How does the state financially support single mothers?

It is impossible to find out what payments a single mother is entitled to from just one regulatory legal act (LLA).

“Preferential” and “compensatory” norms are contained in both federal, regional and local regulations. A single mother can count on support from the state:

- on a general basis (benefits and payments due to all mothers in Russia);

- according to additional criteria (if he confirms his preferential status: as a single mother, large or low-income family, etc.).

A single mother receives the main types of benefits at her place of work (maternity and child benefits). Here, the status of a single mother does not give special privileges - all women have equal rights to receive them.

To find out whether a single mother can count on additional state support, she should contact the local administration or social security authority at her place of residence.

Since 2021, social support for citizens is provided using criteria of need. The principle of “a little bit for all benefit categories” was replaced with targeted social support (only for citizens in real need). This approach is also applied when providing benefits and benefits to single mothers in 2021.

If you have access to ConsultantPlus, find out what benefits and social guarantees a single mother or father can count on. If you don't have access, get a free trial of online legal access.

Situations

Let's look at situations that may arise for single mothers in more detail. The worse their situation, the more assistance the State provides them.

What should a single mother with one child do?

If a single mother has one child, she is entitled to all of the above benefits and benefits, including:

- child care up to 1.5 years old;

- Putin payments up to 3 years;

- benefits paid until adulthood;

- all one-time payments, including those provided at birth;

- tax, labor, social benefits;

- maternity capital in the amount of 483,882 rubles.

What should a single mother with two children do?

If a single mother has two children, then she is entitled to maternity capital in the amount of 639,432 rubles. If she has already received maternity capital for her first child, then the amount will be only 155,000 rubles.

Otherwise, she can count on the same list of benefits and benefits as a single mother with one child.

What should a single mother with many children do?

Requirements for obtaining the status of a large family are established by regions. But most subjects recognize a mother as having many children if she has 3 or more minor children. The same benefits and payments that are described in previous cases apply to her.

In addition to these, there are additional measures:

- Allowance for the third child up to the age of 3 years in the amount of the subsistence minimum for children established in the district (established in regions with low birth rates, of which there are currently 69 out of 85);

- Discount on utilities - for three children the fee reduction is 30%, for four - 50%, if there are 7 or more children in the family - the state compensates the entire fee.

What does an unemployed single mother deserve?

Women who did not work before pregnancy and childbirth receive smaller amounts of benefits than mothers who went on maternity leave. They are calculated according to the minimum wage adopted at the federal level, or are issued in a fixed amount. The list of assistance provided for a single mother without a job is as follows:

- one-time payment at the birth of a child – 18,004.12 rubles;

- monthly payment up to 1.5 years – 7,082.85 rubles.

These are all the support measures offered for non-working single mothers. This does not include benefits and benefits provided to women with low-income status, but most likely, a non-working mother will receive them.

What does a low-income single mother deserve?

In addition to the mentioned support measures for single mothers, there is other assistance, which most often depends on the region:

- A monthly allowance is provided for a child under 18 years of age if the average per capita family income is less than the regional subsistence level. The number of children is not important here. For example, in St. Petersburg, single mothers are paid 1,451 rubles. monthly;

- The benefit for the third and subsequent children under 3 years of age is in the amount of the subsistence minimum per child in the region. Paid if the family income per person is less than the subsistence level.

In some regions, additional monthly benefits are established, which are often small:

- Moscow region – 4591 rub. (up to 1.5 years), 6672 rub. (from 1.5 to 3 years), 2296 rub. (from 3 to 7 years), 1147 rub. (from 7 years to adulthood).

- Sverdlovsk region – 600 rub. (the payment is the same for each child).

- Oryol region - for the first child - 721.23 rubles.

- Perm region – 402.06 rub. (for each child, regardless of their number).

- St. Petersburg – 4,203 rub. - for the first child and 4,802 rubles. - for the second until he turns 1.5 years old. In the range from 1.5 to 7 years they pay 1,560 rubles, and from 7 to 16 years they give out 1,451 rubles.

