Drawing up a receipt for receipt of funds in a situation where the financial asset was actually transferred is a very important circumstance that can protect both parties to the transaction. The operation of transferring money from one person to another is almost always accompanied by the document in question. It is usually drawn up by individuals, but this does not mean that a receipt cannot be written if a monetary debt has arisen between organizations (such as microcredit companies) and individuals. In 2022, new conditions for drawing up the document in question will come into force, which you must familiarize yourself with before drawing up the correct sample.

If there is no receipt, it is dangerous to lend money. Without the document in question, there is much less chance of proving that the funds were transferred to another person as a loan, and were not, for example, a gift. But when there is a receipt, you can lend money. You just need to correctly compose the document in question without missing important information.

What is a receipt and why document it?

A receipt is a document whose purpose is to record the fact of a transaction to provide funds from one party to another. With the condition that the funds in question are loaned and must be returned by a certain point. The document may also indicate other conditions for transferring money, not as a loan, but on other grounds.

It is not always possible to draw up a document as a means of repaying a debt. Typically, a receipt is required if the monetary debt is over a thousand rubles. It is in the paper in question that it is necessary to indicate exactly what amount is transferred from one party to the other. The receipt also indicates the conditions under which the monetary debt is formed, that is, when the funds must be repaid.

This document is necessary if disagreements arise between the parties regarding the timing of repayment and the amount of the debt. To resolve the conflict correctly, it is enough to read the contents of the paper. If you cannot resolve the disagreement on your own, you can go to court with a receipt, which will carefully study the document and, on its basis, find a solution to the conflict situation.

Sometimes you can do without drawing up a receipt, since the document in question is optional . But still, for your own safety, if you have to go to court to get your money back, having such a document significantly speeds up and simplifies the procedure. If there is no receipt, it is very difficult to officially prove the fact of the debt, as well as its size and terms of the agreement.

If the debt is small and there is confidence in the integrity of both parties, the receipt can be drawn up using a simplified template. But if there is any doubt that the transfer of funds has been completed, the document certifying the receipt of money should be additionally supported by the services of a notary and the testimony of witnesses. This is especially true for situations where the transferred amount of money is large.

Regulatory regulation of receipts for receipt of funds

A receipt for the transfer of money is drawn up on the basis of clause 2, art. 808 of the Civil Code of the Russian Federation. It is on the basis of the clause in question in the law that the fact of transfer of money must be confirmed. But there are also several regional documents that regulate the aspect of monetary relations under consideration, which practically do not regulate in any way the form in which the mortgage should be drawn up. In court, almost any form of document containing basic information about the amount and conditions of its transfer, as well as the signatures of the participants in the transaction, was recognized as legal.

In some situations, drawing up a document is not enough - the fact that the transfer and receipt of money were successful must be notarized. The legislation specifies what kind of cases we are talking about. In order to clarify the point in question, the only effective remedy is to seek help from paragraph 2 of Art. 163 Civil Code of the Russian Federation. But you need to take into account that the notary certifies not just a receipt, but a full-fledged loan agreement. The receipt comes with it as an attachment, but is not the main confirmation of the fact of transfer of funds. If there is a mutual agreement between the parties, you can do without the services of a notary regarding the transfer and receipt of money.

How to correctly fill out a receipt for receiving money for a car?

According to the rules of registration, the text of the receipt is completely written in the seller’s own handwriting. This is necessary in controversial situations when it comes to court.

The method of notarizing the receipt is also reliable. An employee of the notary office will correctly draw up the necessary document, the recipient of the money will sign in front of the notary, and he will certify and put his stamp.

A regular receipt is certified only by the personal signature of the recipient of the money. It is compiled in one copy only for the one who transferred them (the buyer of the car). If desired, you can write two copies, one of which will remain with the seller.

What is the difference between a promissory note and a cash note?

People who lend money often confuse the concepts of promissory note and cash receipt. But according to the law, the concepts under consideration have equivalent meaning. Although it should be noted that they may differ slightly - much depends on the circumstances under which the money was received and transferred. Therefore, it is necessary to consider everything in more detail.

For example, a receipt may indicate a situation in which funds were simply transferred from one person to another without having to be repaid. Also, a cash receipt may indicate that the money was transferred precisely as repayment of a debt. In this case, the borrower confirms that the funds have been returned and he has no claims against the debtor. As for the promissory note, it may not only be of a monetary nature, but may indicate the transfer of some other value.

To make the definition more accurate, let’s summarize what a cash and promissory note is:

A promissory note is a paper that confirms the very fact of the debt and is an addition to the loan agreement. According to the terms of this document, you can lend not only money, but real estate, securities, and various things.

