First, it’s worth understanding in what cases a co-borrower on a mortgage can receive a deduction. According to the law, the party involved in the loan agreement has the right to a refund if the following conditions are met:

- the property purchased with a mortgage or its share is registered in the name of a co-borrower, including a spouse (otherwise no tax deduction is allowed, even if they pay the debt in full);

- there are documents confirming the payment of taxes and expenses for repaying the mortgage loan;

- the right to a tax deduction has not been used previously (it can only be used once);

To receive the money due, the co-borrower, as well as the title borrower, must fulfill all these conditions.

Options for obtaining a tax deduction for a mortgage

When purchasing an apartment with the help of a mortgage, co-borrowers can use one of two options for income tax refund: from the purchase and from interest on the loan.

In the first case, when purchasing real estate, participants in the transaction can receive 13% of 2 million rubles. If the cost of housing is lower, then the unused part of the deduction can be used in the future when purchasing another residential property.

A co-borrower can receive 13% of RUB 3 million from interest on a mortgage loan. The peculiarity of this option is that the payment is made once. The unused portion is not carried over to the next transaction.

In what cases can a co-borrower receive a deduction?

It is legally determined that a co-borrower will have the right to a tax deduction if the following conditions are met:

- Availability of documents confirming the purchase of housing by the co-borrower. The acquired property or its share must be registered as the property of a co-borrower (the rule does not apply to spouses; the acquired property becomes common to them in any case);

- If the co-borrower has not previously used the right to apply for a tax deduction. By law, you can only use it once;

- The co-borrower must be a personal income tax payer;

- Availability of documents confirming the fact that the co-borrower has incurred expenses for servicing the mortgage loan.

It is mandatory to fulfill all requirements together

If the co-borrower under the agreement is a spouse, then he can receive a tax deduction in any ratio with the main debtor. Usually the shares are distributed 50/50, but by agreement of the parties any other ratio can be agreed upon. Since the deduction is calculated annually, the proportions can be changed at the request of the spouses.

When drawing up a mortgage agreement, it is necessary to think in advance which of the spouses is more profitable to issue a tax deduction, since there are situations when the main borrower, not having a permanent job, cannot count on payment, while the co-borrower under the agreement can return part of the funds spent on buying a home.

One party to the transaction may completely refuse to receive payments.

Documents for income tax refund

To receive a tax deduction, the co-borrower must provide the following documents to the Federal Tax Service:

- passport;

- an extract from the Unified State Register to confirm the fact of acquisition of the object or its share;

- loan agreement;

- certificate 2-NDFL for the reporting period to confirm payment of taxes;

- a statement from the bank about payments made to service the mortgage debt;

- if available, marriage certificate;

- Declaration 3-NDFL.

You can get a more complete list by consulting with Federal Tax Service managers.

Conditions for returning personal income tax when purchasing an apartment

In the case of purchasing an apartment, it is possible to return part of the invested funds through the use of property deductions (Article 220 of the Tax Code of the Russian Federation). They exist in two forms that can be used together:

- Direct costs of purchase or construction:

- their volume is limited to 2,000,000 rubles;

- the deduction can be attributed not to one, but to several objects;

- if the apartment is sold without finishing (and this is reflected in the contract), then it is permissible to include the costs of finishing work and materials in the amount of purchase costs.

- Mortgage interest. This deduction is also limited in amount (RUB 3,000,000). Additionally, it can only be applied to one object.

The procedure for obtaining a deduction when purchasing an apartment with a mortgage is described in detail at ConsultantPlus. You can view the experts’ explanations and see the line-by-line filling out of the declaration for the mortgagee by getting free trial access to the system.

Deductions can be used:

- in relation to income taxed at a rate of 13%;

- if there is a right to property, which will be confirmed by the corresponding certificate issued when purchasing the object, or an acceptance certificate for shared participation in construction;

- for expenses that have documentary evidence and were made by the taxpayer personally, not at the expense of budget funds (or maternity capital funds) and not when purchased from a related party;

- each of the owners for the full amount when purchasing in joint or shared ownership;

- when parents purchase housing registered for children under 18 years of age.

Read more about deductions for a mortgage in the material “Tax deduction when buying an apartment with a mortgage (nuances)” .

Step-by-step instructions for income tax refund

After collecting documents, the co-borrower must apply for a tax refund. The sample contains the applicant's full name, TIN, place of residence, period for which the deduction is issued, the calculated amount, details for transferring funds, etc. It is recommended to clarify more detailed information at the Federal Tax Service office, since at the moment there is no regulated application form.