Maternity payments and child benefits for a single mother

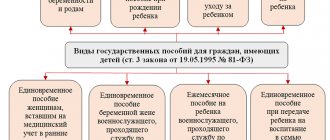

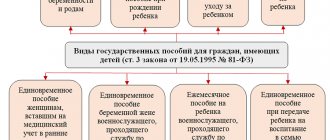

What payments are due to a single mother in 2021 under federal law? The types of benefits to which she is entitled (on a common basis with other citizens with children) are listed in Art. 3 of the Law “On State Benefits for Citizens with Children” dated May 19, 1995 No. 81-FZ.

The figure below shows the types of benefits for all expectant mothers (before the birth of the child) and after the birth of the baby:

The amount of benefit for a single mother in 2021 depends on her average earnings over the previous two years or on the minimum wage. To receive benefits you need to contact your employer. He will transfer the necessary documents and information to the FSS, which will pay the money. A non-working mother should contact the social security authorities for benefits.

We tell you more about what benefits each mother is entitled to at the birth of children in the materials of the section “Children’s benefits in 2021 - 2021 (amount, required documents)”.

Find out about the nuances of assigning, calculating and paying maternity benefits from the articles in our special section.

We will tell you further what other advantages, privileges, compensations and benefits exist for single mothers in 2021.

Documents for processing payments

To apply for benefits and additional benefits, the mother should collect a package of the following documents:

- Application for benefits.

- Baby's birth certificate.

- Certificate of cohabitation of mother and child.

- Other documents, depending on the benefit for which the single mother is applying.

A certificate of joint residence can be obtained at the passport office at the place of registration. All necessary documents should be taken to the social protection department or MFC. The task of social protection employees is to check the specified information, visit the family in person, and, based on the data received, draw up acts on the cohabitation of the applicant and the child.

As soon as the application for payment of benefits is accepted by the social security authorities, accrual begins to occur. Payments are made until the child reaches adulthood. In some cases, benefits may be paid only for up to three years.

If a mother and baby live in a place other than their place of registration, the woman will have to take a certificate from the social security authorities regarding registration. The certificate must indicate that the single mother does not receive any payments at the place of registration. Then the benefit will be paid at the place of residence.

If a woman is employed, then part of the benefits should be arranged with the employer. The benefit paid from Maternity Capital funds is assigned by the Pension Fund.

Free dairy kitchen: how accessible is it for a single mother?

The opportunity to receive free dairy products at the dairy kitchen is one of the social support measures. Not everyone can enjoy this privilege. The list of persons, standards for issuing special food, as well as the list of organizations supplying dairy products for dairy kitchens are determined by local authorities.

Recipients of special food usually include children from large and low-income families, bottle-fed babies, disabled children and other categories of people in need. Local authorities can also grant pregnant and nursing mothers the right to receive special food.

If a single mother in her region of residence falls into these categories, she must not only confirm her right to special food (for example, document the status of a low-income family), but also regularly update her prescription at the medical institution where the baby is registered.

Thus, not all single mothers can count on free food in a dairy kitchen, and the process of obtaining the right to a dairy kitchen is quite labor-intensive. But there are also many benefits from receiving such government support: children receive high-quality, varied and fresh food, and mothers can use the saved funds for other priority needs for the child.

Assistance of 5,000 rubles for children under three years of age.

Children under three years of age whose mothers are eligible to receive maternity capital - due to the coronavirus epidemic and government support - will be provided with assistance.

The payment will be 5,000 rubles from April 2021 and will last three months.

In this case, payments will be from the budget, and not from maternity capital.

Children born before March 31, 2021.

Advantages of a single mother when registering a child for kindergarten

What benefit does a single mother receive when her child enters a preschool institution?

A single mother has the right to count on priority enrollment of her child in the group. To resolve this issue, you must contact the administration of the preschool institution directly. The status of a single mother allows you to speed up the process of getting your child into kindergarten if there are no other preferential applicants (for example, children from large or low-income families). If there is also a queue among beneficiaries, it will not be possible to “jump” over it.

A single mother can also count on compensation for part of the monthly parental payment (clause 5 of Article 65 of the Law “On Education in the Russian Federation” dated December 29, 2012 No. 273-FZ).

The amount of such compensation is established by regional authorities taking into account the criterion of need, but not less than:

- 20% of the SRRP (average parental payment) - for the first child;

- 50% of the SRRP for the second child;

- 70% of the SRRP is for the third and subsequent children.

