Let's figure it out, a receipt is an official document in court. And can the receipt be used as evidence?

The other day, a distant acquaintance called me asking me to borrow money against a receipt to buy an iPhone 7 Plus as a gift for his girlfriend.

Refused. And then he turned to a lawyer to understand the issue of the value of such pieces of paper as legal documents. Also interesting: Feature of the Moscow metro: how to understand which direction you are going.

I collected the data obtained in an article for our readers. It will be useful in life.

Note! The information presented is valid for Russia. Discuss the situation in your country with a local lawyer.

What is a receipt?

A receipt is a handwritten document that records the relationship of two or more persons in a particular area. Most often, it turns out to be confirmation of a loan of funds, transfer of documents for temporary use, and so on.

According to their purpose, receipts are divided into several main types:

- Receipt for child support, which is due to one of the parents living with the child until adulthood

- A receipt for no claims, which confirms this fact in case of damage to health, property, etc.

- A receipt for receipt of documents or securities, which confirms the need to return them at a specified time

- A promissory note confirming the transfer of a specific amount of money and the need to return it at a specified time - the most popular type

The receipt is drawn up in one copy and remains with the party to whom the money, documents, etc. should be given.

Cases when you can draw up a receipt by hand

Despite the convenience of drawing up and a number of advantages of a handwritten receipt, it cannot be used in every situation. Before drawing up such a document, it is important to know whether it will have legal force in this case. Since there is a list of agreements, for example, an agreement for the purchase and sale of real estate, an agreement for the donation of real estate and others, which are valid only after being certified by a notary.

You can limit yourself to a handwritten receipt if the amount borrowed does not exceed ten minimum wages. It is also better to record amounts less than the above in this document so that unpleasant situations do not arise. Large sums must be certified by a notary office.

When providing different types of services, such a receipt also continues to be valid.

It will also be relevant when renting/renting an apartment. In this case, two parties can protect themselves in this way: one - from dishonest landlords, the other - to exclude the option of terminating the transaction in a short time, which was not initially counted on. In such a situation, all financial relations must be agreed upon and recorded in the contract. It is necessary to indicate the amount of money transferred for the apartment and the period during which the tenants have the right to use the housing.

How to write a receipt correctly

In order for the receipt to become a legal document and not turn into a substitute for toilet paper, it must be properly executed.

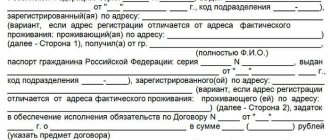

Example of a receipt. Clickable.

Pay attention to 10 basic nuances of the receipt:

- The receipt is written by hand (not printed)

- The name of the document should be in the middle - “Receipt”

- Below the name on the left is the name of the city (“Moscow”)

- On the right opposite the city is the date in full (“March 20, 2010”)

- Last name, first name and patronymic are written in full (“Ayfonov Ayfon Ayfonovich”)

- After your full name you need to indicate your full passport details (series, number, who issued it), date of birth, address of residence - this is necessary for both parties

- Amount of money in numbers and words (or description of another benefit transferred)

- Name of the currency (or other nuances of the relationship)

- Date of return of money (documents, etc.)

- Below the text on the left is the date of the signature, and on the right is the signature of both parties (it should resemble the passport as closely as possible)

If the receipt was drawn up in front of witnesses (two or more), their signatures, like those of the parties to the transaction, will also come in handy. This condition can be considered optional, but desirable.

Requirements for an uncertified receipt

According to the legal decision of the judge, the legal force of an uncertified receipt is manifested only if everything was done correctly when writing it. If the document is not certified, in this case its structure must be clear and correct, meeting the following requirements:

- a document of this type must be written by hand;

- The recipient of the funds must write the document in his own handwriting;

- there is a need to set the exact date of drawing up the paper, because its legal force has a period that is equal to three years;

- the document must include passport data of both the borrower and the entity lending money, indicating who is which party to this type of relationship;

- when the object of the agreement is not cash, but a specific item, you need to draw up a detailed description of all its qualities and characteristics;

- if the object of the agreement is a vehicle, then its engine number, model, make, body type, VIN code and color must be written down;

- you need to write in detail about the conditions for issuing a loan and the rules for repaying it;

- when funds are issued for use at interest, their quantity is clearly indicated;

- the data and amount of debt must be indicated in numbers and displayed in words;

- the currency in which the debt was transferred must be indicated;

- when renting out an apartment, when this is done against a receipt, you need to clearly describe all its characteristics, indicate what property is located there;

- the exact deadline for the return of borrowed movable or immovable property, as well as money, must be present.

