What is a promissory note and what are the requirements for it? How is interest on a loan calculated if it is not indicated? And most importantly, how to collect a debt on a receipt in court and pre-trial? We'll talk about all this in our article.

In practice, most citizens, when issuing loans to other individuals, very rarely enter into full written agreements. Although, according to the Civil Code, a loan agreement between citizens in the amount of 10,000 rubles or more must be concluded in writing.

Typically, the borrower issues a promissory note to confirm receipt of funds. But in order for the creditor to later be able to collect funds from the debtor, the document must meet certain requirements.

Requirements for a promissory note

If there is a written agreement, and the receipt only confirms the fact of transfer of funds, then it is sufficient to indicate in it that on a certain date the lender transferred, and the borrower accepted, under the loan agreement (number, date) funds in the amount of (specify the amount) and undertakes to return them within the terms and conditions established in the loan agreement. In addition, the borrower must sign it.

Required items

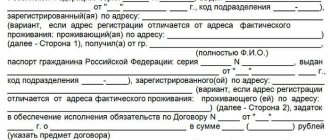

If there is no written agreement, and the receipt is the only evidence of the origin of the borrowing relationship, then it must indicate:

- date and place of drawing up the document,

- information about the lender and borrower, their full name, place of registration, passport details,

- loan amount (in numbers and words),

- loan terms (repayment period, interest rate),

- acceptance of borrowers' funds and obligation to repay them,

- signatures of the creditor and debtor, and their decoding.

If there is no loan repayment period, then the loan must be repaid within 30 days from the date of presentation of the request (clause 1 of Article 810 of the Civil Code of the Russian Federation).

If the receipt does not mention interest, then a loan in the amount of no more than 100,000 rubles is considered interest-free.

If the loan is considered interest-bearing, but the receipt does not indicate the amount of interest, then it is determined in the amount of the key rate of the Central Bank of the Russian Federation in force in the relevant periods.

It is very important to indicate the loan amount and information about the parties in the receipt.

The most important thing is that it should clearly follow from the contents of the note that the money is not being transferred as a gift, not as payment for goods or services, but temporarily on the terms of return.

For example, the court refused to collect the debt, since the contents of the document did not indicate that the funds were received by the defendant as a loan; the receipt did not contain an obligation to return them (Appeal ruling of the Moscow City Court dated November 14, 2019 in case No. 33-48893/2019) .

Pledge agreement

The loan agreement can be supported by the presence of collateral, which will guarantee the lender the receipt of the disbursed funds in any case. The collateral depends on the loan amount. It can be a garage, a car, a country house or an apartment. But it is worth noting that the value of the collateral does not have to correspond to the amount of the loan issued. But it cannot be less than the debt. That is, it must cover the amount of money borrowed.

The need for collateral is due to the fact that many people take out varying amounts of loans and then do not pay them back. And in order to get his money back, the lender will have to spend a lot of time in court. If the debtor does not have a stable income, then repayment of the debt may take a long period of time.

Important! The presence of collateral significantly protects the lender from non-repayment of money.

Both movable property and real estate can be used as loan collateral. Experts recommend using real estate, because an unscrupulous borrower can hide movable property.

According to the law, a pledge agreement does not require notarization. But if the object of the pledge is real estate, its registration with the Rosreestr authorities is mandatory. The fact of transfer of money is documented in the form of a receipt. If the return is made in cash, it is also necessary to prepare it.

Deadline for collection of funds according to receipt

A general limitation period of three years applies to loan repayments. How to calculate it?

If the receipt indicates the loan repayment period, the statute of limitations begins to run the next day after the expiration of the repayment period. If the period is not specified, then the statute of limitations is counted after 30 days from the date of sending the lender’s request to repay the loan.

But the court will apply the statute of limitations only if the defendant declares so. Therefore, if you are the defendant, claim the statute of limitations before the court makes a decision.

Borrow money secured by real estate

Securing a loan with real estate collateral occurs when the loan amount exceeds one million rubles. In this situation, the parties sign the agreement in 3 copies. Next, you need to sign a pledge agreement. After registration with Rosreestr, an encumbrance is placed on the property, and the borrower will not be able to dispose of it without the consent of the lender.