A single mother will not be able to use the above privileges if we are talking about a commercial kindergarten. Only state, municipal or departmental preschool institutions can reduce parental fees.

Thus, in 2021, child benefits for a single mother sending her child to kindergarten are not provided for by law. But this category of mothers can count on certain privileges.

To whom then does the state pay benefits?

As we see, the status of a single mother, which would take into account all the life and financial circumstances of a parent raising a child alone, has not been established at the state level. There are only such legal concepts as “a person with responsibilities within the family” and “single parent”, recognized by the Supreme Court of the Russian Federation. In relation to the resolution of the plenum No. 1, issued in the above-mentioned institution in 2014, the following are considered individual characteristics that allow a woman to be classified as a single mother:

- the mother has obligations to raise, develop and raise the child;

- the mother actually takes care of the child alone;

- the child’s father died or was lost for some other reason;

- the child's father is deprived of parental rights or declared incompetent;

- The child's father has been declared missing.

As a result, as already mentioned, if the father accepted the child or the fact of paternity was recorded in court, then the mother does not have the right to count on assigning the status of a single person. It is also impossible for a mother whose marriage has been terminated to obtain this status, but the father is indicated on the child’s birth certificate, because legally the mere status of being divorced does not mean automatic acquisition of the status. In this case, one or another state financial assistance is not expected, and the mother has the right only to go to court to collect alimony. There is also the opposite set of circumstances: previously a woman had the status of a single mother, but then registered her first or subsequent legal marriage. In this case, the assigned status will be lost, since in fact she will not be raising the child and supporting the family alone. And finally, a woman will be denied the status of a single mother if she gave birth to a child within 300 days after the official divorce or other reasons that influenced the loss of the father of this child.

pexels.com/Elina Fairytale

The child went to school: what kind of government support can a single mother count on?

When a child goes to school, the mother has more costly tasks: where can she get additional funds to buy a school uniform, can her child eat in the school canteen for free, and what kind of benefit can a single mother receive in 2021 in connection with such expenses?

Federal legislation does not provide for special monthly “school” benefits for a single mother in 2021, which will help her provide decent support for her child while studying. We can only count on the support of local authorities.

Municipalities define the categories of those in need in different ways (usually large and low-income families, sometimes single mothers), and also set the amounts of benefits and compensation in their own way based on budgetary capabilities.

Funds are allocated:

- for the purchase of stationery and other school supplies;

- two hot meals a day for children in school canteens;

- partial compensation of tuition fees in art and music schools (up to 30%);

- discounted vacation vouchers (once every 2 years);

- other benefits and compensation.

Regional regulations for single mothers may provide one-time cash payments for the purchase of school clothes, sports uniforms, or provide the opportunity to purchase these items in discount stores. In some regions, authorities pay for travel and meals for schoolchildren.

Payments in Moscow

The Moscow authorities have provided a number of subsidies for single mothers who are registered with their child in the locality. For example, he establishes a monthly allowance provided for by Normative Act No. 67 of November 3, 2004, Resolutions No. 911-PP of December 28, 2004, No. 954-PP of December 28, 2016 (as amended).

The payment is assigned to those women whose income is below the minimum required for living.

The amount of assistance depends on the age of the son or daughter and is:

| Number of years | Amount, rub. |

| Until 3 | 15 840 |

| From 3 to 7 | 7 613 |

| From 8 to 18 | 6 336 |

In addition, monthly compensation payments have been determined in order to minimize the impact of price increases on:

- Products for a family with a child under 3 years old – 713 rubles .

- Accommodation for mothers of children under 16 years old - 317 or 792 rubles .

If a woman is registered in Moscow and has many children, then she is entitled monthly to: additional financial assistance for a third or subsequent minor dependent, compensation for a telephone, utility bills, and children's goods. A young ( under 30 years old ) parent can count on receiving:

- A one-time additional payment upon the birth of a newborn, the amount of which is determined by the order of appearance in the family:

| Birth order | 1 | 2 | 3 and following |

| Index | Minimum wage*5 | Minimum wage*7 | Minimum wage*10 |

| Value for 2021, rub. | 88 395 | 123 753 | 176 790 |

- Compensation for expenses associated with this event. The indicator is:

| Birth order | Amount, rub. |

| First | 5 808 |

| Second or next | 15 312 |

| 3 or more at the same time | 52 800 |

Preferential use of the pool for children with one parent

In order to preserve and strengthen the health of children, regional and municipal authorities may provide preferential conditions when paying for the cost of physical education, health and sports services. But only in the case when these services are provided by institutions that are part of the state system of physical education and sports.

