According to a recent survey conducted by Kommersant, almost half of Russians (49%) are against borrowing money. The reason is obvious: often debtors are in no hurry to return the money given to them on their word of honor or completely refuse to fulfill their financial obligations. A quarter of respondents (25%) “wait patiently and tactfully remind” them of the debt, and as a result, only 8% of survey participants receive their funds back on time. These data are confirmed by a study by the portal Superjob.ru: 39% of respondents never lend money to anyone.

It turns out that the decision to lend money to someone almost inevitably leads to their loss. However, if you look closely, it will become clear that such “inevitability” is rather the result of a lack of legal knowledge among our compatriots. How to lend correctly and not lose money?

Decide on the form

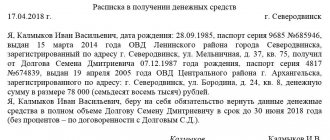

According to the law, any transactions between citizens exceeding the amount of 10,000 rubles must be formalized in writing. At the same time, many are accustomed to making do with a free-form receipt. However, you need to remember that a receipt does not provide any guarantees; its main purpose is to record the fact of transfer of money. Repaying a debt through court based on such a document is extremely problematic. Therefore, you can limit yourself to a receipt only if the loan amount is insignificant and you are morally ready to accept the loss of this money. However, even in this case, a few simple rules should be followed.

- The receipt is handwritten personally by the person you are lending money to. If the case goes to court, the borrower may deny the existence of the debt or say that he did not write the receipt and that the signature was forged.

- The receipt indicates the passport details of the debtor and creditor, the loan amount, as well as the date of transfer of money. Some people mistakenly think that the receipt can indicate other nuances, such as refund conditions or the amount of the penalty. Such clarifications are permissible only in a full-fledged loan agreement.

- The borrower must confirm receipt of the money by signing. The amount can be transferred in person, but it is better to make a bank transfer: this way you will additionally record the fact of transfer of money.

In all other cases, it is better to contact a notary and draw up a full-fledged loan agreement.

How to give and borrow correctly: instructions from lawyers

How to draw up a loan agreement so that you can later collect the debt without going to court? What is the difference between a loan agreement and a receipt? What must be indicated in it so as not to lose the opportunity to return the money forcibly? What will prove the transfer of the loan amount if it was transferred to a bank account? Lawyers answered this and other questions.

As for loans, the first and main rule is not to test people’s integrity, says lawyer Dmitry Shniger . He advises not to give money without registration and not to provoke the borrower to do bad things that he might not have done if he had signed the paper. Unrepaid loans on parole often destroy family and friendly relationships, warns the lawyer.

This is part of the material about loans. Read the full text here:

Everything you wanted to know about loans: 10 transaction risks and changes in the Civil Code

The best option is an agreement, but a receipt can become a source of problems when collecting a debt. It is a one-sided document in which the borrower confirms that he has received the debt and undertakes to repay it. This, in fact, is not an agreement, but evidence of the conclusion of an agreement, which is very weak if the money was transferred in cash and the receipt was not notarized, says Schniger. As the lawyer warns, the borrower must write that the amount was transferred as a loan. If he does not indicate this - either through an oversight or intentionally - then it will not be clear from the receipt where the debt arose: for example, it could be a payment for some service, says Schniger. It will be very difficult to receive money from such paper later.

If you spell out all the agreements in detail in the agreement, this will make debt repayment easier. Lawyers explained what must be taken into account.

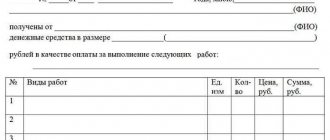

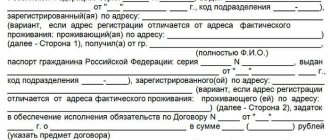

Basic data of both parties (full name, date and place of birth, full passport data, address of permanent registration and/or temporary registration). This will help the bailiff find the debtor using databases, seize his property, and block travel abroad, says , a lawyer at the legal department of Heads Consulting .

Return period and method (cash or non-cash, immediately or in parts).

