You've been wanting to buy a garage for a long time and finally found the right one. However, from the moment of choosing a property to the moment of obtaining ownership rights, a financial question often arises.

For various reasons, the buyer does not always have the entire amount of money that is required. Of course, you can make a purchase by borrowing the missing money at interest from the bank. However, it may take 10 days to submit documents to receive a loan, during which the owner can sell the garage to someone else who has the required amount.

You can “stake out” an object you like in the following ways:

Receipt for prepayment

Most transactions are based on prepayment. After completing all the necessary documents required by law to secure ownership rights, the money is transferred in full to the seller and the treasured property is at the disposal of the buyer. In this case, the new garage owner already has the full amount of his own or borrowed money to complete the transaction. This type of payment must be documented by receipt.

When writing a receipt, you must adhere to the general requirements:

- The document is written by hand;

- Contains full name and passport data of the seller and buyer;

- The money transferred must be recorded in numbers with the explanation in brackets;

- Contain all information about the purchased object;

- The owner must put his signature with a transcript;

- If possible, witnesses are invited. It is worth checking first whether they are relatives of the owner of your future garage.

Registration procedure (with sample)

It is best to draw up a sample in advance, before concluding a transaction, and agree on the text with the other party.

The receipt is issued by hand. There is no single drafting standard. However, there is a list of items that must be specified:

- Name (Receipt) and date of preparation in DD/MM/YYYY format.

- Detailed information about the buyer and seller: Full name, passport details with registration.

- Subject of the transaction: location and number of the garage, its area, which garage cooperative it belongs to.

- Number and date of the agreement under which the owner carries out the transaction (for the garage under agreement No. 11111 dated 01/01/2018).

- Confirmation of the fact of transfer of money indicating the amount in words and figures. Separately, it should be noted that the seller has no claims regarding the transfer.

- Certification of the receipt with the signatures of the seller and two witnesses indicating the full name, passport number and registration data.

The document is given by the seller in exchange for money. If the parties do not trust each other, it is better to use the services of a notary.

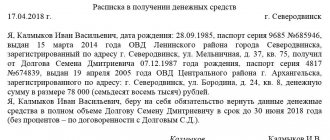

Sample of drawing up a receipt

Certification of a document by a notary

To certify the receipt of money from a notary, the personal presence of the seller and buyer with the purchase and sale agreement and passports is necessary . The lawyer will record the transfer of money and note in the journal the fact of provision of the service, insuring against possible loss or problems with forgery.

As an advance payment

As an alternative to full prepayment, you can consider an advance payment.

An advance is the transfer to the seller of an agreed portion of the funds for the purchased object, but not yet assigned to the new owner by the purchase and sale agreement.

This option for transferring money can be recorded either in writing or by oral agreement. However, remember that the advance payment does not guarantee the completion of the transaction, although it is subject to return if the parties do not comply with the terms of the agreement.

How do you prepare a receipt for purchasing finance for a garage?

The receipt is drawn up in free form, but only manually. The paper is needed, first of all, by the purchaser and protects his interests; taking this into account, he is obliged to make sure that all positions of the receipt are written correctly. In order for the receipt to have legal force and, if necessary, to be an argument in court, it must be approved by a notary or the signatures of 2 witnesses confirming their passport information and registration.

After approval of the purchase and sale contract, where the price of the garage is written, a receipt is created. It also indicates the price and period of payment, and its form. The following information must be written on the receipt:

- Name of paper – receipt;

- The number when she's with

created; - Full name of the seller, all his passport information, including registration;

- The same information about the acquirer;

- Approval of the acquisition of finance from the acquirer;

- The cost is indicated both in numbers and letters;

- Object, its number, name of the cooperative, area and location;

- Number and number of the sales contract;

- There are no claims against the purchaser for payment.

Confirmed by signatures of participants, witnesses with confirmation of their passport information. Then the receipt is given to the purchaser and added to the contract.

For various reasons, the buyer does not always have all the finances that will be needed. Of course, it is possible to complete the purchase by borrowing funds that are not enough for interest at a banking institution.