Reference! If the debt is not paid, the property is put up for auction, and the money from the sale is returned to the creditor to pay off the debt.

Before entering into a transaction, it is necessary to check the estimated value of the real estate, its liquidity and the presence of third parties living in it. For example, if children under 18 live in an apartment or house, this property cannot be used as collateral.

Pre-trial procedure for debt collection by receipt

The lender may try to recover funds from the borrower out of court. To do this, draw up and send a claim to the debtor.

In your complaint please indicate:

- information about the parties to the loan agreement,

- the fact that the borrower has received funds,

- the loan repayment deadline has arrived,

- demand for its return.

Send the claim by mail with notification or hand it to the debtor in person.

If the loan repayment period is not specified, then before going to court you must send the borrower a written request to repay the loan, wait 30 days, and only after that go to court.

In what cases do borrowers not return funds?

These reasons are the following facts:

- If the borrower has no funds.

- If the borrower hopes that this document does not have legal force.

- If the borrower tries to stretch out the time to repay the debt.

- If he hopes that after a couple of attempts to return his money, the lender will lag behind the careless borrower and turn a blind eye.

- Various other options are also possible in which the borrower does not return the borrowed funds to their owner. In such a matter, a trial (usually a judicial one) is required.

[su_youtube url=”

«]

How to collect a debt on a receipt in court

The statement of claim is filed with the district court at the defendant’s place of residence.

If the loan amount together with interest does not exceed 50,000 rubles, then contact the magistrate.

After the court decision comes into force (one month after the decision is made, unless an appeal is filed), you can receive a writ of execution to present it to the bailiff service.

Magistrates also have jurisdiction over cases of issuing a court order. A court order is issued for monetary claims of no more than 500,000 rubles, based on a written transaction. A court order is an executive document. But not all courts recognize the receipt as an indisputable requirement.

If the amount of the claim is no more than 100,000 rubles, then the case can be considered through simplified proceedings without calling the parties.

To correctly determine the jurisdiction of the dispute and draw up a statement, contact a lawyer.

How to properly file a claim for debt collection using a receipt

When filing both a claim and an application for a court order, you must pay a state fee. Its size depends on the amount of the claim.

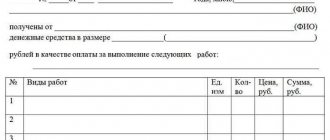

In the statement of claim, please indicate:

- name of the court,

- information about the plaintiff and defendant,

- circumstances of the loan,

- demand for loan repayment.

Attention! If the loan amount is indicated in the receipt in a foreign currency (currency of the debt), then you have the right to collect it only in Russian rubles (currency of payment) in an amount equivalent to the currency of the debt at the exchange rate of the Central Bank of the Russian Federation on the date of execution of the court decision. (Resolution of the Plenum of the Armed Forces of the Russian Federation No. 54 of November 22, 2016).

- requirement to pay interest for using a loan (if the loan is interest-bearing), interest on the basis of Art. 395 of the Civil Code of the Russian Federation for late loan repayment,

Attention! The obligation to pay interest on the loan amount (penalty) in the amount provided for in clause 1 of Art. 395 of the Civil Code from the day when it should have been returned until the day it is returned to the lender, arises in case of delay in obligations, regardless of the payment of interest provided for in paragraph 1 of Art. 809 of the Civil Code, for the use of a loan (Definition of the Armed Forces of the Russian Federation dated September 5, 2016 No. 4-KG15-75).

- signature.

What documents should be attached to the claim?

Attach to the application a copy of the receipt, a receipt for payment of the state fee (request for deferment), as well as evidence of sending the claim to the defendant.

In addition, evidence of the issuance of the loan and its terms may include:

- audio or video recording,

- recording of a telephone conversation.

Submit your application to the court by mail or via the Internet by filling out a special form on the website.

claim for debt collection

2021 sample

View document

What role does a receipt play when repaying a debt?

IOU

is a document written by hand. The text in the document confirms that one party lent the other a certain amount of money, and that the borrower undertakes to repay the funds within a strictly specified time frame.

