In court, when collecting debt under a loan agreement, the main evidence is a cash receipt, promissory note, receipt of money. And you need to remember this when lending money. A correctly executed receipt will help save time in court and facilitate a court decision on debt collection in the event of going to court.

So, drawing up a promissory note (monetary) is necessary when concluding a loan agreement. The possibility of receiving money from it in the future depends on how correctly the receipt is drawn up. Such a receipt can be used in court as evidence of the loan of money and the terms of the loan agreement.

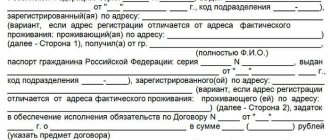

|

A cash receipt must also be drawn up when concluding a written loan agreement, including a notarized one. It is the receipt that will confirm the fact of transfer and receipt of money. Then it will be extremely difficult for the borrower to dispute his debt, including due to lack of money.

We advise you to read

Do you want to protect yourself when borrowing money?You are reading: Loan agreement, loan of funds

Why do you need a receipt?

A receipt is a document confirming receipt of something. As a rule, the receipt is drawn up by hand. This is the most optimal option, incl. with the expectation of a possible handwriting examination. But it is also permissible to print a receipt, then it is advisable to write the amount and the transcript of the name by hand.

In the receipt, the party who received the funds indicates their data, date of preparation and place, what and on the basis of what (loan) they received. Of course, the receipt must be signed personally (by power of attorney, then its details must be indicated in the document).

The receipt is a one-sided document. It is compiled and signed by only one person - the recipient of material benefits. He gives the completed and signed receipt for safekeeping to another person (the one who transfers the item or money). The receipt is a supporting document.

If necessary, it can be used as evidence of a completed agreement.

The most common are receipts for receipt of money. Such a receipt confirms that the money was actually received. Money can be transferred under a housing rental agreement, a car purchase and sale agreement, a real estate sale agreement, a lease agreement, a contract agreement, an agreement for the provision of legal services and other types of agreements. A receipt can be used to confirm receipt of alimony and compensation for damages. The receipt may confirm that the employee has received material assets or cargo for reporting. And in all these cases, the receipt will act as proof of the relevant agreements.

Do I need to get it certified by a notary?

The obligation to certify a receipt by a notary is not stipulated in the legislation of the Russian Federation, i.e. Each lender has the right to decide for himself whether he is interested in having the receipt certified by the signature of an employee of a notary office or not.

However, the very fact of having a notary’s autograph gives the receipt greater significance, so you should not neglect it.

The only minus here, or rather, even two – time costs and additional financial expenses.

What is the difference between a promissory note and a cash receipt?

If we talk about a receipt confirming a loan of money, then the terms cash or promissory note are equivalent. However, these concepts can be used in other situations. Thus, a cash receipt can transfer money in general, and not just as a loan. For example, a cash receipt confirms the repayment of a debt or the transfer of money for sold property. Not only money, but also other things can be transferred under a promissory note. From this we can derive the following definitions:

- A promissory note is a document confirming the existence of a debt under a loan agreement.

- A cash receipt is a document confirming the transfer of funds.

A promissory note can be used to lend money, things or securities. Using a cash receipt, money can be transferred both as a loan and to repay a debt or pay off other obligations.

Therefore, it would be correct to draw up a promissory note specifically to confirm the loan, and a cash receipt for other cases of confirmation of the transfer of money.

Legal status of the document

It is easier to draw up the paper right on the spot, by hand - this is a simple form of receipt. If a serious transaction is being made and it is planned to transfer a fairly large amount, then it is recommended to carry out the procedure in the presence of a notary.

However, both documents are endowed with legal force: both a receipt signed by a notary and a form filled out manually by the parties. Of course, notarization increases the status of the paper. In simple words, if a dispute arises regarding the transfer of money, a notary will act as a witness to the circumstances.

When drawing up a simple written form in the event of a dispute, the authenticity of the document is confirmed by conducting a special examination. And this takes quite a lot of time. But notarization is not a requirement.

Requirements for a receipt for the transfer of money

Let's consider 5 mandatory requirements for a promissory note:

- It is necessary to indicate the place of its preparation (the locality where the money is transferred).

- Write down the name of the document being drawn up - Debt Receipt or Cash Receipt

- The full last name, first name and patronymic of the person borrowing money and the person lending it must be indicated. The borrower must provide data without abbreviations, as in the passport. You can also provide the full passport details of the parties.

