Home » Inheritance » State duty when entering into an inheritance in 2020

123

According to the legislation of the Russian Federation on taxes and fees, when entering into the right to inheritance, it is necessary to pay a state fee. Payers are both citizens and organizations that perform legally important actions (executing a purchase and sale agreement, donation, inheritance).

State duty on inheritance in 2021

The mechanism for paying state duty on movable and immovable property and its amount are regulated by Federal Law No. 146 of July 31, 1998. “Tax Code of the Russian Federation” (hereinafter referred to as the Tax Code of the Russian Federation), according to which the amount payable is calculated individually, since it directly depends on the degree of relationship with the deceased and the estimated value of the property. The state duty rate is reviewed annually.

When first contacting a notary, the successor pays the so-called notarial fee for the preparation of primary documentation and opening of the will. According to the Tax Code of the Russian Federation, all notaries must have the same cost of services.

For 2021, article 333.24. The Tax Code of the Russian Federation establishes the following fee for performing notarial acts:

- certificate of will – 100 rubles.;

- opening the envelope and reading out the closed will – 300 rubles.;

- Carrying out an inventory of inherited property (so-called measures to protect the inheritance) – 600 rubles.

The transfer of property to a new owner after the death of the testator is carried out on the basis of a certificate of inheritance rights. It is the main document of title for registering property rights. However, the tax code does not distinguish between inheritance by law (in the event of the death of the testator) and by will.

The state duty rate for registration and issuance of a certificate of inheritance in 2021 in both cases will be:

- For heirs of the first stage (children, husband/wife, parents) – 0.3% of the assessed value of the property, maximum 100 thousand rubles.

- For heirs of the second stage (siblings and half-brothers/sisters, grandparents) – 0.6% of the assessed value of the property, maximum 1 million rubles.

The successor himself has the right to decide which estimated amount to start from when calculating the state duty. For these purposes, not only the market value of the property is used, which is usually somewhat inflated, but also the amount indicated in the inventory or cadastral documents.

If there are several documents indicating the value of the property, the smallest of them is taken into account (Article 333.25 of the Tax Code of the Russian Federation).

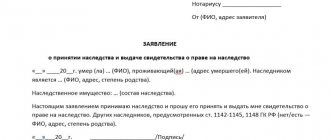

Issuance of a certificate of right to inheritance by law and by will

A certificate of the right to inheritance is issued at the place of opening of the inheritance by a notary. To obtain a certificate, the heirs, within the period established by law, provide the notary with a package of documents:

- death certificate of the testator;

- grounds for inheritance:

- will;

- documents confirming family relationships;

- title documents for property;

- acts of valuation of inherited property;

- heir's passport;

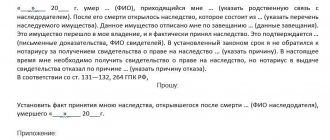

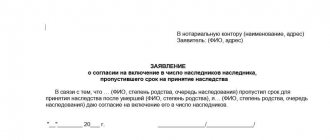

- application for entry into inheritance rights.

The notary collects evidence and verifies the facts, sending relevant requests to various authorities (banks, government agencies).

Read more about: What documents does a notary need to formalize and enter into an inheritance?

After six months from the date of opening of the inheritance, a certificate of the right to inheritance is issued. A certificate can be issued before the expiration of six months if it is reliably proven that, apart from the persons who applied for the certificate, there are no other heirs entitled to the inheritance.

For the issuance of a certificate of the right to inheritance by law and by will, a state fee is paid.

How not to pay state duty

Not everyone has to pay a fee. According to the current tax legislation, there are preferential categories of citizens who are fully or partially exempt from paying state duty when entering into an inheritance, namely (Article 333.35 of the Tax Code of the Russian Federation):

- disabled people of groups 1 and 2 (minus 50% of the duty rate on the date of payment);

- WWII participants;

- citizens who have been awarded the title of Hero of the USSR or Hero of the Russian Federation;

- Knights of the Order of Glory.

A tax benefit is provided only if there is an appropriate certificate confirming that the heir belongs to a particular category.

Example. After the death of her father, the daughter inherited an apartment, the estimated value of which was 1 million 800 thousand rubles. Since the daughter is a first-priority heir, she must pay a state fee of 0.3% of the value of the property, that is, 5,400 rubles. Being a disabled person of group 2, the daughter has a benefit of 50%, so the amount of state duty for her will be 2,700 rubles.

The following have the right not to pay state duty when entering into an inheritance (Article 333.38 of the Tax Code of the Russian Federation):

- Persons who lived with the testator in the same territory (on the same plot, house, apartment, room) before and after his death.

- Heirs of victims of political repression or those killed in the performance of official duties.

- Minors.

- Citizens declared incompetent.

