What should be contained in the contract?

A strict form of gift agreement with the condition of lifelong residence has not been approved. In terms of content, to give legal force it must contain:

- date (in words) and place of compilation;

- information about the parties to the transaction (full name without abbreviations, passport details, registration address);

- description of the residential premises being donated (mailing address, total and living area, number of rooms, on what floor it is located);

- details of the document confirming the donor’s ownership of the apartment;

- condition of the donor's lifelong residence in the specified premises;

- signatures of the parties.

It is permissible to stipulate in the contract other terms of intangible obligations to the other party. For example, indicate accommodation, distribution of utility bills, etc.

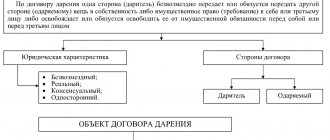

A gift transaction is always gratuitous and specifying material conditions in the contract is unacceptable. This is a two-sided document that seals the transfer of property as a gift from one party and the voluntary acceptance of it by the other. If the donor does not want to fulfill the conditions of residence, the donee has the right to refuse the transaction.

Civil law as void when:

- it states the condition for the transfer of property only after the death of the donor (then it is better to draw up a will), Art. 572 Civil Code of the Russian Federation;

- the obligation of the donee to make a monthly payment for the property accepted as a gift is indicated (this clause is characteristic of the annuity agreement), Art. 583 Civil Code of the Russian Federation.

The best option during your lifetime is to donate an apartment, but stay in it - to issue a deed of gift with lifetime residence. By putting his signature on the document, the donee accepts this condition.

The document is drawn up in three copies: one for each party and an additional one for Rosreestr. The transfer of ownership is subject to mandatory state registration, for which you will need to contact the Rosreestr authority with a package of documents.

Judicial practice, examples

The presence of such an encumbrance in a gift agreement is considered completely legal in judicial practice, which corresponds to paragraph 3 of Article 308 of the Civil Code of the Russian Federation.

The fact is that legal liability does not establish duties for citizens who do not participate in it, except for those circumstances prescribed in legislation and other regulatory documents or contracts in which such agreements of the parties are specified.

And also, if liability is indicated not exclusively in relation to both parties, but also for other persons to whom any residential property will be transferred.

An example of this is the Resolution of the Perevolotsk District Court of the Orenburg Region. dated September 15, 2015 in case No. 2-788/2015.

With the termination of ownership of property, when it is transferred to another person, it does not affect the donor’s right to live in such living space in compliance with all his subsequent rights (Resolution of the Zheleznodorozhny District Court of the city of Voronezh dated September 21, 2015 in case No. 2-1730/2015).

It should be taken into account that legal proceedings are not always one-sided in their decisions.

All this is due to the fact that the laws of the Russian Federation lack certain standards that would ensure compliance with all rights by the new owners who acquired the property in relation to the donor of real estate.

How to draw up a gift deed with lifelong residence?

Initially, the parties must reach verbal agreements. If the donee accepts the terms of the other party, then he should proceed to draw up a gift agreement. To do this you need to follow these steps:

- Drawing up a deed of gift . You can do this yourself using ready-made solutions taken from the Internet, or contact a lawyer. A notary will also help you draw up a deed of gift, who will immediately certify the transaction.

- Visit to a notary's office . A gift agreement does not always require notarization. But many lawyers believe that in order to reduce risks, a deed of gift with lifelong residence of the donor must have a notary’s signature.

- State registration of the transfer of ownership to the donee . After signing the gift agreement, the recipient of the object does not yet have property rights. To do this, you need to contact Rosreestr or the MFC with an application for the transfer of ownership rights. Both parties to the transaction must appear.

For registration actions, you must pay a state fee of 2,000 rubles.

- Get an extract from the Unified State Register of Real Estate . Lifetime residence in the case of a deed of gift is not a burden. This item will not be filled in in the extract from the Unified State Register. The deed of gift will only limit the possibility of disposing of the property, since it will be impossible to write the donor out of the donated apartment.

Documents and design algorithm

Registration of a deed of gift with an encumbrance consists in following sequential actions - an algorithm.

First, the contract itself is drawn up, then it is advisable to contact a notary (mandatory in the case of donating a share in an apartment with shared ownership). After which, all documentation for the transaction must be checked for accuracy and correctness and registered in Rosreestr as a transfer of ownership from one party to another.

Registration in Rosreestr will take from three to five days. And after three weeks, a certificate from the Unified State Register is issued.

The notary will require the following documents to draw up a deed of gift for an apartment with the right of indefinite residence for the owner who presents it:

- Civil passports of both parties.

