Ask a lawyer

faster. It's free!

A receipt for receipt of money for an apartment is a necessary and obligatory document when making a transaction for its purchase. This is in fact the only written evidence that funds were transferred by one party and received by the other. Therefore, you should not transfer them without documenting them.

A receipt is not an independent document, since any transaction must be sealed by an agreement. Therefore, the text of the receipt must indicate its details as the basis for payment in cash for the purchased property. Receipt of money is confirmed, both under the main purchase and sale agreement and the preliminary agreement.

It is drawn up in only one copy on behalf of the seller and is kept indefinitely by the buyer, confirming receipt of cash.

How to write a receipt for receiving money for an apartment?

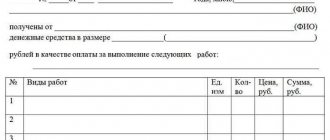

Citizens, when paying in cash under a transaction agreement for the sale of an apartment, must make a receipt.

According to civil law, it must reflect the following points:

- date of receipt in words;

- information about the parties to the purchase and sale agreement on the basis of which cash payments are made (full name, passport details, place of birth, registration information);

- in the case where the interests of the seller are represented by an authorized person, the receipt indicates his data and details of the notarized power of attorney, on the basis of which he has the right to receive funds (Article 185 of the Civil Code of the Russian Federation).

You should make sure that the receipt indicates the authority of the person acting under a power of attorney to receive money specifically under a specific apartment purchase and sale agreement.

- the amount of transferred cash is indicated in numbers and in words in rubles or the ruble equivalent, the currency is determined in the transaction agreement itself (clause 1 of article 424, article 317 of the Civil Code of the Russian Federation);

- the purpose of transferring money, indicating information about the object of acquisition (apartment and its exact address);

- The details of the agreement in accordance with which the transfer of funds is made must be specified;

- in case of final payment, the receipt must contain a record indicating this and the absence of claims for payment on the part of the seller;

- if funds are transferred partially as payment under a purchase and sale agreement, then it is necessary to indicate how they were received (partial payment, deposit or advance). A separate receipt is issued for the remaining amount.

In order for the receipt to have legal force and be able to become evidence in court in controversial situations, the following conditions must be adhered to:

- drawn up and signed by the seller himself in full;

- a complete decoding of the recipient's signature is required;

- blue ink is used from a ballpoint pen so that there is no doubt that this is not a copy (a copy of a receipt is insignificant);

- Errors and corrections are not allowed.

Features of drawing up a receipt for the sale of apartments with several owners

In the case of purchasing an apartment from several owners (an apartment in common ownership), the registration of a receipt has some features.

If an apartment is purchased from two or more co-owners, then the receipt must be signed by everyone who signed the purchase and sale agreement. In the case when the apartment was in common shared ownership, and the sellers received money based on the size of each share in the real estate, then each of the co-owners (the seller of the share) draws up a separate receipt, which indicates the amount that is due only to him.

Witnesses when calculating the deposit

The transfer of funds can take place in front of witnesses, which reduces the risk of challenging it. More often than not, the buyer is interested in this. The receipt must contain information that the process took place in the presence of witnesses and their personal data in strict accordance with personal documents.

To confirm the fact of transfer of money, two witnesses who have an opinion independent of the participants in the transaction are sufficient. Their presence is indicated in the receipt and certified by personal signatures with a transcript.

Sample deposit for an apartment

Deposit agreement

Tyumen

October 22, 2023

Lorin Raul Albertovich, registered at the address: Tyumen region, Tyumen city, Domozhirova street, building 284, apartment 951, passport: number 0000 series 000000, issued by the Ministry of Internal Affairs of Russia for the Tyumen region in the city of Tyumen on December 12, 2000, hereinafter referred to as the “Seller”, on the one hand, And Chistyakov Alber Pavlovich, registered at the address: Tyumen region, Tyumen city, Novoselova street, building 157, apartment 942, passport: number 0000 series 000000, issued by the Ministry of Internal Affairs of Russia for the Tyumen region in the city of Tyumen on December 10, 2000, hereinafter referred to “Buyer”, on the other hand, have entered into this agreement as follows:

The preamble of the agreement contains information related to the personal data of the parties. Thus, the text of the preamble contains the following provisions:

- Firstly, the type of transaction being concluded (in our case it is a Deposit Agreement).

- Secondly, the place, that is, the city in which the agreement is drawn up;

- Thirdly, the date of conclusion of the contract;

- Fourthly, the surnames and initials of the parties, registration addresses and passport details;

- Fifthly, the roles of the participants in the transaction.

All of the above items together constitute the contents of the preamble.

Further, the agreement contains sections containing essential (without which the agreement does not enter into legal force) and additional (at the discretion of the parties) conditions. Below we will present a sample of each section separately.

Nuances of registering a receipt

- For a minor child under 14 years of age who is the owner of an apartment, funds to pay for the cost of the property being sold are received by his representatives by law (parents or guardians). Their presence is required when transferring money; they also write a receipt. At the same time, they indicate their personal information and the child’s. The child does not have to be present during the transaction.

