Article updated: December 24, 2021

Mitrofanova SvetlanaLawyer. Work experience - 15 years

Hello. The total cost of conducting the entire transaction of donating an apartment to a notary includes: 1) the cost of drawing up and certification of the donation agreement; 2) submitting an agreement to register the transaction; You may also need an additional service - notarized consent from your spouse.

A small digression - if you need a free consultation, write online to the lawyer on the right or call (24 hours a day, seven days a week for all regions of the Russian Federation) Moscow and the region; 8 (812) 425-62-89 — St. Petersburg and region; all regions of the Russian Federation.

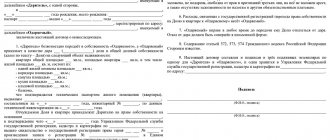

(to enlarge the picture, click on it)

Under what conditions can you give your share in the apartment to your wife or husband?

With shared ownership of an apartment, there are cases when, after the death of one of the spouses, his share of the housing is inherited by children or other heirs other than the surviving spouse.

Such situations lead to conflict situations associated with attempts to win back the share belonging to the one who remained the owner of another part of the property.

To avoid such situations, spouses give each other shares so that one person owns the apartment .

The procedure for transferring a share of an apartment as a gift to a spouse, according to general principles, does not differ from the standard donation procedure. And the conditions, in general, are no different.

Basic conditions of donation:

- If spouses are owners of shares in an apartment and one of them decides to give ownership to the other, the transaction must be formalized according to the principle of a regular gift.

- You can gift a share of an apartment to a spouse only if the spouses are the owners of separate parts of the housing.

- All donation documentation must be made exclusively in writing.

- When signing a gratuitous transfer agreement, the presence of both spouses is mandatory.

- And the main condition for the admissibility of the transaction is the official right (confirmed by documents) of the donor to dispose of part of the real estate that he plans to donate.

- Another important point during the procedure is to notify the owners of the remaining parts of the property about their desire to donate their share.

In this case, official written permission is not required from them, but if other owners have not been notified, they may protest against the transaction even after it has been registered, creating serious problems for both participants in the property transfer process.

Cases of transferring a part of jointly acquired property to a spouse are quite rare and are considered a legal paradox, because an apartment purchased jointly is already considered the property of both spouses , therefore, in order to give a share to a spouse, you will have to take written consent from the second spouse, which in itself is considered absurd, while the second the part that remains in the property of the donor will still be considered joint property; such transactions are not adequate, but still have the right to life.

We talk about the cases in which the consent of the second spouse is required for a gift transaction, we talk in this material, and here you will learn how to correctly give your wife an apartment purchased in a joint marriage.

Adequate transactions include all other transactions in which there are no pronounced contradictions.

The concept of shared ownership

A share is an abstract given, a set of rights in relation to a specific thing. Shared ownership is considered as a concept that is closely related to the concept of common property (such a right arises in relation to a thing that is indivisible by nature or by law, or in relation to a thing that is divisible, but owned by several persons in cases where this is directly established either by law or by agreement sides). It should be noted that, in contrast to joint ownership (which by default occurs, for example, between spouses), the shared ownership of a thing by several persons presupposes a strict definition of the shares of co-owners .

The size of shares in shared ownership can be established taking into account the provisions of the law or on the basis of an agreement concluded between the co-owners . If the size of the shares is not determined, it is recognized as equal (as follows from paragraph 1 of Article 245 of the Civil Code of the Russian Federation).

Legislative acts of the transfer procedure

The donation of a share of an apartment to a spouse, as well as the usual procedure for the gratuitous transfer of property, is regulated by Article 572 of the Civil Code of the Russian Federation and other paragraphs of this code, but in matters that are contrary to donation, when the apartment is considered jointly acquired property, certain norms of the family code that determine the property rights of spouses are applied.

According to Art. 34 and 39 of the RF IC, when defining an apartment as jointly acquired property, it is possible to donate a share of real estate, but in the amount of no more than half of the total area of housing .

The concept and aspects of donation

General provisions regarding donations are provided for in Chapter 32 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation). The essence of a gift agreement, as a general rule, is that one party transfers or undertakes to transfer to the opposite party a certain thing as a gift . It is important to note that the transfer is made absolutely free of charge (there should not be any counter-representation on the part of the donee, otherwise the contract may be declared invalid). This transaction may also include:

- transfer of property rights of claim (to the donor or to some third party);

- release of the donee from any property obligation (for example, to the donor or any third party).

When donating a piece of real estate, it is necessary to obtain the consent of the gift recipient to accept the gift . The donee has the right to refuse it.

Where should I go to apply?

Current legislation allows donations to be made without the participation of representatives of legal or notary offices, but contacting a notary office will help prevent mistakes when completing a transaction.

Both public and private notaries can be involved in the donation procedure; the difference can only be in the cost of services, because private notaries charge a much higher fee.

Additionally, you will have to go to the Registration Chamber or the MFC to register the deed of gift, since the deed of gift itself, from a legal point of view, is considered only an intention to donate a share of the apartment; the property is transferred into the ownership of one of the spouses only after registration.

We have prepared other useful materials about the nuances of registering a deed of gift between spouses. From our publications you can find out whether spouses during a divorce can claim real estate given to one of them during marriage.

List of required documents

To rationally conclude a transaction of donating a share of an apartment to a spouse, you will need the following documents:

- Identification documents of both spouses (passports).

- Marriage certificate.

- Property papers confirming the right to own certain shares of the apartment.

- Housing cadastral number.

- Technical passport for the apartment with the current layout and a separate plan of the territory that is being donated.

- Documentary information about the residents registered in the apartment.

