Purchasers of land plots and other real estate properties have the right to property tax deductions. This makes it possible to return income tax from the budget or not pay it in the future. It will be useful for anyone who has become the owner of a garage structure to find out whether it is possible to obtain a tax deduction when purchasing a garage.

Will the tax be refunded?

The procedure and conditions for tax refunds when purchasing various real estate properties are set out in Article 220 of the Tax Code of the Russian Federation. There is no tax deduction available for purchasing a garage in 2021. A garage box does not belong to residential premises.

Important! The right to receive a property tax deduction arises only when concluding purchase and sale transactions of real estate related to the housing stock.

Even if the owner subsequently converts the box into a suitable premises for living, he still will not be able to return the deduction. The conversion of non-residential premises into residential premises is not considered as construction or purchase.

Important! Every garage owner must remember that in relation to transactions with such property, the right of deduction can only be used to reduce the amount of income tax.

Changes in legislation

The person who bought the garage needs to be aware of the changes, as they affect

rights to receive deductions in the future. According to the new rules, the period of ownership, during which you do not have to report to the tax authorities and pay a fee, is 5 years. That is, if this deadline has not passed, you will have to go through the procedures described above.

However, the new provisions apply to property acquired after January 1, 2021; for other real estate, the period remains the same - 3 years. If you are going to buy or sell land for a garage, then you should adhere to the same rules, since land plots belong to a different type of property.

What documents are needed

The owner of the garage is required to fill out a declaration and pay personal income tax. Before contacting the tax authority, you need to collect papers that will help in calculating the exact amount of payment and receive a property deduction.

Main list of documents:

- Agreement for the purchase and sale of a garage building (copy).

- Certificate of ownership of the structure (copy).

- Copies of documentation documenting the costs of purchasing a garage.

- Copies of certificates of receipt (or non-receipt) of income for the year from the sale of property.

- Completed declaration.

- Passport or identity card (copy).

When contacting the tax service, you must have the originals of all these documents with you.

We prepare documents

Until January 1, 2021, to obtain a property tax deduction, real estate objects that did not exceed the ownership period of more than 3 years were taken into consideration. If the deal was concluded after this date, you will have to wait 5 years to save yourself from having to report and pay.

There will be no need to report on purchased property for less than 3 years in 2021, but the person who sold it will have to if the purchase of a garage falls within the above deadlines. To do this, you need to fill out the 3-NDFL declaration.

Depending on the situation, you should fill out the declaration in different ways - if a citizen has expenses and documents confirming them, you should attach them and fill out the appropriate fields.

When documents are not saved, other lines are filled in. If a garage is sold for the second time in a year, other values are filled in, and if a car was also bought along with the garage, then completely different values are entered into completely different lines.

If necessary, you can contact specialized companies to prepare documents. For a fee, their employees will independently calculate the tax and draw up a declaration, which will need to be personally taken to the tax authority or sent by email using a special resource.

What is a tax deduction

Personal income tax is the obligation of every Russian to pay income tax in the amount of 13%. In a situation where a person sells a structure for maintaining a car for a million rubles, the tax on the sale of the garage will be 130 thousand rubles. This amount can be reduced or not paid at all if a number of conditions are met.

Tax deductions, which represent a refund of funds spent on education and treatment, and the acquisition of real estate, are relieved of the obligation to pay gigantic sums.

Conclusion

In transactions with non-residential real estate, it is impossible to reimburse personal income tax, but it can be used to reduce the amount of tax calculated on the amount of funds received from the sale. Depending on the availability of documents confirming expenses for the property being sold, the amount of tax also changes - the number of rubles, if documents are available, will decrease. Otherwise, it makes sense to use the deduction amount of 250,000 rubles, unless, of course, it has already been used previously. It should be understood that this deduction is provided only once in a lifetime—multiple use is prohibited by law.

The deadline for incurring obligations to the tax authorities has been increased to 5 years, but only for objects acquired since the changes took effect. The previous period of 3 years applies to all previously purchased objects.

The income received from the sale of the garage should be reported using the 3-NDFL declaration form. You can draw it up either independently or with the help of special companies that provide services for drawing up and submitting declarations. The cost of such services varies depending on the region, and the price list is compiled by management and is not controlled by legislation or government agencies.

https://youtu.be/miawHj2dkKc

Refund of property tax deduction when selling a garage in 2021

Every owner of a garage box should know whether he will have to pay tax if he sells it. According to the Civil Code of the Russian Federation, a garage is recognized as real estate if it is inextricably linked with the land plot. A permanent structure has a solid foundation and cannot be moved to another location. When calculating tax payments when selling a building, two factors are taken into account:

- The amount for which it was sold.

- The length of time the item is in the seller's possession.

Residents of the Russian Federation pay 13% of their income to the treasury. If the owner of the garage is not a resident of Russia, the tax will be 30% of the amount of additional income.