- If the deed of gift is drawn up for a person under 18 years of age, then his birth certificate.

- Documentation for the apartment, proving the owner’s rights to the property (certificate of state registration).

- A document indicating the presence of registered people in the specified living space (extract from the house register).

- Cadastral passport and additional technical documents for real estate, which reflect the price and layout of the living space.

- Certificate from the Federal Tax Service regarding the absence of tax arrears.

- A certificate from the Unified State Register or Housing Management, proving state registration of the owner of the living space.

- Consent of the spouse to make a gift transaction, which must be provided in handwritten form.

- If the act of donation occurs with the participation of persons under 18 years of age, then written permission will be required from the state executive authorities responsible for them at the moment.

The deed of gift is drawn up in the presence of both parties. If it is not possible for one of them or both of them to be present at the same time, the transaction is concluded with the assistance of their attorneys under notarized powers of attorney.

Do I need to pay personal income tax?

Receiving a gift is a material benefit for the recipient. According to tax legislation, he has an obligation to pay personal income tax on such income in the amount of 13% of the cadastral value of the residential property.

Find out more

An exception is the case of donating property in favor of close relatives. In this case, they are exempt from taxation. The circle of close relatives is established by the Family Code in Article 14.

Deed of gift with encumbrance

An encumbrance refers to some specially created circumstances or obstacles to limit the new owner’s use of the property acquired as a gift.

This deterrent occurs when the owner of the apartment tries to exercise his legal rights to the property to the detriment of the donor.

A mortgage on an apartment is the most common type of encumbrance. Every citizen in our country is now familiar with it.

For example, you purchase an apartment with a loan taken from a bank and apply for a mortgage. Consequently, from this moment the purchased living space does not completely belong to you, since it is pledged to a financial institution until the loan is fully repaid. This is a burden!

Therefore, you cannot yet dispose of the property in full; there are significant restrictions. Every step you take is carried out with the permission of the bank.

As soon as the owner decides to donate such real estate to relatives, a deed of gift with an encumbrance is drawn up, and the appropriate conditions are specified in it.

When concluding an agreement with an encumbrance, the donor’s authority to dispose of the apartment does not go through the registration procedure in the Unified State Register of Real Estate, but he has the right to use the living space legally.

Donation of an apartment with lifelong residence is divided into 3 main types.

Mixed gift

A mixed type gift agreement implies the fact that the donor has the right to own real estate for the rest of his life in partial form.

That is, under such conditions, the donee assumes the responsibility of providing the donor with an unhindered right of residence in the given living space without a period of time.

With the right of ownership and use

The agreement states that the donor has the right to use the apartment for life, and the transaction is registered. Then, according to the transfer and acceptance certificate, the living space is transferred with full rights and obligations to the new owner.

The procedure for use has been agreed upon

In this case, the general order of priority for the use of real estate specified on a contractual basis is agreed upon between the two counterparties to this agreement.

In our case, there is an agreement between the donor and the person taking ownership of the property.

Sale of an apartment in which the donor lives

In fact, after state registration of the transfer of the right to the apartment to the donee, the donor loses the opportunity to dispose of it. And the new owner can sell it to other persons. Since it is impossible to write out the donor, the buyer must be notified of this circumstance. If he accepts it, then the deal will take place.

Restrictions on the right to sell to third parties in the text of the deed of gift are unacceptable . Such an agreement can be declared invalid.

If the donor dies, who owns the apartment?

According to the deed of gift, ownership of the apartment passes to the person who accepts the gift. If it stipulates the lifelong residence of the donor, then this condition is valid until his death. The heirs will not be able to claim this living space, since it no longer belonged to him during the life of the donor.

When they can refuse

The guardianship and trusteeship authorities may refuse to draw up such a gift agreement if the donee is a minor and the transaction is contrary to his interests. The spouse or other owners who are not interested in the loss of property can refuse.

Rosreestr may refuse registration due to incorrect presentation of the package of papers or incompleteness of its completion. If the reason for the refusal is corrected, you can apply for registration again.

It is worth remembering that a deed of gift can be challenged after it has been drawn up and entered into force. This usually happens when the form of the agreement is not followed, there are doubts about the donor’s legal capacity, or circumstances have been identified that influence his decisions.

You can learn how to terminate a gift agreement by agreement of the parties or in court from our article.

Additional terms of the deal

The document may contain different conditions. The main thing is that the recipient agrees to them.

These conditions include:

- The right of the owner to retain one or more rooms in the property.

- The owner has the right to donate only one room.

- The owner after the death of the donor will be the donee.

- The owner after death will be a third party.

