Both transactions ( donation and exchange ) are used by their parties to legally formalize the transfer of ownership of property. However, each of them has its own specifics.

Similarities between giving and bartering:

- they represent civil transactions, therefore, by virtue of Art. 153 of the Civil Code of the Russian Federation (Civil Code of the Russian Federation) give rise to new legal relations or modify existing ones;

- are contracts, and their conclusion requires the agreed bilateral expression of will of Art. 420 Civil Code of the Russian Federation.

The main distinguishing feature of donation is its gratuitousness . By virtue of Art. 572 of the Civil Code of the Russian Federation, the concept of “donation” covers the free transfer of property that does not imply reciprocal provision. Barter, on the contrary, is paid (Article 567 of the Civil Code of the Russian Federation).

Everyone can understand the difference between giving and bartering in general terms. Despite this, the choice of the type of agreement for formalizing relationships (especially regarding real estate) is very important.

The transition from barter to donation and vice versa often allows you to achieve the desired effect, for example:

- adjust taxation;

- avoid the emergence of rights to the subject of the contract in third parties;

- not to obtain permission to alienate property from persons who have the right of pre-emption;

- hide the presence and movement of funds from fiscal authorities or creditors.

It must be taken into account that choosing a type of agreement that is inadequate to the real relationship between the parties is always risky . The legal structure of a transaction (exchange or donation) is the “outline” on which the agreement of the parties on specific issues rests. It determines, among other things, the requirements of which chapters of the Civil Code of the Russian Federation will be applied in the event of a dispute - Ch. 32 on donation or ch. 30 and ch. 31 about me.

Agreement of gift or agreement of exchange: concept, content

In civil law, gift and exchange transactions are intended to transfer ownership from the actual owner to another individual or legal entity. Both transactions are bilateral, but that's where the similarities end.

The following is typical for a gift agreement (hereinafter referred to as DD):

- Gratuitous. When transferring property to the donee, the donor has no right to make counterclaims, money or services from the donee (Article 572 of the Civil Code of the Russian Federation);

- Succession. When a gift is promised, the obligations of the deceased donor pass to the heirs. The rights of the donee to a gift do not pass to his legal successors (Article 581 of the Civil Code of the Russian Federation);

- Prohibitions. You cannot make gifts worth more than RUB 3,000. on behalf of incapacitated persons or children under 14 years of age. Donations in favor of employees of banks, state and municipal enterprises are prohibited if this is related to their work activities (Article 575 of the Civil Code of the Russian Federation);

- Restrictions. A donor who is a legal entity has the right to donate property that belongs to him under the right of operational or economic management, with the written consent of the owner. To alienate property in joint ownership, the consent of the remaining owners will be required (Article 576 of the Civil Code of the Russian Federation).

Note! When donating, it is possible to draw up two types of contracts: real or consensual. In the first case, the transaction begins to be executed immediately after signing. In the second, a promise of gift is implied, and the gift passes to the donee on a specific date or event specified by the donor.

The characteristics of the barter agreement (hereinafter referred to as DM) look different:

- Instead of the donor and donee, the parties are called seller and buyer. The rules of purchase and sale apply to the transaction (Article 567 of the Civil Code of the Russian Federation);

- The costs of transferring the goods are borne by the transferring party. If the exchanged property is recognized as unequal, the difference in value is paid additionally (Article 568 of the Civil Code of the Russian Federation);

- If counter-fulfillment of obligations is not provided or the agreed deadlines for the transfer of goods are not met, the second party has the right to suspend the transaction, refuse it and demand compensation for losses (Article 569 of the Civil Code of the Russian Federation);

- The ownership right passes to the buyer after fulfillment of the terms of the transaction, unless otherwise provided by the contract (Article 570 of the Civil Code of the Russian Federation);

- If a third party withdraws the exchanged goods for reasons that arose before the signing of the DM, the second party has the right to demand compensation for losses (Article 571 of the Civil Code of the Russian Federation).

Thus, you can donate or exchange any property owned by the donor or seller: real estate, a vehicle, securities, jewelry, household appliances, expensive tools. The main difference lies in the presence or absence of benefits, as well as the form and content of contracts.

Invalidity of a sham transaction

According to Part 2 of Art. 170 of the Civil Code of the Russian Federation, feigned if it is concluded not to achieve a result, but to cover up real legal relations that have developed within the framework of another transaction. With regard to individuals, we are usually talking about formalizing the legal relationship of exchange with a gift agreement; with regard to legal ones, on the contrary, it is about registering a gift by exchange, since gratuitous agreements between SPD (business entities) are prohibited .

