Initial data: in 2014, my wife and I bought a two-room apartment in a new building in the city of Lobnya for 3.9 million rubles. 800 thousand rubles were not enough for the purchase, another 500 thousand were needed for repairs. In total, we borrowed 1.3 million rubles. at Sberbank at a rate of 12% per annum (12.75% including annuity payments). The house was completed in July 2014.

You can submit documents to the tax office the next year after purchasing real estate. When it comes to a new building, everything is the same, but the starting point is the date of commissioning of the house. For example, in 2014 the house began to be occupied, in 2015 you can apply for a deduction.

Where to go?

You can receive a tax deduction at the tax office at the place of official registration. “Registering” in a new building is problematic. For this you need a certificate of ownership. You can apply for a certificate after registering the house with the cadastral register - this takes the developer from several months to a year. In general, not soon.

I am registered in Orekhovo-Zuevo near Moscow, my wife is registered in Kazan. These are the cities you need to contact. There is no need to go at all. Documents can be sent by mail even by regular letter.

How much will they return?

Each real estate buyer can return 13% of the cost of housing, but not more than 260 thousand rubles. Even if the apartment costs 7 million rubles, the state will transfer only 260 thousand rubles. In this case, the size of official income is very important. If it is 15 thousand rubles. per month, then only 180 thousand rubles will accumulate over the year. - they will return 13% (23.4 thousand rubles). The balance will be carried over to next year.

| Official salary, rub. | 15 000 | 30 000 | 50 000 | 100 000 | 150 000 |

| The amount that the tax office will return for last year, rub. | 23 400 | 46 800 | 78 000 | 156 000 | 234 000 |

If the buyer of the property does not have an official income, then a tax deduction will not be given.

Pay off your mortgage early

- Deposit free money without waiting for a large amount to accumulate. This way you will gradually reduce payments or the mortgage term by reducing the balance of the loan and the amount of interest.

- The best moment for early repayment is the scheduled payment date or two or three days after it. This way, the entire amount you deposit will go towards paying off the principal and not interest.

What is more profitable to shorten – the term or the payment?

In the long term, of course, it is more profitable to reduce the period. The shorter the loan term, the less interest you will pay. But if your life circumstances have changed and it has become not very comfortable to pay the same monthly amount, then it is more profitable and reasonable to reduce the payment, leaving the term the same.

In the end, you can always combine methods of early repayment depending on the situation.

What documents are needed for tax deduction?

1. On the first working day of the new year, we went to our accounting departments at our place of work to get a 2-NDFL certificate, which indicates the income received for the previous year.

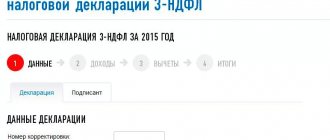

2. Next you need to fill out a tax return in form 3-NDFL. For many people this is very difficult. For help, you can contact specialists who will fill out the document for a small fee. The easiest way is to wait for your personal account to be updated on the nalog.ru website (the password for it must be obtained in advance from any tax office using your passport).

Usually, by mid-January, a special program or online service appears on the tax service website that allows you to fill out 3-NDFL for the past year. The completed form is exported to excel or pdf, printed and signed on each sheet.

3. The following papers are also needed:

- a copy of the apartment purchase and sale agreement;

- a copy of the apartment acceptance certificate (for new buildings);

- a copy of the loan agreement (if the property was purchased with a mortgage);

- a copy of the receipt for the transfer of funds to the account of the real estate seller;

- a copy of the marriage certificate (if the property is acquired as joint property);

- a written statement on the distribution of the amount of property deduction between spouses. It states that the tax base for deduction is divided into such and such parts. For example, in my case, with the cost of an apartment being 3.9 million rubles, my wife set herself 1.9 million rubles, and I set myself 2 million rubles. From these amounts everyone will get 13% back.

4. There can be not one deduction, but several. Including for treatment or educational services in state-licensed institutions. In 2014, I took courses in English. During the year I collected checks for payment of services. The result was 35,960 rubles. – from them I asked for 13% (4675 rubles). I made a photocopy of the agreement with the courses, as well as a copy of all receipts on one sheet. I attached these documents to the assembled package, and previously indicated information about tuition fees in the tax return.

I took the collected documents to my tax office in person. I took advantage of the fact that there was a reception there on Saturday. The wife sent the papers by registered mail. Two weeks later, information about registered declarations appeared in personal accounts on nalog.ru.

There is no need to collect this pile of documents again in subsequent years. They will already be on your file. All you need is a new tax return, a 2-NDFL income certificate and a certificate of payment of mortgage interest.

Documents for income tax refund

To receive a tax deduction, the co-borrower must provide the following documents to the Federal Tax Service:

- passport;

- an extract from the Unified State Register to confirm the fact of acquisition of the object or its share;

- loan agreement;

- certificate 2-NDFL for the reporting period to confirm payment of taxes;

- a statement from the bank about payments made to service the mortgage debt;

- if available, marriage certificate;

- Declaration 3-NDFL.

You can get a more complete list by consulting with Federal Tax Service managers.

How much to wait?

The tax office has three months to review the declaration. The period begins to run from the moment the documents are registered. In the past, many people said that the starting point was the date the papers were sent by mail. In practice this turned out not to be the case. Sent. The envelope lay in line for a week to be opened and only then was it added to the database.

