To enter into an inheritance through the court, you need to provide the most complete package of evidence of your right to do so. It is worth handing over to the court everything that you can collect: from official documents to testimony from neighbors. In this case, the reason is not important - it is a missed deadline for entering into an inheritance or a court case regarding the size of the shares. The final decision will always be in favor of a closer relative with more official papers. The acceptable period is from 3 to 10 years (in exceptional cases) after the distribution of the inheritance by a notary.

In some cases, probate courts last for years and involve multiple appeals. If you are preparing for such a lawsuit or even just studying the issue, contact a lawyer for disputed inheritance issues. A specialist will analyze your case in detail and suggest the most effective tactics in court.

Do you want to figure it out, but don’t have time to read the article? Lawyers will help

Entrust the task to professionals. Lawyers will complete the order at the cost you specify

244 lawyers on RTIGER.com can help with this issue

Solve the issue >

About the timing of inheritance

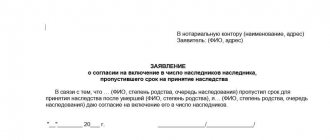

The application must be submitted to a notary or to the court within 6 months from the date of death of the testator (there are exceptions). What does “within 6 months” mean? and what needs to be done? After the death of a citizen, heirs according to the law of the first priority or according to the will have only 6 months to apply for inheritance:

- to court (if there are any inheritance disputes or there are no documents necessary for registration by a notary;

- to a notary (if there are no disputes and the nature of the documents submitted does not contradict the norms of the notary).

To avoid missing the deadline, you can submit documents in person. The second option is to send them by mail or other official delivery service. The date of sending the correspondence will be considered the proper date for filing the application for acceptance of the inheritance.

When does inheritance take place under a will?

You can submit documents to enter into the right of inheritance immediately after receiving a document certifying the death of the testator. But you are not obliged to do this immediately; the main thing is to have time to declare your inheritance rights before six months have passed. The period begins to count from the next day of the date on the death certificate, or the date of entry into force of the court decision declaring the citizen dead.

ATTENTION! If you miss the six-month deadline, the notary will rightfully refuse to accept your documents. If you had valid reasons that prevented you from filing on time, you can submit an application to the court to have the inheritance period extended, attaching documents confirming that the reason that prevented you from doing everything on time is valid.

Fractional parts

If the property was purchased by spouses during marriage, the surviving spouse has the right to allocate the marital share. That is, usually 1/2 of the share (if there is no marriage contract) goes to the surviving spouse according to a document issued by a notary. This document is called a “Certificate of Title.” And only after this is the inheritance formed after the deceased spouse - this is the second 1/2 share. It is she who will be inherited by the heirs. In the absence of a will - in equal shares between citizens called to inherit a certain order, in the case of a will - there are options for dividing and allocating obligatory shares under Art. 1148-1149 of the Civil Code. In addition, the will can be contested; this should be taken into account when registering an inheritance.

Mandatory share of inheritance - what does this concept mean?

Every citizen, of course, has the right to bequeath his own property to anyone he deems worthy, be it his relative, loved one, neighbor, friend, charitable foundation or other legal entity.

However, the law identifies certain categories of citizens who, under no circumstances, can be completely “disinherited.” These include:

- Children under the age of majority

- Disabled adult children, spouses, parents of the testator

- Disabled persons who were dependent on the testator at the time of his death

Whether specified or not specified in the will, the law regulates the specific share that disabled dependents must receive as an inheritance.

This mandatory share must be no less than 50% of what disabled dependents would receive under the usual, legal order of succession.

To make it clearer, let's give an example.

A woman leaves all her property as an inheritance to her niece (the daughter of her deceased sister), leaving her two daughters and her husband without an inheritance. One daughter is 25 years old, the second is 15, her husband is a disability pensioner. Thus, her family has two members who have the right to receive a compulsory inheritance share: a teenage daughter and a disabled spouse.

