In a situation where there is no will and you have not declared rights to the inheritance, after six months you can lose it forever. This rule, however, has its exceptions. For example, a direct heir can assume inheritance rights automatically. Just conscientiously use the property of the deceased and take care of it - for example, pay bills for the apartment, make repairs to it. If no other heirs appear, the property passes to you. But it’s safer and calmer to make everything official.

general characteristics

The procedure for entering into an inheritance without a will means the voluntary and unconditional acceptance of values (Article 1152). Consent must be expressed documented or confirmed by the actual receipt of things, money, property rights. Previously, the family has the right to familiarize itself with the value of assets and the amount of debts. The decision must be balanced, since it cannot be changed later. Forcing relatives to participate in the procedure for registering an inheritance with a notary after the death of the debtor is not allowed.

It is also impossible to renounce part of the assets. The civil legislation of the Russian Federation provides for the receipt of the entire complex.

The issuance of a notarial certificate becomes the basis for forwarding creditor claims. Along with the deceased’s valuables, his debts are transferred to the new owner. If there are no applicants, repayment is made from the property estate. Unfulfilled claims are considered uncollectible and then written off.

What can be included in inheritance and what not?

The inheritance is formed from the things and other property of the deceased person, as well as the property rights and obligations belonging to him. In other words, not only assets are subject to inheritance, but also the debts of the testator, which are distributed in a similar way among the heirs.

The exception is those property rights and debts that are directly related to the personality of the deceased person. These include alimony, payments as compensation for harm or damage caused to the health and life of the testator or third parties. Intangible benefits, including non-property rights, are not subject to inclusion in the inheritance.

How is an inheritance distributed without a will?

Only relatives can take over rights without documenting the last will of the deceased. The basic rules are contained in Art. 1116 of the Civil Code of the Russian Federation. On the opening day of the case, all applicants must be alive. An exception is made only for the children of the testator. A child has rights from the moment of conception. The registration procedure is suspended. Babies born alive are given an equal share as everyone else.

The main feature is the order:

- Parents, children, spouses (Articles 1142, 1148 of the Civil Code of the Russian Federation). Immediate family members are called first. At the same time, dependents receive a share. The wife or husband loses the opportunity if the marriage has been dissolved by the time the citizen dies. The right to inherit property after the death of a former spouse arises from recipients of alimony (Article 90 of the RF IC). They must live together with the deceased owner for at least 1 year.

- Sisters, brothers, grandmothers, grandfathers (Article 1143 of the Civil Code of the Russian Federation). They can get the property secondarily. Claiming a share is allowed if there is at least one common parent. The fact of living together or maintaining close relationships does not affect the distribution.

- Uncles, aunts (Article 1144 of the Civil Code of the Russian Federation). In the absence of a will in the event of death, they are included in the third line of inheritance. To be included in the number of applicants, one blood relative is enough.

Subsequent queues are listed in Article 1145 of the Code. Conscription is carried out according to the number of generations. The list of applicants is opened by great-grandparents. He is completed by his great-nephews and nieces. The last to be called are stepdaughters, stepsons, stepfathers, stepmothers.

The order and scheme of inheritance of the rights and property of the deceased according to the law is supplemented by specific rules. Thus, it is necessary to take into account the presentation mechanism. If a family member has died by the time the case is opened, his children can take the share.

What is the personal property of spouses?

Whether property is personal is determined by the time of its acquisition and the method of receipt. So, for example, all property that you acquired before marriage will be exclusively yours. After marriage, it will not be considered joint property.

However, you can receive personal property while you are married. This will be considered all that you:

- Receive as a gift, either officially by deed of gift (for property worth over ten thousand rubles) or without drawing up this document;

Read how to draw up a deed of gift for an apartment here.

- You will inherit.

Attention!

After the death of the wife, her personal property will be inherited by law, that is, according to the lines of inheritance or by will. In this case, there will be no division into two equal shares, and the spouse cannot claim half of this property.

What you need to know about deadlines

Registration of inheritance without a will is carried out within 6 months. The period is counted from the date of death of the previous owner. An exception is made for cases where the testator is declared deceased. The starting point is the date of entry into force of the judicial act (Article 1154 of the Civil Code of the Russian Federation).