Miracles are rare, so the tax office is unlikely to surprise you with a quick response. Two months later they remembered about us. They called me on my mobile phone and asked me to correct several numbers in the 3-NDFL declaration as quickly as possible, and also to attach another copy of some document. Fortunately, you can log back into your personal account, correct it, print it again and mail it. The deadline continues to tick at this time. For violating it, the inspector will have problems.

A few days before the deadline, the audit was completed, and the amount of the tax deduction was confirmed. We learned about this on the website nalog.ru, checking it every day.

Step-by-step instructions for income tax refund

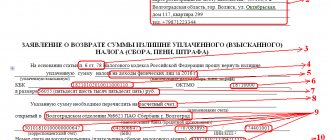

After collecting documents, the co-borrower must apply for a tax refund. The sample contains the applicant's full name, TIN, place of residence, period for which the deduction is issued, the calculated amount, details for transferring funds, etc. It is recommended to clarify more detailed information at the Federal Tax Service office, since at the moment there is no regulated application form.

The next step is to fill out the 3-NDFL declaration. You can do this online at www.nalog.ru or use the help of specialists. The completed package of documents must be submitted to the Federal Tax Service by contacting a specific department and sent by mail with copies attached. After receiving them, the tax service will begin a desk audit, which lasts three months. If the documentation is in order, the co-borrower will receive a mortgage deduction within a month.

How to receive the money?

After that, run again. Now you need to quickly fill out an application for a refund. Everything is simple in it: it indicates from whom, where, the amount of return and the details of the bank account to which the confirmed amount should be transferred.

The paper is sent to the tax office. It can be attached immediately when sending all documents, but within three months the refund amount may be adjusted or the bank in which the account is opened may change.

As soon as the application for a refund is registered with the tax office, a new 30 days begin to count (a month, as stated in the Tax Code), during which the inspectorate must transfer the money. My wife received a joyful text message about the receipt of funds on her bank card account two weeks later, and I received it after two and a half.

And another 13%

Every borrower and co-borrower has the right to receive a deduction from the interest paid on a home loan. To receive these amounts, you must annually obtain a certificate from the bank about the interest paid on the loan. The information is indicated in the tax return.

However, as I was told by the tax office, the “main” tax deduction for the apartment will be returned first, and only when it is exhausted will it come to interest compensation. That is, I must first receive 260 thousand rubles. and only then 13% of the interest paid on the loan. In this case, the share of the payment will be taken from the application for the distribution of the tax deduction between the spouses. For example, we paid interest for 150 thousand rubles, and our shares in the loan are 55% and 45% - thus, we will receive 10,725 rubles each. and 8,775 rub. respectively.

Good news for those who took out a loan for 20-30 years: the maximum amount of interest paid, from which 13% is returned, is limited to 3 million rubles. This means that borrowers can additionally return another 390 thousand rubles. Together with the “main” tax deduction, the result is 650 thousand rubles. Every real estate buyer can count on this amount with a mortgage. It can be returned either for one property or for several (if they were purchased later than January 1, 2014).

Use maternity capital

If you have maternity capital, feel free to use it for a down payment or full repayment of the loan immediately after receipt. Now 483.8 thousand rubles are paid for the first child, 155.5 thousand rubles for the second.

If you did not receive maternity capital for your first child, then 639.4 thousand rubles will be paid immediately for the second.

There are nuances:

- When using a certificate, a child or children for whose birth maternity capital was issued are required to be allocated a share in the apartment for the purchase of which your capital is used.

- If you are selling an apartment in which maternal capital has been invested, the child or children will need to be allocated part of the property in the new apartment.

- Maternity capital can be invested in the purchase of only a separate object. This means that it must have its own entrance and communications (i.e., it will not be possible to take a share in an apartment or private house using maternal capital).

If you want to contribute maternity capital towards early repayment of the mortgage, then pay attention to the following points:

- You can submit an application for disposal of maternal capital not only at the Pension Fund, but also at a bank branch.

- Early repayment of a loan with maternity capital always reduces the payment amount; reducing the term in this case is impossible.

- Maternity capital cannot pay off arrears, fines and penalties.

- Matkapital first pays off the interest accrued since the last payment, and the remainder goes to pay off the debt.

You don't have to go to the tax office

You can also receive a deduction at your place of work. To do this, you do not need to wait until the year following the purchase of the apartment. The order is as follows:

- write a free-form application to your tax office requesting a tax deduction;

- prepare copies of documents evidencing the purchase of real estate;

- submit the application and copies of documents to the tax office;

- after 30 days, receive a notification from the inspectorate about the right to deduct;

- submit a notification to the accounting department at the place of work.

In this case, the tax deduction is returned in parts - it simply will not be withheld from subsequent wages, that is, during the period of the refund, your salary will increase by 13%. Not everyone is comfortable with this.

Summary

- Each person can return up to 260 thousand rubles. from the cost of the apartment, as well as up to 390 thousand rubles. from interest paid on the mortgage.

- It is beneficial to receive a tax deduction as quickly as possible, since money depreciates every year.

- The higher the official salary, the faster you can get money.

- The tax deduction can be returned through the tax office or at your place of work.

- If you submit all documents to the tax office in January, then in May the tax office will transfer the requested amount to your account.