. 325-FZ has introduced two innovations for property deductions when purchasing an apartment in 2021:

- A parent or guardian can receive a housing deduction for children and wards recognized by the court as incompetent, without an age limit (previously there was a limit of up to 18 years).

- When refinancing a loan under borrower assistance programs, you can receive a tax deduction in the amount of interest, even if the mortgage loan was refinanced not by a bank, but by another organization.

What documents to collect for the tax office?

Documents for a 13% refund from the purchase of an apartment can be presented in photocopied form. The tax office will definitely check their legality using its databases. Sometimes originals may be requested, but this rarely happens.

To obtain the right to deduction you will need:

- an extract from the Unified State Register or a certificate of ownership;

- home purchase agreement;

- financial confirmation of the transaction - checks, receipts, statements;

- certificate 2-NDFL when filing a declaration;

- Marriage certificate;

- power of attorney for the transfer of money, if the transaction was carried out by a trusted person;

- if the spouses divided the deduction between themselves, then a statement of distribution.

You can send scanned versions of documents or file printed copies with your declaration.

Tax deduction for an apartment loan - features of refinancing in 2021

In 2021, receiving a deduction on interest when refinancing was allowed only if the new lender was also a bank. In 2021, an exception appeared to this rule - non-bank organizations according to the list of the Government of the Russian Federation. A prerequisite when preparing documents for a tax deduction when purchasing an apartment for the amount of interest paid is that any refinancing agreement must contain a direct reference to the original loan agreement. In turn, the initial loan agreement must be targeted, that is, the text of the document must indicate the purpose of the money issued - for a specific apartment.

The requirement for a mandatory reference when refinancing to the original loan agreement applies to all possible situations for obtaining a deduction:

- initial or subsequent refinancing at a bank;

- refinancing using state support in other organizations.

Unfortunately, it is easy to lose the right to a tax deduction on interest on the purchase of an apartment when refinancing:

- if the on-lending agreement was concluded before 2021 not with a bank, it could be various financial organizations without a banking license, individuals or employing organizations;

- if such an agreement was not concluded in 2021 with a bank, and the new creditor is not included by the Government of the Russian Federation in the list of organizations through which state support is provided;

- if the new document does not directly mention the very first loan agreement as a source for financing the purchase of housing - even if refinancing is carried out for the second or third time, it is still necessary to refer to the first loan agreement.

How to confirm expenses

The deduction will not be provided if the fact of expenses is not confirmed. But since when buying an apartment they don’t issue checks like at the cash register, you have to collect other papers. You can prove payment for housing using a receipt, contract, receipt or bank payment. When preparing payment documents, consider some nuances:

- If you confirm a transaction with a receipt , it does not have to be certified by a notary. It must contain information about the property, the former owner, the amount and date the seller received the money. In addition, the receipt must contain a signature. It is better to fill out the document by hand; a printed one will not work.

- If you confirm the transaction with an agreement , it must be notarized. In the document, indicate that the seller received payment for the housing.

It is better to use a receipt as proof of expenses. The Supreme Court believes that the indication of payment in the contract does not yet indicate the completion of the transaction.

You can also prove the fact of payment with bank documents. If you paid for the apartment through a bank, receipts, payment orders or bank statements will do.

Changes to the tax deduction when purchasing an apartment for children or dependents

Purchasing housing in the name of a child (in whole or in part) allows the parent to receive a property deduction within the limits of the child’s or ward’s share. The child retains the right to the benefit; the amount of the property deduction limit used is issued to the parent. In previous years, this rule only applied to children under 18 years of age. From 2021, a tax deduction for the purchase of an apartment applies to children (including adopted or guardianship children) of any age if the court has declared them incompetent. An important condition for receiving benefits is that housing must be purchased at the expense of the parent or guardian. If the parent invested his savings or took out a corresponding loan, then a deduction will be provided; If state support funds are used, the tax will not be refunded.

When to submit documents

Submit the documents collected to return 13% of the purchase of an apartment simultaneously with the 3-NDFL or application. If you apply for a deduction online, through your personal account on the FSN website, you can attach scanned copies of documents. If you apply for a property deduction from purchasing an apartment in person or by mail, photocopy the documents. Next, they will be checked by the tax office. The period of the desk audit lasts about 3 months. If everything is correct, then only after this the right to deduction arises.

To receive compensation for part of the money spent, photocopies are suitable. If the tax office has any suspicions, Federal Tax Service specialists will independently verify the accuracy of the information in Rosreestr, the Civil Registry Office or the Pension Fund of the Russian Federation. If they still ask for originals or if any document is missing, a tax inspector will contact the applicant and explain the situation. Therefore, indicate the correct telephone number in the 3-NDFL or application, and keep the original documents at hand during the verification process.

How to get compensation

The taxpayer can choose one of two ways to return 13%:

- You can receive the full amount of the deduction from previously withheld taxes into your bank account. To do this, in the application, indicate the method of return “to a bank account” and enter the details for the transfer.

- You can also get 13% back in installments from each salary. To do this, provide the employer with a notification that the right to a property deduction has arisen. For a certain period, the accounting department will not deduct 13% from wages. If the entire refund amount is not paid in one year, the remaining compensation will be transferred to the next. This may continue for several years until the buyer is compensated for the entire amount of the property deduction.

Registration through an employer has several advantages:

- you don’t have to wait until the next year after the transaction to start receiving money;

- the period for checking documents by the tax service will not last for 3 months, but only for 30 days;

- You can get a refund for all income taxes withheld since January 1 of the current year, even if the home was purchased in July or November.