They are the heirs of the first stage, while the niece is the heir of the second stage, since the inheritance rights of the testator's sister were transferred to her. If there were no will, she would not have the right of inheritance at all, since there are heirs of the first priority. The two daughters and husband would split the inheritance equally, 1/3 each.

The testator's adult, able-bodied daughter has no right to inheritance, since she is not specified in the will. But the minor daughter and disabled husband should receive 50% of what would have been legally due to them in the absence of a will. That is, 1/6 of the inheritance each.

Thus, the inherited property is divided into the following parts: 1/6 goes to the husband, 1/6 to the minor daughter, and 4/6 (2/3) goes to the niece.

Registration of inheritance after the death of mother, husband, father, son, wife, parents, grandparents

The Civil Code very cleverly defines kinship and lines of inheritance. It seems that blood relatives, such as grandmother-grandson, granddaughter-grandfather, are not heirs by law. We all understand that these are three generations; children, parents, and grandparents are family members and close relatives. But not everyone can inherit after each other. Natural grandchildren and granddaughters were not registered as heirs after their grandparents. After them, only their own children can inherit, and not grandchildren a generation later.

The only exceptions are cases when the middle generation is not alive, and, instead of the dead, their place is taken by the next generation (grandsons and granddaughters). It’s the same with the third and fourth lines of inheritance.

The first priority of legal heirs is the spouse, children and parents. If there is no one, the second line of heirs is called to inherit, etc. If second cousins or nieces want to inherit after the death of a relative, it is necessary to calculate whether they even fall into the circle of heirs called by law.

Therefore, before writing an application for inheritance to a notary or filing a claim in court, you need to understand who is the heir and who is not. Not every blood relative has the right to inherit after the death of a citizen.

A will written in favor of one of the relatives or third parties can also change the fate of the heirs according to law. The date of writing the will may also change the size of the shares due to the heirs under the will. There are a lot of subtleties. It is difficult for an ordinary citizen not versed in jurisprudence to imagine everything. But to calculate and accurately determine is almost impossible.

How to register property rights to inheritance

This is the final stage of inheritance. The property is now yours, and you are faced with the task of obtaining full rights to it. In fact, all procedures are not much different from those that citizens undergo who have acquired property or received it as a gift.

To re-register real estate and land plots, you should contact Rosreestr, to re-register a vehicle - to the traffic police. You should have a passport, property documents, and a certificate of inheritance with you.

All this can be done after the 6 months allotted for entering into inheritance rights have expired.

Registration of inheritance after death

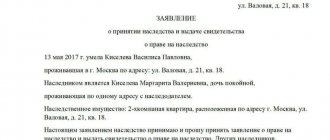

After the death of a citizen, the procedure for processing documents can be simple or complex.

An example of a simple inheritance registration.

Mother died.

Her only heir is her daughter. The apartment is privatized, the documents are in order. The apartment is located in the same city where the daughter lives. My daughter didn’t change her last name, her passport is fine. After the funeral, 2 months later, the daughter collected the necessary additional certificates and began registering the inheritance with a notary. In this example, of course, the daughter can handle the inheritance process herself after the death of her mother. This is not a difficult matter. It is only important that you have time to collect documents and be present in government organizations.

An example of complex inheritance registration.

Mother died. She was married four times. The documents have not been preserved. The apartment in which the mother lived before her death has begun to be privatized and the paperwork has not been completed. The ex-husband claims a share of the inheritance. In addition, the mother had a disabled nephew, whom she supported with her own money and took care of him in every possible way. In addition, during her life, her mother often recalled the unregistered farm in the Novgorod region after her grandmother. And one more thing - the bank filed for a refund of the loan funds.

This is a difficult matter. Not every specialist will be able to understand it. If all the heirs who are entitled to shares in the inheritance can come to an amicable agreement, good. What if everyone “pulls the blanket in their own direction”?