- A paper confirming the absence of debt obligations on the property that they plan to donate.

How to draw up a contract?

Important! Drawing up an agreement on donating part of an apartment to a spouse is carried out with the participation of both spouses.

- At the same time, the documents must contain information about the donor and the recipient, the apartment, its owners and the share that is being donated.

- The relationship between spouses must be confirmed with a marriage certificate, because if you do not indicate the relationship, you will have to pay tax.

The agreement should also reflect the donor’s intention to transfer the share of the apartment to the spouse free of charge and his consent to receive the gift. - Additionally, you should confirm the absence of debts on the share of housing, indicate the names of people registered in the apartment. The deed of gift is drawn up in three copies, one of which must remain with the parties concluding the transaction, and one must remain with the notary.

- If the signing of papers was carried out without the participation of a notary, it must be signed in two copies.

Donating a share of an apartment to a former spouse involves paying a tax of 13% , due to the fact that after the divorce people are considered strangers. For this reason, confirmation of family ties is considered one of the important points of the gift agreement.

Other owners: when their consent is required

Many questions are related to whether consent to donate a part from the remaining homeowners is always necessary. If the deed of gift concerns the transfer of additional “squares” to one of the owners, who, thus, expands his share, the consent of the other owners is not at all necessary.

In situations where an apartment is given to a stranger, notarized consent from other owners is required. Otherwise, the remaining owners will easily get the transaction declared invalid.

However, if the property is shared, and this part is allocated in kind, the owner can dispose of it absolutely freely, without obtaining the consent of the other owners.

Registration of a transaction

An agreement to donate a share of an apartment is considered only as an intention to transfer part of the housing to the spouse; taking ownership of the donated property is possible only after going through the procedure for registering the agreement (Article 574 of the Civil Code of the Russian Federation, Article 131 of the Civil Code of the Russian Federation).

- The document is registered either at the Registration Chamber or at the MFC; for this, both parties must appear at the registration office with the originals of the deed of gift, as well as a copy of the agreement.

Additionally, the following documents are submitted upon registration:

- the right to dispose of property;

documents for the share of the apartment;

- cadastral number of the housing, the share of which is donated;

- Marriage certificate;

- coupon confirming payment of the state fee for registration.

- The parties to the agreement must write an application to the registration authority; forms of this document can be obtained directly from the Registration Chamber or the MFC.

- After submitting documents, the relevance of which is checked by a specialist from the registration institution, in three to seven days the recipient will be issued a certificate of ownership.

Financial expenses

If the donation is made between existing spouses, that is, between people who are currently legally married, the financial waste associated with the transaction will be minimal. First of all, you will have to pay for the services of a notary if he is involved in the registration. The services of a state notary service employee will be cheaper , but due to the fact that there are always long queues at state notary offices, most often people turn to a private contractor. His services may cost a little more, but cannot exceed 0.05% of the cost of the part of the apartment that is the subject of the transaction.

Before carrying out the registration procedure, you will have to pay a fee, the amount of which varies within a thousand rubles.

Personal income tax

Personal income tax is collected only if the transaction is carried out between former spouses whose marriage was dissolved before the agreement was signed. A civil marriage is not considered kinship; when donating a share of an apartment to a common-law spouse, thirteen percent of the tax will be charged.

Deadlines

The deed of gift is completed within one day, that is, on the day the donation form is filled out; after its signing, the transaction for the transfer of part of the property is considered ready for registration.

The agreement enters into legal force after registration, which must be carried out within a month after signing. If the spouses do not contact the registration authority within a month, the contract is subject to automatic cancellation. Registration of an agreement with the Registration Chamber usually takes three days ; the procedure at the MFC may take a week or more, but not less than a month.

To whom should you not give a part of the house?

The prohibition on donation is stipulated by Art. 575 of the Civil Code of the Russian Federation. A contract cannot be concluded if:

- the share of the house belongs to a child under 14 years of age , an incompetent citizen , even if a legal representative acts on their behalf;

- recipients are employees of a medical or educational organization and other institutions providing social services ; caring for orphans and citizens undergoing treatment;

- recipients - persons holding government positions in the Russian Federation , being civil servants, employees of the Bank of Russia in connection with their official position, official responsibilities.

For example , if a house was purchased through the investment of maternal capital, a share of the property belongs to the child. His mother can give only the part that belongs to her, but the minor's share will remain his.

Cases in which spouses may be refused

There are cases when registration may be refused; there may be several reasons for this:

- The contract is drawn up incorrectly or there are certain inconsistencies in it.

- The data on the share of the apartment specified in the contract do not coincide with the real indicators: the area is indicated incorrectly, the cadastral number does not correspond, the layout of the plot which is being donated does not correspond to the data in the technical passport.

- The donor does not have documents confirming the sole ownership of the part of the apartment that he wants to donate.

- The owners of other parts of the apartment are against donation.

What to do if refused?

If registration was refused, the reasons for the refusal should be taken into account and measures should be taken to eliminate them. After this, you can re-issue the deed of gift, but it is better to enlist the support of a notary.

Is it possible to refuse to accept a gift?

Accepting property as a gift is not the responsibility of the recipient. The child’s representative has the right to refuse to accept part of the apartment at the stage of signing the contract.

If the decision to refuse was made after the conclusion of the transaction, then refusal is permitted by agreement of the parties or by a court decision. The first option involves issuing a written refusal and its subsequent registration in Rosreestr (Article 573 of the Civil Code of the Russian Federation). If refusal of a gift causes losses to the donor, he has the right to demand compensation.

The second option involves going to court. For example, the donor/done may file a claim to invalidate the contract. The claim must be filed within three years.