A cash receipt is a document whose purpose is to transfer money. Moreover, the funds can be transferred both as a loan and as a return (this circumstance simply needs to be stated in the document).

Based on all of the above, a promissory note is an ideal document to confirm a loan, while a cash receipt can be useful to correctly confirm the transfer of funds, but not necessarily a loan.

What types of receipts exist?

The money issue is always quite acute, especially when it comes to transferring large sums from person to person. A receipt is precisely the type of document that is used in this case. But given the specifics of the topic, the receipt does not have any special types. However, for ease of use of the tool in question, it was decided to divide it into the following several types:

- substantive, which describes the purposes for which the money was provided;

- pointless, which is compiled without taking into account the purposes of the loan.

But many other circumstances may influence the receipt of a specific type of document. For example, will the document in question be drawn up by a notary, put his signature on it, certifying the receipt. It is also important to consider how the document is compiled - by hand or printed. For example, you can draw up a receipt for your salary by hand.

A receipt for receipt of money may be drawn up. This document is drawn up to confirm that funds have been received. For example, if an employee is given an advance or paid in full for a service when receiving a salary or scholarship. But a receipt must also be drawn up if you receive a loan from a microfinance organization or other similar organizations. In addition, the document in question will be very useful if the financially responsible person has to issue employees with some valuable equipment, etc.

Contents of the receipt

In accordance with civil law, the receipt must contain the following information:

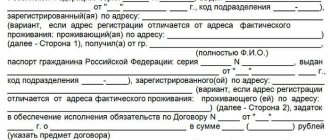

- details of the parties to the car purchase and sale transaction (full name, passport details). If one of the parties is represented by an authorized person, then his details are indicated, as well as information about the notarized power of attorney and the authority to receive funds;

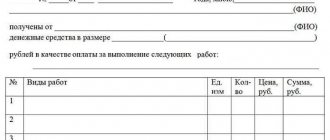

- the amount of money received in figures and words;

- the purpose of the cash transfer and information about the purchase and sale agreement;

- date of document preparation;

- handwritten signature of the recipient of the funds (car seller).

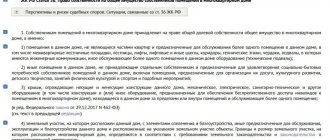

Rules for drawing up a receipt

You can write a receipt for a monetary debt by hand and on plain paper - there are no strict requirements for drawing up the document. Of course, a document can be printed, but it is believed that a written document has more legal force, since in a controversial situation, a graphological or handwriting examination can be carried out to prove its authenticity. But the printed text, no matter how hard you want, cannot be studied.

In this case, the document must contain mandatory information. For example, you should enter the date and place of drawing up of the receipt, who draws it up and who is the other party, indicating passport details, addresses and other identifying data.

Considering that the receipt implies a cash payment, the amount must be indicated. And not only in digital equivalent, but in words. In cases where money is transferred in foreign currency, you should indicate the exchange rate at the time of transfer of money and clarify whether the amount of the debt will change if the rate begins to fluctuate in one direction or another. It is advisable to indicate whether interest is accrued for the period while the financial instrument is used.

The document should also clarify the terms and method of refund. For example, will they be returned in cash or transferred to a card, the full amount or several payments. If you plan to repay the money in installments, you should draw up a payment schedule in order to track delays, if any, and take action in a timely manner.

Receipt for receipt of money for a car - what is it for?

The purchase and sale transaction of a vehicle must be formalized by an agreement. It specifies all aspects of the transfer of property and funds. The parties have the right to agree on any payment method, including cash.

The receipt of the amount from the buyer can be recorded in the text of the contract or a separate document – a receipt – can be drawn up. It is not mandatory, but it will establish the fact that the seller received the money and in what quantity.

Cash payments are considered the most vulnerable in legal terms. Therefore, it is often recommended to confirm the transfer of the amount with a receipt. It does not matter whether you pay in full in cash or only partially. It is better to draw up the document immediately at the time of transfer of money.

It is recommended to draw up a receipt in the following cases:

- making a portion of the amount under the contract as an advance payment;

- when selling through a proxy (the power of attorney must contain a clause stating that the owner instructs him to receive funds);

- The amount indicated in the contract is less. This option is often used by resellers. If for any reason you have to terminate the deal, you will be able to prove that you actually transferred more money than stated in the contract.

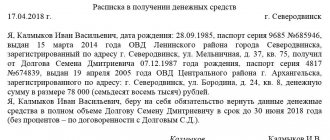

Sample receipt for receipt of funds

To correctly draw up a document about funds received, you will probably need a sample receipt for receiving money. The example under consideration shows the structure of the document, helps determine what information needs to be indicated, and whether details are needed. Usually, to correctly draw up a document, nothing other than a sample receipt for receiving money is required.