For example, such benefits are provided for in paragraph 7 of Art. 32 of the Law “On Social Support for Families with Children in the City of Moscow” dated November 23, 2005 No. 60. You can find out about the benefits provided in the field of physical education and sports on the official websites of sports institutions - on the website of the Moscow Department of Sports in the section “Preferential Services”, preferential benefits are listed categories of citizens who have the opportunity to receive physical education, health and sports services at the Olympic Village sports complex (use of swimming pools and a gym, visits to children's swimming sections). Beneficiaries include children from large and low-income families, orphans and disabled children. To obtain subscriptions on preferential terms, you must contact the administration of the sports complex with documents.

Travel reimbursement and free entry to the zoo

Are there benefits for single mothers in 2021 to reduce travel costs and expenses for cultural events for their children?

Taking children to the zoo and not worrying about paying for travel on city public transport - such benefits can be enjoyed, for example, by capital families with children (Article 26 of the Law “On Social Support for Families with Children in the City of Moscow” dated November 23, 2005 No. 60). Children living with one parent are not included in a separate category of beneficiaries, but enjoy the same privileges.

Children with Moscow registration who have not reached the age of 7 years have the right to:

- for free travel on buses, trolleybuses and trams (public urban passenger transport);

- free entry to zoos, cultural and recreational parks, exhibition halls and museums run by the capital’s government.

Benefits do not apply if the child is visiting a private museum or using other means of transport (for example, private taxis or commercial shuttle buses).

If a single mother lives in a small locality, she will not need this kind of benefits - the village may not have public transport, much less a zoo.

When will child benefits start?

When the payment will be received depends on the deadline for submitting the application. More time is needed to consider it. If you apply now, your payment for July should be received by August 25, 2021. Further, if the body makes a positive decision, the benefit will be transferred to the parent’s account monthly from the 1st to the 25th. The sooner the application is submitted, the faster payments will begin to arrive.

This type of subsidy is issued for 12 months at once. Next, it will need to be reissued and extended. When the child turns 18 years old, the benefit is automatically withdrawn. No more money will be sent to the parent’s account in this direction.

Reimbursement for telephone costs

Are there benefits for single mothers in 2021 to pay for communication services?

Compensation payments for telephone payments personally for single mothers are practically not found in regional legal entities. Although this type of social support exists for low-income and large families. For example, in Art. 17.2 of Law No. 60 for metropolitan families with three or more children, one of the parents (guardian, guardian, stepmother or stepfather) is provided with monthly compensation for using the telephone. This type of social support is provided until the youngest child in the family reaches the age of 18.

You should not expect full reimbursement for landline phone costs or reimbursement for cellular phone costs. Regions usually provide payments “per telephone” as a percentage of the approved subscription fee tariff.

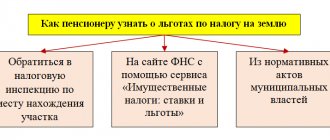

Tax benefits and deductions

For single parents, double personal income tax deductions are provided for children. Let us remind you that a tax deduction is not compensation or payment, it is a documented right that exempts part of the income from personal income tax.

The amount of standard tax deductions for 2021 for single parents:

| Personal income tax deductions for children for single mothers | Who does the tax benefit apply to? | |||

| For each dependent under 18 years of age. and for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 years. | For each dependent, if the minor is under 18 years of age. is a disabled child, or a full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II | |||

| on the first | on the second | on the third and every subsequent | ||

| Single mother (parent), adoptive parent who is providing for the minor | 2,800 rub. | 2,800 rub. | 6,000 rub. | 24,000 rub. |

| To a single guardian, trustee, foster parent who is caring for a minor | 2,800 rub. | 2,800 rub. | 6,000 rub. | 12,000 rub. |

An example of determining the amount of a deduction: employee Morkovkina D.A., who is a single mother, has an only disabled daughter of 8 years old.