The document is direct evidence of the debt. It is a key factor in the legal process. Receipts confirmed by notarization are especially valued, although the law does not force private creditors to contact notaries. But in the legal process, this will help speed things up.

Interestingly, creditors who did not require a receipt also have a chance to return the money. But in this case it will be more difficult to return the money.

The difference in debt collection with and without a receipt is as follows.

| If there is a promissory note | In the absence of a promissory note | |

| Proof | The receipt itself confirms the fact of the debt | Other evidence of debt is needed: recognition by the debtor himself, witnesses, money transfers based on a bank card statement, and so on. |

| Collection process | Through the order | Through enforcement proceedings by bailiffs |

| Deadlines | You can get a court decision in a few days | The process will take a long time, and challenges to higher authorities are possible. |

Without a receipt, collecting a debt is very difficult.

What to do if the borrower is bankrupt

If the borrower is declared bankrupt, the loan is collected in accordance with bankruptcy law.

After the introduction of debt restructuring, the deadline for the fulfillment of all obligations is considered to have arrived, and the accrual of penalties stops.

To be able to collect the debt, the borrower must submit an application to the arbitration court to include his claims in the register of creditors' claims within two months from the date of publication of the application declaring the debtor bankrupt (in the Kommersant newspaper). You can also track the information on the Fedresurs website.

To correctly draw up an application and prove the existence of a debt, contact a lawyer.

We have prepared a detailed article on how to recover money by initiating bankruptcy proceedings for the debtor. Useful material for lenders - we recommend you read it!

Are you a creditor and do you need protection of your interests in court? Sign up for a consultation!

Sign up

Witnesses. Are they necessary?

Some people, when transferring their documents to someone, prudently enlist the support of witnesses. These can be any uninterested persons (adults and capable), information about whom is also included in the receipt (their full name, passport details and registration address).

With their signatures, the witnesses confirm that certain papers were transferred in exactly the quantity and condition indicated in the receipt.

Thus, in a certain way, witnesses perform the role of a notary.

How to challenge a receipt for lack of money

The presence of a receipt from the lender is confirmation of the borrower’s failure to fulfill the obligations of the borrower to repay the loan, unless otherwise proven (Decision of the Supreme Court of the Russian Federation dated February 13, 2018 No. 41-KG17-39; Appeal determination of the Moscow City Court dated November 28, 2019 No. 33-51586/2019) .

The loan agreement is considered concluded from the moment the money is transferred. The debtor can challenge the loan by proving that in reality the funds were not provided to him.

Evidence may include:

- information about the financial situation of the creditor, which does not allow him to provide the loan amount indicated in the receipt,

- witness's testimonies,

- information about the lack of funds from the debtor after the issuance of the receipt.

Attention! In itself, the argument that the lender does not have a sufficient amount of money is not a basis for recognizing the loan agreement as non-monetary (Appeal ruling of the Moscow Court dated July 22, 2019 in case No. 33-12511/2019).

But in case of bankruptcy of the debtor, the reality of issuing funds to close relatives and other affiliated persons, on the basis of a receipt, can be challenged by the financial manager or bankruptcy creditor as an imaginary transaction precisely on the basis of the above signs.

The courts also take into account such signs as the issuance of further loans in the conditions of non-repayment of previously issued amounts, the failure of the creditor to take measures to claim the loan amount. If the court determines that the note is fictitious, it will refuse to include the creditor’s claims in the register (resolution of the Moscow District Court of April 30, 2019 in case No. A40-243525/17).

People often turn to their friends, relatives, and colleagues for cash in order to avoid taking out a bank loan. As a rule, borrowers in such situations try to repay their debt on time and in full in order to maintain normal human relationships and not burden themselves with unnecessary legal and personal problems. However, not everyone succeeds and not always.

Then lenders have to one way or another return their money on a claim, through the court, the bailiff service, or even using the services of collection agencies.

In fact, there are a large number of options for civil transactions, the failure of which may result in receivables. But in practice, disputes about the collection of the loan amount against a receipt are especially common, since this is the most popular type of civil dispute about the collection of funds between individuals. People often borrow money from their loved ones and, unfortunately, are not always able to repay it on time or in full.