It is necessary to confirm that the money has been handed over - in the text of the agreement (“Amount transferred”) or with a separate receipt that contains a link to the agreement. It begins to operate only from the moment the funds are transferred. Baskakova says that it can be certified by the signatures of witnesses, and advises checking so that the amount in the contract matches the one received in hand.

If funds are transferred to a bank account, Schniger advises indicating the purpose of the payment: “Issuing a loan under an agreement with such and such,” and keeping a copy of the payment order. “If you do not specify the purpose of the payment, then it will be impossible to determine the transferred amount as a loan,” warns Schniger. He adds that a payment slip is not reliable evidence of a loan, unlike a receipt, because it comes from the lender.

Repayment of the debt can be secured by pledging property or a surety. If money is returned in parts, this must be documented in as much detail as possible, indicating the name, date, amount, currency, advises Baskakova.

Schniger suggests notarizing the agreement, and issuing the receipt as a separate document, as is customary with notaries. A certified agreement and a receipt in case of non-payment will make it easy to issue a writ of execution from a notary in order to collect the debt from a bank or through bailiffs - without litigation.

If the parties decide to do without a notary, it is better for the borrower to write the entire receipt by hand rather than simply sign the printed text. This will provide more material for a handwriting examination if the borrower declares in court that he did not take or sign anything.

- Courts and judges

- Conclusion of an agreement

When is a prescription examination needed?

An examination to determine how long ago documents were produced is carried out as part of a forensic technical examination of document materials.

An examination of the prescription of details is prescribed when necessary:

- establish the fact that the date and time of the actual signing of the document or the entry of individual details does not correspond to the date and time of preparation specified in the document;

- determine the absolute or relative time of execution of the document and its parts;

- establish the fact that a document was executed or certain details were entered in a specific period of time;

- determine whether changes have been made to the details by adding notes or drawings after drawing up and signing the document

To establish how long ago documents were produced, the expert is guided by scientific data. He chooses the methodology at his own discretion. There are several patented methods, including the “Methodology for determining how long ago details were completed in documents based on the relative content of volatile solvents in strokes” developed by the Ministry of Justice, authored by E.A. Trosman, G.S. Bezhanishvili, N.A. Batygina, N. Arkhangelskaya. M., Yurovoy R.A.

When should a limitation examination not be carried out?

The physical and chemical research method (the Ministry of Justice recommends the gas-liquid chromatography method), based on the presence of “volatile substances” in the ink (paste) of pens that evaporate at a certain speed, has a number of limitations:

- Suitable for documents stored at a temperature of 20-25 C, at a humidity of 30-60%, in the absence of a light source (in a stack of documents, in a closet).

- Suitable for documents actually produced (according to various sources) 1.5–3 years before the examination, maximum.

- Suitable for documents, the details of which are made with both a ballpoint and a gel (capillary) pen (that is, ink). However, according to clause 6.1 of the Methodology, details written in ink (for example, for gel pens) are unsuitable for research only when the document is two years old or more.

- It is not suitable if the document has been subjected to aggressive, usually temperature, effects (from cases often encountered in practice: to speed up the disappearance of “volatile substances”, documents are ironed with a rag, dried on a radiator, placed under a table lamp, and so on).

- It assumes the destruction of a document (from cases often encountered in practice: attackers cut out strokes that can be analyzed).

How to write a receipt correctly so that it is valid in court

Most handwritten receipts are financial in nature. For example, a domestic situation when a friend or relative borrowed a large sum of money for a certain period of time.

In order for a simple piece of paper to turn into a document and be evidence in court, you need to know some rules:

- The receipt is written in the presence of both parties.

- It should be drawn up in legible handwriting by the person who borrows money or uses any service, and not by the person who provides any benefit.

- If a citizen refuses to fulfill his obligations, through a handwriting examination in court it is possible to identify the person who wrote this document.

- Unaware citizens prefer to print out a receipt because they believe that a handwritten receipt does not have any obligations. This is a misconception; moreover, when going to court, difficulties may arise in the process of identifying the person who wrote this document.