In the case of a feigned gift, there are always two transactions.

The first is “feigned”:

- is concluded to divert attention from the real transaction and is usually intended to legally formalize the transfer of ownership;

- not intended to be performed by the parties;

- usually meets the requirements of the Civil Code of the Russian Federation regarding content, design, notarization, state registration, etc.

The second is “covered”:

- concluded between the parties secretly;

- planned to be carried out “on faith”;

- usually not formalized in any way, it is a “gentleman’s deal”.

There are exceptions , for example: the parties notarize a counter-donation instead of an exchange and at the same time exchange handwritten receipts regarding the essence of real legal relations; Judicial practice has taken the path of recognizing such documents as evidence in cases of claims for invalidation of contracts.

Additionally

Sham transactions are void (Part 2 of Article 170 of the Civil Code of the Russian Federation). They do not give rise to legal consequences. If a fact of sham is revealed, the court establishes the content of the real transaction and applies to it the rules governing this type of contract.

Theoretically, by virtue of Art. 166 of the Civil Code, void transactions are invalid from the moment of conclusion, regardless of the fact that their illegality is recognized by the court. In reality, everything is much more complicated. A statement about the sham of a gift or exchange made by a third party or even a party to it has no legal consequences. This requires a court order.

A claim for a sham transaction is usually filed by a third party who benefits from the consequences of a real, rather than a hidden transaction. The plaintiff in such a case is in an extremely difficult position:

- the parties to the transaction declare that there are no hidden intentions;

- There is usually no documentary evidence;

- The cover transaction is completed and, as an option, registered in the Unified State Register.

By virtue of Art. 56 of the Civil Procedure Code (Civil Procedure Code) of the Russian Federation, the plaintiff is obliged to prove the circumstances to which he refers . Usually he attempts to testify about what he saw and heard himself, or to bring witnesses. The success of the event is extremely doubtful.

For your information

The number of decisions on the recognition of barter and gift transactions is tiny compared to their actual volume. The matter usually does not go to court - there is no point in filing a futile claim.

Positive practice in such cases concerns situations where the plaintiffs are authorities (most often the Federal Tax Service) or “changed their minds” parties to the contract who have written evidence of counter-provision - receipts, acceptance certificates, documents from transport companies on the delivery of goods, etc.

Example

A claim was filed regarding the invalidity of the exchange agreement dated 03/01/14, according to which the defendant (IP) undertook to transfer 1,500 tons of grain to the plaintiff (LLC) in exchange for 5 combines. The LLC handed over the combine harvesters and technical passports to the individual entrepreneur, but did not supply the grain to the individual entrepreneur. The act of acceptance and transfer of grain dated March 23, 2014 is fictitious. The LLC considers the transaction to be a sham, covering up the gratuitous transfer of special equipment, and asks that it be declared void. The IP rejected the demands. He explained to the court that by the time the agreement was concluded, the LLC had in storage grain belonging to the individual entrepreneur in the amount of 1,500 tons. According to Art. 224 of the Civil Code of the Russian Federation, if at the time of concluding an agreement on the alienation of a thing it is already in the possession of the acquirer, the thing is considered transferred.

The LLC representative indicated that the storage agreement has nothing to do with me. The witness explained that the grain was not transferred; the signed acceptance certificate concerned the grain that was in the LLC’s storage.

According to Art. 567 of the Civil Code of the Russian Federation, the rules on purchase and sale are applicable to me. According to Art. 458 of the Civil Code of the Russian Federation, the seller’s obligation is fulfilled at the time of delivery of the goods to the buyer. The transfer of grain was not carried out and was not intended. The parties signed an acceptance certificate, but, as confirmed by the defendant and the witness, the grain was not transferred under the act. The reference to the fact that this meant grain stored by the LLC is not documented. The plaintiff disputed this fact. According to Art. 575 of the Civil Code of the Russian Federation, donations between business entities are not allowed. The court declared the agreement no. dated 03/01/14 invalid (feigned) and ordered the LLC to return the combine harvesters.

Form and content of the gift agreement

According to Art. 574 of the Civil Code of the Russian Federation, a deed of gift is drawn up in writing, if real estate is alienated, by the donor of a gift worth more than 3,000 rubles. an organization acts, or the contract contains a promise of donation.

In practice, written form is also required in other cases. For example, Art. 574 of the Civil Code of the Russian Federation does not provide for it for donating cars, but the traffic police will require a paper agreement from the recipient to register the car.