But submitting papers to purchase a loan may require 10 days, during which the owner is able to sell the property to anyone else who has the necessary finances.

Most transactions are mainly based on advance payment. After all the necessary papers required by law to approve property rights have been completed, the entire finances are given to the seller and the desired premises become the property of the purchaser. In this situation, the other garage owner already has the entire amount of his own or borrowed finances to complete the transaction. This type of transaction is provided with appropriate documentation.

When creating a receipt, you need to take into account the following requirements:

- The paper is written with one's own hand;

- Includes full name and information from the passports of both parties;

- The transferred finances must be recorded in a numerical form with decryption;

- Include complete information about the item received;

- The owner is required to write his own signature with a decryption;

- Whenever possible, witnesses are invited. It is necessary to find out in advance whether they are relatives of the owner of the garage in question.

In the form of a deposit

A deposit is also one of the types of advance payment. The difference is that this is only a portion of the total amount of the agreement. Unlike an advance, a deposit imposes certain obligations on the participating parties, which are discussed in the advance agreement and sealed with a receipt. You need to know that if the terms of the agreement secured by the deposit are violated, the seller returns double the rate (if the terms of the agreement were violated by the buyer, the money cannot be returned).

The law does not provide for strict regulations on the transfer of funds; the transfer can be recorded in free form, even without notarizing the document.

But no matter what payment option you decide to use when making a purchase or sale in the end, it will be better to prepare in advance and use a sample receipt for receipt of funds. The form already has mandatory fields to fill out, which will simplify the procedure for returning the prepayment in the event of termination of agreements.

Extract from the Unified State Register of Real Estate

An extract from the Unified State Register of Real Estate is proof of ownership of the property. A certificate of registration of rights is a conditional document that requires confirmation. Before transferring the deposit or drawing up a receipt, you must verify the rights of the owners. A fresh extract from the Unified State Register of Real Estate will allow you to clarify information about the owners of real estate, the absence of encumbrances, and arrests. You can order an extract online via the Internet. The price of the service is 250 rubles. At the same time, you should not trust the electronic statement provided by the buyer, since it is possible to edit the data and enter false information.

What's better? Receipt or loan agreement?

What the documents have in common is that they are both aimed at establishing legal relations between the lender and the borrower of funds. Both papers are provided for by law, namely the Civil Code of the Russian Federation (from the eight hundred seventh article to the eight hundred fourteenth).

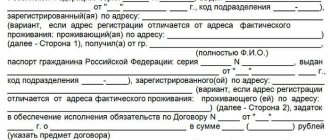

The loan agreement for the purchase of land will have the following structure:

- date of conclusion;

- place of detention;

- Full name of the borrower and lender;

- passport details of both parties (year of birth, when issued, who registered?);

- subject of the concluded agreement;

- rights and obligations of both parties;

- bearing responsibility;

- deadlines;

- procedure for resolving conflicts;

- signatures and details of both parties.

An agreement is a more complex procedure; it is signed by both parties who entered into it. A receipt is a simple document that is signed only by the person who borrowed money for the transaction.

The structure of a receipt for receiving funds, unlike a contract, is quite simple. It must indicate the date, full name of the borrower, full name of the lender, for how long the funds were received, in what quantity, as well as the date of return of the money.

Writing a receipt for the purchase of finance for a garage

When selling premises, there are often situations when a receipt for receipt of finance for the premises is one piece of paper approving the execution of the procedure. And when the seller is not very honest, difficulties cannot be avoided. At the legislative level, what is called a receipt and its intended purpose is not explained in detail. Nevertheless, the Civil Code provides for a standard on the basis of which the lender must provide paper confirming the fulfillment of the obligation at the request of the borrower (Article 408). A receipt for the purchase of finances for the premises will be proof of the same fact - the transfer of finances to a specific person, when, of course, it was created correctly. Legislation and legal practice consider a receipt when purchasing premises or performing other procedures to be a suitable argument for the fact that the seller has acquired finance for the premises.

