When getting a job, a person carries with him not only a store of knowledge, skills and hopes, but also certain documentary evidence of his personality, competence and law-abidingness. When going through the official employment procedure, you need to pay attention to the documentary side of the process. The law provides for a certain list of documents that must be in the hands of each applicant when establishing an employment relationship. In practice, this list is usually further expanded due to the requirements of the employer.

Question: What educational documents can be required when hiring a medical worker to conduct pre-trip and post-trip medical examinations of drivers? View answer

Let's consider which papers are required when concluding an employment contract, and which requirements can be argued about, and whether it is worth doing.

What documents should an employer request when hiring a citizen of Kyrgyzstan ?

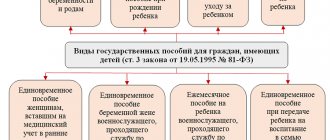

Types of child benefits according to law

Before looking for the answer to the question of what documents are needed for child benefits, let’s decide what kind of child benefits exist.

First of all, the types of benefits that citizens with children can apply for are listed in Art. 3 of the Law “On State Benefits...” dated May 19, 1995 No. 81-FZ (see in the figure):

Thus, state benefits for citizens with children can be divided into two groups:

- Benefits paid to women during pregnancy and during maternity leave after the birth of a child.

- One-time and monthly benefits after the birth of a child.

Documents for child benefits must be submitted to the employer at the place of work of one of the spouses or to the social security authority (if a non-working citizen or university student is applying for benefits).

Certain categories of citizens (for example, unemployed parents) can submit documents for applying for child benefits to the MFC.

Income taken into account when calculating

When forming compensation accruals, all types of earnings are considered.

- Salary, bonuses, business and investment profits, etc.

- Money received from the sale or rental of real estate.

- Subsidies for foster or ward minors.

- Child benefits received once a month.

- Other types of payments that compensate for utility bills. Subsidy money for covering housing and communal services is not included in the total amount. Conditional discounts for paying for living space and utilities are also taken into account.

When carrying out settlement activities, the income of both the applicant and his relatives is recorded: husband or wife, father, mother, adoptive parents.

List of documents for receiving maternity benefits

To apply for maternity benefits (M&B), the employee must provide the employer with the following package of documents:

- sick leave;

- application for payment of benefits;

- certificates of the amount of earnings from previous places of work for the estimated 2 years, if any;

- an application to replace the years of the calculation period if the amount of benefits increases when changing periods.

IMPORTANT! The benefit is not paid if the employee applied for it 6 months after the end of the BiR leave (Article 12 of the Law “On Compulsory Social Insurance” dated December 29, 2006 No. 255-FZ).

An addition to the B&R benefit is a benefit in connection with registration in the early stages of pregnancy. The basis document for receiving this benefit is a certificate issued by a medical institution. As a rule, both of these benefits are paid at the same time. Therefore, if the employee submitted a certificate of registration in the early stages of pregnancy along with the documents necessary for payment of maternity benefits, ask her to write one application for both benefits.

The employer, having received the entire package of documents from the employee, is obliged to transfer them to the Social Insurance Fund within 5 calendar days. The fund makes a decision on payment within 10 days and transfers benefits to the maternity leaver.

You will find ready-made instructions for receiving maternity benefits in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

Invoice

This document is required to be issued only by organizations and entrepreneurs that are VAT payers - mainly those who work on the general taxation system.

Organizations and individual entrepreneurs using the simplified tax system and patent usually do not pay VAT and therefore are not required to issue invoices. There are a few exceptions, which we covered in a separate article.

The invoice is issued in duplicate and signed by the supplier of the product or service. One copy is given to the buyer, the other remains with the seller. An invoice must be issued no later than 5 days after shipment of goods or provision of services.

An invoice is the basis for deducting VAT, so all organizations treat it with special trepidation.

In order not to study the form and rules for issuing an invoice, use Elba.

Create an invoice in Elba

List of documents for obtaining a one-time benefit for the birth of a child

After the birth of a child, one of the parents has the right to receive a one-time benefit in the amount of 18,004.12 rubles if the child was born before 01/31/2021 inclusive or in the amount of 18,886.32 rubles if the child’s birthday is after 02/01/2021.

The composition of the documents is as follows:

- application for assignment and payment of benefits;

- a certificate from the second parent’s place of work (or from social security if the other parent does not work) about non-receipt of benefits (see sample here);

- birth certificate issued by the civil registry office.

IMPORTANT! If the parents are divorced, a certificate of non-receipt of benefits from the second parent is not needed. Instead, you will need a divorce certificate and a certificate of the child living together with the employee.