The disadvantage of receiving a deduction at the workplace is that the notice to the employer is issued only once for the entire tax period. If you change your job, you will have to wait until the start of the next tax period to add 13% to your salary. But if you already combine work, you can bring the same notice from the tax office to all employers at once.

How many times and how much can you return?

The tax deduction from the purchase of real estate arises only once. The maximum amount with which a tax resident can return 13% of the purchase of an apartment is 2 million rubles. And the compensation will be 260 thousand rubles. This amount does not apply to interest on a mortgage loan if the home was purchased using bank borrowings. There is a separate limit of 3 million rubles for interest.

If the cost of housing is less than 2 million rubles, the deduction will depend on the expenses incurred. For example, with expenses of 1.7 million, the deduction will be 221,000 rubles. If an apartment or house is more expensive, amounts over 2 million rubles are not taken into account. In any case, 260,000 rubles is the maximum that the state will return to one taxpayer for the purchase of housing.

Please note that the remainder of the deduction from the purchase of an apartment or house can be transferred to other properties. Previously, buyers did not have such a right, and even if the apartment cost only 1 million rubles, the remainder of the deduction was burned. The transfer can only be made when purchasing real estate. This cannot be done for mortgage interest; they are tied to one object.

Distribution of deduction shares between spouses

Both spouses have the right to return 13% of the purchase of an apartment if the marriage was concluded before the purchase of real estate. But when determining shares, you need to take into account some features. The deduction is distributed in several ways depending on the type of property:

- Common shared ownership . In this case, the deduction is distributed depending on the shares of each spouse invested in the cost. If the wife’s share in the cost is 5/6, and the husband’s only 1/6, then with the cost of housing being 6 million rubles, the shares will be distributed as follows: the man will receive 13% of 1 million rubles, and the woman 13% of 2 million rubles, since this the maximum possible amount.

- Common joint property . In this case, the shares are determined depending on those specified in the agreement. If the agreement was not formalized, the amount of the tax deduction will be divided equally between the spouses. Everyone will be entitled to receive 13% of 2 million rubles. Therefore, when buying an apartment more than 4 million rubles. the family will be able to return 520 thousand rubles. for two.

- The sole property of one of the spouses . If the husband and wife did not enter into a marriage contract, all property is considered common if it was acquired during a legal marriage. The tax deduction is distributed between spouses as in the previous version.

With the latter option, it is necessary to conclude an agreement on the distribution of shares, since the default equal division does not work in this case.

Amount of tax deduction when purchasing an apartment 2021: no change

The amount of the deduction in 2021 remains the same:

- 2 million rub. for acquisition, construction and repair;

- 3 million rub. interest expenses on the target loan.

However, in the near future it is possible that the tax deduction for purchasing an apartment will increase. Recently, a bill on this matter was introduced to the State Duma. Its authors ask to raise up to 3 million rubles. deductions for the purchase and construction of housing and up to 4 million rubles. when paying interest.

Additional nuances

Please note that if part of the amount for the apartment on the mortgage was paid by maternity capital or compensated to the military under the NIS program, then this part will not be taken into account when calculating the deduction. You need to independently take away the money used under the certificate or NIS, because the tax office will check this information in any case.

The right to deduction cannot be transferred to relatives , even close ones. For example, a house was bought by a father who has been retired for 5 years and has no taxable income from which personal income tax would be withheld. An elderly man will have the right to a deduction, but he will not be able to exercise it.

The shares of minor children in real estate are added to the expenses of the parents. This means that the parent will not be compensated for more than 260 thousand rubles, but if the taxpayer’s share is less than 2 million rubles, then the child’s share will be taken into account when calculating. At the same time, when a minor citizen grows up and starts working, he will not lose his right to a property deduction and will receive it in full.

Pensioners have special rights to receive deductions. They are compensated for expenses not only in the current year when the apartment was purchased, but also for the 3 previous years. This nuance is provided in order to return compensation to the senior citizen before he stopped receiving wages. For example, a pensioner retired in 2021 and bought a home. He can file returns for 2021, 2021 and 2021 and receive a deduction for the years while he was still working but was not yet eligible for housing. Other Russians do not have such privileges. First, the right to housing and only then the right to deduction.

5 / 5 ( 1 voice )

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Why they may not give a tax deduction when buying an apartment in 2021

- The amount of expenses is not documented.

- The documents were completed incorrectly. Possible options: the seal on the contract is not readable, the seller’s passport details are not indicated in the purchase act, the intended purpose is not indicated in the loan agreement.

- Other people's funds were used. Classic options are purchasing an apartment using maternity capital, a military mortgage, or purchasing housing by an employer for employees. There is judicial practice regarding claims by the Federal Tax Service against citizens who managed to receive a tax deduction for an apartment when budget funds were allocated to them, but did not inform the tax authorities about this.

Sometimes payment by another person is still allowed:

- purchase of housing by spouses;

- registration of residential real estate in the name of children or wards.

- A citizen has no taxable income from the year of acquisition of real estate. In this case, he will have nothing to return from the budget, since it is impossible to receive money for the period before purchasing the property. The only exception is pensioners, who are allowed to receive a tax deduction when purchasing an apartment based on income documents for the three previous years.

- There is a subordinate position or influence between the seller and the buyer. Here are some examples of such situations:

- close relatives;

- superior and subordinate;

- organization and its founder.

Text: Natalia Petrakova, Olesya Moskevich

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya