16

Entry into inheritance rights occurs after the death of the testator. Heirs can formalize an inheritance in 2 ways - by will or by law. When preparing papers, the heir incurs a number of expenses. The main payment is the state fee for issuing the certificate. Its value is determined by the norms of Tax legislation. Additional expenses include paying for the services of a notary who opens an inheritance case. Let's consider how the state duty is calculated when entering into an inheritance according to law and will in 2021.

Percentage and amount of state duty for inheritance

The amount of the fee is determined by law and depends on the degree of family relations and the price of the property. The tax rate reduction is provided only for the preferential category of applicants.

Duty amount in 2021

| No. | Fixed rate | Payers | Limit amount |

| 1 | 0,3% | Parents, children, spouses, brothers and sisters | 100,000 rub. |

| 2 | 0,6% | Other assignees | 1,000,000 rub. |

Additional services are paid separately. Their cost is determined for a specific situation.

This includes:

- expert assessment of property;

- notarial services;

- payment of the testator's debts (if any);

- filing an application with the court (for example, establishing a legally significant fact);

- lawyer services (drawing up a claim, representing interests in court);

- registration of property after receiving a certificate.

By will

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

Inheritance of property under a will is considered a priority. The testator independently determines in the administrative document the circle of heirs who can lay claim to his assets. Documents are processed at the place of registration of the deceased citizen. All expenses for paying taxes fall on the shoulders of the heirs.

What percentage is paid for inheritance under a will? The amount of the duty is determined by Article 333.24 of the Tax Code of the Russian Federation. The amount of tax does not depend on the method of receiving the property. The state fee is paid before filing an application for inheritance rights.

When registering an inheritance under a will, the successor does not have to confirm family ties. However, if he does not provide the necessary documents, the duty is calculated in the general manner (0.6% of the value of the property received).

If a citizen is a close relative and has the right to apply a preferential duty rate, then he is required to submit a list of documentation confirming the family connection:

- birth certificate;

- marriage certificate;

- court decision to establish the fact of family ties.

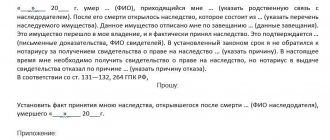

Sample application for acceptance of inheritance under a will

By law (without a will)

If the testator did not leave an administrative document, then the inheritance occurs in the order of priority determined by law. Heirs of the same line are entitled to equal shares.

An exception is made for persons entering into an inheritance as a representative. For example, if a deceased heir leaves 2 children, then his share is divided between them in equal parts.

The amount of state duty when accepting an inheritance is also established by Article 333.24 of the Tax Code of the Russian Federation. The right to pay the duty at a preferential rate is given to the heirs of the 1st and 2nd stages. Since entering into an inheritance is possible by law only with confirmation of family ties, the procedure for calculating the duty is established by default.

Sample application for acceptance of inheritance by law

Comments

Anna

Hello. My husband died. I'm entering into an inheritance. We have a 4 year old son. a motorcycle, a garage and an apartment with a mortgage (my husband has 3/5, which he bought from my parents when he was married to me). My eldest son and I have 2/5 shares. We have lived in the apartment since 1983. (there was still maternity capital; after paying off the mortgage, the youngest would need to be allocated a share). how much will a notary charge? (St. Petersburg)

Answer

Marina

My husband died on July 1. 2021, 1/2 husband and wife lived in the apartment, the wife continues to live in the same apartment. A 13-year-old minor child is registered in the same apartment, but was born after the purchase of this apartment. The husband's living parents, his father and mother, renounced their inheritance in favor of their minor grandson. There is also a garage and a car. Thus, a wife and a minor son enter into inheritance, the wife gets 1/3 of her husband’s property, and the son gets 2/3. What will be the approximate amount to pay the natary and will it be necessary to pay a state fee since we remain living in the same apartment and our son is a minor?

Answer

Edward

Hello, a share in an apartment is inherited by a mother from her deceased daughter, who lived together in the same apartment, the mother lives in the apartment even after the death of her daughter, and she is the daughter of deportees and has a certificate of rehabilitation from the Ministry of Internal Affairs. What fees and how much should the mother pay to the notary and what fees are she exempt from, thank you.

Answer

Timofey

The apartment is in 1/3 shares. The wife's mother died, leaving the wife's father and wife (daughter). What is the fee for a notary? They told us 26 - 28 thousand rubles, is this normal?

Answer

Alexei

Hello! After the death of a spouse, you need to formalize the right of inheritance of the car and garage. The notary calculated the tax for the car at 16,000 rubles, for the garage at 17,000 rubles. Where did these amounts come from?

Answer

Yulia Borisovna

Hello. Share of 1/3 of the apartment, 1 share of the grandfather (my husband), 2 share of the grandmother (my husband), 3 share of the husband, grandparents died, the husband did not take ownership of the apartment in time, all the documents were collected, I am wondering how much to pay the notary for services?

Answer

Fee for entering into inheritance in standard situations

The amount of the duty does not depend on the type of inherited property. It is established depending on the value of the objects and the presence/absence of family ties between the recipient and the testator.

However, the amount of payment for notary services directly depends on the type of property. The cost of the certificate varies depending on the presence/absence of real estate as part of the estate.

Important! The amount is paid by each legal successor for each object in the certificate.

The tariff amount is set by the regional notary chamber. However, the tariff is marginal.

Each notary chamber may set a lower amount. The main thing is not to exceed the established limit.

Example. In the Amur Region, the fee for issuing a certificate of inheritance rights in the absence of real estate is 2,700 rubles. And if there is real estate as part of the inherited property, each heir will have to pay 3,400 rubles for each object.

Excerpts from the Tax Code of the Russian Federation

Section 333.24. Amounts of state fees for notarial acts

1. For the performance of notarial acts by notaries of state notary offices and (or) officials of executive authorities, local governments authorized in accordance with the legislative acts of the Russian Federation and (or) legislative acts of the constituent entities of the Russian Federation to perform notarial acts, the state fee is paid in the following amounts :

1) for certification of powers of attorney to carry out transactions (transactions) requiring (requiring) a notarial form in accordance with the legislation of the Russian Federation - 200 rubles;

2) for certification of other powers of attorney requiring a notarized form in accordance with the legislation of the Russian Federation - 200 rubles;

3) for certification of powers of attorney issued in the order of substitution, in cases where such certification is mandatory in accordance with the law

Russian Federation - 200 rubles;

4) for certification of mortgage agreements, if this requirement is established by the legislation of the Russian Federation:

- for certification of residential mortgage agreements to ensure repayment of a loan (loan) provided for the purchase or construction of a residential building or apartment - 200 rubles;

- for certification of mortgage agreements for other real estate, with the exception of ships and aircraft, as well as inland navigation vessels - 0.3 percent of the agreement amount, but not more than 3,000 rubles;

- for certification of mortgage agreements for ships and aircraft, as well as inland navigation vessels - 0.3 percent of the agreement amount, but not more than 30,000 rubles;

4.1) for certification of purchase and sale agreements and pledge of a share or part of a share in the authorized capital of a limited liability company, depending on the amount of the agreement:

- up to 1,000,000 rubles - 0.5 percent of the contract amount, but not less than 1,500 rubles;

- from 1,000,001 rubles to 10,000,000 rubles inclusive - 5,000 rubles plus 0.3 percent of the contract amount exceeding 1,000,000 rubles;

- over 10,000,001 rubles - 32,000 rubles plus 0.15 percent of the contract amount exceeding 10,000,000 rubles, but not more than 150,000 rubles;

(Clause 4.1 introduced by Federal Law

dated 06.12.2011 N 405-FZ)

5) for certification of other contracts, the subject of which is subject to assessment, if such certification is mandatory in accordance with the legislation of the Russian Federation - 0.5 percent of the contract amount, but not less than 300 rubles and not more than 20,000 rubles;

6) for certification of transactions, the subject of which is not subject to assessment and which, in accordance with the legislation of the Russian Federation, must be notarized - 500 rubles;

7) for certification of agreements for the assignment of claims under an agreement on a residential mortgage, as well as under a credit agreement and a loan agreement secured by a residential mortgage - 300 rubles;

for certification of constituent documents (copies of constituent documents) of organizations - 500 rubles;

9) for certifying an agreement on the payment of alimony - 250 rubles;

10) for certification of a marriage contract - 500 rubles;

11) for certification of surety agreements - 0.5 percent of the amount for which the obligation is accepted, but not less than 200 rubles and not more than 20,000 rubles;

12) for certifying an agreement to amend or terminate a notarized contract - 200 rubles;

13) for certification of wills, for accepting a closed will - 100 rubles;

14) for opening an envelope with a closed will and reading out a closed will - 300 rubles;

15) for certification of powers of attorney for the right to use and (or) dispose of property, with the exception of the property provided for in subclause 16 of this clause:

- children, including adopted children, spouse, parents, full brothers and sisters - 100 rubles;

— other individuals — 500 rubles;

16) for certification of powers of attorney for the right to use and (or) dispose of motor vehicles:

- children, including adopted children, spouse, parents, full brothers and sisters - 250 rubles;

— other individuals — 400 rubles;

17) for committing a maritime protest - 30,000 rubles;

18) for attesting to the accuracy of the translation of a document from one language to another - 100 rubles per page of document translation;

19) for making a writ of execution - 0.5 percent of the amount collected, but not more than 20,000 rubles;

20) for accepting deposits of money or securities, if such acceptance of deposit is mandatory in accordance with the legislation of the Russian Federation - 0.5 percent of the accepted amount of money or the market value of securities, but not less than 20 rubles and not more than 20,000 rubles;

21) for certification of the authenticity of a signature, if such certification is required in accordance with the legislation of the Russian Federation:

- on documents and applications, with the exception of bank cards and applications for registration of legal entities - 100 rubles;

- on bank cards and on applications for registration of legal entities (for each person, on each document) - 200 rubles;

22) for the issuance of a certificate of the right to inheritance by law and by will:

- children, including adopted children, spouse, parents, full brothers and sisters of the testator - 0.3 percent of the value of the inherited property, but not more than 100,000 rubles;

- to other heirs - 0.6 percent of the value of the inherited property, but not more than 1,000,000 rubles;

23) for taking measures to protect

inheritance - 600 rubles;

24) for protesting a bill for non-payment, non-acceptance and undated acceptance and for certifying non-payment of a check - 1 percent of the unpaid amount, but not more than 20,000 rubles;

25) for issuing duplicate documents stored in the files of state notary offices and executive authorities - 100 rubles;

26) for performing other notarial acts for which the legislation of the Russian Federation provides for a mandatory notarial form - 100 rubles.

2. The provisions of this article are applied taking into account the provisions of Article 333.25 of this Code.

Section 333.25. Features of paying state fees when applying for notarial acts

1. For performing notarial acts, the state fee is paid taking into account the following features:

1) for notarial acts performed outside the premises of a state notary office, executive authorities and local government bodies, the state fee is paid in an amount increased by one and a half times;

2) when certifying a power of attorney issued in relation to several persons, the state fee is paid once;

3) if there are several heirs (in particular, heirs by law, by will or heirs entitled to an obligatory share in the inheritance), the state duty is paid by each heir;

4) for the issuance of a certificate of the right to inheritance, issued on the basis of court decisions declaring a previously issued certificate of the right to inheritance invalid, the state fee is paid in accordance with the procedure and in the amounts established by this chapter. In this case, the amount of the state fee paid for a previously issued certificate is subject to refund in the manner established by Article 333.40

of this Code. At the request of the payer, the state fee paid for a previously issued certificate is subject to offset against the state fee payable for the issuance of a new certificate within one year from the date of entry into force of the relevant court decision. The same procedure is used to resolve the issue when re-certifying contracts declared invalid by the court;

5) when calculating the amount of the state fee for certification of contracts subject to assessment, the amount of the contract specified by the parties is accepted, but not lower than the amount determined in accordance with subparagraphs 7 of this paragraph. When calculating the amount of the state duty for issuing certificates of the right to inheritance, the value of the inherited property, determined in accordance with subparagraphs 7 of this paragraph, is taken. When calculating the amount of the state duty for certifying transactions aimed at alienating a share or part of a share in the authorized capital of a limited liability company, as well as transactions establishing an obligation to alienate a share or part of a share in the authorized capital of a limited liability company, the amount of the agreement specified by the parties is accepted , but not lower than the nominal value of the share or part of the share. When calculating the amount of the state duty for certifying purchase and sale agreements and pledging a share or part of a share in the authorized capital of a limited liability company, the assessment of the share or part of the share as the subject of the pledge, specified by the parties to the pledge agreement, is accepted, but not lower than the nominal value of the share, part of the share, respectively.

(as amended by Federal Laws dated July 19, 2009 N 205-FZ

, dated December 6, 2011

N 405-FZ

)

At the choice of the payer, a document indicating the inventory, market, cadastral or other (nominal) value of the property, issued by the persons specified in subparagraphs 7 of this paragraph, may be submitted to calculate the state duty. Notaries and officials performing notarial acts do not have the right to determine the type of property value (valuation method) for the purpose of calculating state duty and require the payer to submit a document confirming this type of property value (valuation method).

(as amended by the Federal Law

dated November 29, 2012 N 205-FZ)

In the case of submission of several documents issued by persons specified in subparagraphs 7 of this paragraph, indicating different values of property, when calculating the amount of the state duty, the lowest of the specified values of the property is accepted;

(as amended by the Federal Law

dated November 29, 2012 N 205-FZ)

(Clause 5 as amended by the Federal Law

dated December 31, 2005 N 201-FZ)

6) the assessment of the value of the inherited property is made based on the value of the inherited property (the exchange rate of the Central Bank of the Russian Federation in relation to foreign currency and securities in foreign currency) on the day of opening of the inheritance;

7) the cost of vehicles can be determined by appraisers, legal entities who have the right to enter into an agreement to conduct an assessment in accordance with the legislation of the Russian Federation on appraisal activities, or forensic expert institutions of the justice authority;

(Clause 7 as amended by the Federal Law

dated November 29, 2012 N 205-FZ)

the value of real estate, with the exception of land plots, can be determined by appraisers, legal entities who have the right to enter into an agreement to conduct an assessment in accordance with the legislation of the Russian Federation on valuation activities, or organizations (bodies) for recording real estate at its location;

(Clause 8 as amended by the Federal Law

dated November 29, 2012 N 205-FZ)

9) the value of land plots can be determined by appraisers, legal entities who have the right to enter into an agreement to conduct an assessment in accordance with the legislation of the Russian Federation on appraisal activities, or by bodies carrying out state cadastral registration and state registration of rights to real estate;

(as amended by Federal Laws of November 29, 2012 N 205-FZ

, dated November 30, 2016

N 401-FZ

)

10) the value of property not provided for in subparagraphs 7 of this paragraph is determined by appraisers or legal entities who have the right to enter into an agreement to conduct an appraisal in accordance with the legislation of the Russian Federation on appraisal activities;

(Clause 10 as amended by the Federal Law

dated November 29, 2012 N 205-FZ)

11) the value of a patent inherited is assessed based on all amounts of state duty paid on the day of death of the testator for patenting an invention, industrial design or utility model. The value of inherited rights to obtain a patent is determined in the same manner;

12) the assessment of property rights transferred by inheritance is made from the value of the property (the exchange rate of the Central Bank of the Russian Federation - in relation to foreign currency and securities in foreign currency), to which the property rights are transferred, on the day the inheritance is opened;

13) the assessment of inherited property located outside the territory of the Russian Federation, or property rights transferred to it by inheritance, is determined based on the amount specified in the assessment document drawn up abroad by officials of the competent authorities and applied on the territory of the Russian Federation in accordance with the legislation of the Russian Federation.

2. The provisions of this article shall apply subject to the provisions of Articles 333.35

and

333.38

of this Code.

Benefits upon inheritance

When opening an inheritance, not all categories of relatives are required to pay a state fee. Benefits are available to:

- disabled people or WWII participants;

- heroes of the USSR/RF;

- Knights of the Order of Glory.

- disabled people of groups 1 and 2 pay 50% of the accrued tax amount when inheriting property.

In addition, if the potential heir lived with the deceased person for the last 6 months, then he is exempt from paying the fee. No duty is paid on the bank deposits of the deceased.

Categories of citizens exempt from paying state duties and technical services

Articles 333.35, 333.38 of the Tax Code of the Russian Federation determine the list of persons who are completely exempt from paying state duties or who are entitled to discounts when entering into an inheritance. These include:

- heroes of Russia or the Soviet Union;

- participants or disabled people of the Second World War;

- former prisoners of war, prisoners of the Nazis;

- disabled people of groups I and II (50% discount on all notary services);

- people receiving real estate or a share where they lived with the deceased;

- people acting in the interests of wards and minor children;

- citizens registering rights to deposits, insurance payments, royalties;

- persons whose successors are people who died during public service, political repression, or while saving people.

Discounts are provided based on documents presented at the notary's office. Moreover, if the property is inherited by several persons, and one of them is exempt from payment, the state duty is reduced in proportion to the number of heirs.

Who is exempt from state duty when entering into an inheritance?

A certificate of property rights is issued without paying a fee:

- heirs who are relatives of the testator who died during the performance of his official duty;

- persons who inherited insurance payments (personal or property insurance), wages, royalties or bank deposits.

To use preferential rights, you must provide supporting documents.

Important! Beneficiaries are exempt from paying only state fees. Notary services must be paid in full.

Is tax due paid?

Until 2005, citizens paid tax on inherited property. But this norm was abolished. In accordance with paragraph 18 of Art. 217 of the Tax Code of the Russian Federation, income received as a result of inheritance is exempt from taxation.

However, you will still have to pay a fee when inheriting:

- Rewards for creating an original work of science and literature.

- An object of art, if it is sold.

- Rewards for invention, creation of an industrial design or utility model.

How is the state duty on inheritance calculated?

There are many factors that influence the final payment amount. For example, the value of inherited assets, the number of participants, the share of each applicant, the availability of benefits.

Also, when calculating the amount of the fee, you can use different types of value (inventory, market, cadastral). The heir independently chooses the indicator for calculation.

The notary cannot insist on a certain type of assessment or make recommendations. The choice depends on the wishes of the heir.

However, the law prohibits the use of inventory value for apartments that were built after 2013. Since they are not technically registered. Since 2013, the powers to register real estate have been transferred to Rosreestr.

Example. After the death of my parents, I was left with a 2-room apartment. The heirs are two daughters who have reached adulthood. No will was made. The estimated cost of the object is 2,300,000 rubles. The tax amount for relatives of the 1st stage is 0.3%. The contribution amount is 6900 rubles. (2,300,000 x 0.3%). Consequently, each heir must pay 3,450 rubles. But, since one of the daughters has lived with her parents for the last 2 years, she is exempt from paying the mandatory fee.

How much does it cost to register an inheritance with a notary for a house and land?

You can estimate the approximate amount of costs for registering an inheritance, when its object is a house and land, by imagining the following situation.

The father left his only son a house (7 million rubles) and a plot of land (2 million rubles). For each of the objects there are title documents, and data on the cadastral value has been obtained. The son's expenses will be:

- The state fee for obtaining a certificate is 0.3% * 9 million = 27 thousand rubles.

- UPTH - 6 thousand * 2 = 12 thousand rubles.

- Registration of a house and land plot in Rosreestr - 2 thousand and 350 rubles. respectively.

In total, the total amount of expenses will be 41,350 rubles.

If there are no title documents for the house and land plot, the total amount of expenses may increase to 50 thousand.

The costs of notary services depend on the circumstances and conditions of inheritance. Their cost is influenced by the following factors:

- Is there a will or is inheritance carried out by law?

- Does the heir participate personally or through a representative.

- Do you have title documents for the property or do they need to be restored?

How much does it cost to inherit a house after your mother's death?

The costs in such a situation will be similar to the costs listed above, with the exception of the costs of issuing a certificate for a land plot and its re-registration.

If the heir lived with his mother, he is exempt from paying state duty.

Taking the above example as a basis, provided that the son and mother lived together, the costs will amount to 8 thousand rubles. (6,000 UPTH + 2,000 registration of property rights).

How much does it cost to inherit an apartment?

Let's look at the cost of inheriting an apartment using an example.

After the death of her father, the daughter received a two-room apartment. The cadastral value of the property is 5 million rubles. Since the daughter lived separately (she was not entitled to benefits), the state duty will be: 5,000,000 * 0.3% = 15 thousand rubles. Registration of ownership of an apartment will cost 2 thousand rubles.

In total, the total amount of expenses is 20,350 rubles, where 3 thousand (notary services), 350 (certificate of cadastral value), 15 thousand (state duty) and 2 thousand (re-registration of the apartment).

If the apartment has not been privatized, then it will not be included in the inheritance mass. So, in accordance with Art. 1112 of the Civil Code of the Russian Federation, it includes property that belonged to the testator at the time of death. A non-privatized apartment is not the property of the deceased.

However, if the testator began the process of re-registering it as property during his lifetime, it may be included in the inheritance.

What is the cost of inheriting after the death of a husband?

In addition to the expenses mentioned, spouses may be faced with the need to allocate a marital share.

Let's consider an approximate algorithm for calculating expenses.

After the death of her husband, mother and daughter inherited a two-room apartment. The cadastral value of the property is 5 million rubles. The apartment was jointly acquired property, respectively, 50% belongs to the wife and another ¼ is due to her by inheritance. The spouse is exempt from paying state duty because she lived together with the testator.

The cost of notary services will be approximately 3 thousand and 200 rubles. for the allocation of the marital share. Obtaining a certificate of cadastral value 350 rubles. In total, the wife will have to pay 3,550 rubles.

What is the cost of registering an inheritance with a notary after the death of one of the parents?

When registering an inheritance after the death of a mother or father, you should take into account the above recommendations. The cost of expenses is calculated similarly to the examples discussed.

The total cost is affected by:

- Living together with a deceased parent.

- The need to evaluate objects of inheritance.

- Availability of title documents.

- Whether the successor participates personally or through a representative.

Where can I get a property valuation?

Since the amount of the duty paid depends on the value of the property, there is a need for an assessment. Heirs need to contact the appropriate organization.

To assess the land, you can visit Rosreestr or another specialized organization at the location of the site. A written agreement will also be required.

An apartment assessment report can be obtained from the BTI (built before 2013) or from a commercial organization. The cost of services of appraisal companies starts from 3,000 rubles.

The assessment is carried out taking into account the requirements of the Federal Law dated July 29, 1998 No. 135-FZ. The period for assessing real estate ranges from 5–7 days. The deadline is 1 month.

Much depends on the intended purpose of the property and its market value. In the case of plots of land, their size is also taken into account. The valuation of a vehicle is carried out according to the same scheme as real estate.

If the subject of the inheritance is shares or money in foreign currency, then the amount of the fee will be determined in accordance with the Central Bank exchange rate on the day the inheritance is opened.

After the property has been assessed, the heirs must be given an act (report). Based on it, the amount of state duty is calculated.

Example : Citizen A. received an apartment by right of inheritance. After visiting the notary, he was told that a real estate appraisal was required. Not knowing all the details, citizen A. contacted the specified company. The apartment was assessed at a market value of 2,500,000 rubles. Calculation of the duty amount – 2,500,000 x 0.3% = 7,500 rubles. Later, the heir learned from a lawyer friend that there are 3 types of valuation, and the market one is the most disadvantageous in terms of the amount of the duty. Having contacted the BTI, citizen A. received a different assessment amount - 812,000 rubles. Calculation of the tax amount – 812,000 x 0.3% = 2,436 rubles. Ultimately, option 2 was chosen, where the amount of the fee decreased by more than 3 times.

If it is impossible to determine the value of the inheritance: valuation of the inherited property

Payment of the state fee for entering into an inheritance is a necessary legal requirement for the successor. As far as we know, the amount of the contribution depends on the price of the property, amounting to 0.3% and 0.6% of its value. To correctly calculate the amount of the fee, the notary needs to know the value of the property. This is the only reason why a property valuation should be carried out upon taking possession.

Heirs have the right to independently choose the method of property valuation: at market or cadastral value. You can find out the value of real estate from the state’s point of view on the State Register website without paying - any specialist can enter the resource and obtain information. Obtaining a market valuation involves expenses. To carry out the procedure, you must use the help of independent appraisers or authorized government bodies who will charge a fee for their services.

Depending on the region, the real estate valuation procedure costs 5-10 thousand rubles. It can be economically justified only if the cadastral value of the property significantly exceeds the market value.

Note! In addition to real estate, all types of property of the deceased that require registration are subject to assessment: transport, shares, bonds, business, weapons. Items must be appraised within six months after the death of the testator.

You can find out how much they pay for the valuation of various inheritance objects in the table:

| An object | Amount, rub |

| House, apartment, garage | from 5000 |

| Land plot | from 8000 |

| Freight car | from 5000 |

| A car | from 4500 |

How is the state duty paid?

Duty Payment Options

| No. | Option | Payment order |

| 1 | Cash | Payment is made at any bank based on a receipt issued by a notary. The amount of the fee depends on the financial institution. In addition, funds can be separated directly at the notary’s office. This option is a priority. |

| 2 | Through ATMs | The payer will have to independently enter the payment details, its purpose, the name of the recipient and the amount of the contribution. A prerequisite is to receive a receipt. |

Due date

Interested parties are given 6 months to enter into inheritance. The countdown of time begins from the moment of death of the testator.

Heirs can contact the notary immediately after receiving the death certificate. Applicants need to pay 100 rubles for submitting an initial application.

After six months, you will need to visit the notary again and pay the notary fee in full. The basis for calculating the amount of the fee is an expert assessment. It must be ordered as of the date of death of the owner.

Important! According to the law, the heir does not need to rush to carry out the assessment. If during the inheritance process a successor under the will is identified, the funds will be wasted.

How much does it cost to register property rights?

After receiving a certificate of inheritance, the successor must contact the appropriate government agency to re-register ownership.

Registration of a private house or apartment is carried out in Rosreestr according to the tariffs established by Art. 333.33 Tax Code of the Russian Federation.

The cost of re-issuing documents for these objects will be 2 thousand rubles. For re-registration of a share in the right of common shared ownership, you will also have to pay 2 thousand rubles. State registration of ownership of a land plot will cost 350 rubles.

The list of tariffs for performing registration actions in relation to real estate can also be found on the Rosreestr website.

The registration of a vehicle is carried out by the territorial division of the traffic police. The costs will be 850 rubles. For changing license plates, the fee will be 2,850 rubles. You must register your car within 10 days. Violation of the established deadline is punishable by a fine.

When the successor received funds in a bank account as an inheritance, nothing needs to be paid. The heir must contact the bank with an application to withdraw funds from the account and provide a certificate of title to the property of the deceased.

Additional costs

In addition to the mandatory inheritance fee, you will also need to pay notary fees, which include the services of a probate specialist.

The cost is formed from a number of payments:

- announcement of the text of the will – 300 rubles;

- safety of property entrusted to the notary – 300 rubles;

- signature authentication – 100 rubles.

Costs when going to court

The amount of state duty when inheriting property is determined by law. However, its size may change if the heir asserts his rights in court.

Example. To challenge a will or to extend the period for entering into inheritance, the applicant must separately pay 300 rubles. The same applies if the establishment of legal facts is required.

The services of a lawyer (preparing a claim, representing the interests of the plaintiff in court) are also paid separately. After the completion of the legal proceedings, the heir will have to pay the state fee in the general manner when contacting a notary office.

What can you save on?

Often, notaries are persuaded to make a separate copy of the certificate for each heir. They strongly recommend that you draw up a document for any object from the will. Each additional certificate costs money, but whether to do it or not is a personal matter; the procedure established by law does not oblige you to do so.

Evaluation of successors, incl. pensioners must do it at their own expense. Independent organizations or BTI will help with this. In order for a pensioner to save money, it is necessary to take into account the cadastral value, which is lower than the market value. In order for the property to be calculated at the cadastral price, the pensioner needs to contact the BTI.

Regions have their own benefits for a certain category of citizens, including pensioners. Before completing all the paperwork, it is recommended to ask a representative of the notary’s office to tell you about your rights and ask other questions about receiving an inheritance. In addition, the legislation is changeable, but all the benefits mentioned earlier are valid to this day in the Russian Federation. You can find out information on other countries on the corresponding Internet resources. For example, information on Ukraine is on the state’s legal portal.

Thus, pensioners will not be able to receive an inheritance without spending their own money. Even if the heir is one of the persons entitled to benefits, in any case he will have to pay notary services, property tax, etc.