It is important for lawyers to work in the interests of their client. If the customer is a daughter, then the maximum share of the inheritance should go to her. If the customer is a disabled nephew, then the lawyer’s actions are strictly opposite to what a lawyer would do to protect his daughter’s rights. What if your daughter was doing expensive renovations in her apartment? What if the loan was taken out in order to use it for an operation for his mother, and his disabled nephew was supported by his mother’s money, which was given to her by the same daughter? There are many legal positions here that will be different under different circumstances of the case. And citizens themselves are not able to understand such inheritance matters or such complex situations.

Is it possible to register an inheritance if the father got married before his death?

Registration of marriage relations leads to an increase in the number of heirs.

However, in practice, the distribution of property takes into account the following factors:

- existence of a will;

- minor and/or disabled children/parents/dependents;

- the presence of joint property of the spouses.

If the deceased father managed to acquire movable or immovable property together with his wife, then such property is their joint property. Consequently, the spouse's share is allocated from the inheritance mass.

The rest of the property is divided among the heirs who submitted the application. If the assets of the deceased citizen were his personal property, then it is all included in the estate.

Example. Citizen G. was a widower and raised a son. After some time, he remarried. 2 years later the man died. The testator had a personal apartment and a bank deposit. On the day of death, the man lived with his wife. His son was a 3rd year student at a university and lived in another city. The 1st line heirs according to the law include the spouse and child of the deceased citizen. The testator's parents died before he did. When filing an application with a notary, it was determined that the deceased person did not leave a will. Consequently, the property of an intestate testator is divided equally between his wife and son. If the testator left behind an administrative document and bequeathed the apartment to his son, and the contribution to his wife, then the woman’s claims to part of the apartment would have no legal basis.

Registration of inheritance if there is nothing to inherit

In some cases, unregistered objects can be inherited

An unregistered dacha, unprivatized apartments, unknown property, etc. are reasons to contact a legal organization to prove the real inheritance. Of course, it is not possible to register property in all cases. But, if, after careful work, evidence is found that proves the citizen’s intention to register real estate as a property during his lifetime, one can hope for the success of the case.

How to calculate inheritance tax without a will

The very concept of inheritance tax has not existed for more than 10 years, but a state duty has appeared, which you must pay at the notary’s office. It includes notary services. The amount depends on the value of the property and the degree of relationship and can sometimes be quite high.

- heirs of the first stage, as well as parents, brothers and sisters give 0.3 percent, the maximum amount does not exceed 100 thousand rubles;

- other family members pay 0.6 percent, the maximum amount does not exceed 1 million rubles.

Judicial practice under Article 1152 of the Civil Code of the Russian Federation

Appeal ruling of the Judicial Collegium for Criminal Cases of the Supreme Court of the Russian Federation dated July 26, 2018 N 44-APU18-9SP

As can be seen from the materials of the criminal case (volume N 12, sheet 143), the Administration of the Usolsky urban settlement of the Perm Territory was rightfully recognized as a victim in the criminal case (in person of the representative by proxy U.) due to the fact that the crime committed caused material damage to the municipal body. By virtue of Art. Art. 1151, 1152 of the Civil Code of the Russian Federation, private house located at the address: Usolye, st. ... is escheatable property, and the ownership of it passed by inheritance by law into the ownership of the administration of the Usolsky urban settlement. In paragraph 50 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 N “On judicial practice in cases of inheritance”, it is explained that escheated property passes by inheritance by law into the ownership of the municipality without an act of acceptance of the inheritance, and also regardless of the registration of inheritance rights and their state registration.

Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated January 22, 2019 N 5-КГ18-268

In accordance with paragraph 1 of Article 1152 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), in order to acquire an inheritance, the heir must accept it. An inheritance can be accepted within six months from the date of opening of the inheritance (clause 1 of Article 1154 of the Civil Code of the Russian Federation).

Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated March 12, 2019 N 14-КГ18-59

In accordance with paragraph 1 of Article 1152 of the Civil Code of the Russian Federation, in order to acquire an inheritance, the heir must accept it. Acceptance of an inheritance is not required only for the acquisition of escheated property (Article 1151). An accepted inheritance is recognized as belonging to the heir from the date of opening of the inheritance, regardless of the time of its actual acceptance (clause 4 of Article 1152 of the Civil Code of the Russian Federation).

Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated March 26, 2019 N 5-КГ19-33

In accordance with paragraph 1 of Article 1152 of the Civil Code of the Russian Federation, in order to acquire an inheritance, the heir must accept it. As explained by the Plenum of the Supreme Court of the Russian Federation in paragraph 36 of the resolution of May 29, 2012 N “On judicial practice in cases of inheritance”, the commission by the heir of actions indicating the actual acceptance of the inheritance should be understood as the commission of those provided for in paragraph 2 of Article 1153 of the Civil Code of the Russian Federation Federation of actions, as well as other actions for the management, disposal and use of inherited property, maintaining it in proper condition, in which the heir’s attitude towards the inheritance as his own property is manifested. Such actions, in particular, may include: the heir moving into the residential premises belonging to the testator or living in it on the day of opening of the inheritance (including without registering the heir at the place of residence or place of stay), the heir's processing of the land plot, filing a lawsuit applications for the protection of their inheritance rights, requesting an inventory of the testator's property, payment of utilities, insurance payments, reimbursement from the inherited property of expenses provided for in Article 1174 of the Civil Code of the Russian Federation, other actions regarding the ownership, use and disposal of inherited property. These actions must be completed within the period for accepting the inheritance established by Article 1154 of the Civil Code of the Russian Federation.

Ruling of the Supreme Court of the Russian Federation dated 04/08/2019 N 304-ES17-3813(3) in case N A03-18961/2015

In canceling the judicial act adopted in the case, the district court, guided by the provisions of Articles 8.1, 218, 219, 223, 551, 1152 of the Civil Code of the Russian Federation, the explanations given in paragraph 6 of the Resolution of the Constitutional Court of the Russian Federation dated May 26, 2011 N 10-P, and also in paragraph two of paragraph 3 of the resolution of the Plenum of the Supreme Court of the Russian Federation dated June 23, 2015 N “On the application by courts of certain provisions of Section I of Part One of the Civil Code of the Russian Federation”, considered erroneous the conclusions given therein that the completion of the procedure for the sale of the debtor’s property and his exemption from further fulfillment of obligations to creditors does not affect the rights and legitimate interests of M.V. Ilyina, who acquired encumbered property at an auction and does not have an objective opportunity to register her right in relation to the said property due to its continued presence in the bankruptcy estate of the debtor.

Determination of the Constitutional Court of the Russian Federation dated March 26, 2019 N 716-O

1. Citizen A.F. Gorbuntsov challenges the constitutionality of the following provisions of Article 1152 of the Civil Code of the Russian Federation: paragraph 2, according to which the acceptance by the heir of a part of the inheritance means the acceptance of the entire inheritance due to him, no matter what it is and no matter where it is located; when an heir is called to inherit simultaneously on several grounds (by will and by law or by way of hereditary transmission and as a result of the opening of an inheritance, etc.), the heir may accept the inheritance due to him on one of these grounds, on several of them, or on all grounds ; acceptance of inheritance under conditions or with reservations is not allowed;

Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated April 16, 2019 N 18-КГ19-9

To acquire an inheritance, the heir must accept it (clause 1 of Article 1152 of the Civil Code of the Russian Federation). By virtue of paragraph 2 of Article 1152 of the Civil Code of the Russian Federation, the acceptance by the heir of a part of the inheritance means the acceptance of the entire inheritance due to him, no matter what it is and no matter where it is located.

Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated June 18, 2019 N 5-КГ19-83

In accordance with paragraph 1 of Article 1152 and Article 1154 of the Civil Code of the Russian Federation, in order to acquire an inheritance, the heir must accept it within six months from the date of opening of the inheritance. Based on the provisions of Article 1153 of the Civil Code of the Russian Federation, an inheritance can be accepted either by the heir submitting an application for acceptance of the inheritance to a notary (to issue a certificate of the right to inheritance), or by the heir taking actions indicating the actual acceptance of the inheritance.

Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated June 18, 2019 N 5-КГ19-88

Due to the fact that an accepted inheritance is recognized as belonging to the heir from the date of opening of the inheritance, regardless of the time of its actual acceptance, as well as regardless of the moment of state registration of the heir’s right to inherited property, when such a right is subject to state registration (clause 4 of Article 1152 of the Civil Code of the Russian Federation) , escheated property is recognized as belonging to a public legal entity from the date of opening of the inheritance upon the occurrence of the circumstances specified in paragraph 1 of Article 1151 of the Civil Code of the Russian Federation, regardless of the awareness of the public legal entity about this and the commission of actions by it aimed at accounting for such property and formalizing its rights.

Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated July 30, 2019 N 5-КГ19-118

A different moment of emergence of the right is established, in particular, for the acquisition of ownership of real estate in the event of full payment of a share by a member of a consumer cooperative, in the order of inheritance and reorganization of a legal entity (paragraphs two, three of paragraph 2, paragraph 4 of Article 218 of the Civil Code of the Russian Federation, paragraph 4 Article 1152 of the Civil Code of the Russian Federation).

Determination of the Judicial Collegium for Civil Cases of the Supreme Court of the Russian Federation dated July 16, 2019 N 18-КГ19-54

A different moment of emergence of the right is established, in particular, for the acquisition of ownership of real estate in the event of full payment of a share by a member of a consumer cooperative, in the order of inheritance and reorganization of a legal entity (paragraphs two, three of paragraph 2, paragraph 4 of Article 218 of the Civil Code of the Russian Federation, paragraph 4 of Article 1152 of the Civil Code of the Russian Federation).

Commentary to Art. 1152 Civil Code of the Russian Federation

1. The acquisition of an inheritance is the acquisition of rights (for example, ownership) to inherited property. In order for the heir to become the owner (owner) of the inherited property, the mere fact of opening the inheritance is not enough. Part 1, clause 1, art. 1152 indicates that for this the heir must accept the inheritance.

The verb “must” used in the norm does not mean the obligation of the heir to accept the inheritance, but the fact that it is impossible to acquire it otherwise than through acceptance of the inheritance. The acceptance of an inheritance itself, as follows from the interpretation of the rules on accepting an inheritance in its entirety, is not an obligation, but a right of the heir.

As a subjective right, the right to accept an inheritance arises in the heir regardless of his will at the time of opening the inheritance, if there are grounds for calling him to inherit. The subjective civil right to accept an inheritance is an absolute right, since it does not imply the presence of corresponding obligations and a specific obligor. It is distinguished from other subjective civil rights, firstly, by the basis of its occurrence, which is not the will of the subject, as according to the general rule, but the fact of the opening of an inheritance; and secondly, its content, which is not specific powers, but the formation of another right.

Since acceptance of an inheritance is a right, the heir can either accept the inheritance or refuse to accept it. The will to accept an inheritance can be direct (then it is expressed in writing) or indirect (then it is expressed in the form of implied actions). The will to refuse to accept an inheritance can be expressed both directly and through silence. The absence of actions aimed at accepting the inheritance indicates the heir’s refusal to accept the inheritance. Thus, there is a presumption of refusal to accept an inheritance in the absence of an expression of will to accept it.

2. Only heirs by law and by will have the right to accept an inheritance. Other persons do not have such a right (for example, a legatee does not have the right to accept an inheritance, but an obligatory right of claim against the heir).

The act of accepting an inheritance as a lawful action is a civil law transaction specifically aimed at the emergence and change of civil law relations. As a legally significant action, acceptance of an inheritance entails the emergence of rights to the inherited property in the heir and a change in the status of the heir: from a potential successor of the testator, he becomes an actual legal successor. As a transaction, the acceptance of an inheritance must comply with general civil rules on transactions (for example, on legal personality, on form, etc.) and can be declared invalid on the basis of the rules on the invalidity of transactions, therefore the will to accept an inheritance must be formed freely and independently of other persons , must be expressed in proper form and comply with the requirements of the law.