- Indicate the loan amount (the specific amount that is transferred from hand to hand is indicated in rubles and kopecks; it is better to duplicate the digital data in written text).

- The date when the money was received is indicated (the date is indicated in full, that is, day, month, year).

- At the end of the receipt, the signature of the borrower is required (the signature must be written in full, correspond to the full signature of the borrower under normal conditions. If the document is printed on a computer, it will be correct if the borrower at the end of the receipt handwrites his last name, first name and patronymic without abbreviations and signs) .

There are 2 additional requirements for the receipt, which are indicated at the request of the parties:

- The period when the borrower will return the money (repayment of the debt can be in parts or the entire amount). The date may be specified specifically as “DD-MM-YYYY” - this will be the correct option to avoid confusion, or a specified period of time. If the parties do not indicate the date on the cash receipt, the refund will be made 30 days after the creditor makes such a claim.

- The amount of interest for using money (usually the amount of interest is indicated for a month, but it is allowed to indicate interest for any period) and the amount of interest (fine) for violating the terms of repayment of the loan (usually the amount of interest is indicated for each day of delay).

Types and features

Taking into account legal norms, such documents do not have clearly defined types, however, to determine when and which one to use, documents are divided into the following types:

- substantive – a description of the purpose for which the funds are provided;

- pointless when there is no clear purpose for obtaining a loan.

In addition, the type of document is influenced by the following circumstances:

- drawing up by a notary with its subsequent certification;

- by hand, for example, to receive a salary.

The paper may provide funds under various circumstances of receipt:

- advance payment for services provided;

- salaries, scholarships, pensions and other payments;

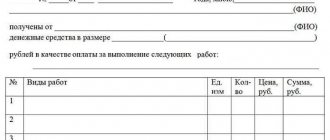

- money for performing services;

- loan from a microfinance organization or other organization.

Also, such a document can be issued by a financially responsible person, for example, when an employee receives equipment or other operating systems against receipt.

How to get money back from a promissory note

When you issue a receipt, you should think about how to get the money back later. It is good if a good and trusting relationship has been established between the parties, and no force majeure events have occurred during the loan. But no one is immune from troubles.

When transferring money by receipt, you should in any case limit the transferred amount to the available capabilities. So that later non-repayment of this amount does not lead to bankruptcy of the borrower.

When drawing up a receipt for receiving money, carefully read all the data indicated in it so that there are no errors. Pay special attention to the correct spelling of the last name, first name and patronymic of the borrower and debtor (it’s better to check your passport). And also for the amount of money indicated in the receipt (it is better if, in addition to numbers, the amount is written down in words). The promissory note must indicate that the money is being transferred as a loan.

We advise you to read

In case of delay in repaying the debt according to the receipt, or violation of the terms of the loan agreement, a Statement of Claim for collection of the debt under the loan agreement is filed with the court.

Examples in various situations

Here is the text of the receipt for receiving money when registering the purchase and sale of land or real estate.

| Receipt Saint Petersburg 01.03.2021 I, Sergeyev Sergey Ivanovich, born December 11, 1980, place of birth: Tyumen, passport series 1234, number 123456, issued by the Federal Migration Service of Tyumen on August 2, 2010, registered at the address: s. Serebryany Bor, Ivanovsky district, Tyumen region, no. 10, received from Ivan Petrovich Ivanov, born on March 19, 1963, place of birth: Kirov, passport series 4321, number 654321, issued by the Kirov police department on April 13, 2013, registered at the address: Kirov st. Stroiteley, 12, apt. 123, the amount of 500,000 (five hundred thousand) rubles for the land plot I sold, located at the address: s. Serebryany Bor, Ivanovsky district, Tyumen region, plot 4, area 8 acres, cadastral number 40:60:1234567:30-50; one-story log residential house with an area of 60 sq. m, cadastral number 40:60:1234567:30-50 and outbuildings - a bathhouse and a barn - according to the “Agreement for the sale and purchase of a land plot and a residential building” dated 10/01/2019, drawn up in simple written form. The calculation has been completed in full. I have no complaints against the buyer. Full name, signature |

A similar rule applies to transactions for the purchase of vehicles: an example of a receipt for receipt of funds under a car purchase and sale agreement.

