Procedure for entering into inheritance

The procedure for opening an inheritance begins with the submission of an application by one of the relatives to the nearest notary office. Further procedure:

- presentation of a complete package of documents with the application;

- opening an inheritance case based on an application;

- announcement of the will (in the absence of an administrative document, the notary waits for statements from each relative, but does not independently look for potential recipients of property);

- waiting six months;

- division of property into parts between heirs;

- preparation by a notary of a certificate for receiving an inheritance;

- re-registration of property rights to the object.

The property passes into the possession of the heir after six months from the date of death of the testator (confirmed by a notary certificate). But it is possible to fully dispose of the property only after re-registration of the property.

Deadline for filing inheritance documents

The law establishes the following types of deadlines:

- 6 months – the total period for entering into inheritance;

- 9 months – acquisition of property rights through hereditary transmission;

- 3 years is the statute of limitations for disputes related to the acquisition of inheritance rights.

The missed period may be restored based on a court decision if there are compelling reasons.

Where to go

A person claiming inheritance must contact a notary. For this purpose, a period of 6 months from the date of death of the testator.

Documents must be submitted at the place where the inheritance was opened:

- at the registered address of the deceased person (if known);

- at the place where the will is kept;

- at the location of the real estate;

- at the location of the most valuable property.

If there are several notaries working in the area, then you can call each of them and find out who exactly will open the case. Contact information can be found on the Internet on the website of the Federal Notary Chamber or found in one of the notary offices.

After the expiration of the period established by law, the heirs will have to go to court (Article 1155 of the Civil Code of the Russian Federation).

Grounds for reinstatement:

- the heir did not know the death of the owner (the person lived in the territory of another state or did not maintain contact with the deceased relative);

- the citizen completed military service upon conscription;

- the heir was undergoing long-term treatment and other valid reasons.

Application for inheritance

The appeal is prepared in free form.

There is no need to write an application yourself at home, since the notary's office has its own application form. The application contains the following information:

- personal data of the applicant;

- relationship between the testator and the heir;

- personal information of the deceased person (full name, last registered address);

- a list of property claimed by the heir (in the absence of a will, you may not indicate a list of property);

- confirmation of familiarization with rights and obligations;

- signature and date of application.

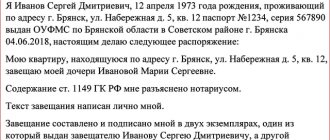

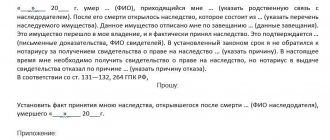

Sample application for acceptance of inheritance:

Terms of inheritance after death according to law and will

The cost of inheritance according to law and will

Are there any benefits

Some heirs do not have to worry about paying state fees, since they fall under the category of beneficiaries.

These include:

- children under the age of majority;

- heirs of persons who have death insurance and those killed at work;

- recipients of insurance sums in the event of death;

- people with mental disabilities;

- those who inherit funds related to royalties, pensions or contributions;

- heirs of those who were repressed and died during service or from injury or illness;

- persons living with the deceased on the day of his death and after are exempt from paying duties on this property.

All of the above do not have to pay fees established by the state. Disabled people of groups 1 and 2 are entitled to a 50% discount.

Despite the benefits, you will have to pay for the technical and legal work of a notary.

Documents for registering an inheritance with a notary

Table “List of required documents”

| Document type | Peculiarities |

| Statement | An appeal is a written confirmation of a person’s voluntary desire to inherit an inheritance. Filing an application does not oblige the heir to receive the property. Further, in the process of considering enforcement proceedings, it will be possible to abandon part of the property. The absence of an application is regarded as a reluctance to enter into an inheritance. For minor participants, the appeal is written by parents, guardians, and legal representatives. A child over 14 years old writes the application independently, but the parent signs, confirming consent to accept the inheritance. |

| Will | The procedure for registering a will ends with notarial approval. The original order remains with the notary. When opening an inheritance, the notary checks in the system whether there is a will. The testator has the following powers:

Having a will does not guarantee that property will be divided in accordance with the last wishes of the deceased person. A will can be revoked or annulled by the heirs after the death of the owner. |

| Personal document | Only a passport or birth certificate may be used, depending on age. Documents are transmitted with originals and one copy. The copy bears the person’s signature and a mark indicating that the contents correspond to the original. |

| Confirmation of hereditary case | Property is transferred to heirs under the following circumstances:

|

| Housing documents | A relative of the deceased submits to the notary a copy of the passport of the deceased testator. Additionally, a certificate is issued confirming the last residence/registration address of the deceased person. Confirmation can be a copy of the testator’s house register, which shows his registration address. The second method is to obtain a certificate of family composition from the city council. This extract is submitted to the notary in the original. |

| Confirmation of relationship | Only relatives of a person can receive property in the order of legal priority. According to a will, valuables can also be transferred to strangers. Confirmation of family/blood connection is:

Originals and copies are provided. |

| Property documents | This category includes:

The complete list of documents depends on the category of property. |

By right of representation

The right of representation is the transfer of property to the relatives of the testator, whose parents died earlier. Additionally served:

- a copy of a document confirming the relationship of the testator and the deceased heir;

- death certificate of the deceased heir;

- documents confirming the relationship between the representative and the heir.

Mandatory share

According to the law, the following can claim the obligatory share:

- minor children;

- disabled relatives;

- disabled dependents.

Confirmation of the right to receive a compulsory share of property are:

- child's birth certificate;

- conclusion of a medical commission confirming receipt of a disability group (subject to regular renewal);

- explanations of witnesses confirming the cohabitation of the dependent and the testator;

- a copy of the house register or a certificate of family composition confirming joint registration;

- a certificate in the name of the dependent from the Pension Fund confirming the absence of other sources of income.

Hereditary transmission

Hereditary transmission is the transfer of property to the relatives of the heir who did not have time to formalize his inheritance rights. Among the required documents is an extract confirming the relationship of the failed heir and his relatives.

Inheritance transmission is a legal basis for extending the time frame for registering an inheritance to nine months.

If there is no document

The heir must find or restore the missing document. Otherwise, the succession process will not take place.

It is not difficult to obtain a duplicate of your birth certificate, marriage certificate with a deceased person, or your identity card. The lost paper concerns the applicant directly and can be received within one day at the Civil Registry office. The same applies to lost copies/extracts from judicial acts. You can apply for the issuance of new ones to the authorized judicial body.

But finding or restoring some of them can cause a lot of trouble for the heir. These include:

- will;

- death certificate;

- confirmation of the applicant’s belonging to the current line of inheritance.

Search for a will

The most difficult part of collecting papers can be finding a will. The fact is that in some cases the copyright holder, for some reason, does not inform his heirs about the location of his copy of the document. And then, after his death, they may not find it in the personal belongings of the deceased.

Then the heirs can contact the notary offices at the place of last registration of the deceased with requests for discovery of the will. And if there are no results, contact other authorized institutions of the city. If this does not help, then it makes sense to submit a written request to the notary chamber of the region.

Duplicate death certificate

In the civil registry office, a repeated certificate can be issued only to a relative of the deceased or an interested person (and the heir is such even in the absence of kinship).

Therefore, to receive a duplicate, the successor must submit to the authorized body:

- identification;

- certificate of relationship with the deceased;

- will (if it is in hand);

- a notary's certificate confirming the opening of an inheritance case (if there is no will or relationship).

The same applies to obtaining documentary confirmation of the applicant’s inheritance rights - if a certificate of birth, adoption or marriage with the deceased is not sufficient for this (for example, in cases of inheritance by successors, starting from the second stage and further), you can obtain a duplicate of the missing paper from the registry office at on the same grounds.

List of documents for inheritance by type of property

When filing an application, the heir is required to prepare and transfer documents for all property.

The final list of documents depends on the type of property. Table “List of documents for different types of property”

| Type of property | List of documents |

| Real estate (apartment/house) |

Learn more about inheriting a house and land. |

| Earth |

|

| Transport |

|

| Securities, bank deposits | A certificate with the estimated value of securities or a bank statement with the balance on the deposit account. Additionally, a certificate from the joint-stock company is submitted confirming that the testator has a certain number of shares |

Inheritance queue

In Russia, there are 2 legal ways to receive the property of a deceased person:

- in law;

- inheritance by will.

By law, only blood relatives can inherit. The closer the family ties, the higher the chance of receiving a share in the property of the deceased. There is an order of inheritance - from closer relatives to distant ones along the ascending and descending lines of kinship.

The closest family members are your spouse, children and parents. It is they who have the primary right to become the successors of the deceased. Proof of family ties are marriage and birth certificates. If the family relationship has officially ceased to exist, then the former spouse is not an heir.

Important! If a parent has been deprived of his rights to a child in court, he no longer has the right to inherit from him. However, the child can apply to obtain the property rights of the deceased “deprived” parent.

Inheritance by will assumes that a person independently disposed of his property before his death. He can draw up an administrative document in favor of an individual or legal entity, that is, express his will as he pleases. Challenging a will is quite difficult, especially if all the nuances are followed. Close relatives may not have the right to inheritance.

Documents for registering property rights by inheritance

Re-registration is required for the following types of property:

- real estate (in Rosreestr);

- vehicles (traffic police);

- weapons (licensing system of the Ministry of Internal Affairs).

You must have the following package of documents with you:

- passport (or other identification document);

- statement;

- certificate of inheritance (obtained from a notary);

- receipt of payment of the duty;

Additionally you may need:

- cadastral passport (if the object is registered for the first time; the object must be registered in Rosreestr);

- agreement for the division of real estate (if there is more than one heir);

When obtaining permission to use weapons, a certificate from a narcologist and a psychiatrist is provided, confirming the person’s sanity.