A similar period is established for persons called up as a result of removal from the previous queue. The period is counted from the moment such right arises. If the property was not claimed by the parents, spouse and children of the deceased, other relatives can take advantage of the opportunity after them. Another 3 months are allotted for this.

The notary comments: Example: A widow expected an inheritance without a will from her husband (first priority). However, during the investigation, her involvement in the man’s death became clear. After the verdict was passed, the convicted woman could not lay claim to the assets. Since the testator had neither parents nor children, his brother was called to the procedure. The relative was given an additional 3 months for registration.

The period for entering into inheritance rights without a will after death can be restored. The notary will redistribute the shares if the remaining participants give written consent. If a dispute arises, you will have to go to court. The condition is that the applicant has valid reasons. An exhaustive list of such circumstances has not been established. The following arguments are considered valid:

- Lack of information about the death of a relative, as well as the objective impossibility of obtaining it. The period of inheritance according to the law is not restored to spouses, parents, and adult children if the omission was a consequence of the cessation of communication. Personal hostility is not recognized as a valid reason.

- The incapacitated citizen does not have the opportunity to exercise his rights to register an inheritance according to the law with a notary. This circumstance can be invoked by children under 18 years of age and warded adult citizens.

- Long-term illness associated with stay in a medical organization.

- Misleading a person, deception, threats, violence leading to disruption of order.

The practice of restoring deadlines remains controversial. Thus, not all courts satisfy the demands of persons in correctional institutions. According to the law, deprivation of liberty does not prevent the entry into inheritance rights without a will and the execution of documents. However, in practice, filing an application can be difficult. The servants of Themis approach the consideration of such cases in a comprehensive manner.

Conclusion

- In Russia, there are two options for inheritance - by will or by law.

- The first option involves the execution and notarization of a will or inheritance agreement. It does not abolish the rights of compulsory heirs.

- The second option is used in all other cases and in relation to property not included in the will. In this case, inheritance occurs in the order of priority established by law.

- The first and main condition for receiving an inheritance is to contact a notary - to open an inheritance case or (if it is already open) to be included in it.

- You must contact a notary within six months. After this, you need to collect and provide the necessary package of documents, obtain the appropriate certificate and register ownership of the property.

Methods for registering an inheritance without a will

Regulatory documents mention two options. To receive property, it is necessary to submit an application or actually accept the property of the testator after death (Article 1153 of the Civil Code of the Russian Federation). Each method has its own characteristics.

Contacting a notary

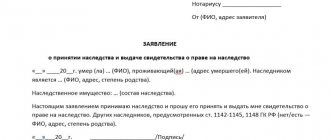

If we are talking about real estate, the application procedure is mandatory. Transactions with such objects are subject to state registration. Documents will have to be notarized if you have transport, registered securities, bank deposits, or investment account balances. Family members will be able to use them only after receiving a certificate.

The order is as follows:

- Definition of an authorized official. Registration of inheritance without a will is carried out at the place of residence of the deceased (Article 1115 of the Civil Code of the Russian Federation). In large cities, division into microdistricts, districts, and blocks is being introduced. If there is no information about the address of the testator, the case is opened taking into account the location of the property. If other relatives have previously contacted the notary, you can find information on the official website of the Federal Tax Service of the Russian Federation.

- Submitting an application. Interested parties simply need to come to the office, present identification and voice their intentions. Representatives must act on behalf of minors and incapacitated persons. A document for receiving an inheritance without a will after death can be drawn up in advance or using a notary form. If the application is sent by mail or transmitted through an intermediary, the authenticity of the signature is verified.

- Registration of a certificate. Following the procedure, confirmation of rights is issued. The presence of a notarial certificate allows new owners to register property in state registers.

Inheritance by fact: entry procedure

Acceptance of values can be confirmed by performing certain actions. Their list is given in Art. 1153 of the Civil Code of the Russian Federation and clarified clause 36 of Resolution of the Supreme Court of the Russian Federation No. 9 of May 29, 2012.

To comply with the procedure for entering into an inheritance without a will, moving into an apartment and paying for utilities after the death of the owner is sufficient. Transport is accepted if family members bear the cost of repairing it. The procedure is also observed when filing a claim for the protection of valuables from attacks and repayment of debts. But receipt of a funeral benefit for the testator cannot be considered as confirmation.