| Receipt Saint Petersburg 10.03.2021 I, Sergeev Ivan Petrovich, registered at the address: Lomonosov city, Rechnaya street, 10, apt. 2, passport series 1234, No. 123456, issued by the Department of Internal Affairs of St. Petersburg on February 10, 2010, received from Ivan Sergeevich Petrov, registered at the address: Pushkin city, Sadovaya street, 25, apt. 15, passport series 4321, No. 65432, issued by the Pushkin police department on February 20, 2003, funds in the amount of 830,900.97 (eight hundred thirty thousand nine hundred rubles ninety-seven kopecks) for the sale of a Lada Samara car, VIN No. 1234567 OR43215СС12345, engine No. 1234СС654321, 2008, black, title 29 245 NR 123456789, under the purchase agreement sale concluded by the parties on March 10, 2020. The funds have been verified by me for authenticity and received in full. ___________________ /__________________/ March 10, 2021 |

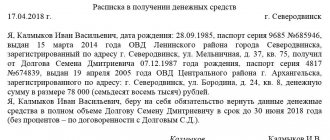

One more example:

From the point of view of the Law of the Russian Federation

The receipt does not have all the advantages that a loan agreement has (they are concluded by banks and microfinance organizations), but it is legitimate, i.e. used as evidence in trials.

To give more weight, it is necessary to draw up the document in the presence of several disinterested witnesses and notarize it.

What legal force does a handwritten receipt have?

The norms of Russian legislation do not imply that the receipt must necessarily be printed - it can be made in any form.

Moreover, a handwritten receipt is easier to identify by handwriting, making it even better than a printed one.

If the situation has reached court proceedings (alimony is not paid, claims are made, documents or money are not returned, and so on), and the author of the receipt refuses his obligations, the receipt will become excellent evidence in court.

The witnesses in whose presence the receipt was drawn up will also be very helpful here.

Receipt for borrowing money at interest according to the law

According to paragraph 2 of Art. 808 of the Civil Code of the Russian Federation, in order to confirm the loan agreement and its terms, you can provide a receipt from the borrower or another document that certifies the transfer by the lender of a specific amount of money or a certain number of things.

When the debt does not exceed 10 thousand rubles in total, the parties may well resort to concluding oral agreements on the return of money and interest. But if the value of the transfer object is greater, then you should definitely draw up the necessary documents; as a rule, this will be a regular loan agreement. It has legal force if it is signed by all parties. In addition, you can simply issue a receipt.

It is necessary to notarize a transaction in the following cases:

- when required by law;

- provided for by the agreement of the parties, at least by law this form was not required for transactions of this type (Clause 2 of Article 163 of the Civil Code of the Russian Federation).

Based on this, there are no strict requirements for notarization of a receipt. It is important to understand that the notary does not work with the receipt separately; he can only certify the loan agreement and along with it the receipt that is attached to it.

Therefore, if you are going to lend money and at the same time want to notarize this transaction, then you need to draw up a loan agreement. But if you have already given away the funds and have only drawn up a receipt for the loan at interest, you do not need to worry, because this document already has legal force and guarantees that the borrower will return the funds to you. If problems arise, in each case a lawsuit cannot be avoided.

Interest is usually paid along with the principal. If the money is returned in a lump sum, then the amount of interest must be paid immediately. When the debt is repaid in partial payments, interest is paid on the balance of the loan debt on the date of partial repayment.

[offer]

Interest payments can take place in different ways:

- with monthly payment;

- with payment according to schedule;

- lump sum payment;

- quarterly deposit of money.

All details of the transaction, such as: the procedure for repaying the debt, terms, and other significant conditions, must be reflected in the receipt, even though this is not a full-fledged agreement. If the receipt is issued only to confirm the fact of transfer of funds, then all conditions must be reflected in the loan agreement.

The conditions specified in the receipt come into force from the moment it is signed by the parties to the transaction, so there is no need to additionally go to a notary for certification.

Be sure to remember that only the original receipt for a loan with interest will be accepted in court! A copy of this document, even if certified by a notary, has no legal force.

It is important that only a properly executed document can confirm the fulfillment of obligations between people. You can also invite a witness to draw up a receipt. If the matter comes to court proceedings, he will have to confirm the fact of execution of the document.

How not to pay?

The law provides for situations when a citizen may legally not spend according to a receipt.

| No. | Situations |

| 1 | At the time the loan is issued, the recipient is deprived of legal capacity |

| 2 | At the time of execution of the document, the debtor has not reached the age of majority |

| 3 | The person was unable to understand the consequences of his actions (due to the use of potent drugs or mental illness) |

| 4 | The citizen did not sign the receipt (the signature was forged) |

| 5 | The funds have been returned and there is a supporting document |