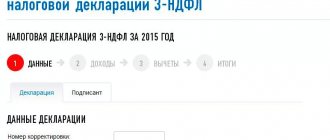

The next step is to fill out the 3-NDFL declaration. You can do this online at www.nalog.ru or use the help of specialists. The completed package of documents must be submitted to the Federal Tax Service by contacting a specific department and sent by mail with copies attached. After receiving them, the tax service will begin a desk audit, which lasts three months. If the documentation is in order, the co-borrower will receive a mortgage deduction within a month.

What is the most profitable way to apply for a property tax deduction: 5 life hacks

On their income, Russians pay personal income tax - a tax on personal income in the amount of 13% (for income over 5 million rubles per year - 15%). They can be returned by filing a tax deduction. For example, property - when buying a home.

There are two types of property deduction:

- for the purchase of real estate;

- to pay interest on a mortgage loan.

| Tax deduction for the purchase of real estate | Tax deduction for mortgage interest payments | |

| Limit (maximum amount with which you can get a deduction) | 2 million rubles per person (if the apartment was purchased after January 1, 2014). | — 3 million ₽ if the apartment was purchased after January 1, 2014; — there is no limit if the property was purchased before January 1, 2014. |

| Maximum deduction amount | 260 thousand ₽ (13% of 2 million ₽). | 390 thousand ₽ (13% of 3 million ₽) for real estate purchased no earlier than 2014. |

| Number of objects for the purchase of which you can apply for a deduction | — If the property was purchased after January 1, 2014, then you can get a deduction from several properties until the limit is exhausted. The remainder does not burn. — If the property was purchased before January 1, 2014, then you can only get a deduction for one property. The remainder is burned. | — You can only receive a deduction for one object. The remainder is burned. |

| When can I get it? | Only after receiving ownership. | There is no need to wait for the loan to be fully repaid. You can submit documents for deduction annually. |

Read on topic:

Instructions: what is a tax deduction and how to get it

5 ways to get a better tax return

1. Buy an apartment while married

If real estate was purchased during marriage, the tax deduction for its purchase will double - both spouses can receive a tax deduction. Each 260 thousand rubles for the purchase of housing and 390 thousand for interest on the mortgage. As a result, you can return 1.3 million rubles. True, in this case, interest on the loan must be paid for 6 million rubles, the cost of the apartment must be at least 4 million rubles (since the limit on deductions when buying a home is 2 million rubles for each person).

If the apartment was cheaper, you will have to distribute the shares.

2. Distribute shares wisely

If the property cost less than 4 million rubles, the spouses need to distribute the shares: who will receive a deduction from what amount.

Lyudmila Melnikova,

tax consultant

“If you were married at the time of purchasing your home, it is considered community property. Since 2014, each spouse can receive a deduction for their share in such an apartment. Here it is important to remember the restrictions of 2 million rubles per person. If the apartment cost 4 million rubles or more, then everything is simple: each spouse invests 2 million of their own money, so they can receive a full deduction.

If the apartment cost less than 4 million rubles, then each spouse paid less than 2 million. It doesn’t matter who in the family worked and earned more. This is common property. You just need to distribute the shares among the spouses. It is better to do this so that the spouse who pays more taxes has a larger share. Then you will receive the total deduction faster.

For example, a couple got married and a year later bought an apartment for 3 million rubles. At the family council, they decided that the wife’s share was 2 million, and the wife’s share was 1 million rubles. The wife receives the full amount of the deduction - 260 thousand rubles, and the husband - 130 thousand rubles. With the next purchase of real estate, the spouse will be able to again apply for a deduction from the remaining 1 million rubles and receive another 130 thousand rubles.”

3. Record all income

The amount of your property tax refund directly depends on the amount of your income: the more you receive, the more income tax is deducted. This means that you will have the required amount for your refund faster.

Therefore, you need to take income certificates from all places of work. Even if you work part-time at about a quarter of the rate, as a freelancer under a civil contract, this is still your income, you pay 13% tax on it and have the right to a refund.

4. Don’t rush to become self-employed

This applies, first of all, to freelancers - specialists who, as a rule, work remotely with different customers on a permanent or temporary basis. For example, photographers, designers, copywriters and other specialists.

There are several ways to formalize your employment relationship if you are a freelancer:

- Sign a civil contract (contract or service agreement). In this case, 13% income tax will be deducted from your salary, which means you will be able to receive a deduction.

- Sign up for a contract as a self-employed person. This is a tax on professional income with a preferential rate of 6% when providing services to legal entities. That is, by registering as self-employed, you will pay almost half the tax, which means you will receive more in your hands. However, you will no longer be able to return the taxes paid as a deduction.

Lyudmila Melnikova,

tax consultant

“Self-employed people pay tax on professional income and are exempt from personal income tax. Therefore, they cannot claim a property tax deduction, since it is used when calculating the tax base for personal income tax.”