The notary comments: Example: A citizen died, leaving behind a comfortable apartment. The testator's adult daughter received benefits and arranged the funeral. The son moved into the premises, paying bills for electricity, gas, and water supply. After 6 months, a dispute arose between the children. Since the inheritance for the apartment was not registered with a notary after the death of his father, he had to go to court for confirmation. The “Servants of Themis” satisfied the son’s demands. It was his actions that evidenced the acceptance of the testator’s property.

You can do without contacting a notary if the existing valuables are not subject to state registration. Personal belongings, household appliances, cash, jewelry - the relatives of the deceased divide them independently by mutual decision.

FAQ

What is meant by inheritance?

Inheritance is the property and property rights or obligations of a deceased person that are subject to distribution among the heirs.

What methods of inheritance exist in Russia?

Today, inheritance is carried out in one of two ways: by will (if such a document is officially executed and certified by a notary, an inheritance agreement is equivalent to it) or by law (in all other cases).

Which heirs are in the first line?

Closest relatives – spouses, children, parents.

Who is included in the list of compulsory heirs?

Minor or incapacitated children, disabled or incompetent spouses and parents, and disabled dependents.

How long does it take to contact a notary?

The law establishes the need to contact a notary within six months. If the deadline is missed, it can be restored, but only with the consent of other heirs or by court.

How to register an inheritance without a will according to law

Notaries adhere to the Methodological Recommendations of the Federal Tax Service of the Russian Federation No. 03/19 dated March 25, 2019. The basis for opening a case is a document indicating the death and the need to distribute the property of the testator. To start the proceedings, a statement from the interested party, someone’s refusal to receive valuables or other requests is sufficient.

The procedure for registering an inheritance case by a notary involves collecting and recording information. Information about assets and potential recipients is analyzed. The corresponding entry is made in the unified register of the Federal Tax Service of the Russian Federation. As part of the proceedings, requests may be sent to banks, tax authorities and other authorities. Telecommunication channels are now actively used. At this stage, the testator is checked for bankruptcy.

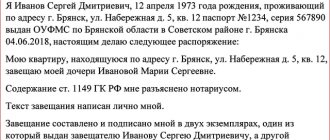

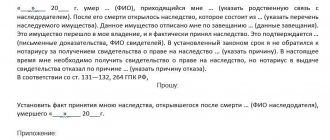

Application and attachments to it

This is a mandatory stage of acquiring an inheritance without a will. A written appeal becomes the basis for including a person in the list of property recipients.

A single sample has not been approved. However, the application must contain information about the applicant, date, consent to accept the inheritance, grounds for claims, signature (clause 5.16 of Methodological Recommendations No. 03/09).

The following circumstances and facts will need to be confirmed:

| Presence and degree of relationship |

|

| Composition of property |

|

| Grade |

|

How much does it cost to enter into an inheritance without a will in Moscow and when can you not pay?

The price consists of the state fee for individual notarial acts, as well as remuneration for technical, consulting and legal assistance. The costs of obtaining an intestate estate depend on the valuation of the estate left after death and the number of applicants.

The size of the state duty is established by Art. 333.24 Tax Code of the Russian Federation. To accept money as a deposit you will have to pay 0.5% of the amount, but not more than 20,000 in domestic currency. A certain amount is also collected for protective measures.

The cost of obtaining a certificate of inheritance rights is determined taking into account the type of relatives. From parents, spouses, children of full brothers and sisters, 0.3% of the value of assets is withheld, but not more than 100,000 rubles. When inheriting by other heirs, you will have to pay 2 times more - 0.6% with a limit of 1,000,000.

Remuneration for services is calculated according to tariffs. They are approved taking into account Art. 22.1 Fundamentals No. 4462-1 and rates of the regional chamber.

According to Art. 333.38 of the Tax Code of the Russian Federation, a notary applies a preferential procedure for entering into inheritance. The following are exempt from duty:

- Government bodies. Before transferring rights to public structures, a search for family members and relatives is organized. Only in their absence does the property pass to the authorities.

- Disabled people. The benefit is provided to citizens of groups 1 and 2. They will have to pay only 50% of the established amount.

- Individual. For inheritance without a will in the form of a privatized apartment, as well as a house and land under it, state duty is not withheld. The condition for the norm to come into force is living in such premises before and after the death of the owner. The distribution of property of testators who died in the performance of military, civil, or public duty or who died no later than 12 months after receiving injuries in these circumstances is excluded from taxation. The rule applies to bank deposits, insurance payments, labor and royalties. The benefit applies if the testator received only a pension.