These are the main terms that may be specified in the contract. Moreover, in the first two cases we are not talking about shared donation. After death, the apartment will completely become the property of the donee.

The third point is regulated by Article 292 of the Civil Code.

In the fourth paragraph, relatives of the donee, and not the donor, can act as a third party. In this case, the consent of the donee must be expressed officially.

Rights and obligations of the donee

Once a contract is concluded, all parties are required to comply with its terms. It is from the text of the document that the rights and obligations of the donee flow. So, if the agreement provides for the payment of annuity, then he must pay an agreed amount monthly for the maintenance of the donor. In addition, the law provides for a number of other rights:

- The gift itself in the form of housing can be accepted at any time after the agreement is drawn up and signed. There is no time limit for this.

- The ability to refuse a gift in the form of a house or apartment without explanation.

- The right to make all transactions with real estate provided for by law, if they do not violate the donor’s right of residence.

Each of the parties to the agreement is endowed with its own rights and responsibilities.

Rights and obligations of the donor

When drawing up a document of donation, it can provide for a large number of various rights and obligations of both parties, and stipulate all the nuances of residence. For example, the donor can reserve the right to live in a specific room and at the same time have unhindered use of the entire living space.

Signing the deed of gift preserves the donor's right to permanent registration. He can part with her only voluntarily. No structures or persons have the right to force him to do this.

When donating with an encumbrance, it is important to take into account all the subtleties of the process

The legislation also assigns a whole range of rights to the donor:

- The Family Code provides that if the donor is a disabled person, then the donee is obliged to support him. It does not matter to what degree of relationship these persons are.

- It is possible to register a deed of gift only for a share in a home with the condition that the entire remaining area will become the property of the donee only after the death of the owner.

- In addition to him, other persons (for example, close relatives) may live in the apartment, but their circle and terms must be specified in the text of the contract.

- According to the deed of gift, the donor may receive the right to a life annuity (i.e. maintenance).

- The right to terminate the transaction, provided that the donee does not comply with the terms of the agreement (for example, interferes with the donor’s residence in the apartment).

When drawing up an agreement, it is necessary to provide for all the details. It would be better to contact a professional lawyer for clarification. For example, if the text indicates that the owner retains the right to use the residential premises, but does not live there permanently, this means that he also bears maintenance responsibilities. So, in the event of flooding of neighbors due to the fault of the donee, he will be obliged to pay them compensation (which can then be demanded from the person who is really to blame for the incident). Therefore, lawyers recommend retaining only the right to use housing.

Positive and negative points for both sides

First of all, let's look at how the donor benefits from his donation. The most important advantage is an improvement in financial condition. As a rule, in addition to the possibility of permanent residence (and permanent registration) in the apartment, he receives a monthly lifelong annuity and is freed from the need to pay utility bills on his own. In the home itself, he can behave absolutely freely in everyday life. Plus, the contract can stipulate the need to carry out repairs at the expense of the new owner, as well as the possibility of third parties living in the apartment.

In addition, if the donee does not fulfill the terms of the agreement, then, according to the Civil Code of the Russian Federation, the transaction on the transfer of housing can be challenged in court.

The main disadvantage of such a donation will be the fact that the new owner has the right to make any transactions with housing. That is, it is possible to buy and sell it or rent it out, etc.

For the person who receives housing as a gift, you can outline your positive and negative points. The most important achievement will be obtaining ownership of an apartment. The new owner has the legal right to dispose of it at his own discretion. That is, make any types of transactions: sell, donate, provided that the donor will still live in this apartment.

If the issue of the donor’s maintenance is not specified in the contract, then the donee is not obliged to do so. Plus, the received property is not subject to division between spouses and any of the relatives of the former owner of the apartment cannot claim it. In addition, if both parties to the transaction are closely related, then they will not have to pay income tax.

But the procedure for obtaining housing in this way also has its disadvantages:

- The donor has the right to live in this apartment for the rest of his life. Nobody has the right to evict him.

- Problems arising during real estate transactions. Clients rarely agree to buy or rent housing with encumbrances.

And most importantly, all positive and negative aspects for both parties depend only on the clauses of the contract. Participants in the transaction are required to follow it strictly.

The donation procedure has both pros and cons for each party.

Benefits for the donor

A person who donates real estate with the right to stay in this apartment until his death receives many benefits:

- preserving a place for permanent residence;

- lack of opportunity to extract from real estate;

- expenses associated with the maintenance of housing are transferred to the recipient.

The disadvantage is represented by the lack of full legal protection against the arbitrariness of the recipient of the gift, who may challenge the clause relating to lifelong residence.