Having a receipt is an effective means of providing peace of mind to both parties to the transaction, as it protects their interests both when a debt arises and when it is closed. A receipt for receipt of money can be drawn up in one copy in order to subsequently be handed over to the person giving the money.

The correct document is filled out and certified according to the general rules, but can be written in free form. It is mandatory to indicate on paper all the necessary details and the most detailed information about the fact of the transfer of money, who provides the monetary debt and who receives it. For ease of filling out, you can use the following form as a correct sample that will help you avoid mistakes.

How to draw up a receipt for receipt of money under a purchase and sale agreement?

Lawyer Antonov A.P.

The receipt for receipt of money under a purchase and sale agreement contains information about the seller and buyer, the agreement, the amount of money received by the seller and the date of receipt, as well as information about the representative, if any. If the parties to the purchase and sale agreement have determined the method of payment in cash, then in order to confirm the receipt and transfer of money by the seller, a receipt can be drawn up. For example, a receipt is used for cash payments between individuals under a contract for the sale of real estate (apartment) or a contract for the sale of a vehicle. In such a receipt, it is recommended to indicate the following information (Articles 161, 185, 185.1, 317, 408, paragraph 1, Article 424, paragraphs 1, 2, Article 434, paragraph 1, Article 454, paragraph 1 Article 485 of the Civil Code of the Russian Federation): 1) data of the parties to the purchase and sale agreement: full name, place of birth, passport details or other identification document. If a representative acts under a power of attorney on behalf of any of the parties when receiving funds, then his surname, first name, patronymic, place of birth, passport details or details of another identification document, as well as details of a duly executed power of attorney should be indicated. In addition, it is necessary to make sure that the specified power of attorney provides the authority to receive funds under the purchase and sale agreement; 2) the amount of funds transferred, which should be indicated in numbers and in words. The amount is indicated in rubles or in the ruble equivalent of an amount determined in foreign currency or in conventional monetary units; 3) the purpose of payment of funds and information about the purchase and sale agreement; 4) an indication that the seller has no claims against the buyer for payment of the contract price, if payment under the sale and purchase agreement is formalized in full by a receipt; 5) date of preparation of the document. The receipt must be signed. To avoid subsequent risks of challenging the signature on the receipt by interested parties, the receipt can be drawn up by writing its entire text by the seller or his representative (recipient of funds) in his own hand.

Sincerely, lawyer Anatoly Antonov, managing partner of the law firm Antonov and Partners.

Still have questions for your lawyer?

Ask them right now here, or call us by phone in Moscow +7 (499) 288-34-32 or in Samara +7 (846) 212-99-71 (24 hours a day), or come to our office for a consultation (by pre-registration)!

Errors when drawing up a document

Even if you have the correct format for a sample receipt for the receipt or transfer of funds, mistakes still happen. Therefore, let's look at situations that should be avoided if you want to be sure that there will be no problems.

The most common mistake is not to individualize the person who received the monetary debt. Typically, such a mistake occurs if the receipt is made by relatives or close people who believe that this is nothing more than a formality. Moreover, the name may be indicated, but there is no passport information that more accurately identifies the person.

Also, errors often concern inaccurate designation of the loan amount, interest is not taken into account, etc. As a result, when the deadline comes, the amount received may be much less than agreed upon. If the money was lent, but the borrower did not receive a receipt for the funds, the debtor can say that there really was a receipt for the loan, but the money was not transferred to him. This will make it more difficult to prove the existence of a debt. Exactly the same situation arises if the debtor returned the money, but the other party did not sign a receipt confirming receipt of the money. Unscrupulous persons may demand the debt again.

If the document does not indicate the deadlines for the transfer of money, or is stated vaguely, demands to repay the debt may be refused. Moreover, it will be completely justified. It is also advisable to indicate in the document that the money is transferred specifically as a loan, and is not payment for some service, therefore it must be returned.

When the conditions for early return of money, delays and other force majeure situations are not specified, the unscrupulous party to the transaction can turn this to their advantage. For example, the debtor will avoid meeting with the borrower so that he does not present him with a demand to repay the debt ahead of schedule.

Not a mistake, but a reason to secure a document with a notary is the case when a cash receipt is drawn up on a computer and not written by hand. The form of the document in question can be challenged, especially if the debtor actually received the money and wants to delay the time frame for its return. And if the document is written by hand, it can also be challenged. The reason for this is errors and corrections in the text.