How much does it cost to obtain a certificate of inheritance?

Inheriting property is not only a pleasant procedure in terms of enrichment, but also sometimes costly. The law establishes certain fees that are paid upon receipt of the certificate.

That is, you will first have to spend money, and only then enjoy the inheritance you receive.

What affects the price

Regardless of the degree of relationship, you will have to pay a state fee for registering an inheritance. Although there is a small nuance - a stranger or distant relative pays much more.

Amount of state duty for registration of inheritance:

- If the legal successor is one of the closest people, that is, a spouse, parent, sister or brother, child, you need to pay 0.3% of the total amount of the assessed property. The advantage is that the contribution is limited to 100 thousand rubles.

- Those who do not fall into the circle of immediate relatives or are not an outsider at all will have to pay 0.6% and the limit on the collected duty reaches 1 million rubles.

All heirs under the will should pay more attention to this fact, since the absence of the need to present proof of relationship automatically applies the second point.

To reduce the payment, if the person meets the first point, the notary is provided with documents indicating a closely related relationship with the testator.

In what cases is a will invalidated?

Contesting a will is a fairly common procedure. The will is declared invalid, in whole or in part, by the court. Moreover, according to the law, only relatives (heirs of all orders) or the person indicated as an heir in the previous will (if there was one) can file an application. Most often, this role is played by relatives who consider themselves “left out.”

The grounds for challenging a will and declaring it fully or partially invalid are:

- Failure to comply with the legal form of the document (lack of signature, notary seal, other violations)

- Inconsistency of the essence of the will with the legislation of the Russian Federation

- Incapacity of a citizen at the time of writing a will (proved by documents)

- Unfair actions of the heir towards the testator (threats, physical and psychological violence, direct deception or misrepresentation), which must also be proven

In cases where the court recognizes the invalidity of a will, the heirs indicated in it do not enter into the inheritance (if we are talking about strangers) or enter on a general basis (if we are talking about family members).

Disagreements between heirs

Disputes may arise between the successors of the deceased property owner regarding:

- lack of specific indication of the shares of each heir in the common property;

- one of them has a priority right to receive the inheritance;

- at the time of drawing up the will, the testator himself was completely or partially incapacitated.

In the latter case, there is a real chance to challenge the will. But it is necessary to prove the fact of incapacity. If the testator did not undergo an examination during his lifetime and there is no corresponding judicial act, then it will be necessary to undergo a posthumous psychiatric examination.

If a person was mentally and spiritually healthy, but did not perceive reality due to his age, it will be more difficult to prove his incapacity. It may be necessary to bring in witnesses from among the neighbors or relatives with whom he lived.

Duty amount

Inherited property is not subject to tax. But the notary fee for the state fee, which is charged for carrying out the procedure and issuing inheritance certificates, can be quite high.

The duty amount is calculated based on:

- Degree of relationship between the testator and the recipient of the inheritance

- Total value of inherited property

Heirs of the first two stages, namely, children and parents, spouses, siblings, pay a duty of 0.3%, but not more than 100 thousand rubles.

Heirs of other orders and persons not related to the testator by blood ties - 0.6%, but not more than 1 million rubles.

In some cases, inherited property does not require payment of a fee at all. For example, an apartment, if the heir lived in it until the death of the testator and continues to do so.

Will as a document

A will is qualified by law as a “unilateral act of expression of will.” The owner of the property expresses his desire as to who, after his death, will own all the property earned and accumulated by him during his life. And if, in the absence of a will, everything passes to the legal heirs in shares determined by law, then the will can be drawn up for any individual or legal entity. With some reservations, which we will discuss below.

The will is personally drawn up by the citizen and notarized. In some cases, a notary can draw up a will himself using dictation. At the same time, he is obliged to make sure that the citizen is in a capable state, understands the meaning of his actions and is able to bear responsibility for them.

After drawing up a will under dictation, the testator must read its text and put his signature. Only after this the notary certifies the signature, affixes a seal and enters the document into the register. After the death of the testator, his will is executed in accordance with the requirements of the law.

Is it possible to refuse an inheritance?

Valuable property transferred by will to heirs may carry encumbrances. These could be:

- Real estate pledged to the bank or with persons registered in it who have the right of lifelong residence.

- Debentures.

It is impossible to accept an inheritance and refuse debts. The heirs have the right either to completely agree with the will of the testator and accept the inheritance as it is, or to refuse it. The refusal is issued in the same notary office where the inheritance case was opened. You can refuse completely, without specifying the reasons and those to whom the rights to the inheritance will be transferred, or you can draw up a refusal in favor of any person specified in the will or not specified.