According to Art. 333.38 of the Tax Code of the Russian Federation and letters of the Ministry of Finance No. 03-05-06-03/87 dated July 28, 2010. When transferring ownership of bank deposits, state duty is not paid.

Example. Citizen S. bequeathed her house to citizen A., who had cohabited with her for the past 12 years. The cost of the house, according to experts, was 2 million 200 thousand rubles. The amount of state duty in this case is calculated as 0.6% of the cost of the house, that is, 13,200 rubles. Due to the fact that the citizen lived with S., he is exempt from state duty. Although there was no documentary evidence of the fact of cohabitation, A. called neighbors and work colleagues as witnesses. They confirmed to the notary that for a long time before S.’s death, her house was A.’s main place of residence, and he took part in its arrangement and ensured the safety of the property.

Features of payment by several heirs

The fee upon entering into an inheritance must be paid in full from the inherited property by each of the heirs. But only if there is, we do not talk about a share in the inheritance.

Example:

Suppose a certain Ivanov A. indicated several heirs in his will. According to the will, Ivanov T.’s daughter will receive a car, Ivanov E.’s son will receive an apartment, and Vostrikov M.’s niece will receive a summer cottage. Each heir will be required to pay a notary fee based on the value of the property he receives in full. If the heirs receive the property in shares, then the notary fee is calculated based on the value of the corresponding share of this property. So, if Ivanova T. and Ivanov E. receive an apartment in equal parts, i.e. 1/2 share each, then the notary fee for each heir will be calculated based on the cost of 1/2 share of this apartment.

When entering into rights to a share of the inheritance, the heir pays the state fee in accordance with his share. To do this, you will need to provide a document that will contain a monetary value of the share being inherited.

Example:

Let’s assume that a certain Paramonova S.’s father died and he did not bother to draw up a will, which means that the apartment in his ownership will be inherited by law. At the same time, Paramonova S. has a brother, Paramonov V., who has equal rights to his father’s apartment with his sister. There are no other heirs. In this case, the apartment will be divided in equal shares - ½. The amount of state duty when registering an inheritance will also be divided. Let’s assume that the apartment was assessed according to the cadastre and its cost was 1,200,000 rubles, respectively, the cost of ½ share is 600,000 rubles. At this cost, the state duty is: 0.3% x 600,000 rubles. = 1800 rub.

Payment order

The function of a tax agent is assigned to a notary, since according to paragraph 1 of Art. 333.18 of the Tax Code of the Russian Federation, the tax is paid before any notarial acts are performed. You can pay the state duty when entering into an inheritance either in cash or in non-cash form. When paying through a bank cash desk, form No. PD-4sb (tax) is issued. The details are issued by the notary.

The payment confirmation receipt is presented to the notary along with the rest of the documents for inheritance.

Sample payment form for payment of state duty upon inheritance

Expenses in addition to state fees

In addition to paying a fixed state fee, you will need to pay the notary for services to provide them with legal and technical assistance. Prices for such services are set by the notary himself and are usually available to all visitors to the notary's office at the appropriate stand.

The amount of these services may vary, so it is recommended to check their cost in advance with a specific notary office. The size of these services greatly influences the costs when registering an inheritance.

Due date

The deadline for paying the state duty is fixed by law and is 6 months from the date of opening of the inheritance. If the deadline was missed for valid reasons, you can apply to the court at your place of residence or registration with an application for its restoration.

Each article on our portal is compiled taking into account basic cases. Despite the apparent simplicity of the procedure, there are individual features and tricks that require legal advice. So, there are nuances of paying the state fee when transferring the right of inheritance to a car, bank deposits made before 1991 and in other special cases. Some of our clients also encountered pitfalls when calculating the state duty for transferring property under a will. In addition, it is difficult to take into account constant changes in the current legislation of the Russian Federation.

To do everything correctly and save your time and money, take advantage of a free consultation with lawyers on our website.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

(

7 ratings, average: 3.29 out of 5)

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

46

Entry into inheritance after death under a will

The procedure and rules for entering into inheritance under a will are established by the chapter...

23

Lawsuit to restore the deadline for accepting an inheritance in 2021

The judicial hearing of the case on restoration of the period for accepting an inheritance begins with...

49

How to enter into an inheritance for grandchildren after the death of a grandmother or grandfather

The legislation establishes two methods of inheritance: by will and by law....

27

How is the inheritance divided between the wife and children after the death of the husband?

After registering the marriage, the husband and wife acquire in relation to each other...

57

What documents are needed to register and enter into an inheritance with a notary after death?

A complete list of documents required to accept an inheritance is established in the individual...

14

First priority heirs after death

The basic principles and rules of inheritance are defined by Part 3 of the Federal Law No....