Consignment note (N TORG-12)

Registers the sale of goods to another individual entrepreneur or LLC. It is usually not used for working with individuals.

The invoice is issued in two copies: the first remains with the supplier and records the shipment of goods, and the second is transferred to the buyer and is needed by him to accept the goods.

Usually the invoice is drawn up according to the standard TORG-12 form. But you can use your own template.

Invoice template

Article: consignment note TORG‑12

In Elba you can create an invoice based on an invoice.

Create an invoice in Elba

Documents for receiving child care benefits up to 1.5 years old

One of the parents or any other relative has the right to go on parental leave until the child reaches 1.5 years of age. To assign benefits you will need the following documents:

- employee’s application for benefits;

- child's birth certificate;

- birth certificate of the previous child;

- a certificate from the second parent’s place of work stating that he is not on parental leave and does not receive a monthly allowance. If a parent does not work, he can take such a certificate from social security. If a relative, for example a grandmother, will be caring for the child, such certificates will be needed from both parents.

Read about the minimum and maximum amount of child care benefits in 2021 here.

In order to receive benefits, wives of military personnel must provide, in addition to the above documents, a certificate from a military unit confirming that the child’s father completed conscription military service.

You will find ready-made instructions for receiving benefits for a child under 1.5 years old in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

Who will be approved for early payments?

In 2021, the conditions for the opportunity to retire early have changed:

- Women with three or more children. If a woman has three children, she has the right to make pension payments 3 years earlier than the official deadline. Women with 4 children can retire 4 years earlier. But it is necessary to take into account annual changes in retirement age. Women must have at least 15 years of insurance experience.

- Great experience. Women who have worked for 37 years and men who have worked for 42 years also have the right to retire earlier, but only by 2 years.

- Unemployed persons. For those citizens who do not have the opportunity to get an official job, pension payments begin 2 years earlier than their retirement date. But this happens taking into account the period of adaptation to retirement age.

The conditions for early retirement for residents of the Far North and regions equivalent to them have not changed. Employees who carried out their activities in dangerous working conditions can receive a pension early. Teachers and medical workers with a certain experience of 25 and 30 years, respectively. A man and woman who have a disabled child retire 5 years earlier than the official deadline.

To exercise your right to early retirement, first consult with an employee from the Pension Fund. If he confirms the possibility of exercising such a right, begin collecting documents. Send the application and list of required documents to the Pension Fund. The Pension Fund will receive the documents, issue you a receipt and begin the review. Check the documents carefully, as it often happens that in the papers confirming the right to early retirement, mistakes and typos are made in the full name and spelling of the position. In this case, request documents from the organization’s archives.

5 / 5 ( 2 voices)

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

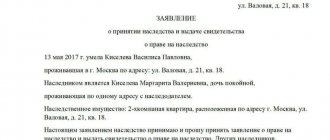

What to include in the application (sample)

As can be seen from the previous paragraphs, regardless of the type of benefit, the recipient must write an application for payment. It reflects the following information:

All information specified in the application must be confirmed by signing. You must also indicate the date the application was submitted.

See below for what an application for child benefit might look like:

It is better to fill out the application at the place where you receive benefits according to the sample proposed by the employer or the social security authority. You should also attach a package of documents (certificates, extracts, copies). We will tell you further about what certificates may be needed to apply for child benefits.

Where to send your request

Preferential programs for paying for housing and communal services are administered by social protection. You can generate and submit a document in person, online on a special service or through the MFC.

By entrusting the solution to the issue to the Multifunctional Center, you will only need to collect documentation for housing benefits. The staff of the institution will receive all other information independently. Here, specialists will readily help you fill out the application and forward it to its destination.

Those who want to apply for a subsidy through State Services will have to register on the portal, create a personal account and confirm the creation of an account. The next step is to fill out an application according to the proposed form, attach documents and activate sending.

We collect a set of certificates: about birth, family composition and others

The answer to the question of what certificates are needed to apply for child benefits depends on the type of benefit and who is applying for it. We will focus on the basic certificates required when applying for child benefits.

Certificate of birth of a child (form 24)

This certificate is required when applying for a one-time benefit at the birth of a child (clause 28 of order No. 1012n). A certificate of birth of a child is issued by the civil registry office in form 24, approved by Decree of the Government of the Russian Federation “On approval of forms…” dated October 31, 1998 No. 1274.

The certificate form is presented below:

This certificate is issued in one copy for registration of child benefits and must be submitted in the original along with the application and other necessary documents.