After signing the paper, you need to decipher the signature, because only then will it be valid without notarization. If the amount of interest indicated on the receipt is equal to the bank loan rate, then the borrower is better off choosing the second option, because it is more practical.

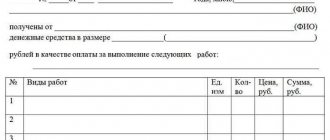

Sample of an uncertified receipt

According to the debtor's documents, it is worth additionally checking the information written on the paper, since unscrupulous people indicate incorrect data, and creditors are then unable to prove anything. Conducting a transaction using fake documents has become relevant, because it cannot be challenged, and scammers make money from it.

A receipt that is not certified by a notary has legal force if it is written correctly. The paper can indicate not only the object of the loan, interest, repayment period, but also what will happen if a person does not return the borrowed item or money on time. Having done everything according to this list, you can consider the receipt to be correctly drawn up, so you can do without a notary and additional cash costs.

What legal force does a handwritten receipt have?

The norms of Russian legislation do not imply that the receipt must necessarily be printed - it can be made in any form.

Moreover, a handwritten receipt is easier to identify by handwriting, making it even better than a printed one.

If the situation has reached court proceedings (alimony is not paid, claims are made, documents or money are not returned, and so on), and the author of the receipt refuses his obligations, the receipt will become excellent evidence in court.

The witnesses in whose presence the receipt was drawn up will also be very helpful here.

Disclaimer. What to do

It often happens that the defendant refuses to fulfill its debt obligations and evades responsibility.

In such situation:

- A statement is written with an official demand for repayment of the debt.

- Sent by registered mail to the debtor's address.

- Notification of receipt is noted.

- Wait thirty days. The legal framework specifies exactly this period of consideration.

Note!

If there is no response from the party, the creditor goes to court to protect rights and receive compensation.

Do I need to notarize the receipt?

Not necessary, but possible.

Here are the benefits of notarization:

- The notary can check the legality of the transaction as such

- Notarization more easily confirms the identity of the person who wrote the receipt.

- A receipt with notarization is more likely to be accepted by the court as evidence

But the services of a notary cost money, so they are not used so often.

I think in this case you need to focus on the seriousness of the transaction. If we are talking about a relatively large amount of money or important documents, certification is required. Otherwise, as desired.

Special cases when notarization is required

If the borrower receives a large amount of cash in hand, then the creditor needs to notarize the receipt written by the debtor. There are cases in which only a legally certified receipt is considered genuine and they are as follows:

- the loan amount exceeds the debtor’s salary by approximately 10 times;

- both parties to the agreement are supporters of the official certification of the paper;

- The parties want to be completely sure that their agreement is legal.

Borrowing money against a receipt is more profitable than taking out a loan from a bank, so the system for processing and certifying such documents is well-established and allows everyone to use this service. A notary’s certification is direct evidence of the competent drafting of a transaction, which will be 100% useful in court.

Let's summarize and draw conclusions

Let's briefly and point by point:

- The receipt has legal force and can be used as evidence confirming something in court, the main thing is that it is drawn up correctly

- A handwritten receipt is even more powerful than a printed one, because it can be used to more accurately identify the author - make sure that the signatures match the passport

- Additional witnesses to the preparation of the receipt - they will come in handy

- Notarization of the receipt would not hurt – it makes it easier to determine the author of the document

And most importantly, lawyers argue that receipts should not be compared to toilet paper. So use it.

Please.

Have you encountered promissory notes or other receipts? If yes, be sure to share your personal experience. I'm sure it will help many.

( 33 votes, overall rating: 4.36 out of 5)