Legal advice: even if a written DD is not required by law, it is better to draw it up. This will make it possible to provide for the rights and obligations, responsibilities of the parties, and, if necessary, to quickly resolve a dispute about donated property in court.

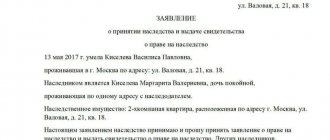

Sample donation agreement

The DD must include all information about the transaction, otherwise it will not be accepted for registration when it is required, or third parties will be able to challenge it.

What data will be needed:

- Full name, registration addresses, passport details of the donor and recipient;

- Gift details;

- Rights, responsibilities and obligations of the parties;

- Date of signing;

- Execution start date;

- Conditions for termination or modification of the DD;

- Signatures of the parties.

Sample real estate donation agreement: alt: Apartment real estate donation agreement

Advantages and disadvantages

Donation has several advantages and disadvantages:

| pros | Minuses |

| Exemption from taxation for transactions between close relatives, transfers of money or gifts in kind | Donees who are not close relatives of the donor pay personal income tax in the amount of 13% of the cost |

| You can donate the fulfillment of debt obligations for the donee or the right to claim a debt from a third party | Prohibition on gifts between commercial organizations |

| Property donated to a son or daughter during marriage in case of divorce is not divided (Article 36 of the RF IC) | Gratuitous: the donor receives nothing in return |

| Material and intangible benefits (rights) are transferred as a gift | High costs are possible: if the DD requires notarization, you will have to pay several thousand to the notary |

| When alienating a share in the right to real estate, there is no need to ask the consent of the remaining owners | To donate part of the housing shared by spouses, you will have to allocate a share |

| Simplicity of design | |

| Difficulty of challenging (a plus for the donee and a minus for the donor) | |

Which is better, a gift agreement or an annuity agreement?

How to draw up a debt gift agreement?

Challenging a deed of gift after the death of the donor

The procedure for challenging a deed of gift by third parties can only be carried out after the death of the donor. While the donor is alive, he has the right to dispose of his own property at his personal discretion. Also, the donor has the right to challenge the deed of gift in case of such a need (it should be noted that the deed of gift is not subject to changes and amendments, unlike a will, which can be changed as many times as the testator wishes).

The donor's heirs may challenge the provisions of the deed of gift after the death of the testator in the following cases:

- The procedure for drawing up the deed of gift took place under pressure. Heirs have the right to file a claim if there is official evidence that the gift agreement was concluded due to a threat to the life of the donor or his relatives.

- The papers were drawn up by an incapacitated citizen. The giver could sign without realizing his own actions. In this case, the heirs can appeal to the court, providing a significant evidence base (for example, medical reports, doctors’ notes, and so on).

- The papers were prepared through deception. In order to challenge such a transaction, interested parties are required to provide the court with evidence of fraud.

- Forgery of a document.

- When drawing up the contract, the spouse's permission was not obtained.

- If we are talking about a deed of gift for an apartment, the document can be challenged if the recipient is not registered.

- Errors in document preparation.

- An imaginary deal. In this case, we consider situations where the deed of gift was drawn up solely for the purpose of covering up a real transaction (for example, the purchase/sale or exchange of property).

- The donor had no idea about the legal consequences of the agreement. It should be noted that such a situation can be challenged by the relatives of the donor even before his death.

If the procedure for challenging a deed of gift occurs after the death of the donor, relatives are obliged to take into account the deadlines established by current legislative norms. In accordance with the provisions of the law, the procedure takes from one to three years to complete.

Form and content of the exchange agreement

The provisions of Art. 159-160 Civil Code of the Russian Federation. If there is no mandatory notarial form or registration of ownership, the transaction can be completed orally at the request of the parties.

Written form is required if:

- The value of the property exceeds 10,000 rubles;

- The transaction is carried out between legal entities and individuals;

- Consent to the procedure from a third party is required;

- An attorney participates in the procedure under a power of attorney.

Important! If the DM requires notarization, the power of attorney for the representative is also certified.

Sample exchange agreement

If there is an exchange of real estate, the contract must contain comprehensive information about the transaction:

- Date and place of imprisonment;

- Full name, passport details of the parties;

- Information about real estate: addresses, area, cadastral numbers, number of rooms, dates of construction;

- Information about additional payment (if the exchange is unequal);

- Conditions for amendment and termination;

- Responsibilities, duties and rights of the buyer and seller;

- Information about encumbrances (if any);

- Dates of ownership;

- Allocation of expenses;

- Signatures of the parties.