Certificate of family composition

The registration certificate (Form 9), referred to in everyday life as a certificate of family composition, contains information about all persons registered in a specific residential premises (in an apartment or private house):

To obtain this certificate, you can contact the housing maintenance organization at your place of residence or the passport office. There are also ways to obtain a certificate through the MFC or the State Services portal.

Certificate from the place of work about non-receipt of benefits

When applying for a monthly child care benefit, a certificate from the place of work of the child’s parent who is not applying for benefits is required, confirming the fact of non-receipt of this type of benefit (clause 54 of Order No. 1012n).

Detailed information about such a certificate and its sample can be found here.

If the parents of the newborn are divorced, this certificate is not needed. The benefit is assigned to the parent who lives with the child. When applying for benefits, that parent must provide a copy of the divorce certificate.

Other certificates

In some cases, when applying for child benefits, other certificates may be needed. For example:

- a certificate confirming the fact of disability - when applying for benefits for the adoptive parents of a disabled child;

- a certificate from the Department of Internal Affairs stating that the whereabouts of the wanted parents have not been established, a certificate of the parents being in custody - when assigning benefits in connection with the transfer of a child into guardianship or into a foster family;

- other certificates.

Find out what a certificate of employment looks like and where it is submitted here.

What other help does a low-income family receive?

Low-income citizens are entitled to food and clothing assistance, as well as subsidies for housing and communal services. Let's consider each type of financial support separately.

Food aid

Interested parties need to prepare documents and visit the social service center (SSC). The commission will review the application and make a decision. If it is positive, the applicant will be notified by a social worker.

If they have a Muscovite social card, citizens are issued an electronic certificate. RUB 2,000 will be credited to the card, which can be used to purchase food. The certificate is valid for 1 month. You can find out the list of available stores by number (from 08:00 to 20:00).

The rest of the citizens are given food packages. More detailed information about the conditions for providing food assistance can be found on the website of the Moscow Mayor.

Clothing assistance

The procedure for obtaining targeted clothing assistance is almost the same. The applicant needs to collect documents and visit the CSC. If the decision is positive, the applicant will be given a certificate for 2,000 rubles. The money is credited to the Muscovite’s social card. Targeted assistance is also provided in kind. Purchases of goods are made only in special stores.

Housing benefits

Low-income citizens are entitled to a subsidy to pay for housing and communal services. It can be obtained by home owners, users (tenants) of premises and members of housing cooperatives.

To receive a housing subsidy, you must have Russian citizenship, registration in a specific region, and no debts to pay for housing and communal services. At the same time, more than 10% of family income should be spent on paying for services. When calculating the indicator, you need to take into account the maximum income for a particular family (3-5 people). You can get acquainted with the figures for Moscow on the website of the State Public Institution GCZhS.

On a note! Housing subsidy is provided for six months. The recipient then needs to resubmit the documents.

When do you need to go to social security with documents?

You must apply for child benefits to social protection authorities if your parents do not have an official place of work or they are full-time students at higher educational institutions. That is, in situations where applying for benefits to the employer is not possible. If one of the spouses works, he should apply for child benefits at his place of work.

The figure below shows what documents may be required for child benefits from social security:

Depending on the type of benefit received, the set of papers submitted to social security may vary. The specific list of documents to be submitted must be clarified with specialists of the social protection authority before starting the procedure for obtaining child benefits.

What documents are required to replace rights through the MFC

The documentation package is still the same, the procedure takes place in two stages - first, a visit to the multifunctional center (either through a real queue and coupons, or using an online registration), and then the state traffic inspectorate department. Advantages:

- personal contact with a specialist helps clarify unclear issues;

- speed of registration;

- There is an MFC in every city and regional center;

- possibility to pay the fee at the terminal.

Relative disadvantages include:

- state duty without discount – 2 thousand rubles;

- the need to go to two organizations instead of one;

- There are queues if you don't sign up online.

Documents for receiving Putin benefits

Currently, there are several payments that can be called “Putin’s”.

Firstly, since 2021, the law “On monthly payments to families with children” dated December 28, 2017 No. 418-FZ has been in force, according to which citizens who gave birth to the 1st or 2nd child in 2021 and after are entitled to so-called presidential payments .

Read more about this benefit in the material “Presidency payments at the birth of a child in 2021 - 2021”

To receive this benefit, you must contact social security (at the birth of the 1st child) or the Pension Fund of the Russian Federation (at the birth of the 2nd child) with a complete package of documents.