Garage amnesty 2021 – latest news on garage law

Tax deduction when buying a garage - is it possible to get it?

The law says that when making any real estate transactions, citizens must independently assess personal income tax. At first glance, it may seem that there is nothing complicated about selling or buying - the parties have agreed on the object and the cost, all that remains is to sign the documents and re-register the right.

However, there are nuances specified in the Tax Code of the Russian Federation.

Latest Garage Amnesty news in 2021

The first edition of the bill under number 1043216-6 “On the right of ownership of garages and garage associations” was submitted to the State Duma for consideration back in April 2021, but was rejected on July 25, 2021.

The new version of the project was called “On garages, on the procedure for acquiring rights to them and on introducing amendments to certain legislative acts of the Russian Federation” and was prepared by the Ministry of Economic Development in February 2021 . Its text implies amendments to other legislative acts:

- on social protection of disabled people;

- about mortgage;

- land code;

- town planning code;

- on state registration of real estate;

- about banks and banking activities.

The bill is quite large-scale and requires a comprehensive study of issues related to legal regulation in relation to garages. Information about its submission for consideration has not yet been registered. We will monitor further changes.

Here we will look at frequently asked questions:

- What is the area of the free plot? It all depends on the garage itself, no more than 30 square meters. meters.

- How long can it take to apply? Registration takes 12 days, excluding the collection of documents.

Do I need to pay tax on garage sales?

Another important question for retirees is whether they need to pay tax on garage sales in 2021. The answer depends on the following two factors:

- The assigned price at the conclusion of the transaction.

- How long was the special-purpose building owned by the pensioner?

To sum up the question of whether pensioners pay tax when selling a garage, we can clearly answer that payment is made on a general basis, as provided for individuals.

Retirement age is not a basis for exemption from payment of financial obligations from income. The categories of citizens who can count on tax exemption are people of retirement age, living in certain regions.

In addition, pensioners are exempt from financial obligations when selling property:

- Heroes of the Soviet Union and Russia.

- Having the Order of Glory of the third degree.

- Disabled people.

Do I need to pay sales tax?

After signing the purchase and sale agreement for the garage structure, all documents for it are transferred to the new owner. Before calculating personal income tax on income received, pay attention to the fact: for how long the garage was in the possession of the seller. If it is more than 3 years, income taxation is removed - the person does not need to file a declaration.

Important! When a citizen has owned a car storage box for less than 3 years, he is obliged to report and make payment.

A declaration in Form 3 is filled out and all papers are presented. The tax is calculated based on the value indicated in the purchase and sale agreement.

A person may at this moment exercise the right to reduce the amount of tax payment. For real estate that is not residential (such as a garage), the deduction amount will be 250 thousand rubles. Calculation procedure:

- Subtract the amount spent on the purchase of a garage box from the cost of income.

- Subtract 13% from the remaining amount to transfer to the budget.

- If there are no papers confirming the original cost of the structure, a tax deduction is applied. They deduct 250 thousand rubles from the transaction amount. Subtract 13% from the balance.

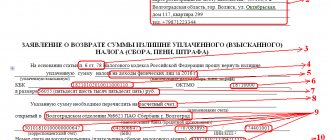

Instructions for drawing up 3-NDFL

You can order the preparation of 3-NDFL from us, or you can do it yourself.

When drawing up a declaration, a ready-made form for writing and a visual sample already filled out. The form is filled out as legibly as possible in capital block letters in accordance with the sections presented. To be filled in with a pen and blue or black ink. If you print it on a printer, then only one-sided printing with blue or black ink is used. You cannot correct anything in the declaration.

If the text was deformed during printing, the sheet should be reprinted. Each letter must have its own cell. The numbers must be indicated in rubles; if up to 50 kopecks we round down, if above - up. Form fields are filled out from left to right. If some indicator is missing in the cells, put a dash. At the bottom we sign and put the date.

How to submit a declaration

All financial transactions with a garage building that fall under the taxable category are subject to declaration at the place of registration in the Federal Tax Service.

Important! The declaration must be submitted no later than April 30 of the year following the year in which the real estate purchase and sale transaction was concluded.

If the seller fails to meet the deadline, penalties will be charged for each month of delay in the amount of 5% of the due tax amount to be paid.

When a citizen fills out a declaration, he must pay the due tax payment no later than June 15 of the year that follows the year of the transaction and receipt of funds. In case of non-payment, a penalty will be charged.

To submit a declaration, use any convenient method:

- Personal appeal to a representative of the tax authority.

- Sending by Russian Post by registered mail.

- Through the Internet portal of State Services.

- Through a representative on the basis of a notarized power of attorney.

When submitting a declaration by registered mail and using the State Services service, you must visit the tax office to sign the application.

