Who needs it

Lending money to a relative or making an advance payment under an agreement - all these operations involve the transfer of funds from one person to another.

To avoid conflicts in the future, figure out how to write a receipt for receiving funds correctly, and use this knowledge in practice. This is not always necessary, but what if one of the parties refuses to fulfill its obligations? For example, a relative will brush you off with the words that he did not occupy anything. And the company will again demand an advance payment for future deliveries, omitting the fact of making an advance payment in cash. In such situations, you will have to prove your case through court, and this is long and expensive. It is much easier to worry about yourself in advance and draw up a supporting document. It is recommended to indicate on what terms the loan was issued (interest-free or with interest).

IMPORTANT!

If money is lent and if one of the parties (or both) is an organization, then preparing only a receipt for receipt of money is not enough. In such a situation, you will have to draw up a loan agreement (Articles 807-811 and 814 of the Civil Code of the Russian Federation).

Certification of a receipt by a notary

In fact, a receipt certified by a notary means the drawing up of a loan agreement that can be notarized. You will have to pay a fee for services. If the debtor refuses to repay the loan, the creditor does not need to go to court. It is enough to obtain a writ of execution from a notary. With this inscription you can go to the executive service. To protect yourself as much as possible from losing money, the lender can additionally draw up and notarize a pledge agreement for the debtor’s property.

Legal status of the document

It is easier to draw up the paper right on the spot, by hand - this is a simple form of receipt. If a serious transaction is being made and it is planned to transfer a fairly large amount, then it is recommended to carry out the procedure in the presence of a notary.

However, both documents are endowed with legal force: both a receipt signed by a notary and a form filled out manually by the parties. Of course, notarization increases the status of the paper. In simple words, if a dispute arises regarding the transfer of money, a notary will act as a witness to the circumstances.

When drawing up a simple written form in the event of a dispute, the authenticity of the document is confirmed by conducting a special examination. And this takes quite a lot of time. But notarization is not a requirement.

Cost of debt recovery services

It is recommended to return the money with the help of a law firm. If the debtor does not want to make contact and does not plan to give you the due amount, a lawsuit will most likely be required. Other methods rarely work.

Where and to whom will need to be paid as part of debt collection:

- Collection agency. If you use the services of debt collectors, you will have to share part of the collected debt on a receipt. In reality, such cooperation rarely occurs.

- Your legal representative. If you do not want to personally deal with this matter, you can involve a legal representative in the process - for example, a lawyer, and pay for his services.

- Lawyers. You can use their services one-time - for example, order only consultations or the preparation of an application; Or you can seek comprehensive legal support.

The calculation of the cost of collection is carried out personally, and depends on the amount of debt, the correctness of the debt receipt, the measures taken, the defense strategy and other factors.

Compilation rules

If you decide to complete the transaction through a notary, then you don’t need to worry about how to draw up this document. An employee of a notary office will independently prepare all the necessary papers, register the transaction in state accounting registers and issue special forms.

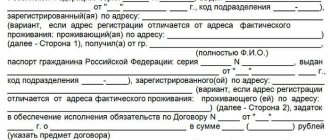

Questions arise when filling out the form yourself. It is permissible to use a receipt form, entering the necessary details and conditions into it, or draw up a document yourself.

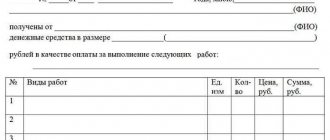

Instructions on how to correctly draw up a receipt for the transfer of money from one person to another:

1. Place and date. First of all, indicate the place and time of drawing up the document. The place is the locality in which the transfer of funds takes place, and the time is the date. For example, indicate: “Samara city 03/12/2020”.

2. Information about the parties to the transaction. Disclose the information one by one: first indicate the details of the person issuing banknotes, then write down the details of the recipient (see at the end of the article). What information to disclose depends on the status of the parties.

If one of the parties is an individual, then enter his full name in the receipt template. fully. Then write down your passport details or details of another document proving your identity. If the party is an individual entrepreneur, then add his TIN and OGRNIP to the details.

If the participant in the transaction is a legal entity, then indicate:

- last name, first name and patronymic of the head of the company;

- job title;

- full name of the legal entity;

- TIN, OGRN of the organization.

If the party is an authorized representative, enter:

- his last name, first name, patronymic;

- passport or other identification document details;

- date and number of the power of attorney;

- information about whose interests the representative is acting in.

3. Now write down how much you are transferring, indicate in what currency the transaction is being made. Indicate the amount not only in numbers, but also in words. Use this option to indicate the amount: 120,000 rubles (one hundred twenty thousand rubles 00 kopecks).

4. Include information about the grounds and obligations. Describe in detail the basis on which money is transferred from one party to the other. For example, transferring an amount into debt, receiving a loan from an employer. Also describe what obligations each party assumes when making a transaction: the borrower undertakes to repay the debt within ____ calendar months. In this case, specific dates and deadlines for return must be indicated.

5. Additional terms of the transaction (optional: used if necessary). Indicate the purpose for which the money is transferred: to buy a car or to pay for treatment. They provide for the amount of payment for the use of borrowed capital - this condition is not mandatory, but is often used. Specify: the borrower agrees to repay 100,000 rubles plus a use fee of 1,000 rubles.

They also determine the rules for the return of money or establish the procedure for offsetting the advance received. It will not be superfluous to describe the responsibilities of the parties and the procedure for resolving disputes.

The finished document is signed by the borrower - the recipient of the money. By this he personally assures that he received the money. The completed receipt in one copy is kept by the lender and is confirmation of the fact of transfer of banknotes or goods.

For variety, we present below possible methods of collection.