- A minor child who has already received a passport writes a receipt in his own hand indicating that he received the amount of money in the presence of one of the parents. The receipt is certified by the child’s personal signature. Legal representatives must also provide their details and sign.

- If there are several sellers, then each is required to write a receipt on his own behalf indicating his specific share of the transaction.

- The receipt does not require notarization. However, the parties, by mutual agreement, can contact a notary to confirm the fact of transfer of funds. Then the document will have stronger legal force.

The receipt has no statute of limitations and must be kept by the buyer. You should not submit its original to the tax authority or Rosreestr. Only the original is a legally significant document that can serve as evidence of the transfer of cash during legal proceedings, as well as when receiving a tax deduction.

Features of the document

A receipt is drawn up unilaterally. After registration, the document is transferred to the second party to the transaction. The latter will keep it until the terms of the guarantee are fulfilled. Based on the receipt, the beginning and end of legal relations are established. It is required to be drawn up when a certificate is required for any action or event. From the moment of registration, a person has responsibilities.

The receipt is drawn up in writing. It should contain all information relevant to the case. In some cases, the paper must be certified by a notary. This is relevant when a large amount of money is transferred. However, certification occurs at the request of the transaction participant. The receipt is similar in its functions and purpose to a loan agreement.

Sample receipts are not approved by law. However, the document usually has a stable structure. It contains these mandatory details:

- Information about the person who has undertaken the obligations.

- Information about the person in respect of whom the receipt is being filled out.

- Date of completion.

If the paper does not contain all the necessary details, it will not be considered valid.

Rules for the money transfer procedure

Most often, the receipt has to be used twice, or, more precisely, its writing, since funds can be partially contributed when purchasing real estate, that is, as a down payment and after concluding a purchase and sale agreement, when the full balance of the debt on the apartment is repaid. If it is necessary to write two receipts, the first is destroyed, and after completion of the transaction only the second remains with the full repayment of the required amount of money, but the full amount is indicated minus the deposit (down payment). The receipt is attached to the purchase and sale agreement and must be kept in a safe place. In addition, the fact of drawing up a receipt for receipt of funds must be indicated in one of the clauses of the purchase and sale agreement, since the money is transferred in cash.

In addition to knowing how to correctly write a receipt for the agreed amount of money, it is important to familiarize yourself with the procedure for transferring funds for an apartment. So, before receiving a receipt and transferring money, follow these rules:

- Double-check all information specified in the receipt in accordance with current documents.

- Before carrying out the transaction, prepare and make sure that the owner of the apartment is in front of you - order an extract from the Unified State Register of Real Estate.

- Check the signature on the receipt and on your passport.

- Under no circumstances agree to a photocopy; the buyer must have only the original.

- The document storage period is unlimited.

- For greater security of the transaction and transfer of money, you can attract witnesses. They will also have to put their signatures on the receipt opposite their personal and passport information. If a controversial situation arises, they may be involved in court proceedings to clarify the circumstances.

Even if the sale and purchase transaction is successful, do not destroy the document under any circumstances. Tax legislation stipulates the opportunity to receive a tax (property) deduction for purchased real estate and thereby send the accumulated amount from your wage contributions (personal income tax) as compensation for part of the cost of the purchased apartment. But to carry out such an operation, you will need to provide the Tax Inspectorate, along with other documents, with a receipt that will confirm the fact of payment for the purchase of real estate.

Below is a receipt for an apartment for tax deduction. The sample receipt is standard, so to avoid inconsistencies in a specific case, it is better to first consult with the Tax Inspectorate at your registration address.

Sample receipt for receipt of deposit

Rights and obligations

This section provides a list of obligations of the Counterparties under this agreement. Thus, provisions related to the actions of persons are prescribed here, namely, how they should act in certain situations. We present approximate formulations that appear in this section below:

The seller has the right to: • Require timely payment of a deposit in the amount specified in the clauses of this agreement. • Require the Buyer to properly fulfill its obligations under this agreement. The Seller undertakes: • After signing this agreement, provide the Buyer with all the necessary documents for the alienated object; • 7 (Seven) calendar days before signing the agreement for the purchase and sale of a residential building, provide the Buyer with documents related to payment for communication services. Electricity, etc. • After signing the contract, do not carry out any repairs or other work that entails a change in the characteristics of the residential building. • Bear responsibility in case of violation of the provisions of this agreement, as well as in case of failure to fulfill the obligations established by this agreement. • Fulfill your obligations in accordance with the provisions of the concluded agreement. The buyer has the right to: • Demand compliance with all agreements between the parties. • Require the provision of all documents for the residential building after signing this agreement. • Require the Seller to properly fulfill its obligations under this agreement. The Buyer undertakes: • To transfer to the Seller the full amount of the deposit within the period specified in this agreement. • Bear responsibility in case of violation of the provisions of this agreement, as well as in case of failure to fulfill the obligations established by this agreement. • Fulfill your obligations in accordance with the provisions of the concluded agreement.