The main thing you need to concentrate on when purchasing premises is that the garage is real estate, and a receipt for the purchase of finance will not become the basis for changing the registration of property rights. In this situation, the seller’s receipt for the purchase of the premises or a receipt for the purchase of the deposit will approve the transfer of money for registering the transaction. By purchasing a receipt, the purchaser will have the opportunity to confirm the transfer of money. To re-register property rights to real estate from one to another, you need to draw up a sales contract in writing, and the paper on the acquisition of finance for the premises will become a necessary addition to the contract. At the same time, the property right to the premises will pass to the next owner only as a result of state registration, which is carried out on the basis of the law on state registration of rights to premises and operations with them. The state registration office requires a sales contract, which will include all significant circumstances, and is created under the terms of civil laws. That is, the contract must include the following information: about the participants, the subject, the cost of the contract, time, and so on. In addition to the contract, it is also necessary to create and approve an act of acceptance and transfer of the item, where you need to write about its condition, acceptance and transfer of the item.

Competent design

A sample receipt for purchasing finance for a garage can be easily found on the Internet. But it would be better not to use any template; its form, be that as it may, must meet these conditions. First of all, it is necessary to take into account that the purchaser must fill out the receipt for the purchase of finance for the premises, the template of which was prepared earlier, with his own hand, otherwise, it is very difficult to justify the execution of the document based on the signature alone.

The more detailed the information contained in the document on the transfer of money, the more confidently it will protect the interests of its owner.

So, the receipt must include the following information:

- name of paper;

- the most extensive data about the purchaser of funds (full name, physical location, passport information, details of other supporting documents);

- the most extensive data on who donated the funds (full name, physical location, passport information, details of other supporting documents);

- in any case, information about why (what purposes) the funds are given. For example, transfer of rights to property or acquisition of real estate and so on. It is necessary to define as clearly as possible the object that will be purchased (description, physical location, number, etc.);

- the most important details: number and signature (next to the signature of the name of the person who signed).

To summarize, it is necessary to realize that the main document approving the operation is the contract. Even in normal circumstances, for example, when lending money, legal experts advise registering the transaction using a written contract, with the most detailed discussion of the circumstances. It is also necessary to take into account that each document can be registered with a notary, which will certify the transaction. In addition, if the registration process requires special skills, do not try to do everything yourself; it is better to contact an expert.

Receipt text

The text of the paper must contain a number of points that are necessary for the document to have legal force. If detailed information is not provided, the document is considered invalid.

Receipt items include:

- The amount is agreed upon by the seller and the buyer. Written in numbers and words.

- Buyer - his full passport details.

- Seller - passport details.

- Clause regarding receipt of funds with date and time.

- A detailed clause on the terms of a purchase and sale transaction when transferring an advance on a security.

- Dates and signatures.

- Signatures of witnesses.

It is important to indicate in detail the subject of the contract being concluded. Here you need full details of the real estate and its cadastral number with the number of the certificate of registration of ownership.

Sample receipt for deposit

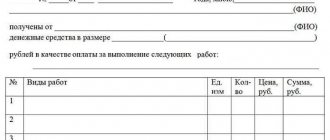

How to create a receipt for the purchase of finance for a garage under a sales contract?

The price is written in the sales contract, which the parties are required to execute upon sale.

In addition to the cost, they also indicate the method of payment of finances and the payment period.

When purchasing finance from a buyer, the seller creates a receipt in which the following information must be displayed:

- name of paper;

- number;

- Full name of the author of the receipt, information from the passport;

- similar data about the buyer;

- approval of the acquisition of finance;

- purchased money is written in numerical and text form;

- the object for which the finances were taken - the number of the premises, its physical location, the name of the cooperative, the area;

- number and number of the sales contract, according to which the premises are sold;

- there are no complaints to the buyer in terms of payment.

The receipt drawn up by the seller is approved, after which it is sent to witnesses for signature and confirmation of data on the papers confirming their identity.

The receipt is given to the recipient and added to the sales contract.