It turns out that if a freelancer bought an apartment, it is more profitable for him to conclude a civil contract with the customer: although in this case the tax will be higher, he will be able to return it in full when he issues a deduction for the apartment.

The same situation applies to individual entrepreneurs (IP): an entrepreneur will receive a tax deduction only if he pays 13% and does not apply any special simplified tax regimes.

5. Apply for a deduction through your employer

You can receive a property tax deduction not only through the tax office, but also through your employer. In the first case, you have to wait until the end of the year to apply for a deduction and get it back from all taxes paid for the year. In the second case, there is no need to wait until the end of the year. That is, you can apply for a deduction immediately after the right to it arises.

To apply for a deduction through your employer, you need to receive a notification from the tax office that you have the right to a tax deduction indicating its amount, take it to your employer and write an application.

After this, the employer will stop withholding personal income tax from your salary. This will happen until the deduction amount is exhausted or until the end of the calendar year (whichever comes first). You can read more about this here.

For the employee, it looks as if his monthly salary was temporarily increased by 13%. This “surcharge” can be applied to a deposit at interest.

Choose a deposit with a favorable rate

How to apply for a property tax deduction:

1. Collect a complete package of documents

Here is a list of documents for obtaining a property deduction through the tax office:

· Declaration 3-NDFL (original);

· tax refund application (original);

· a copy of the equity participation agreement (DPA);

· a copy of the apartment acceptance certificate;

· payment documents (checks, receipts for down payments, mortgage agreement) for the entire cost of the apartment;

· copy of the USRN extract, certificate of ownership.

In the case of a mortgage, you will also need a copy of the loan agreement with the bank and a bank certificate about the interest paid on the loan for the year.

2. Submit a declaration through the taxpayer’s personal account

There are several ways to submit a tax return:

· take it in person (you need to print out the completed declaration, sign it, attach certified copies of documents and take it to the tax office at your place of registration);

· send by mail with a description of the attachment (you need to do everything the same as in the first case, just send by mail);

· through the taxpayer’s personal account.

“The last method is the most modern. Everything is simple here: you create a taxpayer’s personal account on the official website of the tax office, fill it out yourself or upload an already completed declaration, send it and track its status. You wait three months and, if approved by the tax authorities, you receive a tax refund to your bank account. There is no need to go anywhere, waste time on the road and queues. This saves a lot of time,” says tax deductions consultant Mila Melnikova.

3. Get a deduction in a simplified way

From the end of May 2021, you can apply for a property tax deduction in a simplified manner - without filing a declaration and collecting documents. But to do this, you need to wait until you receive a pre-filled application from the Federal Tax Service. As soon as it appears in the “Taxpayer’s Personal Account”, all you have to do is check it and provide the bank details for transferring money. The money will arrive within 1.5 months.

How will the tax office know about your right to deduction? It is assumed that banks (tax agents) will connect to a special data exchange system and transmit information about transactions to the tax authorities. True, this is voluntary. At the time of writing, only one bank agreed to transfer data on apartment payments and mortgage transactions.

Read on topic:

Tax deductions can be obtained without filling out a declaration. How to do it

Results

When purchasing (or acquiring through equity participation) an apartment, an individual can take advantage of two property deductions for personal income tax:

- in the amount of purchase or construction costs (within 2,000,000 rubles, but with the possibility of use for several objects);

- in the amount of interest on the mortgage (within RUB 3,000,000 and applicable only to one of the objects).

The right to deduction is checked and confirmed by the Federal Tax Service. And the tax itself can be reimbursed either at the place of work (by reducing current accruals), or by receiving the amounts overpaid for the year from the Federal Tax Service (after filing a declaration there at the end of the year of acquiring the right to deduction). Reimbursement of the full amount of tax may take several years.

Sources:

- Order of the Federal Tax Service of Russia dated February 14, 2017 N ММВ-7-8/ [email protected]

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Documents evidencing the right to return

The right to a tax refund for a purchased apartment will be confirmed by the following documents:

- certificate of ownership, and in case of shared participation in construction - an acceptance certificate;

- purchase agreement or share participation in construction;

- when purchasing for a child - a birth certificate;

- mortgage agreement, if any;

- documents on payment of interest;

- contract for finishing work, if the apartment was purchased without finishing;

- payment documents for payment of the cost of the apartment, and for finishing costs - building materials and finishing work performed.

About the nuances of applying the deduction for equity participation agreements that provide for the breakdown of the cost into parts, read the material “What is the amount of the personal income tax deduction if the cost of an apartment in a shared-use house is divided into parts?” .