Sample agreement for the exchange of real estate: alt: Agreement for the exchange of equivalent apartments

Pros and cons of an exchange agreement

The advantages of DM are the speed of execution of the transaction: the parties only need to agree on the terms, sign the document and exchange property. If the exchanged item is confiscated from the buyer or seller by a third party, you can demand compensation for losses from the second participant in the procedure.

If the DM is declared invalid, but the property is lost, the party pays equal compensation to the second participant.

One of the disadvantages is that you cannot transfer the right to claim a debt or repay a debt under a DM, as with a gift. In addition, if citizens agree to an unequal exchange, they will have to indicate a deliberately false value in the contract, and the transaction may be declared invalid.

General concepts

First of all, it is necessary to distinguish between the concepts of donation, rent and will, since for many citizens they are identical.

- Donation is the gratuitous transfer of property to another person. The donor has no right to impose any conditions, whether of a property or non-property nature.

- Rent is a paid transfer of property to another person. The annuity recipient may demand from the payer both monetary support and the performance of certain actions. Despite the transfer of rights to property, one of the conditions of the rent may be lifelong use of the transferred property.

- A will is a gratuitous transfer of property to another person(s). But the right of ownership arises from the heirs only after the death of the owner of the property.

The agreement of the will of an apartment is an annuity, according to which the recipient of the property remains indebted to the owner of the property for life.

If a citizen chooses a way to transfer his inheritance to other people, then he should consider all three options. Otherwise, an unpleasant situation may arise.

Agreement of gift and exchange: comparison

Let's look at the characteristics of DM and DD in comparison:

| Gift deed | Mena |

| Free deal | Compensatory deal |

| Obligations arise from one party - the donor | Obligations apply to both parties |

| There is a ban on gifts between commercial enterprises and to other persons. | There are no prohibitions or restrictions. But you cannot dispose of the property of children under 14 years of age without the consent of the guardianship authorities |

| Donees who are not close relatives are obliged to pay personal income tax when receiving a gift | If there is no profit, there is no taxation |

| You cannot get a property tax deduction | A tax deduction is provided for additional payments for real estate |

What documents are needed to formalize a deed of gift for an apartment?

For mandatory registration of a gift agreement, the documents listed in this list are required:

- passports of both parties to the transaction;

- gift agreement drawn up in 3 copies (one each for the donee, the donor and the state registrar);

- technical passport of the living space received from the BTI;

- cadastral passport;

- documents that prove the legality of the donor's ownership of the transferred property;

- extract from the Unified State Register of Real Estate;

- a certificate from the BTI with the actual cost of housing;

- an extract from the house register confirming the fact that no one else is registered in the apartment except the donor;

- a receipt confirming successful payment of the state fee established for registration of the agreement in the Unified Register;

- consent of other co-owners (optional);

- consent of the spouse (optional);

- notarized power of attorney, if the interests of one of the parties are represented by a third party;

- permission from the guardianship and trusteeship authorities (if necessary).

ARTICLE RECOMMENDED FOR YOU:

Donation agreement after the death of the donor - is gifting possible?

Challenging an agreement of exchange or gift

The deed of gift is disputed on the grounds provided for in Art. 578 Civil Code of the Russian Federation:

- The death of the donor occurred as a result of the guilty actions of the donee (disputed by the heirs);

- The new owner committed a crime against the health of the donor and his relatives;

- The donor issued a DD within six months after declaring himself bankrupt, and the gift was purchased with money from the business (disputed by creditors);

- The deed of gift provides for revocation by the donor in the event of the death of the donee before him.

There are other conditions for canceling exchange and donation.

For example, if an agreement is drawn up for the purpose of covering up another transaction, it may be considered sham (Article 170 of the Civil Code of the Russian Federation). Agreements drawn up under the influence of misconception or unlawful influence from other participants or third parties are also disputed; issued by incapacitated or partially capable citizens.

Donation of property after the death of the owner

Clause 3 of Article 572 of the Civil Code of the Russian Federation provides the following: a deed of gift, under the terms of which property is transferred as a gift after the death of the donor, is considered a void document.

A document that contradicts current legislative norms and has no legal force is recognized as void. The transfer of the donor's property into the property of the donee necessarily occurs only during the life of the donor.

A deed of gift for property, which after the death of the donor will become the property of the donee, is a meaningless document that does not provide any guarantees.