The amount of deduction due to her will be 26,800 rubles. based on:

- 2,800 rub. (RUB 1,400 * 2);

- 24,000 rub. (RUB 12,000 * 2).

That is, the amount is 26,800 rubles. monthly excluded from taxation until the mother’s income exceeds 350,000 rubles. in year.

Does a single mother get free housing?

The status of a single mother in itself does not give her the opportunity to count on free housing. There is no such privilege in the law. But in combination with other conditions (for example, low income, a certain age of the mother, etc.), a single mother can participate in special housing programs.

For example, she can take part in the Young Family program. To do this, she must be no more than 35 years old, and she must prove that her family needs improved living conditions.

The program does not provide free housing, but allows you to receive partial financing for the purchase from the local budget. At the same time, the program participant must have his own funds or a source of their receipt to make the mandatory down payment.

In addition, to solve housing problems, a single mother can try to get on the waiting list for social housing. There are also a number of conditions, the fulfillment of which is checked when placing a single mother on the social housing queue (the presence of a disability in the mother or child; a diagnosis of an illness of a family member confirmed by a medical institution that is unacceptable when living together in the same living space; unsuitability of housing for habitation).

Who has the right of status?

At the legislative level, the definition of “single mother” is defined as a woman whose children do not have information about their father on their birth certificate.

Quite often, such mothers need to be provided not only with material and social assistance, but also with psychological assistance.

This is due to the fact that they are often left with nothing, in a depressed state, while they need to raise and support a minor child.

The main distinguishing features of the categories of women who are single mothers are shown in the table below.

| Assignment of status | Refusal to grant status |

| 1. A mother who gave birth and is raising one or more children without being married, if recognition of paternity did not occur in one of the following ways: | 1. A citizen who is raising children in a single-parent family. That is, after an official divorce, but does not receive alimony payments from her ex-husband for any reason. |

| · There is no joint application of parents to the marriage registration authorities regarding paternity; | |

| · There is no court decision to identify the father. | 2. A mother who gave birth to a baby within three hundred days from the moment the marriage was declared divorced, the marriage was declared invalid, or the death of the husband. In such a situation, paternity is assigned to the ex-husband, which is registered in the registry office, even if he is not the biological parent of the child. |

| 2. A citizen who gave birth to a baby in an official marriage, or within three hundred days from the date of divorce, if the father is the spouse (ex-husband), but the fact of paternity is disputed in court, with a corresponding decision of the judicial authority that the former spouse is not the father of the child. | |

| 3. An unmarried mother who has completed the adoption procedure. | 3. A citizen who is unmarried and raising a child whose paternity has been established voluntarily or in court, even if the citizen does not live with this woman. |

Results

What compensation, benefits and other payments are due to single mothers in 2021 can be found out from the social security authorities or the municipality. Like all expectant mothers, single mothers receive maternity benefits, as well as child benefits (one-time and monthly). As additional support from the state, depending on the region of residence, they can count on free special food (dairy kitchen), reimbursement of expenses for clothing and stationery for schoolchildren, free travel on public transport, etc. To receive such preferences in most regions, in addition The status of a single mother must also meet other criteria (large families, low income, etc.).

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

- Law “On state benefits for citizens with children” dated May 19, 1995 No. 81-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Labor benefits for single mothers

The Labor Code of the Russian Federation establishes the following guarantees for single parents:

- A ban on dismissal of a single mother raising a disabled child under the age of 18. or a minor under the age of 14 years. (Part 4 of Article 261 of the Labor Code).

- Providing annual paid leave at any convenient time at the request of a single parent raising a child under 12 years of age. (Article 262 of the Labor Code).

- Limitation of night work and overtime work, involvement in work on weekends and non-working holidays, assignments on business trips, provision of additional leaves, establishment of preferential labor regimes (Article 264 of the Labor Code).

In addition to generally accepted guarantees, employers have the right to introduce additional benefits and privileges. For example, collective agreements of institutions establish annual additional leaves without pay at a convenient time for up to 14 calendar days (Article 263 of the Labor Code).