The list of papers for both departments will be the same (Appendix No. 2 to the order of the Ministry of Labor and Social Protection dated December 29, 2017 No. 889n):

- application for benefits;

- child's birth certificate;

- documents confirming the citizenship of the Russian Federation of the parent and child;

- information about the income of all family members;

- a certificate from the military commissariat about the parent’s conscription for military service;

- bank account details.

Who is paid?

Pension is a monthly payment to citizens who have reached a certain state-established age. In 2021, this period is 60.5 years for men and 55.5 years for women. When the time comes to retire, the citizen begins to receive pension payments. At the same time, he can continue to work and receive wages from the employer. New requirements for receiving pension payments:

- The retirement age will increase every year; in 2020 it is 60.5 and 55.5 years.

- By 2021, pensioners should have no less than 11 years of insurance coverage. By 2024, this number will rise to 15 years.

- The pension coefficient in 2021 is 18.6. Every year it grows by 2.4. By 2025, pensioners must score 30 or more points.

Some citizens can retire early; conditions have been developed for them that differ from the basic ones.

Who doesn’t make sense to collect certificates and statements to receive benefits?

Clause 4 of Order No. 1012n lists categories of citizens who, even if they have all the necessary documents, are not assigned benefits. These include Russian and foreign citizens, as well as stateless persons:

- Children whose children are fully supported by the state.

Persons who are granted the right to full state support are listed in the law “On additional guarantees for social support for orphans and children left without parental care” dated December 21, 1996 No. 159-FZ.

- Deprived of parental rights or limited in them.

According to Art. 69 of the Family Code of the Russian Federation, parents may be deprived of parental rights if they evade or abuse parental responsibilities, as well as if they abuse children, suffer from chronic alcoholism or drug addiction, or have committed a deliberate crime against a child or another family member.

Child benefits are not provided for those citizens of the Russian Federation who have moved to another country for permanent residence.

How to restore KBM

The bonus malus coefficient affects how much the insurance policy will cost. When the driver’s driving experience is long enough and the driver has no accidents (or very few of them), then compulsory motor liability insurance will be inexpensive (half the standard price).

When you change the VU, the KBM is equal to one. Restoration can be done in:

- an insurance company that provided auto insurance;

- Russian Union of Auto Insurers;

- Central Bank.

We talked about the list of documents that are required to replace a driver’s license at the traffic police, and also highlighted what registration methods exist and pointed out additional nuances. Be careful on the roads!

Results

Types of child benefits are listed in Law No. 81-FZ. These include: a one-time allowance for the birth of a child, a monthly allowance for child care, an allowance for transferring a child to a foster family and others. What documents you need to contact your employer or social security agency to apply for child benefits are established in Order No. 1012n of the Ministry of Health and Social Development. The application for payment of benefits must be accompanied by a certificate from the registry office about the birth of the child, a certificate of his birth, a certificate of family composition, a certificate of non-receipt of benefits by the other spouse and other certificates, extracts and copies.

If the parents are deprived of parental rights or the child is fully supported by the state, the benefit is not paid and documents for its registration are not submitted.

Sources:

- Federal Law of May 19, 1995 N 81-FZ “On state benefits for citizens with children”

- Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

- Decree of the Government of the Russian Federation of October 31, 1998 N 1274

- Federal Law of December 28, 2017 N 418-FZ “On monthly payments to families with children”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Income level to qualify for compensation

The ability to receive benefits from the state largely depends on regional policy. The right to claim preferential accruals is determined not by the specific amount of family income, but by what share it spends on housing and communal services payments.

In Moscow, for example, it will be possible to obtain a subsidy if utility costs amount to more than 10% of total income. In St. Petersburg, you can enlist government help only when the cost of housing and communal services exceeds 14%. In Voronezh, subsidies are provided for payment for utility services in the amount of 10-18% of total income:

- 15 percent for large families, single pensioners, single mothers and people living in low-rise residential buildings, in which heating is provided by companies at inflated rates;

- 10% is relevant for those whose income does not reach the subsistence level.

To make the calculation, you need to add up the earnings/pension received (other documented accruals) for the last six months and compare the total amount with the amount of mandatory expenses for utility bills. If the result is more than 22%, citizens have the right to apply for government benefits. It is important to understand that only material wealth that is officially registered is taken into account.

Before preferential payments are accrued, government officials will once again carry out calculations, taking into account the average amount of a citizen’s income over the last 6 months and the percentage required to cover housing and communal services bills. If the amount equals or exceeds the established standards, submitting documents to receive a housing subsidy will become possible.