- Incapacitated relatives. Inheritance is recognized as free for minor children and wards with mental disorders.

The benefit applies only to state fees. Related services will have to be paid according to the tariffs.

Issuance of a notarial certificate

Based on the results of the property distribution procedure, each family member is issued a title document. Its form was approved by order of the Ministry of Justice of the Russian Federation No. 313 of December 27, 2016. The law allows a general certificate to be issued for a shared inheritance. The rights of new owners are indicated in the form of simple fractions.

After receiving the document, you can freely use and dispose of the assets. If we are talking about real estate, you will first have to enter information into a unified federal database

The notary comments: Example: After the death of a grandmother who died without a will, the inheritance in the form of an apartment went to her grandson. However, the young man was unable to sell the premises after taking ownership. The notary explained what additional documents he must prepare. Before concluding the transaction, the grandson should have registered the transfer of real estate from the testator.

Other assets may require additional action. Thus, depositories transfer securities to the name of the new owner and pay dividends only after presentation of the certificate. The operation of a vehicle involves registration with the traffic police.

What documents are required

Documents for registration of inheritance can be divided into two categories:

- Those that are presented at the first visit and writing an application for acceptance of the inheritance or refusal of it.

- Those required to prepare a certificate of inheritance.

First of all, the notary must bring the documents necessary to register the inheritance. Namely:

- Passport/passports (in addition, the notary may ask for TIN and SNILS).

- Death certificate.

- A certificate from the housing authority about the composition of the deceased’s family (to make it clear whether the heirs lived with him or not).

- Documents confirming family ties.

- Will (if there is one).

The need for subsequent documents depends on the nature of the inherited property. What documents may be needed to register an inheritance? Those that confirm the testator’s right to this or that property, or its very existence:

- Real estate purchase and sale agreements.

- Cadastral and technical passports.

- Banking agreements.

- PTS/STS for transport.

- Property valuation acts, etc.

The notary will definitely tell you what he needs to draw up a certificate of inheritance. If certain papers are missing, the notary may request additional information.

Inheritance of part of the property by close relatives, children, guardians, former spouses

The deceased's assets are distributed among family members in equal amounts. Regardless of the call-up order, disabled dependents have the right to count on a share (Article 1148 of the Civil Code of the Russian Federation).

Parents or adoptive parents, biological or adopted children are considered first priority applicants. Lack of blood relationship does not matter. But guardians are not included in the circle of applicants. Ex-spouses are not granted the same rights. Only recipients of alimony who have lived with the deceased under the same roof for at least 1 year can count on a share of the inheritance after the death of an ex-husband/wife without a will.

Joint ownership deserves special attention. The transfer of an indivisible thing to several citizens is permitted. Rights are calculated in the form of simple fractions. The management and disposal of such assets is regulated by Chapter 16 of the Civil Code of the Russian Federation.

If joint ownership is not possible, it is permitted to enter into an agreement on the payment of compensation. The mandatory share of spouses in inheritance by law gives an advantage. According to Art. 1168 of the Civil Code of the Russian Federation, a widower or widow may demand sole use of a thing. Priority is also given to relatives who constantly exploited the property. In addition, household members have the right to claim household items or furnishings of the testator’s living space. In this case, the benefit holders will pay compensation in full.

Difficult moments

The husband has no right to dispose of the wife's property, which she owned before marriage. The same rule applies to property received by inheritance. Such property is not included in jointly acquired property. As an exception, a positive decision may be made if a significant increase in value as a result of investments during the marriage is proven.

The court may not take into account the right of spouses to equal shares in common property if it comes to the need to take into account the interests of minors.

What rules of inheritance apply to relatives?

Having a blood connection is far from the only condition for obtaining property. Thus, citizens who tried to prevent the legal distribution of the assets of the deceased are excluded from the list of applicants (Article 1117 of the Code).

Before claiming a part of the inheritance without a will, it makes sense to evaluate your good faith. Parents, adoptive parents, guardians, and trustees who are removed from raising children by decision of a government agency or court will not be able to receive the valuables. Persons who maliciously evaded the obligation to support the testator are subject to exclusion from the circle of applicants.