How to get a tax deduction when buying a garage: step-by-step instructions from R.TIGER

Personal income tax is the obligation of residents (citizens and foreigners with the appropriate status) to pay income tax in the amount of 13%. When any transaction occurs, including garage sales, income is generated on which tax is levied. In the declaration, the owner must enter information about the funds received and make contributions to the state.

The state accommodates citizens who pay income tax and provides them with the opportunity to take advantage of tax deductions. The owner has the right to request a refund if the garage was owned for up to three years, and from 2021 – up to five years.

The owner can also claim a deduction for the garage property and for the plot, if the garage has land. In the purchase and sale agreement you just need to fix separately the price of the garage and the land, they will play the main role, as well as the time they remain in the property.

The list of income from which personal income tax is not withheld is written in Art. 217 Tax Code of the Russian Federation. In Art. 217.1 of the Tax Code of the Russian Federation discusses the features of exemption from payment of real estate tax. The conditions for tax refund when purchasing various real estate properties can be read in Article 220 of the Tax Code of the Russian Federation. General issues that relate to real estate are regulated by the Civil Code of the Russian Federation and Federal Law No. 218.

For a garage, the fixed deduction amount is RUB 250,000.

Get an initial consultation from several companies for free

: fill out an application and the system will select suitable companies!

24 companies are connected to this service

Start selection in a few clicks >

Procedure for calculating personal income tax

To calculate personal income tax, you need to subtract the amount spent on the purchase of a garage from the cost of income. Then 13% of the remaining amount is calculated to be transferred to the budget. If there are no papers confirming the original cost, a tax deduction is applied. They deduct 250,000 rubles from the transaction amount. Calculate 13% of the balance.

To make it more clear, let's give an example. You decide to sell for 400,000 rubles. your garage, which you have owned for 2 years. You have the right to take advantage of a deduction or reduce the income received, on which personal income tax will be charged. We calculate the tax deduction as follows:

Cost of garage at sale - Maximum deduction amount = 400,000 - 250,000 = 150,000.

Now we calculate personal income tax: 150,000 * 13% = 19,500 rubles.

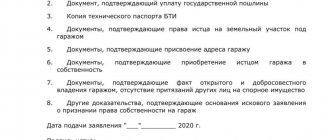

Documents for obtaining a tax deduction

Basic list of required documents:

- first of all, of course, copies and originals of personal documents;

- ownership documents;

- contract of sale;

- application for refund;

- form 2-NDFL and form 3-NDFL;

- financial documents on expenses.

You can submit a declaration by personally contacting the tax authority, sending it by registered mail, using the Internet service of the State Services, or submitting it through your representative (based on a notarized power of attorney). In case of points 2 and 3, it is true that you will still have to contact the tax office in person to sign the application.

The declaration must be submitted by April 30 of the year following the year in which the purchase and sale transaction was concluded. After completing the declaration, the garage owner is obliged to repay the tax payment no later than June 15.

Consequently, if the garage owner does not enter within these deadlines, for failure to comply with the deadlines for submitting the declaration and failure to pay the tax, he will be charged fines for each month of delay in the amount of 5% of the due amount of tax to be paid.

Who is entitled to a tax deduction?

The following have the right to it:

- those who purchased or built a garage;

- those who bought a plot of land for construction together with a residential building - both at their own expense and through borrowed money.

There are also citizens who are not entitled to a tax deduction. Namely:

- unemployed pensioners who do not receive official income and did not pay income tax in the previous tax period;

- people who have unofficial income (“salaries in envelopes”) and do not pay income tax;

- close relatives conducting a purchase and sale transaction between themselves (parents and children; adoptive parents and adopted children; full and half brothers and sisters; grandchildren and grandparents);

- entrepreneurs using a special tax regime (UTII, simplified tax system), regarding income received from business activities. But, if an entrepreneur, in addition to these taxation systems, carries out activities or performs work that is subject to personal income tax, he acquires the right to a deduction.

Instructions for drawing up 3-NDFL

You can order the preparation of 3-NDFL from us, or you can do it yourself.

When drawing up a declaration, a ready-made form for writing and a visual sample already filled out.

The form is filled out as legibly as possible in capital block letters in accordance with the sections presented. To be filled in with a pen and blue or black ink.

If you print it on a printer, then only one-sided printing with blue or black ink is used. You cannot correct anything in the declaration.

If the text was deformed during printing, the sheet should be reprinted. Each letter must have its own cell. The numbers must be indicated in rubles; if up to 50 kopecks we round down, if above - up. Form fields are filled out from left to right. If some indicator is missing in the cells, put a dash. At the bottom we sign and put the date.

Source: https://rtiger.com/ru/journal/kak-poluchit-nalogovyi-vychet-pri-pokupke-garaja-poshagovaya-instruktsiya/