Arbitrage practice

Donation or exchange is contested in court; the process is usually difficult and requires good legal preparation.

But it is possible to have contracts declared invalid and property returned, as several decisions confirm:

- Decision No. 2-5303/2018 2-537/2019 2-537/2019(2-5303/2018;)~M-5049/2018 M-5049/2018 dated April 4, 2019 in case No. 2-5303/2018 (DM);

- Decision No. 2-1249/2018 2-1249/2018~M-1144/2018 M-1144/2018 dated November 13, 2021 in case No. 2-1249/2018 (DM);

- Decision No. 2-55/2019 2-55/2019(2-775/2018;)~M-675/2018 2-775/2018 M-675/2018 dated June 17, 2021 in case No. 2-55/2019 .

Legal advice: the result of challenging contracts is the return of the parties to their original position and the return of property. To prevent this from happening, it is recommended to approach the paperwork responsibly and not try to cover up one transaction for another.

Will

The transaction is one-sided, the document is drawn up by the testator and kept by the notary. Can be composed many times.

You should know that each new will cancels the old one.

The positive point in this situation is that the testator remains in his own interests and remains the owner of his apartment until his death. The negative point is that the testator, due to his age, may be too trusting. And this is often taken advantage of by unscrupulous relatives who can persuade the testator to change the will in their favor.

It should also be remembered that there is a secrecy of a will. Therefore, no relatives should be present when writing a will.

A will can be revoked in court if there are suspicions that the testator was insane at the time the will was written.

Lawyer's answers to frequently asked questions

Is it necessary to fill out an act of acceptance and transfer of real estate under a gift or exchange agreement?

The legislation does not require the execution of a transfer deed, but it is better to draw it up to confirm the fact of acceptance and transfer and the condition of the property at the time of signing.

Do I need to have a deed of gift or exchange certified by a notary?

Not always. Notarization is required for the alienation of a share in property rights, the participation of a representative by proxy or a transaction with the property of a minor.

Do I need to obtain my spouse's consent to exchange real estate purchased during marriage?

Yes, consent is necessary both when giving and when exchanging. Otherwise, the spouse whose rights have been violated will be able to challenge the transaction within 1 year from the moment he became aware of it (Article 35 of the RF IC).

What is the amount of the state duty when registering property rights to housing under exchange or gift agreements?

The amount of state duty is the same everywhere. Individuals pay 2,000 rubles, legal entities – 22,000 rubles. For registration of land plots, depending on the category, the fee can be 100-350 rubles.

What is better for transferring real estate to a close relative: exchange or donation?

For the donee, a DD is more profitable: you don’t have to pay personal income tax and provide property in return. For the seller - DM: in return he will receive another property; in the absence of profit, he is exempt from taxation.

Challenging a deed of gift after the death of the donor

It should be remembered that during the lifetime of the donor, only he himself has the right to challenge the deed of gift. However, after the death of the donor, interested parties can challenge the deed of gift for the apartment. To do this, you should contact the court and provide compelling evidence, for example:

- The procedure for registering a deed of gift took place under pressure. If the relatives of the donor after his death can prove that the property was donated due to a threat to the life of the donor and his relatives, the case will be carefully considered by the judge.

- The papers were drawn up when the donor was incapacitated. The owner could put his signature on the document without even realizing his actions. Close and distant relatives of the donor have the right to challenge such a decision.

- The deed of gift was created through fraud. In this case, it is almost impossible to challenge the fact of deception. Interested parties challenging the deed of gift are required to provide the court with a compelling evidence base.

- Forgery of contract. Statements of the parties must be certified by Rosreestr. If any seals or signatures are missing, such documents not only need to be challenged, but also their illegality must be proven.

- During the process of drawing up the contract, the donor did not obtain the consent of the spouse. In this case, the donor may not require the consent of the spouse if the property is his personal property and was not acquired during the marriage.

- Lack of registration on the part of the donee. Notarization is not completely important, but without this procedure it is impossible to register a document. If this clause was not fulfilled during the life of the donor, after his death the property will be divided among the heirs.

Advantages and disadvantages

Registration of the transfer of ownership by donation has both advantages and disadvantages. All of them, one way or another, stem from the gratuitous nature of this transaction.

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

The debtor can make a donation only on the condition that at the time of the transaction the property is not burdened with an arrest (Article 80 of the Federal Law No. 229 dated 02.10.07), a pledge (Article 334 of the Civil Code of the Russian Federation), a mortgage or pledge (Articles 1 and 13 of the Federal Law No. 102 dated 07/13/98).