If one relative evades/refuses to receive property, the shares of other family members increase proportionally. Exceptions include cases of targeted refusal. In this situation, the part of the person in whose favor the document was drawn up is subject to increment (Article 1161 of the Civil Code of the Russian Federation).

Refusal to register a document

The reasons for refusal are individual in each case. If an MFC employee refuses, you need to consult him about the reasons for this decision. The most common reasons for refusal to register documents are :

- an application for registration of documents incorrectly completed by the registrar;

- presence of blots and corrections in documents;

- imposition of judicial seizure on inherited property;

- presence of encumbrance;

- litigation regarding the inheritance estate;

- failure to pay state fees or lack of supporting receipts.

Accepting an inheritance is always accompanied by hassle and a large number of required documents. By contacting the MFC, the heir will save a lot of time, because all he has to do is obtain papers certifying ownership of the inherited property. If he has questions, he can get answers to them from an MFC employee.

Ask any questions about registering an inheritance in the comments, we will answer within 24 hours.

Briefly about the problems

The notary not only checks the basis of inheritance rights according to the law among relatives, but also searches for potential recipients. Once the case is opened, written notices are sent. Notifications are given to relatives whose place of residence is known. Additionally, an announcement is published in the media (Article 61 of the Fundamentals No. 4462-1). Thus, even children who have stopped communicating can find out about the death of their parents (father, mother) and, after their death, claim rights to a part of the inheritance without a will. Responsibility for timely treatment falls entirely on family members. In practice, public posting of information is not always sufficient.

Creditor claims remain a serious problem. Thus, not all citizens conduct a preliminary assessment of the testator’s obligations. The result is numerous lawsuits over debts. The solution is to thoroughly check the testator.

Another difficulty is the high level of conflict in relationships. The procedure for inheriting rights to property after death by law (without a will) is supplemented by numerous legal mechanisms. The scheme for transferring things is not transparent. The notary has to remember about transmission, mandatory shares, and work with applicants on the right of representation. Relatives are not always ready for such a multifaceted process. Thus, when taking over their rights after the death of their husband, widows often face claims to part of the inheritance from illegitimate children. The result is heated debate. The solution is dialogue between all participants.

Inheritance contract

The will is drawn up by the testator independently. Only he himself will decide whether to inform his heirs about him or not. The information contained in the will is considered secret.

But the legislation also provides for another format of a document similar in meaning, which is called an inheritance agreement. It is concluded between the testator and any of the heirs (or several of them) and contains the conditions for receiving the inheritance.

An inheritance agreement, like a will, is certified by a notary and can be canceled at the request of the testator at any time.

The legislation does not provide for strict requirements for its content. Typically the contract includes the following information:

- rules for determining heirs;

- the procedure for transferring rights to property;

- conditions for appointing an executor;

- responsibilities of heirs, the fulfillment of which is necessary to receive an inheritance (not in conflict with the law);

- other circumstances and conditions affecting the distribution of the testator's assets.

It is important to note that an inheritance agreement has greater legal force than a will. In other words, if both documents are available, the first one is valid.

How to obtain inheritance rights without a will through transmission

The mechanism is described in Art. 1156 of the Civil Code of the Russian Federation. The rule applies in the event of the death of a potential recipient of property. The death must be recorded before the end of the 6-month period after the death of the testator. Human rights are transferred to his children, parents, and spouses.

The notary comments: Example: The owner of the apartment had an adult son and daughter. After the funeral, only the man submitted an application to register an inheritance with a notary after the death of his mother. His sister died during childbirth. By way of transfer, a newborn baby was recognized as the recipient of part of the real estate.

The norm establishes a limitation of the implementation of the mechanism to one generation. This means that in the event of the death of the transmission heir, the right to receive the valuables ceases.

Escheat

Assets unclaimed within 6 months acquire a special status (Article 1151 of the Civil Code of the Russian Federation). After the death of the testator, the property is transferred to the municipality or the state. The condition is the complete absence of relatives or their refusal/removal from the procedure.

The existing real estate becomes the property of the locality. Money, jewelry, and other things go to the state. The transfer of assets to regions is determined by separate laws.

In conclusion, we note that each inheritance case has its own nuances. Before making a decision or going to court, you should consult a notary. Our office receives clients until 9 pm, as well as on weekends and holidays. You can make an appointment by phone or by filling out the application form on the website.