Rules for transferring documents

When there is a need to transfer important documents, the responsible party must first collect and prepare all the documentation. Only after the required package has been collected can you proceed to the stage of drawing up a receipt. After its preparation, the party that transfers the documentation must carefully read the text of the receipt.

If all the information entered is true, and the originator’s signature is similar to that in his general passport, the subject of the agreement can be transferred.

In turn, the recipient must check the list of documents received so that it matches what is indicated in the text of the receipt.

So, let's summarize the procedure:

- Collection of documentation.

- Drawing up a receipt.

- Familiarization with the text of the paper and the list of provided documentation.

- Signing the paper.

- Transfer of documentation.

Receipt: lawyer's comment

Commented by Alexey Nikolaevich Konovalov, deputy head of the YuriuS legal collegium, member of the Russian Lawyers Association, teacher at the Faculty of Law of Nizhny Novgorod State University.

N.I. Lobachevsky (Nizhny Novgorod) Loan agreements are drawn up much less frequently compared to simple receipts for a loan, but still, as a legal document they are considered more reliable.

The lender has the right to file a lawsuit to recover the loan amount from the borrower under the receipt or under the loan agreement from the very first day of the delay, i.e. when the borrower was late with the return of money and did not manage to return it within the period established by the receipt.

The lender has the right to demand the loan amount without interest, with legal interest or with contractual interest, if the accrual of such is provided for in the loan agreement. It is better for the claimant to act in 3 classic stages: oral negotiations, a written claim, and a statement of claim to the court.

Each subsequent stage should be used when actions within the previous one did not lead to any positive result.

In addition to collecting the loan amount itself, you can also demand recovery of losses or compensation for harm to health in your favor if such negative circumstances were caused by failure to repay the loan amount on time.

Loan collection against a receipt cannot be classified as a complex category of cases: rather, on the contrary, this type of civil law dispute is considered one of the simplest in legal practice.

As a rule, case materials consist of several documents. including a statement of claim, a receipt for payment of state duty, a loan agreement and a receipt for the issuance of the loan amount. However, even such a simple dispute requires strict adherence to established procedural rules so that problems do not arise at the stage of consideration of the case in court and when making a court decision.

conclusions

Before lending money, you need to select a suitable document to protect your rights as a lender. If the amount is small, then you can limit yourself to a receipt. In all other cases, an agreement should be drawn up. This could be a loan agreement. It must indicate the details of each party. This is your full name, registration address, passport details and place of birth. It is also necessary to agree on the amount of debt and the timing of its repayment. If there is an interest rate, then it is indicated in the contract. You can also prescribe the conditions for reducing it in case of early repayment of the debt.

The agreement must be drawn up in writing, and in case of significant amounts, it must be certified by a notary. Concluding a transaction with a notary protects both parties from groundless claims in the future.

Important! The fact of transfer of money is recorded using a receipt.

After affixing your signature, you should write a full transcript of your full name on each document.

If the collateral amount exceeds one million, then a loan agreement must be drawn up. After signing, the documents are submitted to Rosreestr for registration and an encumbrance is placed on the pledged property. Accordingly, until the date of full repayment, the borrower cannot sell or give away property without the consent of the lender.

If the debtor fulfills the terms of the transaction in bad faith and allows delays, the lender has the right to apply to a notary for a writ of execution. After putting down the appropriate mark, you can contact the bailiffs, bypassing the court.

As for the pledge agreement, if the terms are violated, the creditor can file a claim in court. By decision of the court, the property will be put up for auction, and the funds received will be transferred to the lender to pay off the debt.

According to the recommendation of many notaries, any debt should be formalized in the form of an agreement and preferably notarized. The receipt also has legal force, but it will be quite difficult to get your money back, having only this in hand.

Do I need to notarize the receipt?

Not necessary, but possible.

Here are the benefits of notarization:

- The notary can check the legality of the transaction as such

- Notarization more easily confirms the identity of the person who wrote the receipt.

- A receipt with notarization is more likely to be accepted by the court as evidence

But the services of a notary cost money, so they are not used so often.

I think in this case you need to focus on the seriousness of the transaction. If we are talking about a relatively large amount of money or important documents, certification is required. Otherwise, as desired.