Donation as a way to withdraw assets is even more relevant for a legal entity than for a citizen. If an individual can sell property, receive payment in cash and supposedly spend or lose the funds, then for the organization the management of money is complicated due to accounting rules.

Donation, both parties of which are business entities, is prohibited (Article 575 of the Civil Code of the Russian Federation).

But an institution can donate an apartment/car to its employee - a relative/friend of the founder.

Doing business without creating a legal entity is convenient, but risky - an individual entrepreneur is liable for business obligations with personal property (Article 24 of the Civil Code of the Russian Federation). In case of problems, the individual entrepreneur can remove property from the blow by donation and achieve debt write-off through bankruptcy proceedings (Article 25 of the Civil Code of the Russian Federation).

The registration of a gift instead of an exchange can be used by the imaginary donee to prevent the spouse from having the right to 1/2 of the property. According to Art.

253 of the Civil Code of the Russian Federation and Art. 34 of the RF IC (Family Code of the Russian Federation), in the absence of a marriage contract, everything acquired by spouses through paid transactions is subject to the regime of common joint property.

However, gifts made to each of them are at their personal disposal.

If the spouse does not claim what was acquired by his marital partner in a paid transaction, when concluding it, you can draw up a notarial statement (for example: “this property is acquired by my spouse for funds / in exchange for property that belonged to him personally, accumulated / acquired by him during the period before entering into marriage"). If there is no consent or it is problematic to apply for it, you can bypass the spouse by registering a gift.

The use of a gift construct may be necessary for the buyer if he cannot show the source of the funds spent on the purchase. This situation is typical for recipients of various types of social assistance for low-income people.

According to Art. 577 of the Civil Code of the Russian Federation, the donor may refuse to fulfill an agreement with a consensual structure (promise for the future) for reasons of a significant deterioration in his health, well-being or change in marital status.

The grounds for refusal are described vaguely, using evaluative categories. If desired, the donor who changes his mind will find a lot of reasons for applying Art.

577 of the Civil Code of the Russian Federation, and if absent, it will create them.

According to Art. 578 of the Civil Code of the Russian Federation, cancellation of a donation at the initiative of the donor is possible in the case when the donee:

- intentionally inflicted bodily harm on him, or attempted to kill the donor or his relatives;

- mistreated an item of intangible value to the donor.

Without going into details of possible fraudulent activities, the following should be noted. The legislator did not specify either the severity of the injuries or evidence of an attempt.

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

Prescriptions Art. 578 of the Civil Code of the Russian Federation does not provide grounds for asserting that these facts must be established by a criminal verdict or resolution in accordance with the Code of Administrative Offenses.

Here is an elementary scheme: feast (alcohol) → insult → provoked fight → recording of beatings through a forensic expert (ordinary bruises) → lawsuit to cancel the donation.

The risk factor of the imaginary donee in a transaction with a legal entity is specified in Part 3 of Art. 578 Civil Code of the Russian Federation. At the request of a third party, the court may cancel a donation made by an individual entrepreneur or organization within six months before declaring him bankrupt.

Mena is the oldest contract in human history, common even before the advent of money. Today it is used narrowly because it has a bulky and inconvenient design that limits the freedom of the parties. There is a well-founded position that barter is a subtype of purchase and sale, because:

- the rules of Ch. 30 Civil Code of the Russian Federation;

- barter relations do not exclude monetary settlements between the parties.

Constant

- The parties are citizens, non-profit firms.

- The payment period does not end with the death of the recipient; the heirs claim payments.

- Payment is made in money, things, services, according to the terms of the transaction. The amount of periodic payments, expressed in money, increases as the cost of living increases.

- Redemption is possible at the request of each participant.

- For the risk of accidental loss or damage to the subject of the agreement, in the case of a free transfer, the annuity payer is responsible, and in the case of a paid transfer, the recipient is responsible.

Which option should you prefer?

When alienating real estate, the question of whether it is better to choose an annuity or simply a gift agreement is quite common. Studying the nuances of each type of transaction will help you figure out which design is preferable:

- concluding a gift agreement is much simpler, while a rental transaction requires notarization;

- the counterweight to the gratuitous transfer of housing when donating is fixed payments in the case of rent;

- state registration is provided in both options;

- when alienating property through rent, a number of obligations and conditions are prescribed, whereas otherwise only the donor has an obligation;

- In some cases, in a rental transaction, a transfer and acceptance certificate is required.