Refusal to accept an inheritance is not a transaction and does not entail the emergence, change or termination of legal relations. The abandoned heir does not acquire rights to the inherited property, and his potential to become the testator's successor remains unrealized.

The need to accept an inheritance in order to acquire it is a general rule, from which, however, there is an exception established by the commentary. Art.

Acceptance of inheritance is not required to acquire escheated property. Thus, the state does not have the right to accept the inheritance. If the inheritance is escheated, the state acquires it regardless of its will on the basis of Art. 1151 Civil Code.

3. Acceptance of an inheritance reflects such a feature of hereditary succession as universality.

Despite the fact that inheritance is a collection of property of various types (including things, rights, obligations), it is a single whole. Therefore, an inheritance due to one heir can only be accepted as a whole.

The integrity of the inheritance entails the possibility of accepting it only in its entirety. The actual consequences of this property of inheritance are as follows. Firstly, by expressing his will to accept at least part of the inheritance, the heir expresses his will to accept all the property due to him. The act of accepting part of an inheritance means the heir accepts the entire inheritance. In this case, the inheritance is acquired by the heir in its entirety, even if the latter cannot be established at the time of opening of the inheritance. If individual parts of the inheritance are located in different places, acceptance of the inheritance at the place of discovery (or in another place) means acceptance of that inheritance, the location of which is unknown or which is located in another location, including outside the country. Wherever the property due to the heir is located, whatever it consists of, regardless of whether the heir knows about it, it is acquired by the heir at the time he accepts any part of the inheritance. Thus, it is not required to accept all parts of the inheritance due to the heir. It is enough to complete the act of accepting part of the inheritance.

Secondly, the integrity of the inheritance makes it impossible for the heir to refuse part of the inheritance. The heir cannot accept only part of the inheritance, refusing the other. An inheritance can only be accepted unconditionally and unconditionally. The heir cannot stipulate the parts, shares or individual items of the inheritance that he accepts and does not accept, or the conditions under which he accepts the inheritance or its parts. Acceptance of an inheritance, therefore, cannot be a conditional transaction and cannot contain either a suspensive or a suspensive condition.

Refusal to accept an inheritance, in turn, is also integral, unconditional and unconditional.

4. A call to inheritance can be made for various reasons. Each such basis of inheritance is recognized as independent and gives rise to the emergence of an inheritance due that is not connected with other grounds. Therefore, the acceptance of an inheritance on one basis must be independent of the acceptance of an inheritance on other grounds.

One heir can be called upon to inherit simultaneously on several grounds, for example, by will, and in the case of intestate property, also by law. To acquire an inheritance on each basis, he must perform a separate act of accepting the inheritance on this basis. Each act of accepting an inheritance is volitional, free and independent, does not depend on the acceptance of an inheritance on another basis and requires a separate expression of the will of the heir.

The heir has the right to accept the inheritance at his own discretion on one of these grounds, on several of them, or on all grounds.

5. It should be taken into account that Part 2, Clause 2, Art. 1152 contradicts Art. 1111 of the Civil Code, which names only two grounds for inheritance: by law and by will. Inheritance by way of hereditary transmission, inheritance of a compulsory share, etc., therefore, cannot be considered grounds for inheritance. Thus, inheritance by way of hereditary transmission is the inheritance of another inheritance that is not an inheritance after the death of the heir. Part 2, clause 2, art. 1152 not only expands the list of inheritance grounds, but also leaves it open.

Incorrect formulation of the norm entails two possible interpretations. This may indicate either an erroneous establishment of the list of grounds for inheritance in Art. 1152, and then, for example, the heir cannot refuse inheritance by law by agreeing to inherit the compulsory share; or about the erroneous use of the term “grounds of inheritance” in it, which entails the opposite consequences, since the legislator did not mean the grounds of inheritance, but various legal facts that entail the emergence of inheritance legal relations. It seems that in order to establish the actual will of the legislator, it is necessary to make appropriate changes to the current legislation.