- The computer-printed form can be used for notarization.

When using a handwritten document, it will be more profitable if the debtor draws it up with his own hand.

Legal advice

- When drawing up a receipt, you should clarify whether the subject of the agreement can not be certified by a notary office. Compliance with all the recommendations specified in this article guarantees that if the debtor does not repay the debt or provide services, then they can be demanded through the court. You can get free advice on how to correctly draw up an agreement of this type on the Internet, in the public domain.

- As a creditor, you must keep the receipt until the debt is fully repaid. It should be remembered that there is a statute of limitations of three years. Therefore, if the debtor does not try to repay the debt, then there is no need to delay going to court. It can be quite difficult to restore your rights after the statute of limitations has expired.

- We should not forget that even with a simple form of receipt it is possible to demand not only the principal amount of the debt, but also a fine from the debtor for late payment.

- If the debtor violated his obligations or did not fulfill the terms of the agreement, then the creditor must write a letter to the debtor. In this letter, you need to demand from the debtor the entire amount of the debt and indicate the date of repayment - usually this is a thirty-day period. It is better to send this document by registered mail so that there is confirmation of receipt.

- If the debtor ignored this message, then the next step would be to go to court, to a magistrate. It is necessary to write an application in which you need to demand to collect the debt from the debtor, attach a receipt and a document confirming payment of the state fee.

- The presence of both parties to the transaction in court is not mandatory. A court order can also be granted in the absence of the debtor. After a decision is made according to which he is obliged to pay the debt, the documents are handed over to the bailiffs. They, in turn, are required to make appropriate inquiries to find out the availability of real estate, information about earnings, information about bank accounts - everything that can be used to compensate for official obligations.

Video on the topic:

What is a receipt?

A receipt is an agreement, confirmed by the signature of a person, which certifies on paper that this person has received a sum of money, securities, things from another person and guarantees to return them. The moment of delivery of money or other things from one person to another is certified only by documents.

A receipt is the most common form confirming the transfer of something from one person to another. A receipt drawn up according to special rules and certified by a notary can confirm the fact of the transfer of a sum of money, material assets, securities, but in a number of cases it is not considered a full basis for their return.

What is an examination of the prescription of a document?

An examination of the prescription of a document is a type of forensic technical examination. It can be carried out both in relation to the document as a whole (“absolute prescription”, for example, to determine whether the actual date of production of the receipt corresponds to the date indicated on it), and to determine which part of the document was completed before the other (“relative prescription”, for example, what was written earlier - the text of the receipt or the signature under it).

A prescription examination is a complex study. Before the examination is carried out using physical and chemical methods (for example, using special equipment - a gas chromatograph), the expert conducts a technical examination of the document to determine the presence or absence of signs of aggressive influence.

Experts must have the following professional competencies: special knowledge in the field of forensic technical examination of a document, as well as have a specialized (basic) special physical and chemical education with knowledge of gas chromatograph operating techniques.

What is the maximum limitation period that experts can establish?

Examination of the prescription of documents is a technically complex procedure, however, even the modern level of development of science does not allow us to establish the prescription of a document with an accuracy of one day.

In expert practice, the maximum accuracy of determining a date is six months, and for relatively “recent” documents.

The expert can draw one of the following conclusions that the document has been drawn up:

- less than six months ago,

- in the period from six months to a year ago,

- between one and two years ago,

- between two and three years ago; more than three years ago.

What questions are asked to experts?

1. Does the date on the document correspond to the period of its preparation? (the expert examines all the details of the document)

2. Have any changes been made to the original content of the document under study?

3. What is the limitation period for making changes to the original content: additions, additional drawings, reprints in the document?

4. Was the document signed during the period when the document was drawn up or at another time?

5. In what chronological order were the details placed on the document?

6. What is the limitation period for affixing a seal on paper?

7. Do the handwritten parts have different periods of writing?

8. Are there any signs of aggressive thermal, light or chemical effects on the document details?