Peaceful solution to the issue

You go to the debtor and try to negotiate a return without going to court.

Let's imagine the situation. You gave a distant relative $20,000 against a receipt for home renovations. The return period is 2 years. Ok, 24 months are up, you wait, but nothing happens. A relative does not answer the phone, although you know where he works and where he lives.

You go to him and appeal to his conscience. He lowers his eyes to the floor and says something like “maybe I’ll give it back later, there’s no money now, his wife is pregnant, the cow is sick, the roof is leaking in the barn,” and so on.

There are two possible options:

- you are trying to get into a position and draw up an additional agreement under which he will return the money to you, say, in a year;

- you understand that no one is going to repay your debt voluntarily, and you are thinking about further actions.

In practice, additional expectations, agreements and attempts to resolve the issue peacefully do not bring results if the debtor a priori does not want to return the money. You will only lose time, your money and faith in people.

Submitting official claims

This is already a more effective method. If your debt is not returned within the stipulated time, you can file a formal claim and send it to the person’s place of residence.

The claim must:

- indicate legal norms for debt claims, referring to them;

- demand a refund;

- indicate further intentions - that you are going to forcibly recover the money through the court.

It is better to draw up a claim with lawyers and send it by registered mail. Be sure to keep the second copy with you and wait for the mail notification - it can be attached to the statement of claim as a supporting document.

If the debtor does not return the money after receiving an official complaint, you can prepare documents for the court.

Appeal to the court of first instance

Proceedings should begin if, within 30 days of receiving the claim, the debtor has not contacted you and has not repaid the debt.

You can contact:

- to the magistrate's court;

- to a court of general jurisdiction.

As a rule, they usually go to the magistrate's court - the case is considered in a shortened time, and the creditor receives a court order. The order has the force of a full court decision. It allows you to start enforcement proceedings and return the money on receipt through bailiffs.

Obtaining a notary's executor's inscription

The return method is used if the debt document was notarized.

All you need to do is contact a notary and submit a package of documents for verification. After a thorough analysis, the notary will issue a writ of execution, with which you can contact the bailiffs at the FSSP.

Contacting third parties to draw up an agreement for the assignment of the right of claim or enforcement

We are talking about collection agencies that professionally collect overdue debts.

Note that this method works 100% only in the bank-collector chain, where the sale of overdue loans is carried out in bulk. Collectors do not like to deal with private creditors.

Typically, cooperation with them is carried out on the following conditions:

- the creditor turns to the magistrate for an order to settle the debt - sometimes collectors make such demands in order to protect themselves;

- the percentage for services will be significantly higher than in the format of cooperation with banks. Collectors may demand at least 40-50% of the money collected from the debtor.

Seeking help from debt collectors will work if the debtor does not pay the money when given the opportunity. Simply put, dynamite in all available ways.

It is possible to collect money through the court using a promissory note

The creditor may initiate foreclosure proceedings based on the promissory note. It is advisable that all the circumstances of the debt registration be indicated there, and that notarization be present.

Examples in various situations

Here is the text of the receipt for receiving money when registering the purchase and sale of land or real estate.

| Receipt Saint Petersburg 01.03.2021 I, Sergeyev Sergey Ivanovich, born December 11, 1980, place of birth: Tyumen, passport series 1234, number 123456, issued by the Federal Migration Service of Tyumen on August 2, 2010, registered at the address: s. Serebryany Bor, Ivanovsky district, Tyumen region, no. 10, received from Ivan Petrovich Ivanov, born on March 19, 1963, place of birth: Kirov, passport series 4321, number 654321, issued by the Kirov police department on April 13, 2013, registered at the address: Kirov st. Stroiteley, 12, apt. 123, the amount of 500,000 (five hundred thousand) rubles for the land plot I sold, located at the address: s. Serebryany Bor, Ivanovsky district, Tyumen region, plot 4, area 8 acres, cadastral number 40:60:1234567:30-50; one-story log residential house with an area of 60 sq. m, cadastral number 40:60:1234567:30-50 and outbuildings - a bathhouse and a barn - according to the “Agreement for the sale and purchase of a land plot and a residential building” dated 10/01/2019, drawn up in simple written form. The calculation has been completed in full. I have no complaints against the buyer. Full name, signature |

A similar rule applies to transactions for the purchase of vehicles: an example of a receipt for receipt of funds under a car purchase and sale agreement.

| Receipt Saint Petersburg 10.03.2021 I, Sergeev Ivan Petrovich, registered at the address: Lomonosov city, Rechnaya street, 10, apt. 2, passport series 1234, No. 123456, issued by the Department of Internal Affairs of St. Petersburg on February 10, 2010, received from Ivan Sergeevich Petrov, registered at the address: Pushkin city, Sadovaya street, 25, apt. 15, passport series 4321, No. 65432, issued by the Pushkin police department on February 20, 2003, funds in the amount of 830,900.97 (eight hundred thirty thousand nine hundred rubles ninety-seven kopecks) for the sale of a Lada Samara car, VIN No. 1234567 OR43215СС12345, engine No. 1234СС654321, 2008, black, title 29 245 NR 123456789, under the purchase agreement sale concluded by the parties on March 10, 2020. The funds have been verified by me for authenticity and received in full. ___________________ /__________________/ March 10, 2021 |

One more example:

Why are witnesses needed?

Some lenders prudently enlist the support of witnesses when transferring money. They may be uninterested persons, information about whom is also required to be included in the receipt (their full name, passport details and address of residence).

With their signatures, they confirm the fact that the money was transferred exactly in the amount stated in the receipt and on the conditions indicated in it.

In fact, in some way the witnesses perform the function of a notary.