6. The act of accepting an inheritance is a transaction, therefore it gives rise to rights and obligations only for the person who made it. If several heirs are called to inherit, each of them must complete an act of acceptance of the inheritance in order for them to have rights to the inherited property. Each of the co-heirs must individually express their will to accept the inheritance. Acceptance of an inheritance by one heir does not mean acceptance of the inheritance by other heirs. An heir cannot accept an inheritance for another heir. Thus, the exercise of the right to accept an inheritance must be independent, free and independent from other co-heirs.

At the same time, it is not prohibited to perform joint acts of acceptance of inheritance by several heirs. Such a joint act entails the emergence of rights to inheritance among all heirs who performed it. For example, one application for acceptance of an inheritance can be written by all or several heirs by law, or heirs by will, if the same property has been bequeathed to them. If, according to a will, different property is bequeathed to different heirs, a joint act of acceptance cannot be made.

7. The heir can exercise his right to accept the inheritance for quite a considerable time. But regardless of the time of acceptance of the inheritance, it is considered to belong to the heir from the date of opening of the inheritance, regardless of the time of its actual acceptance. This means that the heir acquires the right of ownership and the burden of ownership not from the day when he actually accepted the inheritance, but from the day the inheritance was opened. Thus, the acceptance of the inheritance and its consequences have retroactive effect. The actual moment of acquisition of the inheritance (the moment of acceptance of the inheritance) does not coincide with the legal moment of acquisition of the inheritance (the time of opening of the inheritance).

The emergence of rights to inherited property from the moment the inheritance is opened is a rule that has no exceptions. Not only the time of acceptance of the inheritance does not affect the moment of acquisition of the inheritance, but also the commission or non-completion of state registration, if the right to the inherited property is subject to state registration.

State registration of rights does not establish property rights, but confirms the existence of the right. A certificate of state registration, like a certificate of the right to inheritance, is not a title-establishing document, but a title-confirming document. Therefore, the heir may have ownership of the property even before state registration. In addition, the law does not provide a specific deadline for state registration of rights. Thus, the absence of state registration cannot affect the heir’s possession of property rights, but can lead to a limitation of the power of disposal, which is possible only if there is state registration.

Possession of property rights, regardless of the presence of state registration of rights, entails the possibility of transferring such property by inheritance, even if the heir who accepted the inheritance died before registering the received property and receiving a certificate of the right to inheritance. His heirs may request that such unregistered property be included in the certificate of inheritance.

From the moment the inheritance is opened, the heir is considered the owner of the inherited property and the holder of other rights and obligations transferred to him. It is from the moment the inheritance is opened that he has the right to protection of property rights, to income from property, is obliged to pay taxes, etc.

It should be taken into account that, despite the fact that the inheritance belongs to the heir from the date of opening of the inheritance, the heir cannot fully exercise the functions of the owner until the expiration of six months from the date of opening of the inheritance - during this period there is a restriction of the right of ownership in the part that previously concerns all powers of disposal. And if the right to inherited property is subject to state registration, then its full implementation is possible only taking into account the legislation on state registration of the transfer of rights to real estate and transactions with it.

How to take ownership of property not inherited by your father

After the death of parents, their property legally goes to their children. If children die before accepting the inheritance, then hereditary transmission or the rule of representation of heirs applies. It all depends on when exactly the relative who was entitled to the property died.

Example. The couple got into a car accident and died before doctors arrived. The house was left behind. Their son was the only heir. The man submitted the necessary documents to the notary on time. After 4 months, the heir died. The deceased citizen had 2 children. In such a situation, hereditary transmission operates. That is, the children of a deceased father inherit the property of his parents instead of him. Each child gets ½ of the house. The period for acceptance of the inheritance by the grandchildren of a deceased couple can be increased to 3 months.